About 6 months ago I had some time to look into some of the more advanced technical indicators created by John F. Ehlers. For those of you who do not know who he is, he worked as an electrical engineer at one of the largest aerospace companies in the industry before retiring as a senior engineering fellow. He specializes in technical analysis and is also the founder of Maximum Entropy Spectrum Analysis. You can read more about him here: http://www.mesasoftware.com/about_mesa_ehlers.htm

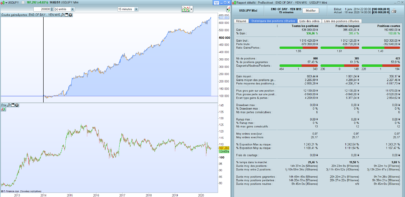

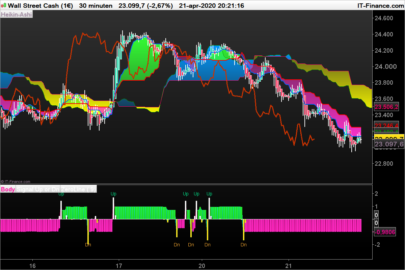

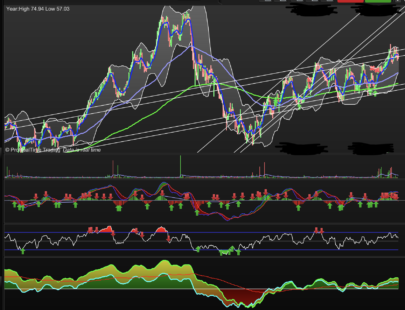

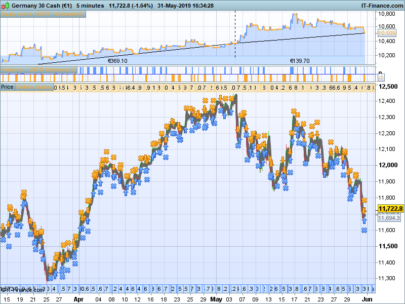

Using the vast code base of MetaTrader I started experimenting with some of his indicators trying to create a robust trend trading strategy that aims to get us onboard new trends as early as possible but at the same time keeping us out of potentially weak or flat trends that will end up going nowhere. In the end, I combined 3 of Ehlers’s indicators with one of Dr Alexander Elder. Then to top it off I combined it with the Ichimoku Cloud with which I have become very accustomed to.

In order to automate this strategy, we first had to translate these indicators to ProRealCode. With the assistance of Nicolas, we managed to do so. See the forum topic here: https://www.prorealcode.com/topic/need-help-to-automate-these-mql5-indicators/page/2/

The strategy rules are as follow:

-

Only take trades in the direction of the color of the Elder Ribbon

-

Validate the strength of the Elder Ribbon using the Ehlers Inverse Fisher Transform. Color must match the direction of the trade. i.e. green for long. Additionally, a sell signal above the zero line will be stronger than one below it and vice versa.

-

Check trend momentum using Ehlers Inverse Fisher Transform of RSI. We do not want to take longs if the indicator is overbought (i.e. green). The opposite would apply for short positions

-

Check trend strength using Ehlers Fractal Dimension. Used in borderline cases to help make a decision (i.e. rule 6) on whether to wait for Tenkan-Sen pullback and/or if price breaks through the 200MA and we have to make a call on whether the re-test will hold or not.

-

If we are below the cloud (and also above Tenkan-Sen and Kijun-Sen) and conditions 1-4 are validated take a long position and use a close below Tenkan-Sen as a stop (up until rule 6 becomes valid). The opposite would apply for short positions. The exception to this rule would be if we are below the 200MA and below or in the cloud (and also above Tenkan-Sen and Kijun-Sen) and condition 1-2 is validated but we have a strong close above the Bollinger Band with a Bollinger W-Bottom structure taken out, take a long position and use the 200MA as target. Use a close below Tenkan-Sen as a stop. The opposite would apply for short positions

-

If we are above the cloud (and also above Tenkan-Sen and Kijun-Sen) and conditions 1-4 are validated take a long position if we are above the 200MA and the Ichimoku leading cloud points up. If not look to rule 7.

