Hello,

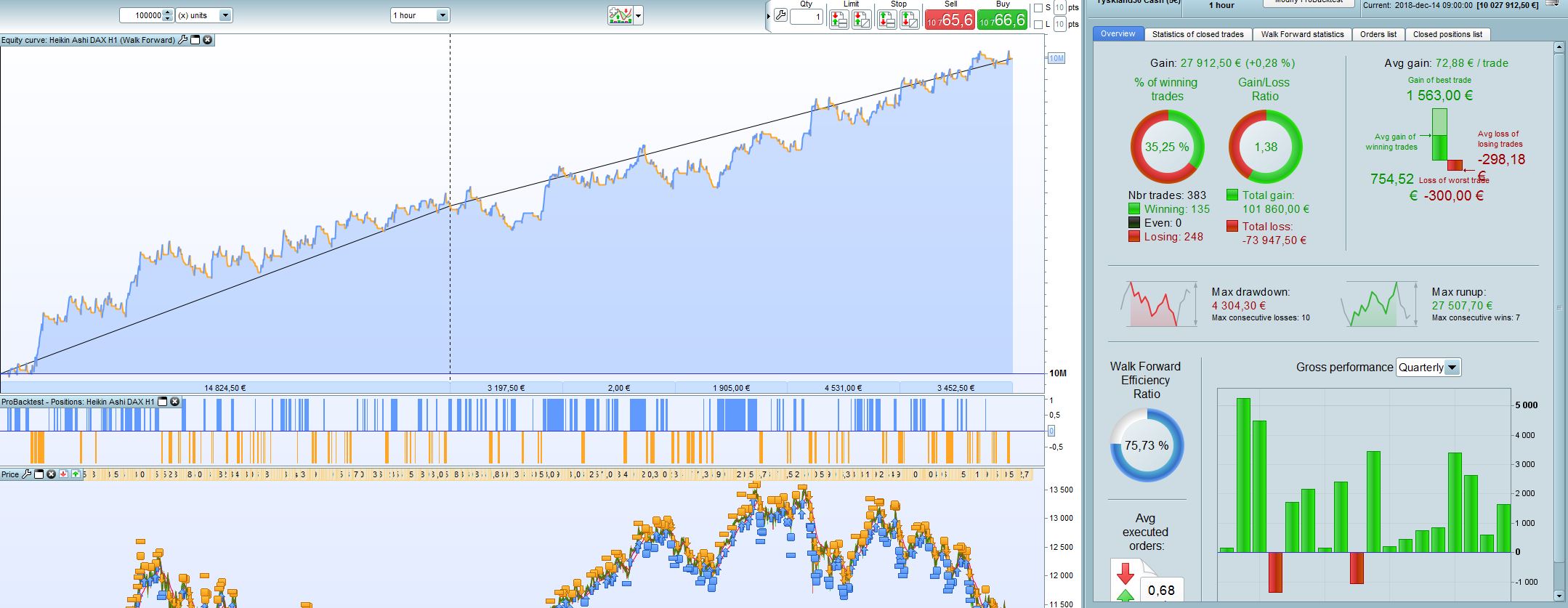

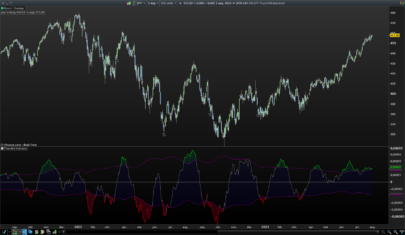

This is one of my first strategies. It is a simple strategy with Heikin Ashi as a trigger during trends. It buys according to Heikin Ashi but only during uptrend set by EMA 25, 50 and 270. It sells acoording to HEikin ashi but only during trends (same EMA).

My question is of course if anyone have any improvement tips, but also my concenr for curve fitting and lack of robustness. I have tried to not make to many adjustments and I did my settings on about 28 months IS and then added another 7 months as OOS. The strategy works on DAX H1 and I didnt find any other markjet that worked well. I had the spread set to 2 for this backtest.

