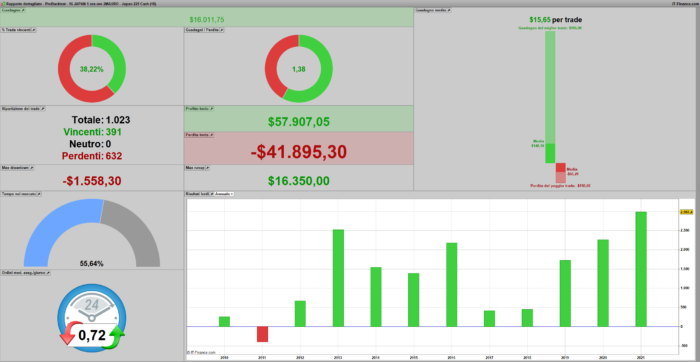

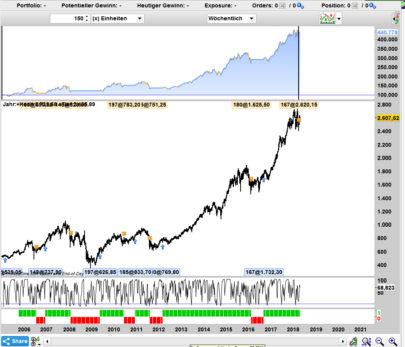

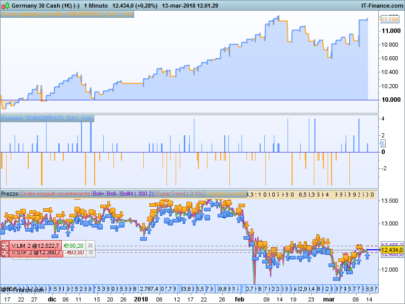

I share this simple strategy with the forum. i put spread 9 against the spread of 7 at 2 am. has been running on the demo for months with positive results. if you come up with something to improve it, contact me. Thank you

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 |

Defparam cumulateorders = false DEFPARAM PreLoadBars = 100000000 n = 0.50 PERIODO= TIME=020000 if longonmarket then sell at CLOSE-(CLOSE*0.010) STOP //0.012 ENDIF IF SHORTONMARKET THEN EXITSHORT AT CLOSE+(CLOSE*0.0081) STOP //0.0077 ENDIF // STOP LOSS & TAKE PROFIT (%) SL = 0.815 //0.85 TP = 7 //7 //MARGINE = 300 // LONGS & SHORTS : every day except Fridays // entre StartTime et EndTime if PERIODO and dayOfWeek <> 5 AND CLOSE[4]<OPEN[4] AND abs(CLOSE[4]-OPEN[4])>10 then //12 buy n shares at CLOSE+(CLOSE*0.000001) limit //0.000003 endif if PERIODO and dayOfWeek <> 5 AND CLOSE[4]>OPEN[4] AND abs(CLOSE[4]-OPEN[4])>10.50 then SELLSHORT n shares AT CLOSE+(CLOSE*0.00003) limit //0.00003 endif // Stop Loss & Take Profit set stop %loss SL set target %profit TP // Exit Time |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

very interesting. I run it in demo. Didi you already run it in real mode?

Ciao si, lo lanciato sul reale ma non da molto tempo. ti farò sapere…

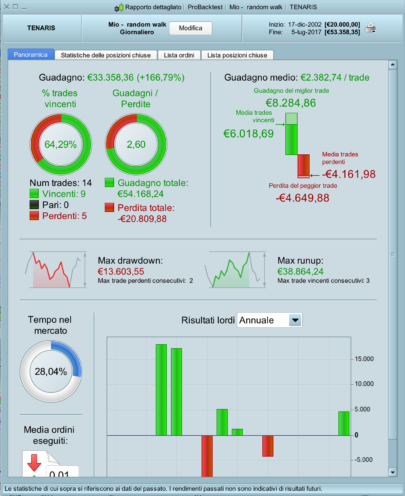

Hello, indeed very good backtest!

Could you tell me what is the approximate amount of overnight charges for 0.5 lot on japan 225 1$? given the amount of the spread, the costs can reduce this excellent performance.

thanks for sharing

Hello adconsulting is there any optimization of the strategy? It looks good till now…

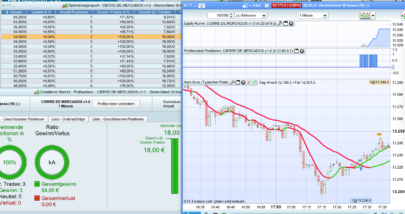

Ciao, ho fatto dei miglioramenti. Allego nuovo codice

Defparam cumulateorders = true

DEFPARAM PreLoadBars = 10000

TradingDaylong = (dayofweek=1 and (time=020000 or time=040000 or time=060000 or time=100000 or time=130000 or time=080000 or time=120000 or time=160000 or time=190000 or time=070000 or time=090000 or time=220000 )) or (dayofweek=2 and (time=100000 )) or (dayofweek=3 and (time=100000 or time=050000 or time=170000 )) or (dayofweek=4 and (time=020000 or time=040000 or time=080000 or time=130000 )) or (dayofweek=5 and (time=100000 or time=040000))