-

If we are in or above the cloud (and also above Tenkan-Sen and Kijun-Sen) and conditions 1-4 are validated take a long position as soon as we have a close below Tenkan-Sen (if rule 1-3 is still valid and Kijun-Sen is at least a couple of points below us). After a pullback to below Tenkan-Sen, rule 2 can be overruled by a strong rejection from either the Elder Ribbon or Kijun-Sen if the close are above the cloud. The opposite would apply for short positions

-

If we are in a long position and we have close below Kijun-Sen and Ehlers Inverse Fisher Transform is red, exit the trade and wait for re-confirmation of rule 7. The opposite would apply for short positions

-

If in a long position, remain in the position as long as the Elder ribbon remains blue and the Ehlers Inverse Fisher Transform of RSI is not green. If the Ehlers Inverse Fisher Transform of RSI turns green and the Ehlers Inverse Fisher Transform turns red, then exit at the first close below Tenkan-Sen. The opposite would apply for short positions

-

Only make one trade per trend i.e per Elder Ribbon color change

Keep in mind that this is a trend trading strategy so the aim is to catch big trends and stay on board for as long as possible, and larger time-frames better afford us this opportunity.

The below code is adapted for USDJPY, but rather download and import the attached ITF file because you would need to have the three indicators installed to use this strategy:

P.S. I have also had success with the strategy on the following markets:

