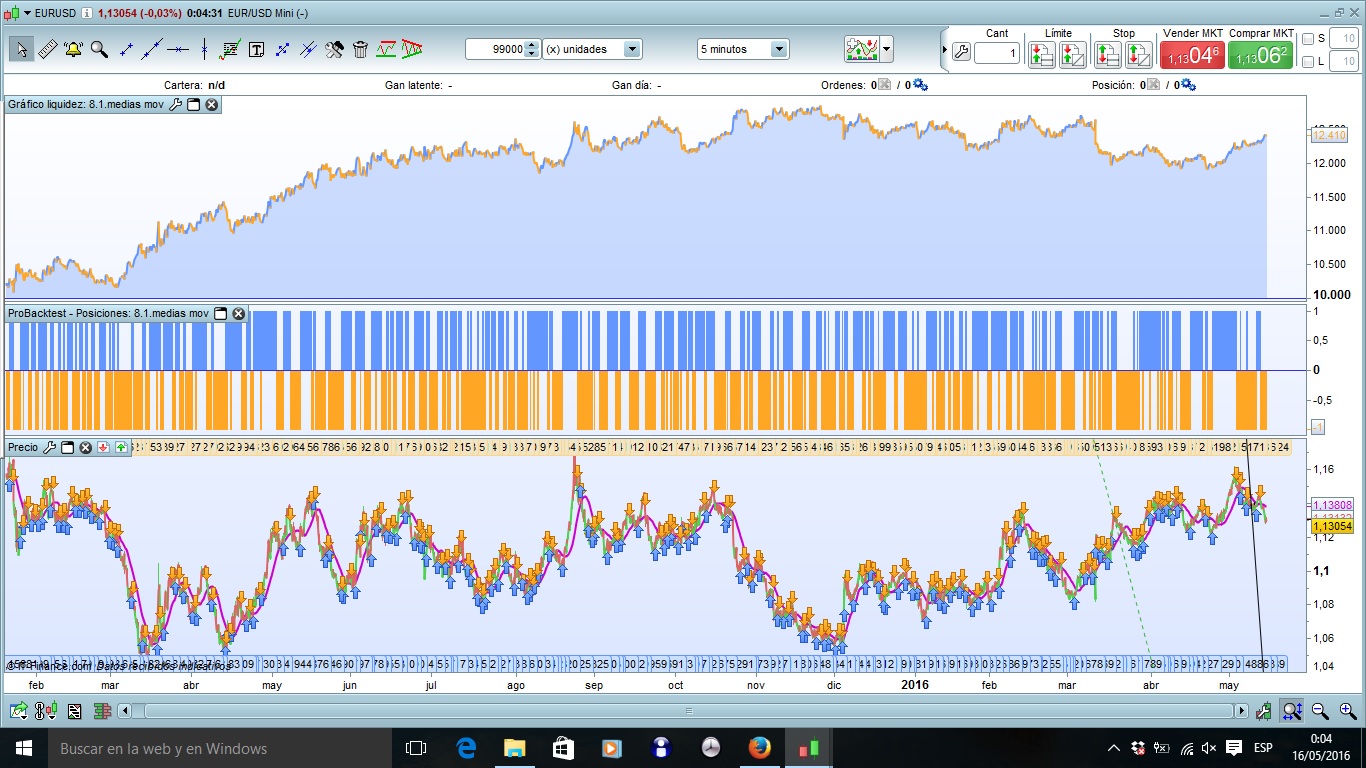

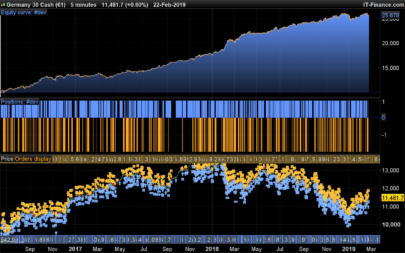

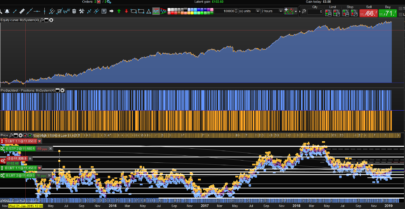

EN/ A small strategy that seems to be working. It is based on three moving average. in 5 minutes it is ok. I encourage you modify and test in other timeframes and pairs. It is made for Eur-Usd. Thank you.