//TradingDaylong = (dayofweek=5 and time=130000)

TradingDayshort = (dayofweek=1 and (time=010000 or time=090000 )) or (dayofweek=2 and ( time=090000 or time=100000 or time=170000 or time=020000 or time=120000 or time=180000 )) or (dayofweek=3 and (time=030000 or time=190000 or time=170000 or time=200000 )) or (dayofweek=4 and ( time=020000 or time=060000 or time=040000 or time=030000 or time=200000 ))

lotnumberlong = 0.70

lotnumbershort = 0.50

if longonmarket then

sell at low-(CLOSE*0.005) STOP //0.012

ENDIF

IF SHORTONMARKET THEN

EXITSHORT AT close+(CLOSE*0.0081) STOP //0.0077

ENDIF

// STOP LOSS & TAKE PROFIT (%)

SLL = 0.95

TPL = 4.50

SLS = 1.20

TPS = 6.40

// LONGS & SHORTS : every day except Fridays

// entre StartTime et EndTime

if TradingDaylong AND CLOSE[4]<OPEN[4] AND abs(CLOSE[4]-OPEN[4])>9 and countoflongshares<=1 and abs(close-open)>close*0.0009 and abs(close-open)<close*0.01 and c4 and c5 and Stochasticd[14,3,5](close)>7 and rsi[16]> 20 and countofshortshares<=lotnumberlong*2.15 and c7 AND C9 then

buy lotnumberlong shares at high+(CLOSE*0.000004) stop//0.000003

set stop %loss SLL

set target %profit TPL

endif

if TradingDayshort AND CLOSE[4]>OPEN[4] AND abs(CLOSE[4]-OPEN[4])>10.50 and countofshortshares<=lotnumbershort*4 and c3 and rsi[16]<83 and close<(high+low)/2 and rsi[16]<70 and Williams[14](close)<-10 and c8 then

SELLSHORT lotnumbershort shares at low-(CLOSE*0.00005) stop//0.00003

set stop %loss SLS

set target %profit TPS

endif

// Stop Loss & Take Profit

if longonmarket and abs(close-open)>close*0.0098 then

sell at market

endif

if shortonmarket and abs(close-open)>close*0.0086 then

exitshort at market

endif

timeframe(daily)

c3 = abs(close-open)<720

c5=rsi[16]>30 and rsi[16]<85 and Williams[14](close)>-82

c6 = Williams[14](close)<-20

c4 = abs(close-open)<800// Close on Monday is below 34-Tg-SMA (daily-TF)

TIMEFRAME(default)

timeframe(4H)

C7=RSI[16]>30 and Cycle(close)<26

c8=RSI[16]<80 and Williams[5](close)>-95

uscitalong=low-(close*0.02)

uscitashort=high+250

TIMEFRAME(default)

timeframe(2H)

C9=RSI[21]>28

TIMEFRAME(default)

d1= close- close[1]>240

d2= close-close[2]>280

d3= close-close[3]>350

if longonmarket and d1 or d2 or d3 then

sell at market

endif

if longonmarket then

sell at uscitalong stop

endif

Ottimo! provo a fare simulazioni e se sono in grado commento…

Ti dico una cosa di prima impressione: vedo si utilizzano entrate multiple inserendo “Defparam cumulateorders = true” … potrebbe essere gradito per una questione di gestione del conto da impegnare, limitare le entrate a un numero definito 2 o 3 massimo. Comunque migliorerebbero il PF dal codice iniziale.

è un po’ più complicato fare il codice però. io ce l’ho impostato in altri sistemi potrei provarci, ma non garantisco che ci riesca 😉

Ciao adconsulting, del nuovo codice di japan 225 cash 1 h, sto provando il nuovo codice da quando lo hai postato, solamente limitandolo ad 1 posizione presa. Va molto bene complimenti (ancora non ho capito con quale criterio funziona mio limite). Non hai altri codici simili su altri strumenti?

Vedi se ti interessa quello che ho postato io su strategie, è weekly, ma vedi come utilizzo più posizioni.

