Hello,

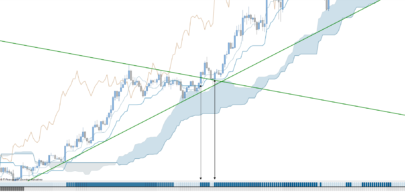

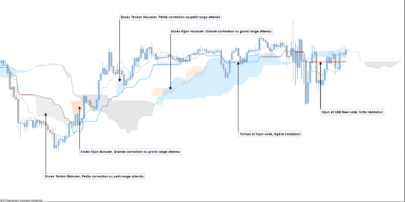

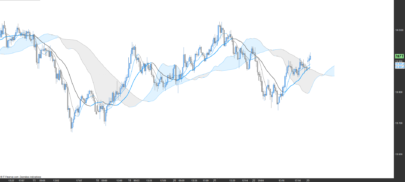

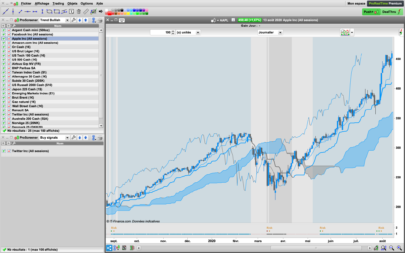

I share my first strategy. Ichimoku is fashionable actually. So I tried to parameter a strategy on the Dax in m5 with a filter on UT, m15 and H1.

Taking losses and letting go of your winnings is the idea for TP and SL management.

The leverage is 5×1 € and a spread of 2. Test from January 2018 to now.

Good test and thank you for your feedback.

(google traduction, je suis français)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 |

DEFPARAM CumulateOrders = false DEFPARAM Preloadbars = 3000 // TAILLE DES POSITIONS n = 5 // HORAIRES DE TRADING TimeAchat = time >= 080500 and time < 152500 TimeVente = time >= 080500 and time < 152500 TIMEFRAME(60 minutes) // INDICATEURS Tenkansen1 = (highest[9](high)+lowest[9](low))/2 Kijunsen1 = (highest[26](high)+lowest[26](low))/2 SSpanA1 = (tenkansen1[26]+kijunsen1[26])/2 SSpanB1 = (highest[52](high[26])+lowest[52](low[26]))/2 Chikou1 = close ////////////// // POSITION KUMO // ACHAT ca1m60 = (close > SSpanA1 and SSpanA1 > SSpanB1) or (close > SSpanB1 and SSpanB1 > SSpanA1) // VENTE cv1m60 = (close < SSpanA1 and SSpanA1 < SSpanB1) or (close < SSpanB1 and SSpanB1 < SSpanA1) /////////////// // POSITION CHIKOU // ACHAT ca2m60 = Chikou1 > SSpanA1[26] and Chikou1 > SSpanB1[26] // VENTE cv2m60 = Chikou1 < SSpanA1[26] and Chikou1 < SSpanB1[26] ////////////// TIMEFRAME(15 minutes) // INDICATEURS Tenkansen2 = (highest[9](high)+lowest[9](low))/2 Kijunsen2 = (highest[26](high)+lowest[26](low))/2 SSpanA2 = (tenkansen2[26]+kijunsen2[26])/2 SSpanB2 = (highest[52](high[26])+lowest[52](low[26]))/2 chikou2 = close ////////////// // POSITION KUMO // ACHAT ca1m15 = (close > SSpanA2 and SSpanA2 > SSpanB2) or (close > SSpanB2 and SSpanB2 > SSpanA2) // VENTE cv1m15 = (close < SSpanA2 and SSpanA2 < SSpanB2) or (close < SSpanB2 and SSpanB2 < SSpanA2) /////////////// // POSITION CHIKOU // ACHAT ca2m15 = Chikou2 > SSpanA2[26] and Chikou2 > SSpanB2[26] // VENTE cv2m15 = Chikou2 < SSpanA2[26] and Chikou2 < SSpanB2[26] ////////////// TIMEFRAME(5 minutes) IF intradaybarindex=0 then toto=0 ENDIF // INDICATEURS Tenkansen3 = (highest[9](high)+lowest[9](low))/2 Kijunsen3 = (highest[26](high)+lowest[26](low))/2 SSpanA3 = (tenkansen3[26]+kijunsen3[26])/2 SSpanB3 = (highest[52](high[26])+lowest[52](low[26]))/2 ////////////// // POSITION KUMO // ACHAT ca1m5 = (close > SSpanA3 and SSpanA3 > SSpanB3) or (close > SSpanB3 and SSpanB3 > SSpanA3) // VENTE cv1m5 = (close < SSpanA3 and SSpanA3 < SSpanB3) or (close < SSpanB3 and SSpanB3 < SSpanA3) /////////////// // POSITION CHIKOU // ACHAT ca2m5 = close>SSpanA3 and close>SSpanB3 and close CROSSES OVER Kijunsen3 and close > Tenkansen3 // VENTE cv2m5 = close<SSpanA3 and close<SSpanB3 and close CROSSES UNDER Kijunsen3 and close < Tenkansen3 ////////////// achat = (ca1m60 and ca2m60 and ca1m15 and ca2m15 and ca1m5 and ca2m5) vente = (cv1m60 and cv2m60 and cv1m15 and cv2m15 and cv1m5 and cv2m5) ////////////// IF achat and TimeAchat and not onmarket and toto=0 THEN toto=1 Buy n shares at market SET STOP pLOSS 10 SET TARGET pPROFIT 120 ENDIF IF vente and TimeVente and not onmarket and toto=0 THEN toto=1 Sellshort n shares at market SET STOP pLOSS 10 SET TARGET pPROFIT 150 ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Good job, thanks for sharing!