- 4H US Crude with a spread of 5 and DigitFactor (Line 20) set to 4

- 2H EURUSD with a spread of 0.6 and DigitFactor (Line 20) set to 8

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 |

//------------------------------------------------------------------------- // Main code : Advanced Trend Trader //------------------------------------------------------------------------- //Author: Juan Jacobs //Market: USDJPY //Timeframe: 4H //Spread: 0.8 //Version 2.0 //Last Updated: 19-Aug-2018 //Disclaimer: Take note that as with any trading strategy, there is an inherent risk when trading in financial instruments. // The author shall not be held liable for any loss, so please ensure you manage your risk responsibly // Results cannot be guaranteed as past performance is not indicative of future results. Defparam cumulateorders = False possize = 1 DigitFactor = 8 //should be optimed between 1 and 10 to cater for different market types i.e. forex or indexes PointFactor = EXP(DigitFactor*LOG(10))*0.0001 //Components MA200 = Average[200,0](close) BollUp = BollingerUp[20](close) BollDown = BollingerDown[20](close) //TEST alpha = 0.09 Price=MedianPrice iTrend=(alpha-square(alpha)/4)*Price+0.5*square(alpha)*Price[1]-(alpha-0.8*square(alpha))*Price[2]+2*(1-alpha)*iTrend[1]-square(1-alpha)*iTrend[2] if barindex<7 then iTrend=(Price+2*Price[1]+Price[2])/4 endif Trigger=2*iTrend-iTrend[2] FastEMA = Trigger//Average[6,1](close)// can be optimized between 6 and 8 Trigger// SlowEMA = iTrend//Average[13,1](close)// TS = (highest[9](high)+lowest[9](low))/2 //Tenkan-Sen KS = (highest[26](high)+lowest[26](low))/2 //Kijun-Sen SA = (TS+KS)/2 //Senkou-Span A (projected 26 periods forward) SB = (highest[52](high)+lowest[52](low))/2 //Senkou-Span B (projected 26 periods forward) //IFTRSI1, LevelUp1, LevelDown1, LevelMid1 = CALL "Ehlers Even Better Sinewave"[50, 0.6, 0.6] LevelUp1, LevelDown1, LevelMid1, IFTRSI1 = CALL "PRC_InverseFisherTrans_RSI_1"[11, 1, 9, 50, 100, 0](close) IFTRSI2, LevelUp2, LevelDown2, LevelMid2 = CALL "Ehlers Even Better Sinewave"[50, -0.5, 0.5] //LevelUp2, LevelDown2, LevelMid2, IFTRSI2 = CALL "PRC_InverseFisherTrans_RSI_2"[23, 0, 9, 50, 80, 20](close) FractalDim, ignored, ignored, FractalLevel = CALL "Ehlers Hurst Coefficient"[30, 0.1, 0.9] //FractalDim, FractalLevel = CALL "PRC_Ehlers_FDI"[30, 1.4](close) LimitTrendTrades = 1 //Limits number of trades per trend change If (FastEMA[1] < SlowEMA[1] and FastEMA > SlowEMA) or ((FastEMA[1] > SlowEMA[1] and FastEMA < SlowEMA)) or (FastEMA[2] < SlowEMA[2] and FastEMA[1] = SlowEMA[1] and FastEMA > SlowEMA) or ((FastEMA[2] > SlowEMA[2] and FastEMA[1] = SlowEMA[1] and FastEMA < SlowEMA)) Then TrendTrades = 0 StrongTrend = 0 TSPB = 1 //TenkanSen pullback Required by Default If (FastEMA > SlowEMA and IFTRSI1 > IFTRSI1[1] and IFTRSI1 < LevelMid1 and IFTRSI2 <= LevelDown2) or (FastEMA < SlowEMA and IFTRSI1 < IFTRSI1[1] and IFTRSI1 > LevelMid1 and IFTRSI2 >= LevelUp2) Then StrongTrend = 1 EndIf EndIf If onmarket[1] = 0 and onmarket = 1 Then LE = 0 SE = 0 TrendTrades = TrendTrades + 1 EndIf EMARangeLim = 0 For i = 1 to 20 Do If Round(FastEMA[i]*PointFactor) = round(SlowEMA[i]*PointFactor) Then EMARangeLim = EMARangeLim + 1 EndIf Next //Rules If onmarket = 0 and FastEMA > SlowEMA and TrendTrades < LimitTrendTrades and EMARangeLim < 1 Then //Up Trend SEC = 0 //Special Exit Conditions Indicator If close < MA200 and close < max(SA[26],SB[26]) and close < TS and close < KS and IFTRSI1 > IFTRSI1[1] and BollUp > highest[50](close)[1] Then Buy possize contract at BollUp stop//market SEC = 2 ElsIf StrongTrend = 1 and IFTRSI1 > IFTRSI1[1] and IFTRSI1 < LevelMid1 and IFTRSI2 <= LevelDown2 Then //Perfect Long Indicator Setup If close > MA200 and close > max(SA[26],SB[26]) and SA > SB and SA > SA[26] and close > KS and close < KS and FractalDim >= FractalLevel and abs(open-close) < abs(open[1]-close[1])*5 Then Buy possize contract at market ElsIf close < min(SA[26],SB[26]) and close > TS and close > KS Then Buy possize contract at market If close > MA200 Then SEC = 1 Else SEC = 2 EndIf EndIf ElsIf IFTRSI1 > IFTRSI1[1] and (IFTRSI1 > LevelMid1 or IFTRSI2 > LevelDown2 or FractalDim < FractalLevel) Then //Weak Long Signal If TSPB = 1 and close < TS Then TSPB = 0 EndIf If TSPB = 0 and (IFTRSI1 < LevelMid1 or IFTRSI2 < LevelDown2 or FractalDim > FractalLevel) and IFTRSI2 < LevelUp2 and low - max((min(open,close)-low),(high-max(open,close))) > KS Then Buy possize contract at market EndIf EndIf ElsIf onmarket = 0 and FastEMA < SlowEMA and TrendTrades < LimitTrendTrades and EMARangeLim < 1 Then //Downtrend SEC = 0 //Special Exit Conditions Indicator If close > MA200 and close > min(SA[26],SB[26]) and close < TS and close < KS and IFTRSI1 < IFTRSI1[1] and BollDown < lowest[50](close)[1] Then Sellshort possize contract at BollDown Stop// market SEC = 2 ElsIf StrongTrend = 1 and IFTRSI1 < IFTRSI1[1] and IFTRSI1 > LevelMid1 and IFTRSI2 >= LevelUp2 Then //Perfect Short Indicator Setup If close < MA200 and close < min(SA[26],SB[26]) and SA < SB and SA < SA[26] and close < KS and FractalDim <= FractalLevel and abs(open-close) < abs(open[1]-close[1])*5 Then Sellshort possize contract at market ElsIf close > max(SA[26],SB[26]) and close < TS and close < KS Then Sellshort possize contract at market If close < MA200 Then SEC = 1 Else SEC = 2 EndIf EndIf ElsIf IFTRSI1 < IFTRSI1[1] and (IFTRSI1 < LevelMid1 or IFTRSI2 < LevelUp2 or FractalDim > FractalLevel) Then //Weak Short Signal If TSPB = 1 and close > TS Then TSPB = 0 EndIf If TSPB = 0 and (IFTRSI1 > LevelMid1 or IFTRSI2 > LevelUp2 or FractalDim < FractalLevel) and IFTRSI2 > LevelDown2 and high + max((high - max(open,close)),(min(open,close)-low)) < KS Then Sellshort possize contract at market EndIf EndIf EndIf //Conditional Exits If longonmarket and SEC = 1 and close < TS and (close < min(SA[26],SB[26]) or (close > min(SA[26],SB[26]) and (IFTRSI1 < IFTRSI1[1] or IFTRSI2 > LevelMid2))) Then Sell at market ElsIf longonmarket and SEC = 2 and (close < TS or high >= MA200) Then Sell at market ElsIf shortonmarket and SEC = 1 and close > TS and (close > max(SA[26],SB[26]) or (close < max(SA[26],SB[26]) and (IFTRSI1 > IFTRSI1[1] or IFTRSI2 < LevelMid2))) Then Exitshort at market ElsIf shortonmarket and SEC = 2 and (close > TS or high <= MA200) Then Exitshort at market EndIf If longonmarket and LE = 0 and IFTRSI2 > LevelUp2 and IFTRSI1 < IFTRSI1[1] and (close < TS or close <= max(highest[2](open)[1],highest[2](close)[1])) Then Sell at market ElsIf longonmarket and LE = 0 and IFTRSI2 > LevelUp2 Then LE = 1 ElsIf longonmarket and LE = 1 and IFTRSI2 < LevelUp2 Then LE = 0 ElsIf longonmarket and LE = 1 and IFTRSI1 < IFTRSI1[1] and (close < TS or close <= max(highest[2](open)[1],highest[2](close)[1])) Then Sell at market ElsIf longonmarket and LE = 1 and IFTRSI1 < IFTRSI1[1] Then LE = 2 //ElsIf longonmarket and LE = 2 and IFTRSI1 > IFTRSI1[1] and close > TS Then //LE = 1 ElsIf longonmarket and LE = 2 and (close < TS or close <= max(highest[2](open)[1],highest[2](close)[1]) or FractalDim < FractalLevel) Then Sell at market ElsIf shortonmarket and SE = 0 and IFTRSI2 < LevelDown2 and IFTRSI1 > IFTRSI1[1] and (close > TS or close >= min(lowest[2](open)[1],lowest[2](close)[1])) Then Exitshort at market ElsIf shortonmarket and SE = 0 and IFTRSI2 < LevelDown2 Then SE = 1 ElsIf shortonmarket and SE = 1 and IFTRSI2 > LevelDown2 Then SE = 0 ElsIf shortonmarket and SE = 1 and IFTRSI1 > IFTRSI1[1] and (close > TS or close >= min(lowest[2](open)[1],lowest[2](close)[1]) or FractalDim > FractalLevel) Then Exitshort at market ElsIf shortonmarket and SE = 1 and IFTRSI1 > IFTRSI1[1] Then SE = 2 //ElsIf shortonmarket and SE = 2 and IFTRSI1 < IFTRSI1[1] and close < TS Then //SE = 1 ElsIf shortonmarket and SE = 2 and (close > TS or close >= min(lowest[2](open)[1],lowest[2](close)[1]) or FractalDim > FractalLevel) Then Exitshort at market EndIf //Immediate Exits If longonmarket and ((close < KS and IFTRSI1 < IFTRSI1[1] and IFTRSI1 > LevelDown1) or (LE >= 1 and IFTRSI1 < IFTRSI1[1] and close < TS and IFTRSI1 > LevelDown1 and FractalDim < FractalLevel)) Then Sell at market ElsIf shortonmarket and ((close > KS and IFTRSI1 > IFTRSI1[1] and IFTRSI1 < LevelUp1) or (SE >= 1 and IFTRSI1 > IFTRSI1[1] and close > TS and IFTRSI1 < LevelUp1 and FractalDim > FractalLevel)) Then Exitshort at market EndIf //Graph LE coloured(0,0,255) as "LE" //Graph SE coloured(255,0,0) as "SE" //Graph SEC as "SEC" //Graph TSPB as "TSPB" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