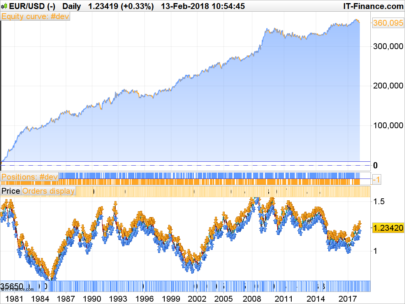

ciao, adesso scarico il tuo codice. Prova quello che ti incollo di seguito. funziona su eur/usd 30 minuti. fammi sapere cosa ne pensi. sta girando da un po’ ed i risultati sono positivi

DEFPARAM CumulateOrders = false

DEFPARAM PreloadBars = 10000

//////////////////////////////////////////////////////////////////

//// Opti

//////////////////////////////////////////////////////////////////

longtrigger = 12

shorttrigger = 62

maperiod = 112

maPeriod1 = 18 // Moving Average Period 100

maType1 = 2 // Moving Average function

stoplossmulti = 8

possizelong = 3

possizeshort =3

TradingDayLong = (dayofweek=1 and (time=050000 or time=100000 or time=190000 or time=020000 or time=010000 or time=050000 or time=190000 or time=170000 or time=073000 or time=180000 or time=200000 or time=123000 or time=080000 or time=140000 or time=070000 or time=153000 or time=183000 or time=220000 or time=003000 or time=030000 or time=210000 or time=033000 or time=043000 )) or (dayofweek=2 and (time=170000 or time=033000 or time=113000 or time=153000 or time=073000 or time=070000 or time=030000 or time=020000 or time=043000 or time=213000 or time=103000 or time=230000 or time=013000 or time=003000 or time=170000 or time=233000 or time=120000 or time=183000 or time=000000 or time=130000 or time=200000 )) or (dayofweek=3 and (time=003000 or time=010000 or time=020000 or time=060000 or time=063000 or time=073000 or time=093000 or time=100000 or time=103000 or time=110000 or time=113000 or time=130000 or time=143000 or time=150000 or time=153000 or time=160000 or time=163000 or time=180000 or time=200000 or time=203000 or time=213000 or time=220000 or time=030000 or time=190000)) or (dayofweek=4 and (time=003000 or time=013000 or time=040000 or time=063000 or time=070000 or time=080000 or time=083000 or time=090000 or time=100000 or time=110000 or time=113000 or time=123000 or time=130000 or time=140000 or time=160000 or time=163000 or time=170000 or time=173000 or time=183000 or time=190000 or time=200000 or time=210000)) or (dayofweek=5 and (time=010000 or time=060000 or time=063000 or time=090000 or time=100000 or time=103000 or time=150000 or time=173000 or time=190000 or time=193000 or time=200000))

//TradingDayLONG= dayofweek=5 and time=203000

//TradingDayshort= dayofweek=4 and time=100000

TradingDayshort = ((dayofweek=1 and (time=160000 or time=163000 )) or (dayofweek=5 and (time=073000 )) or (dayofweek=2 and (time=003000 or time=020000 and time=030000 or time=040000 or time=043000 or time=050000 or time=060000 or time=070000 and time=083000 or time=093000 or time=100000 or time=103000 or time=113000 or time=123000 and time=130000 or time=133000 or time=140000 or time=143000 or time=150000 or time=173000 or time=180000 or time=183000 or time=193000 or time=213000 ))) or (dayofweek=4 and (time=070000 or time=093000 and time=040000 or time=033000 or time=170000 or time=130000 or time=080000 and time=180000 or time=053000 or time=020000 or time=023000))

//////////////////////////////////////////////////////////////////

//// Indicators

//////////////////////////////////////////////////////////////////

IBS = (Close – Low) / (High – Low) * 100

ma = average[maperiod](close)

ma1 = average[maPeriod1, maType1](customClose)

slope1 = ma1 – ma1[1]

//////////////////////////////////////////////////////////////////

//// Entry conditions

//////////////////////////////////////////////////////////////////

b1 = not longonmarket // only open 1 position

b1 = b1 and close < Dhigh(1) // close below yesterday's high

b1 = b1 and IBS ma // close over moving average

b1 = b1 and slope1 > 0 // ma slope is positive

s1 = not shortonmarket // only open 1 position

s1 = s1 and close > Dlow(1) // close above yesterday’s low

s1 = s1 and IBS > shorttrigger // Internal bar strength below trigger value

s1 = s1 and close < ma // close over moving average

s1 = s1 and slope1 Dhigh(1) // close above yesterday’s high

es1 = close 8

timeframe(default)

timeframe(daily)

d1= abs (high-low)<250*PIPSIZE and abs (high[1]-low[1])<250*PIPSIZE and abs (high[2]-low[2])=25

ds=rsi[14]=47

rr2=rsi[14]<56 and rsi[3]<59

timeframe (default)