Nice strategy, I will test it!

Thanks! How can check with 200k bars?

who*

Hi there,

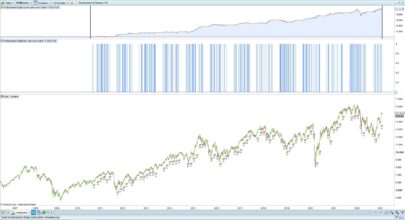

here is a 200k units for this strategy. It’s strange, it seems that the strategy was worse at first but much better then …

https://image.noelshack.com/fichiers/2019/29/2/1563283533-backtest-ichimoku-16-07-2019.png

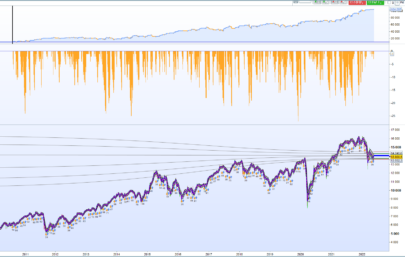

Typical OOS backtest. Sign of survivor bias usually popup in OOS period.

hello, actually it’s a lot less pretty as a startup. I am amazed at the difference that there can be following the periods … What do you mean typical OOS backtest ?

Out Of Sample period. Period that you didn’t use to develop/optimize your strategy.

@tba69 That’s ok, the strategy is good IMO, thanks again for sharing 🙂

Is it possible to have more than 200K bars ?

Yes with V11, up to 1M bars!

what do you mean, Nicolas?

You should do your homework about ‘survivor bias’, ‘overfitting’, ‘robustness’, 🙂

that was i was thinking about… 🙂

I think I got excited too fast … will IG go to version 11 soon?

Once beta is over, they should be able to upgrade to v11. I’m confident that it will happen this year.

Will anyone please test it on 0.1% absolute stoploss; and MFE of 0.5% (applied on high rather than close), the whole story seems more comfortable.

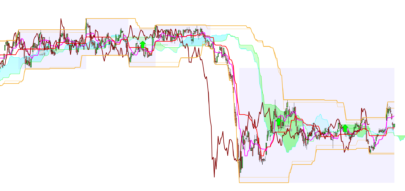

The strategy has been “optimized” with a low success rate but with a high ratio.

Also, I would like to know the timezone applied on this strategy. Thanks

I’m on Paris timezone.

I changed stoploss to 15 and profit to 90. looks good on the 1 minute, but i can not backtest further than april..

I see your rationale, but i am afraid the win rate is a bit too low to stand and keep running the strategy so it would be great if somebody could modify the strategy, striking a better balance between win rate and the profit . (IMO only no offence)

Indeed the success rate is very low, it is only offset by the ratio of x10 between the SL and the TP.

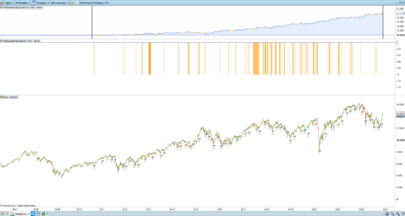

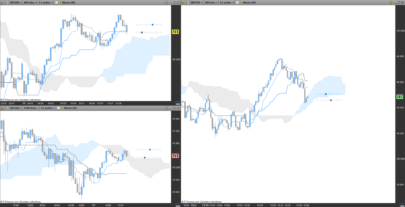

Hello everyone, I allowed myself to change TP and SL and the results are really good on 200k bars.

IF achat and Time Chat and not onmarket and toto = 0 THEN

toto = 1

Buy n shares at market

SET STOP pLOSS 62

SET TARGET pPROFIT 150

ENDIF

IF vente and TimeVente and not onmarket and toto = 0 THEN

toto = 1

Sellshort n shares at market

SET STOP pLOSS 16

SET TARGET pPROFIT 274

ENDIF

Check it out.

Immagini

https://ibb.co/52sBK5j

https://ibb.co/0DTVjcB

https://ibb.co/02HKRs0

have anyone tested this live? and how does it perform?

I liked the idea so much I put it early into live and it took 19 straight losses before hitting a win. So far 5% win with G/L of 0.62, but it also has an open position in profit today so if we’re lucky it breaks profitable today.

Looking at back tests I managed to set it live right after a win and before the regular drawdown which turned out longer than previous ones. I like the strategy so I have faith and will let it run for now.

Since july 24th it’s doing well. Started with a longer drawdown than expected but now it’s 12% win rate and 1.77 G/L . It’s had 4 of those big winners. I’ve tried finding other instruments to try it on but no luck so far. I’ve tried one on OMX30 and although the gain/loss came out similar it’s 60% time in market so doesn’t feel as neat.

Gubben do we have a progress report?

So far so good. After a long drawdown it was winning four times in five weeks. Since 24 july, 46 trades, 4 wins, 42 losses. Worst trade was almost 4 times the average I guess because of a weekend gap so could have gone the other way too. 8,7% winrate, 1.18 G/L. It has 15 losers in a row now so statistically it should take one home soon. It was really close to taking another win but instead it went down to a loss. I know Grahal thinks one should help the bots sometimes and maybe here I should have done that. In anyway, it looks good so far to me.

I am also running a variant on OMX but that one has a different stop loss approach and is much more in market unfortunately. It is profitable so far though, but needs more time to tell cause it doesn’t take trade

Salut

Pourquoi je n’ai pas les même résultats que vous

Any hints for us, on which variables we should be optimising ?

As of November 2020, the current settings make big losses,

Thanks