Please let me know your thoughts.

(please download the attached file to get all necessary codes).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 |

//DAX H1 Heikin Ashi Defparam cumulateorders = false rangestart = 090000 rangeend = 170000 n = 1 Takeprofit = 150 Stoploss = 60 C3 = ExponentialAverage[25](close)//BLACK C4 = ExponentialAverage[50](close)//RED C5 = ExponentialAverage[270](close)//RED indicator1 = CALL "Heiken Ashi" c1 = (indicator1 = -1) c2 = (indicator1 = 1) IF time > rangestart AND time < rangeend AND c2 AND C4 > C5 AND C3 > C4 THEN BUY n shares AT MARKET Set target pprofit Takeprofit SET STOP pLOSS Stoploss Else If time > rangestart AND time < rangeend AND c1 AND C4 < C5 AND C3 < C4 THEN Sellshort n shares at market Set target pprofit Takeprofit SET STOP pLOSS Stoploss ENDIF endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Guessing photo is 100k bars? Because 200K bars was not good. Also u got alot of loosing trades in a row, thats a big red flag for my part.

jebus89, thank you for your feedback. You are correct, the backtest is made on 100K. The bad result for 200K and the fact that I couldnt find other markets for this is not promising. You also mentioned the loss in a row. I guess yoy see this together with the other facts from the backtest? Loss in arow alone shouldnt be a fact to reject a strategy. It depends on the relation between SL and TP as well as the end result, or what do you think?

The more loss in a row you have, the more big winners u need in the future. With a belo 50% winrate, ur gonna need some big winners to save u from loosing 15 trades in a row.. That means ur backtest might be very dependant on a few big winners to make up for all the loss. Increasing the risk of datamining and curvefitting. Also alot of trades lost in a row is going to be very hard to actually trade. Imagine going 9 trades loosing in a row on the same strategy its going to feel like bleeding out, and its gonna leave u praying for a winner to come. what if it dosnt come for another 12 months.. Many loss in a row, frequently haves me thinking ur entry isnt so good.

It dosnt mean 100% sure the strategy is bad, it just at least for me is a few red flags that i would definitly think twice about b4 running live at least.

Also when you find it hard to make it good in other markets, that again is indeed a red flag regarding the average trade u take.. If u get a decent backtest in other markets that means u havnt curvefitted your algo to “cherrypick” the very best trades from the other optimized market. It means u just might ahve something that pulls profit out of the chart, regardless what chart. Thats kind of the clue behind robustness. You dont want a backtest that has cherrypicked alot of good trades from the data. U want a backtest that has even profits, a good sharpe, low volatility in the equity curve, but obviously not a traight line, u want some bumps here and there because u cant always be right.

Thank you for the feedback jebus. I totally agree on every point.

Thanks for posting. I took my SDO strategy, removed the main criteria and inserted your code to match. Results look good for 10 min bar but not on all 200k bars. From jan 2016 it’s good. (before that about even)

Tested with 1 position, stoploss 1% and spread 1. From 1 jan. 2016 winratio at 73% with average gain 23 euro on 153 trades. 3 losses in a row and 15 wins. Total profit about €3500

So maybe the basis is alright but it just needs a few extra filters to succeed.

Thanks Paul for taking your time looking in to this. Could you please insert your code? I will let you know if I find something.

It has only 1 trade a day and the profit target is not used.

Because it trades a complete day, I included an option not to enter new positions during lunchbreak, because of a higher risk. Perhaps it’s curve-fitting, but it does make sense to me. (11.30-13.30)

//————————————————————————-

// Main Code : Heikin Ashi trend

//————————————————————————-

// Common Rules

Defparam Cumulateorders = False

Defparam Preloadbars = 1000

// On/off

Extratradecriteria = 1 // I.e. Long; Only Enters When The Current Bar High Is Lower Then The Lowest Daily High From Today, Yesterday And Day Before.

