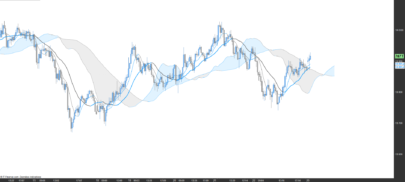

I like the trading concept of Ichimoku. (However the developed Ichimoku Strategy needs to perform better..)

The concept is explained at https://www.investopedia.com/terms/i/ichimoku-cloud.asp

Furthermore I saw some of the learning videos about Ichimoku from Karen Peloille, and an strategy https://www.prorealcode.com/topic/ichimoku-strategy/ on this platform

Searching on the internet I found a strategy fully based upon Ichimoku trading, this has been worked out in the strategy attached.

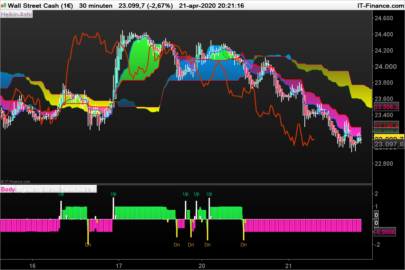

Distinguished are TenkanSen, KijunSen, Senkou Span A and Senkou Span B

- TenkanSen = (highest[S](high)+lowest[S](low))/2 //Default setting S = 9

- KijunSen = (highest[M](high)+lowest[M](low))/2 // Default setting M = 26

- SenkouSpanA = (Tenkansen[M]+Kijunsen[M])/2 //Default setting M = 26

- SenkouSpanB = (highest[L](High[M])+lowest[L](Low[M]))/2 //Default setting L =52

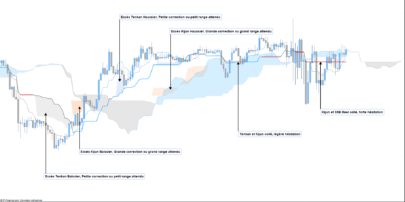

Trading rules can be described as follows:

Open LONG BUY conditions :

- Tenkan Sen crosses over the Kijun Sen AND

- Close is within 4 periods after the crossing above the Kumo (cloud), defined as Maximum (SenkouSpanA, SenkouSpanB)

Open SHORT SELL conditions :

- Tenkan Sen crosses under the Kijun Sen AND

- lose is within 4 periods after the crossing BELOW the Kumo (cloud), defined as the Minimum (SenkouSpanA, SenkouSpanB)

The exit in for strategy is defined for long positions as when the TenkanSen crosses under the Kijunsen, vice versa for short positions.

I added 2 additional exit methods, below described for long positions, vice versa for short positions:

- Method 2 if the close closes under the upper side of the Kumo / Cloud, based upon the SenkouSpanA

- Method 3 if close closes under the lower side of the Kumo / Cloud, based upon the SenkouSpanB

However:

The default settings 9 for TenkanSen, 26 for KijunSen and 52 for SenkouSpanB do not seen to be profitable.

Therefore I played around with the default settings as well as the exit method.

In the attached ITF file with the strategy, I have left the variables S, M, L and cm (closing method) open as variables.