non mi ha incollato il codice completo. ci riporovo

//// Sport Gold (E1 Contract) Spread 0.5

//////////////////////////////////////////////////////////////////

DEFPARAM CumulateOrders = false

DEFPARAM PreloadBars = 10000

//////////////////////////////////////////////////////////////////

//// Opti

//////////////////////////////////////////////////////////////////

longtrigger = 12

shorttrigger = 62

maperiod = 112

maPeriod1 = 18 // Moving Average Period 100

maType1 = 2 // Moving Average function

stoplossmulti = 8

possizelong = 3

possizeshort =3

TradingDayLong = (dayofweek=1 and (time=050000 or time=100000 or time=190000 or time=020000 or time=010000 or time=050000 or time=190000 or time=170000 or time=073000 or time=180000 or time=200000 or time=123000 or time=080000 or time=140000 or time=070000 or time=153000 or time=183000 or time=220000 or time=003000 or time=030000 or time=210000 or time=033000 or time=043000 )) or (dayofweek=2 and (time=170000 or time=033000 or time=113000 or time=153000 or time=073000 or time=070000 or time=030000 or time=020000 or time=043000 or time=213000 or time=103000 or time=230000 or time=013000 or time=003000 or time=170000 or time=233000 or time=120000 or time=183000 or time=000000 or time=130000 or time=200000 )) or (dayofweek=3 and (time=003000 or time=010000 or time=020000 or time=060000 or time=063000 or time=073000 or time=093000 or time=100000 or time=103000 or time=110000 or time=113000 or time=130000 or time=143000 or time=150000 or time=153000 or time=160000 or time=163000 or time=180000 or time=200000 or time=203000 or time=213000 or time=220000 or time=030000 or time=190000)) or (dayofweek=4 and (time=003000 or time=013000 or time=040000 or time=063000 or time=070000 or time=080000 or time=083000 or time=090000 or time=100000 or time=110000 or time=113000 or time=123000 or time=130000 or time=140000 or time=160000 or time=163000 or time=170000 or time=173000 or time=183000 or time=190000 or time=200000 or time=210000)) or (dayofweek=5 and (time=010000 or time=060000 or time=063000 or time=090000 or time=100000 or time=103000 or time=150000 or time=173000 or time=190000 or time=193000 or time=200000))

//TradingDayLONG= dayofweek=5 and time=203000

//TradingDayshort= dayofweek=4 and time=100000

TradingDayshort = ((dayofweek=1 and (time=160000 or time=163000 )) or (dayofweek=5 and (time=073000 )) or (dayofweek=2 and (time=003000 or time=020000 and time=030000 or time=040000 or time=043000 or time=050000 or time=060000 or time=070000 and time=083000 or time=093000 or time=100000 or time=103000 or time=113000 or time=123000 and time=130000 or time=133000 or time=140000 or time=143000 or time=150000 or time=173000 or time=180000 or time=183000 or time=193000 or time=213000 ))) or (dayofweek=4 and (time=070000 or time=093000 and time=040000 or time=033000 or time=170000 or time=130000 or time=080000 and time=180000 or time=053000 or time=020000 or time=023000))

//////////////////////////////////////////////////////////////////

//// Indicators

//////////////////////////////////////////////////////////////////

IBS = (Close – Low) / (High – Low) * 100

ma = average[maperiod](close)

ma1 = average[maPeriod1, maType1](customClose)

slope1 = ma1 – ma1[1]

//////////////////////////////////////////////////////////////////

//// Entry conditions

//////////////////////////////////////////////////////////////////

b1 = not longonmarket // only open 1 position

b1 = b1 and close < Dhigh(1) // close below yesterday’s high

b1 = b1 and IBS < longtrigger // Internal bar strength below trigger value

b1 = b1 and close > ma // close over moving average

b1 = b1 and slope1 > 0 // ma slope is positive

s1 = not shortonmarket // only open 1 position

s1 = s1 and close > Dlow(1) // close above yesterday’s low

s1 = s1 and IBS > shorttrigger // Internal bar strength below trigger value

s1 = s1 and close < ma // close over moving average

s1 = s1 and slope1 < 0 // ma slope is negative

//////////////////////////////////////////////////////////////////

//// Exit conditions Short

//////////////////////////////////////////////////////////////////

el1 = close > Dhigh(1) // close above yesterday’s high

es1 = close < Dlow(1) // close below yesterday’s low

//////////////////////////////////////////////////////////////////

//// Execution

//////////////////////////////////////////////////////////////////

timeframe(weekly)

w=rsi[3]>8

timeframe(default)

timeframe(daily)

d1= abs (high-low)<250*PIPSIZE and abs (high[1]-low[1])<250*PIPSIZE and abs (high[2]-low[2])<250*PIPSIZE