Mfetrailing = 1 // Mfe Trailing Stop

Wtrailing = 1 // Williams 3 Bar Trailing Stop

Breakevenstop = 1 // Breakevenstop, Move Stoploss When Position Is In Profit.

Excludefirsttwoweeks = 1 // Exclude The First 2 Weeks Of Every Year (Weeknumber 1 And 2)

lunchtrading = 0 // [0] no new positions during lunchtime and trades can be closed

// Settings

Positionsize = 1

SL = 1.00 // % Stoploss

PT = 140 // % Profit Target

MFETS = 0.50 // % Mfe Trailing Stop

BES = 0.35 // % Break Even Stop

BESMP = 0.05 // % Break Even Stop Minimum Profit

WTSMP = 0.50 // % Williams Trailing Stop Minimum Profit If Mfe Trailing Stop Is Not Used

ETD = 0 // Exclude a Trade Day; Sunday = 0

// Day & Time

Once Entertime = 090000

Once Lasttime = 170000

Once Closetime = 240000 // Greater Then 23.59 Means It Continues Position Overnight

Once Closetimefr=173000

if lunchtrading then

once breakstart = 240000

once breakend = 240000

else

once breakstart = 113000

once breakend = 133000

endif

If Excludefirsttwoweeks=1 Then

If Year=2015 And Month=1 And (Day>=1 And Day=1 And Day=1 And Day=1 And Day=1 And Day= Entertime

Tt2 = Time = breakstart and time <= breakend

Tradetime = Tt1 And Tt2 and Notrading = 0 And Dayofweek ETD and not breaktime

// Reset At Start

If Intradaybarindex = 0 Then

Longtradecounter = 0

Shorttradecounter = 0

Tradecounter = 0

Mclong = 0

Mcshort = 0

Endif

// [pc] Position Criteria

Pclong = Countoflongshares < 1 And Longtradecounter < 1 And Tradecounter TRADEINDEX

Pcshort = Countofshortshares < 1 And Shorttradecounter < 1 And Tradecounter TRADEINDEX

// [mc] main criteria

if tradetime then

C3 = ExponentialAverage[32](close)//BLACK

C4 = ExponentialAverage[48](close)//RED

C5 = ExponentialAverage[192](close)//RED

indicator1 = CALL “Heiken Ashi”

c1 = (indicator1 = -1)

c2 = (indicator1 = 1)

IF c2 AND C4 > C5 AND C3 > C4 THEN

mclong=1

mcshort=0

else

mclong=0

endif

If c1 AND C4 < C5 AND C3 < C4 THEN

mcshort=1

mclong=0

else

mcshort=0

ENDIF

endif

// [ec] Extra Criteria

If Extratradecriteria Then

Min1 = Min(Dhigh(0),dhigh(1))

Min2 = Min(Dhigh(1),dhigh(2))

Max1 = Max(Dlow(0),dlow(1))

Max2 = Max(Dlow(1),dlow(2))

Eclong = High Max(Max1,max2)