For those with a sharp eye, you will notice that I opted to use 3 different Ehlers indicators in the code than those mentioned in the description. The indicators used can be found in lines 46-53 and to switch them out simply comment out the active one and replace with the commented out one i.e. uncomment line 46 and comment line 47 etc.

Hi Juanj,

is it possibile for you to attach here the indicators that you raccomend for this strategy? thanks!

If you import the attached ITF file the indicators used in the strategy will automatically also be imported. The ones currently commented out can be found by looking here: https://www.prorealcode.com/topic/need-help-to-automate-these-mql5-indicators/page/2/#post-88741

Hi,

Can you attach also your usdjpy picture because it is not clear on screen and I can’t try you code at this moment ?

Thks.

Just click on the zoom icon next to the title to enlarge the picture, it will then display clear

Hey Juan,

This is an awesome piece of code. A little over my head but I am learning fast thanks to people like you.

Have you tried this out on the SA40?

I am playing around with it to see if it can work in that market as the SA40 is my primary market.

I have a pretty decent strategy that I have written for the SA40 and I am currently trying to fine tune it with bits of code I find interesting.

It’s getting a bit daunting I must admit, but I love testing new strategies and indicators. Hoping to find a long term winner.

Once again, thanks for sharing.

Regards

Hi Vacario0s, I actually have not tried this on the ZAF40 as I have other dedicated strategies that I trade for our local market. I obviously don’t post everything here, but if you are interested in personalized help regarding your ZAF40 ProRealTime strategy you are most welcome to have a look at my profile for my details https://www.prorealcode.com/user/juanj/

Thanks, Juan I appreciate it.

Do you mind sharing which strategy you use for our local market?

I understand if you don’t feel like sharing, I know how much time and effort goes into it.

I have been working non stop lately to make my current strategy work over a longer period of time

See my website (available on my profile), I can then better assist local traders like yourself with personalized ProRealTime queries. Including discussing some of my local ZAf40 strategies.

Hola¡¡

Enhorabuena por la estrategia, y gracias por compartirla.

Tu estrategia podria aplicarse a acciones ?..cual es tu opinion?

Gracias

For those perhaps looking to trade this manually, I have added a step-by-step guide here: https://www.fxautomate.com/forum/strategies-and-ideas/new-advanced-trend-trading-strategy

Hey, when I download the itf file and import it into prorealtime, everything goes well however the indicator is just a horizontal blue line when I hit apply. Any idea as to why this is?

Thanks for sharing. It’s probably a good idea to add a stop loss when currencies seem to flash crash at least once a year.

Clearly, the PRT Backtest engine no longer works the same (either that or the data changed slightly) because I cannot get the same results as my previous recorded tests.

What kind of results do you get now ? Looks still pretty fine to me concerning USD/JPY 4h

@zebra would you be so kind as to post your latest 4H USD/JPY results here: https://www.prorealcode.com/topic/need-help-to-automate-these-mql5-indicators/

Thank you juanj for sharing this code, Backtests looks great in USDJPY and Crude Oil

Is anyone already LIVE with this strategy?? If yes .. how are results and experiences?

@Holy Grail, glad you like it. Would you perhaps mind sharing your results here: https://www.prorealcode.com/topic/need-help-to-automate-these-mql5-indicators/

I am reluctant to say this buy I was a member of Dr Elder trading group for a while . The fact is his group consistency underperform the S&P 500 and his Gold star traders barely out perform it. I don’t have a it of faith in his works.

The design is too complex and the performance is low.