DL=rsi[14]>=25

ds=rsi[14]<56

timeframe(default)

timeframe(4H)

r1=rsi[14]>=47

rr2=rsi[14]<56 and rsi[3]<59

timeframe (default)

timeframe(2H)

duel=Stochasticd[14,3,5](close)>20

dues=Stochasticd[5,3,5](close)>18

timeframe (default)

if b1 and tradingdayLong and rsi[14]>=52 and r1 and abs(close-open)>2*PIPSIZE and d1 and not shortonmarket and dl and duel and Williams[14](close)<-3 then

buy possizelong contract at market

set stop %loss 0.98

set target %profit 1.75

endif

if s1 and tradingdayshort and abs(close-open)<50*pipsize and abs(close-open)>4*PIPSIZE and rr2 and d1 and not longonmarket and rsi[5]<55 and Stochasticd[14,3,5](close)<60 and Williams[14](close)>-98 and ds and dues then

sellshort possizeshort contract at market

set stop %loss 0.98

set target %profit 1.75

endif

if el1 then

sell at market

endif

if es1 then

exitshort at market

endif

//////////////////////////////////////////////////////////////////

//// Stop loss

//////////////////////////////////////////////////////////////////

if shortonmarket and abs (close-open)>(close*0.011) then

exitshort at market

endif

if shortonmarket then

exitshort at high+close*0.0059 stop

endif

if longonmarket then

sell at low-close*0.0074 stop

endif

IF NOT ONMARKET THEN

TrailingStart = 60 //60 trailing will start @trailinstart points profit

TrailingStep = 40 //30 trailing step to move the “stoploss”

Distance = 7 //7 pips Distance from caurrent price (if required by the broker)

PointsToKeep = 0 //0 pips to be gained when breakeven is set

//reset the stoploss value

newSL=0

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-TradePrice(1)>=(TrailingStart*PipSize+PointsToKeep*PipSize) THEN

newSL = TradePrice(1)+TrailingStep*PipSize+PointsToKeep*PipSize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=TrailingStep*PipSize THEN

newSL = newSL+TrailingStep*PipSize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND TradePrice(1)-close>=(TrailingStart*PipSize+PointsToKeep*PipSize) THEN

newSL = TradePrice(1)-TrailingStep*PipSize+PointsToKeep*PipSize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=TrailingStep*PipSize THEN

newSL = newSL-TrailingStep*PipSize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

IF LongOnMarket THEN

IF (close + Distance) > newSL THEN

SELL AT newSL STOP

ELSIF (close – Distance) < newSL THEN

SELL AT newSL LIMIT

ELSE

SELL AT Market

ENDIF

ELSIF ShortOnmarket THEN

IF (close + Distance) < newSL THEN

EXITSHORT AT newSL STOP

ELSIF (close – Distance) > newSL THEN

EXITSHORT AT newSL LIMIT

ELSE

EXITSHORT AT Market

ENDIF

ENDIF

ENDIF

//*********************************************************************************

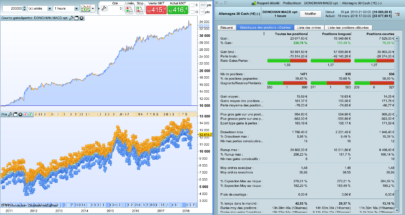

Grazie! ho visto l’ultimo codice e gira correttamente. Lo intendo su eurusd e 30min spred 1p. Risultato storico di ultimi 100000 periodi ottimo (anche troppo!!!) …. Fatico a capire bene come funziona il codice (miei limiti) ….. comunque le perplessità che avrei sono che su altri cross non ha performance paragonabili, è proprio solo per come si è comportato eurusd gli ultimi anni. Non è che è “overfittato” per eurusd? … continuerà ancora?

Vedo che se metto

possizelong = 1

possizeshort = 1

non cambia niente, se non la size… con size 1 posso provare anche un giro in reale… vediamo

