This DAX automatic trading strategy on the 2-hours timeframe, use a basic cycle oscillator to test “overbought” and “oversold” areas to open new orders.

All orders have stoploss and takeprofit.

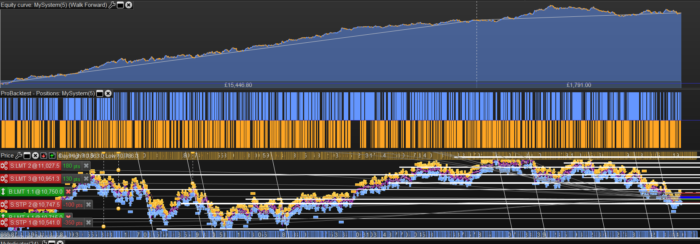

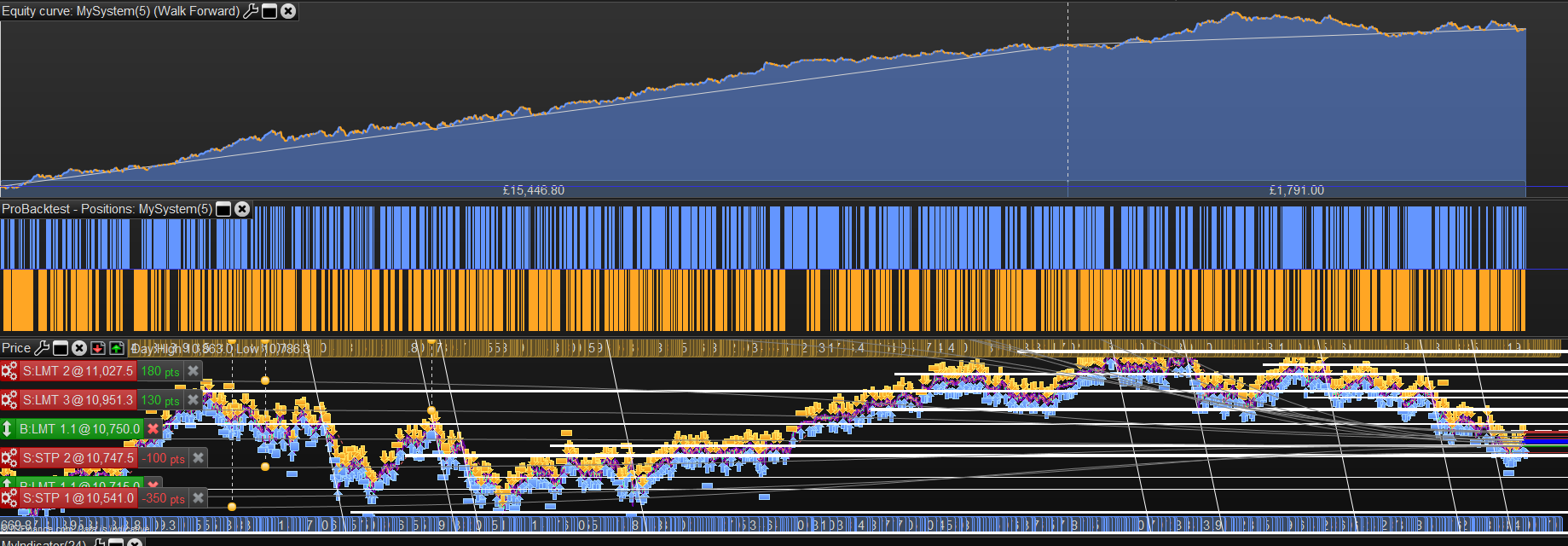

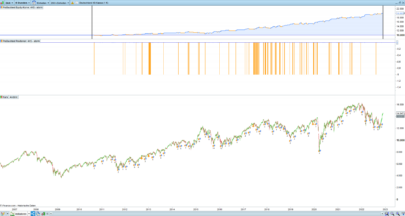

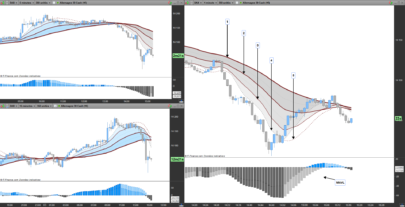

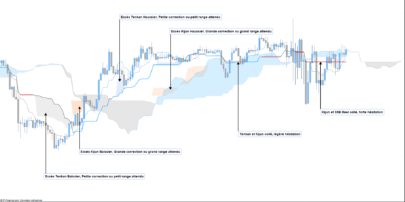

Results attached are from walk forward analysis with 1 OOS period proving robustness of the optimized variables. Variables to be optimized are also described in one of the attached picture.

Discussions about the strategy are running here: Dax Trrend Following, h2 time zone:uk

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 |

defparam cumulateorders = false n=2 soglia = 0.02 timestart = 90000 timeend = 180000 profitti = 275 perdite = 350 timeok = time>=timestart and time<=timeend c = (sin(atan((close-open[n])/open[n]*100/n))) if c crosses over soglia and timeok then buy 1 contract at market endif if c crosses under -soglia and timeok then sellshort 1 contract at market endif set target pprofit profitti set stop ploss perdite |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Francesco,

is it possible to know which indicator you use for this strategy? thanks

c = (sin(atan((close-open[n])/open[n]*100/n)))

this is the indicator. Itis a measure of the angle made by the price. I invented it, dont know if it is useful or not but I found that it worked well with the dax

Thanks Francesco!

You are most welcome!

che strano, a me vengono risultati del tutto opposti sul DAX a 2 ore…

(sin(atan che funzioni sono? non le trovo nella ricerca delle funzioni. e mi aggrego a derschnee i risultati non sono quelli esplicati. ed ho usato un grafico 200k barre a 2h

timestart = 90000

timeend = 180000

se lavorate con fuso italiano mettete timestart 100000 e timeend 190000

non dovrebbe cambiar el asostanza comunque,

grazie mille Francesco: stasera provo da casa, ma non credo che sia un problema di orari.

Non è che il target profit e lo stop loss sono espressi in euro, anziché punti? 275 punti di profitto mi sembrano tanti.

ok, fammi sapere come ti viene, ciao

Ciao Francesco, ho provato anch’io con fuso italiano cambiando i profitti e le perdite in punti ma il risultato non cambia. Ho aggiunto anche lo spread a 1 punto dato che mancava ma sono sempre in perdita sia che parto nel 2018 o 2017 fino ai giorni nostri. Grazie

mi spiace, ma la strategia postata non dà assolutamente la curva dei profitti allegata.

derschnee spiace a me che non riesci a replicarla. Prima di esprimere giudizi pensaci 2 volte.

😉 sfido chiunque a riuscirci!

infatti basta leggere i post degli altri….

ciao Francesco vorrei contattarti su facebook o in privato. Grazie