ES/ Una pequeña estrategia que parece que puede funcionar. Se basa en tres medias mobiles. en 5 minutos va ok. Animo a que modifiqueis y proveis en otros tiempos y pares. A Eur-Usd. gracias.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 |

// Condiciones para entrada de posiciones largas DEFPARAM CumulateOrders = false mm3= average[297] mm2= average[99] mm1= average[50] if mm1<mm2 and mm2<mm3 then sellshort 1 contract at market endif if mm1>mm2 and mm2>mm3 then buy 1 contract at market endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Pablo,

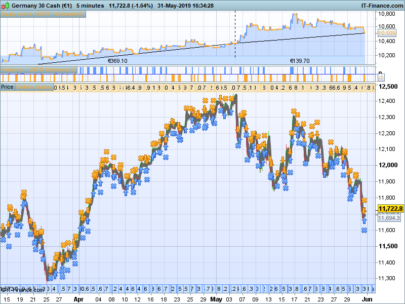

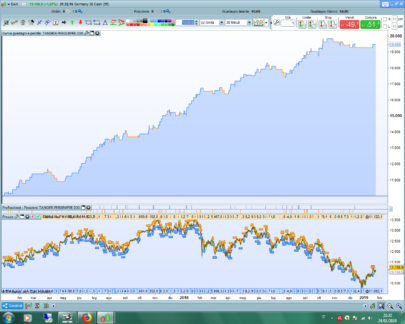

I have optimised this beautifully simple strategy for the GBPJPY and changed the CumulateOrders to “true”. This has produced a rather spectacular result over the course of 12 months on the – too good to be true?

With the same optimised settings, it produces 68% gain on the EURUSD over 12 months.

Many thanks.

Best regards,

Mike

// Condiciones para entrada de posiciones largas

DEFPARAM CumulateOrders = true

mm3= average[100]

mm2= average[80]

mm1= average[90]

if mm1<mm2 and mm2<mm3 then

sellshort 1 contract at market

endif

if mm1>mm2 and mm2>mm3 then

buy 1 contract at market

Hello MikeGCwhen you put “defparameters = true” in each candle you put an order, it is important when you put so many orders know if you put the corresponding spread the pair in which these testing strategy. I’m glad you like my little work. the spread in Gbp / Jpy is 2.5 pips. and Eur / Usd 1.5 which is the typical spread, not the minimum spread. If ahun with the strategy that works I would give as valid. It is important to play with the money management not as a monkey with a revolver. if not everyone knows how you can finish the game.

tonight will schedule more fun moneymanagement, programming strategy through profit the number of lots. seguros.Lo good results more important is the security of your account, that being able to spend what people do not like that happens, we lose never will be 0

Hello,

Cumulating orders isn’t VERY risky ?

Best Regards,

Sorry for my english. I never cumulating orders. Always I made programs with defparam = False

Doctor how do you make to made a good riskmananagement?

Cumulative orders can be very powerful with a good risk control. There’s an interesting thread about a nice risk/reward management system here: http://www.prorealcode.com/topic/grid-orders-with-one-combined-stop-loss-and-limit-can-it-be-done/

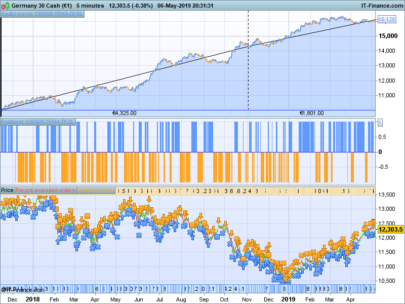

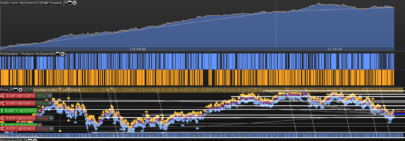

// Condiciones para entrada de posiciones largasDEFPARAM CumulateOrders = falseonce n=2q= strategyprofit[0]mm3= average[297]mm2= average[99]mm1= average[50]n=(q/1000)+5if mm1<mm2 and mm2<mm3 thensellshort n contract at marketendifif mm1>mm2 and mm2>mm3 thenbuy n contract at marketendif

I made a simple risk management twice varying breakdown i max up or down in this program the number of lots according to the strategyprofit entered. Bring us and try it, thanks.

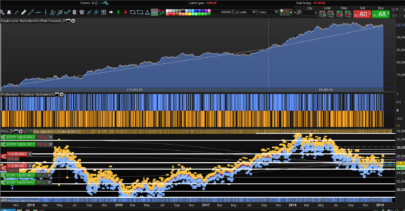

// Condiciones para entrada de posiciones largas

DEFPARAM CumulateOrders = false

once n=2

q= strategyprofit[0]

mm3= average[297]

mm2= average[99]

mm1= average[50]

n=(q/1000)+5

if mm1<mm2 and mm2<mm3 then

sellshort n contract at market

endif

if mm1>mm2 and mm2>mm3 then

buy n contract at market

endif

Did anyone test this live?

Hello every one hope everyone ok)) I was just traying to maximize the strategy by closing with the stochastic. Any idea how the code my sound))