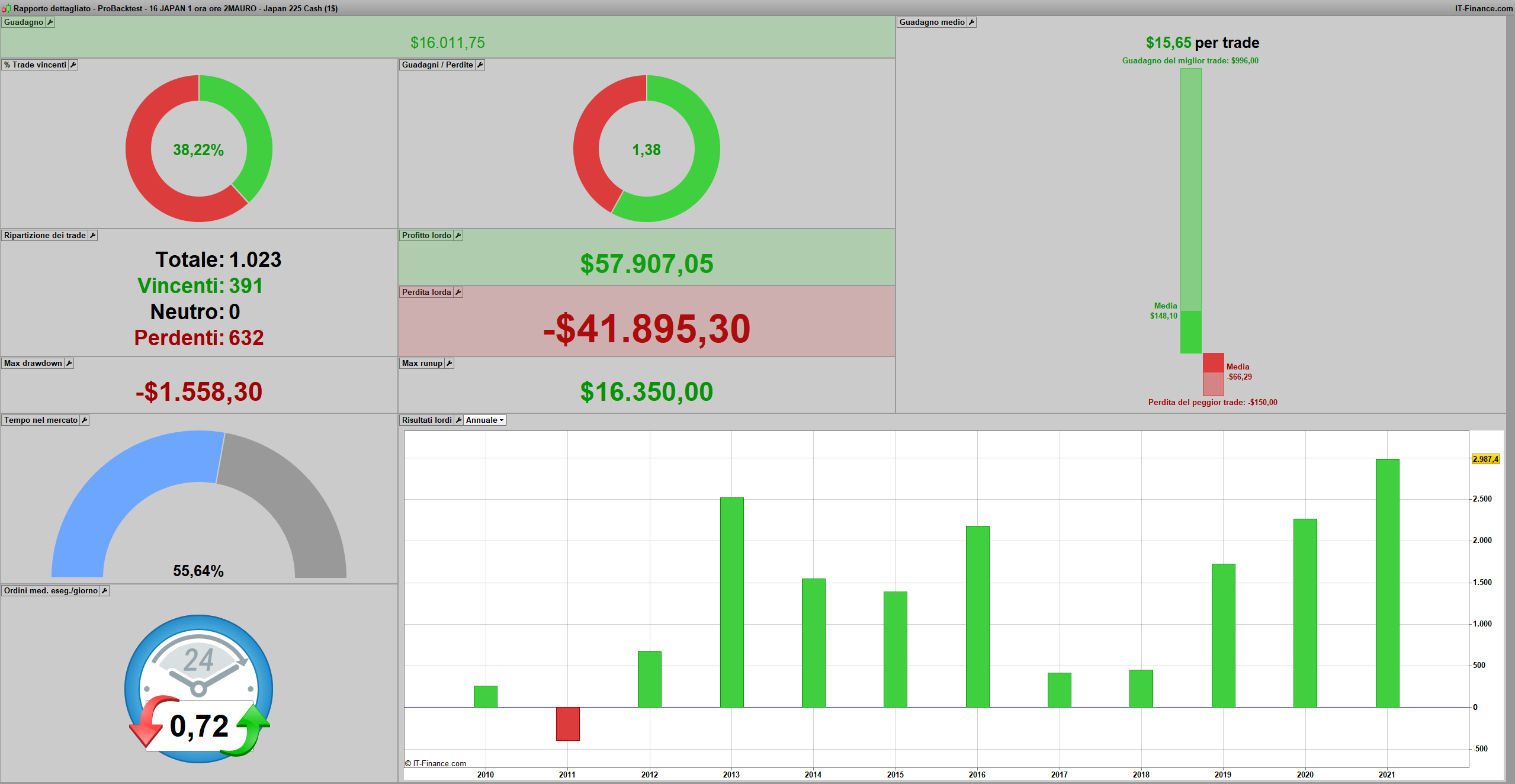

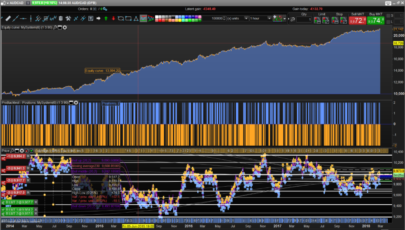

Sto facendo girare il sistema sul JAPAN …. very good performance last 2 weeks, congratulations.

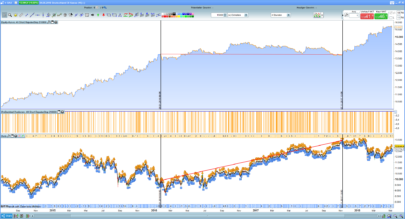

PROVA IL CODICE CHE TI ALLEGO. GIRA SU JAPAN BARRE A 3 ORE. SPREAD 9. GIRA MOLTO BENE

Defparam cumulateorders = false

DEFPARAM PreLoadBars = 10000

TradingDaylong = (dayofweek=1 and (time=040000 or time=190000 or time=100000 or time=160000 or time=070000 )) or (dayofweek=2 and (time=100000 or time=190000 or time=220000)) or (dayofweek=3 and ( time=040000 )) or (dayofweek=4 and (time=040000 or time=160000)) or (dayofweek=5 and ( time=040000 or time=070000 or time=160000))

//TradingDaylong = Dayofweek>=1 and dayofweek<=5

TradingDayshort =(dayofweek=1 and (time=030000 or time=040000 )) or (dayofweek=2 and time=050000 ) or (dayofweek=3 and (time=010000 or time=130000 or time=200000 or time=210000 )) or (dayofweek=4 and ( time=030000 or time=210000 ))

// TAILLE DES POSITIONS

nlong = 0.50

nshort = 0

USCITALONG = TIME = 130000

USCITASHORT = TIME = 210000

// STOP LOSS & TAKE PROFIT (%)