else

Eclong=1

Ecshort=1

Endif

// Long & Short Entry

If not onmarket and Tradetime Then

If Pclong and Mclong And Eclong Then

Buy Positionsize Contract At Market

Longtradecounter=longtradecounter + 1

Tradecounter=tradecounter+1

Endif

If Pcshort and Mcshort And Ecshort Then

Sellshort Positionsize Contract At Market

Shorttradecounter=shorttradecounter + 1

Tradecounter=tradecounter+1

Endif

Endif

// Break Even Stop

If Breakevenstop Then

If Not Onmarket Then

Newsl=0

Endif

If Longonmarket And close-tradeprice(1)>=((Tradeprice/100)*BES)*pipsize Then

Newsl = Tradeprice(1)+((Tradeprice/100)*BESMP)*pipsize

Endif

If Shortonmarket And Tradeprice(1)-close>=((Tradeprice/100)*BES)*pipsize Then

Newsl = Tradeprice(1)-((Tradeprice/100)*BESMP)*pipsize

Endif

If Newsl>0 Then

Sell At Newsl Stop

Exitshort At Newsl Stop

Endif

Endif

// Exit Mfe Trailing Stop

If Mfetrailing Then

Trailingstop = (Tradeprice/100)*MFETS

If Not Onmarket Then

Maxprice = 0

Minprice = Close

Priceexit = 0

Endif

If Longonmarket Then

Maxprice = Max(Maxprice,close)

If Maxprice-tradeprice(1)>=trailingstop*pipsize Then

Priceexit = Maxprice-trailingstop*pipsize

Endif

Endif

If Shortonmarket Then

Minprice = Min(Minprice,close)

If Tradeprice(1)-minprice>=trailingstop*pipsize Then

Priceexit = Minprice+trailingstop*pipsize

Endif

Endif

If Onmarket And Wtrailing=0 And Priceexit>0 Then

Sell At Market

Exitshort At Market

Endif

Endif

// Exit Williams Trailing Stop

If Wtrailing Then

Count=1

I=0

J=i+1

Tot=0

While Count=low[i]) And (High[j]alto[1] Then

Ref=basso

Endif

If CloseWTSMP Then

If Low[1]>ref And High<ref Then

Sell At Market

Endif

If High[1]ref Then

Exitshort At Market

Endif

Endif

If Onmarket And Mfetrailing=1 And Priceexit>0 Then

If Highref Then

Exitshort At Market

Endif

Endif

Endif

// Exit At Closetime

If Onmarket Then

If Time >= Closetime Then

Sell At Market

Exitshort At Market

Endif

Endif

// Exit At Closetime Friday

If Onmarket Then

If (Currentdayofweek=5 And Time>=closetimefr) Then

Sell At Market

Exitshort At Market

Endif

Endif

// Build-in Exit

Set Stop %loss SL

Set Target %profit PT

//graph 0 Coloured(300,0,0) As “Zeroline”

//graph (Positionperf*100)coloured(0,0,0,255) As “Positionperformance”

that copy&paste doesn’t look good. If you want the correct code posted, please open a topic with your strategy and I will post it there.

Many thanks Paul! I will look at it tomorrow (Im using my phone now).

Paul, Im sorry but where do I open a topic?

in ProOrder support, at the bottom

wie kann ich den Code bekommen Paul?

Works with US Crude at 1h as well!

Je préconise de regarder les graphiques H1 et M15 pour visualiser la tendance de fond et d’entrer sur le marcher au minimum sur un graph M5 ne pas oublier que c’est déjà au moins 5 mn de retard par rapport au départ de la vague qui aurait déjà pu changer de sens ce qui n’empêcherait pas une sortie positive au regard de la tendance de fond j’aime bien rentrer lorsque le prix croise une MMT (triangularAverage[9] en Heikin-Ashi (Tout ce qui est automatique n’est pas forcément et loin s’en faut le reflet d’une stratégie appliquée en manuel ) Le marché bouge de façon très aléatoire rien ni personne ni aucun indicateur ne peut prédire de façon fiable la couleur de la ou des prochaines bougies ! Le meilleur indicateur c’est vous, votre regard sur un graphique vous pouvez faire du trading très court court ou long terme sans aucun autre indicateur qu’un graphique et une seule MM Les stratégies les plus simples sont très souvent les plus profitables (ou encore trader uniquement sur le carnet d’ordre) Les débutants et même d’autres sont souvent noyés dans un nombre trop important d’indicateur et de stratégies jusqu’à ce qu’ils comprenne que le plus simple appliqué avec rigueur et le plus profitable (Comme plus de 90% des trader j’ai griller des économies avant de comprendre cela) maintenant je sais plus comment faire pour perdre (rire)