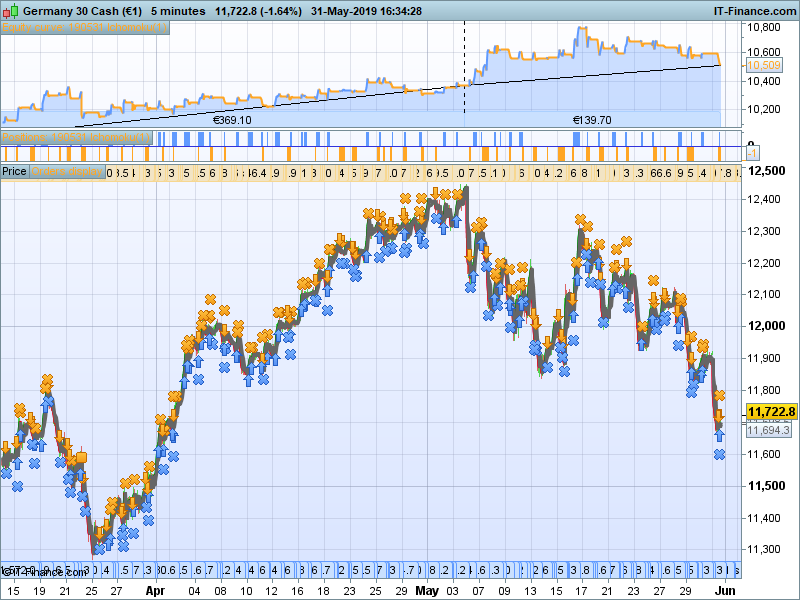

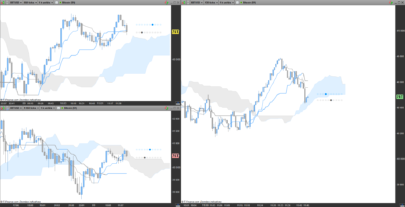

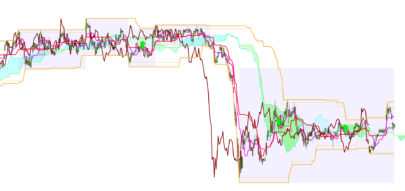

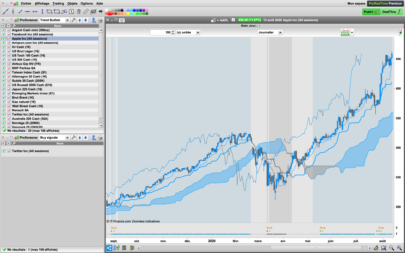

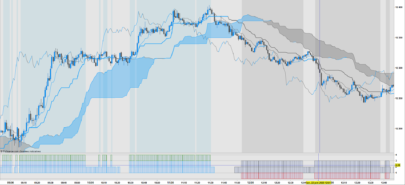

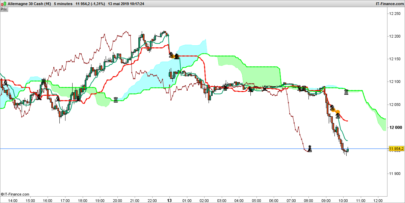

A result is found for the DAX 5 minutes, see also the screenshots, based upon 10.000 bars of the DAX 5 minutes with trading hours from 7:00 AM till 22:00 PM, settings are S =7, M = 14, L = 55 and cm is 1

No good results found so far for other indices and other periods . . . . .

Probably more robust trading strategies are out there . . , hopefully it assists into further developing of good Ichimoku trading strategies.

Comments are more than welcome.

Please download the attached ITF file to get the strategy and its variables to be optimized.

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello, the result on my plateform is totaly different…

Hallo LouRichard,

hope your results are better did you use trading hours from 7:00 AM till 22:00 PM ?

Works good on DJI on 3 min TF over 100k bars.

I optimised the time settings at a 1 hour step over the 24 hour period, but best was how you have it set in the .itf file (08:00 to 16:00).

I am in UK so a direct comparison to you may be 09:00 to 17:00 (as you are 1 hour ahead in Netherlands).

Jan … thank you so much for sharing your hard work with us all!

GraHal

PS it be a good / useful if you open a Topic on the Strategy coding Forum – “Discussion on Ichimoku Strategy by Jan Wind”

I could then post my results on DJI 3 min. I will be running this in Forward Test starting 10 June 19.

GraHal, (very) glad to hear that you found it reasonably working for the DJI !

You could post any findings on :

https://www.prorealcode.com/topic/discussion-on-ichimoku-strategy/

(not sure why it can not here, presumably because not attachments can be made ?)

Hi

Thank you for this. I have replaced the S, M, L and cm with backtested figures in preparation for automatic testing but the program still requests me to replace the backtested variables. Not sure how to get this right. I am a prorealtime newbie. Perhaps I could export the code for you to show me where I am going wrong.

Kind Regards

Allan

Hi, I would recommend to try some other entry criteria: 1) chikou crossing over max(spanA,spanB). 2)double cross of close above Tenkan and Chikou over Tenkan. This two are the most effective entries I know.

As Allanrobison pointed out….. After setting Variable, “summation” from pro builder needs to be replaced with a pro order action, what is this please!

Thanks for this Ichimoku strategy Jan, I wonder now, how this strategy would benefit if the S, M and L values were self optimised with Machine Leaning. Did you ever try that?

Hi Friends. Please let me know inbuilt variable which contains current market price.

I need to compare that with moving average for my exit strategy

Hi guys, please could someone help with a bit of Ichimoku code that will improve performance on DJ long positions Ive added the indicator to my chart but when asked to select the indicator in the chart which Ive previously applied to price and is showing clearly it doesn’t give me the option to select it from the listed indicators so not able to use basic new system coding to give me a start. Thanks in advance.

lol I should be more exact with my wording, more accurately I was looking for an indicator that will help better placement of long positions on dj and thought I’d try ichimoku but any and all advice welcome.

how can we change the default settings?