SLL = 1.15

TPL = 3.50

SLS = 2.25

TPS = 2.50

//MARGINE = 300

IF USCITALONG and uscita THEN

SELL AT market

ENDIF

IF USCITASHORT THEN

EXITSHORT AT MARKET

ENDIF

timeframe(weekly)

dd3= Williams[2](close)>-84 and rsi[14]>15

timeframe(default)

timeframe(daily)

d1=rsi[18]>35 and Williams[3](close)>-84 and abs(high-low)<close*0.055 and abs(high[1]-low[1])<close*0.055 and abs(close-open)<close*0.055 and close>(high+low)/2

uscita=abs(close-open)>60 and rsi[14]<68

timeframe(default)

timeframe(6h)

dd1=Stochasticd[5,3,5](close)>20 and close>(high+low)/2

r1=Williams[14](close)>-84 and close>(high+low)/2 AND CLOSE>OPEN

uscita1=Stochasticd[5,3,5](close)<60

timeframe(default)

timeframe(3h)

dd2=abs(close-open)<close*0.035

us2=low-200

timeframe(default)

if TradingDaylong and close>open AND ABS(CLOSE-OPEN)>26 AND ABS(CLOSE[1]-OPEN[1])>8 and Williams[14](close)>-84 and r1 and d1 and RSI[3](close)>48 and dd1 and dd2 and dd3 and abs(highest[20](close)-lowest[20](open))>60 AND CLOSE>(high+low)/2 then

buy nlong shares at high+40 stop

set stop %loss SLL

set target %profit TPL

endif

if TradingDayshort AND CLOSE<OPEN AND ABS(CLOSE-OPEN)>28 then

SELLSHORT nshort shares AT HIGH+38 STOP

set stop %loss SLS

set target %profit TPS

endif

// Stop Loss & Take Profit

//****************************************************

if longonmarket and close<open and abs (close-open)> 130 or abs (close-open)> 250 then

sell at market

endif

IF NOT ONMARKET THEN

TrailingStart = 90//83 trailing will start @trailinstart points profit

TrailingStep = 55 //50 trailing step to move the “stoploss”

Distance = 7 //7 pips Distance from caurrent price (if required by the broker)

PointsToKeep = 0 //0 pips to be gained when breakeven is set

//reset the stoploss value

newSL=0

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-TradePrice(1)>=(TrailingStart*PipSize+PointsToKeep*PipSize) THEN

newSL = TradePrice(1)+TrailingStep*PipSize+PointsToKeep*PipSize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=TrailingStep*PipSize THEN

newSL = newSL+TrailingStep*PipSize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND TradePrice(1)-close>=(TrailingStart*PipSize+PointsToKeep*PipSize) THEN

newSL = TradePrice(1)-TrailingStep*PipSize+PointsToKeep*PipSize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=TrailingStep*PipSize THEN

newSL = newSL-TrailingStep*PipSize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

IF LongOnMarket THEN

IF (close + Distance) > newSL THEN

SELL AT newSL STOP

ELSIF (close – Distance) < newSL THEN

SELL AT newSL LIMIT

ELSE

SELL AT Market

ENDIF

ELSIF ShortOnmarket THEN

IF (close + Distance) < newSL THEN

EXITSHORT AT newSL STOP

ELSIF (close – Distance) > newSL THEN

EXITSHORT AT newSL LIMIT

ELSE

EXITSHORT AT Market

ENDIF

ENDIF

ENDIF

//*********************************************************************************

Ciao ADConsulting, ho fatto il backtest …. notevole, PF 2 e dd molto basso, bel sistema. Vedo è solo Long e gli ultimi 10 anni il Japan225 è stato long… non vorrei che se inverte il sistema va in crisi.

La posizione short come mai è disattivata? non è possibile settare in maniera diversa una versione per lo short? ci provo….

sul time frame 3 h lo short non mi dava buoni risultati. se il mercato scende il programma sta cmq fermo. ha gli indicatori dei time frame superiori che lo bloccano. ciao

Hello, thanks for the strategy. Very interesting indeed. I’m wonderin could someone please provide in plain English why this type of strategy would work on this Japan225 market? I understand how the strategy works but I don’t understand why it works

I had the same thought when I looked at this strategy when it was first published almost two years ago. The original code has held up okay but it has gone a bit sideways in 2023. If you’re looking at the latest revision of the code above on the 3 hour time frame then that looks too overfit to me, there are too many rules and variables which seem to negatively impact performance if I modify them.

Ciao adconsulting e buon 2024! Nel 2023 il japan su 1h è andato molto bene, complimenti, viene mantenuto tale o ci sono modifiche?

buongiorno e Buon Anno anche a te. non ho fatto modifiche. prova il programma che ti copio di seguito su wall street 1 ora. ha size variabile in base alle performance. il long parte a 0.65 e lo short a 1. poi le size variano in base ai risultati. mi sta girando sul conto reale e funziona molto bene

. se ti vendono in mente miglioramenti scrivimi. ciao e grazie

Defparam cumulateorders = false

DEFPARAM PreLoadBars = 10000

TradingDaylong = (dayofweek=1 and (time=020000 or time=040000 or time=050000 or time=100000 or time=120000 or time=130000 or time=160000 or time=170000 or time=180000)) or (dayofweek=2 and (time=040000 or time=060000 or time=160000 or time=170000 or time=220000)) or (dayofweek=3 and (time=170000 or time=200000)) or (dayofweek=4 and (time=010000 or time=020000 or time=050000 or time=170000)) or (dayofweek=5 and (time=010000 or time=080000 or time=090000 or time=200000))

//TradingDaylong = Dayofweek=5 and time=210000

ONCE Capital = 800

once lotnumberlong=0.65

ONCE MinLotsLONG = 0.65

once lotnumbershort=1

ONCE MinLotsSHORT = 1

moltiplicatoresize = (StrategyProfit/capital)+1

IF StrategyProfit StrategyProfit[1] THEN

lotnumberlong = min(max(0.20, (MinLotsLONG*moltiplicatoresize)),MinLotsLONG*18)

//LotNumber = 1

ENDIF

IF StrategyProfit StrategyProfit[1] THEN

LotNumberSHORT = min(max(0.31, (MinLotsSHORT*moltiplicatoresize)),MinLotsSHORT*18)

//LotNumber = 1

ENDIF

USCITALONG = TIME = 220000

// STOP LOSS & TAKE PROFIT (%)

SLL = 0.85

TPL = 3

IF USCITALONG and uscita and dayofweek1 THEN

SELL AT MARKET

ENDIF

timeframe(weekly)

w= Williams[2](close)>-84

timeframe(default)

timeframe(daily)

d1=rsi[18]>35 and Williams[3](close)>-84 and abs(high-low)<close*0.055 and abs(high[1]-low[1])<close*0.055 and abs(close-open)(high+low)/2 and abs(highest[12]-lowest[12])>180 and Stochasticd[5,3,5](close)>25

uscita=abs(close-open)>60 and rsi[14]-82 and close>(high+low)/2 and close>open and rsi[5]>37

uscita1=Stochasticd[5,3,5](close)22 and close>(high+low)/2

timeframe(default)

timeframe(2h)

dd2=abs(close-open)24

us2=low-150

timeframe(default)

if TradingDaylong and Williams[14](close)>-84 and r1 and d1 and RSI[3](close)>54 and dd1 and dd2 and Williams[14](close)28 and RSI[12](close)(high+low)/2 AND ABS(CLOSE-OPEN)>25 AND ABS(CLOSE[1]-OPEN[1])>8 and Williams[5](close)>-60 and close>14000*pipsize and w then

buy lotnumberlong shares at high+10 stop

set stop %loss SLL

set target %profit TPL

endif

if longonmarket and close 90 or abs (close-open)> 250 then

sell at market

endif

TradingDayshort = (dayofweek=1 and (time=000000 or time=030000 or time=040000 or time=050000 or time=090000 or time=110000 or time=140000 or time=100000)) or (dayofweek=2 and (time=020000 or time=040000 or time=160000 or time=170000 or time=210000)) or (dayofweek=3 and (time=080000 or time=130000 or time=140000 or time=160000 or time=200000 or time=210000)) or (dayofweek=4 and (time=000000 or time=030000 or time=040000 or time=090000 or time=200000 or time=210000)) or (dayofweek=5 and (time=010000 or time=050000 or time=140000 or time=160000 or time=190000 or time=210000 or time=220000 or time=170000))

//TradingDayshort = dayofweek=5 and time =220000

TIMEFRAME(daily)

c3s = close<ExponentialAverage[18](close)

TIMEFRAME(default)

USCITASHORT = TIME = 220000

SLS = 0.75

TPS =3

//MARGINE = 300

IF USCITASHORT THEN

EXITSHORT AT MARKET

ENDIF

timeframe(daily)

dls= close<ExponentialAverage[16](close) and rsi[14]<53

timeframe(default)

timeframe(6h)

Z6s= rsi[16]<55

timeframe(default)

timeframe(2h)

d3s=abs (high-low)<close*0.0085 and Williams[14](close)<Williams[14](close)[1]

timeframe(default)

timeframe(4h)

d1s= close<ExponentialAverage[2](close) and Stochasticd[5,3,5](close)<80 and Williams[3](close)<-58

d2s=Stochastic[14,3](close)<81

timeframe(default)

if TradingDayshort AND closeclose*0.0022 and ABS(CLOSE-OPEN)=< close*0.0085 and rsi[14]<70 and d1s and d2s and d3s and rsi[4]<42 and Stochasticd[3,3,5](close)-94 and rsi[3]>3 and close6 and close>16000*pipsize and dls and z6s then

SELLSHORT lotnumberSHORT shares AT close-28 stop

set stop %loss SLS

set target %profit TPS

endif

// Stop Loss & Take Profit

//****************************************************

if shortonmarket then

exitshort at high+close*0.00125 stop

endif

if shortonmarket and ABS(CLOSE-OPEN)>= close*0.0085 or rsi[14]>70 then

exitshort at market

endif

IF NOT ONMARKET THEN

TrailingStart = 85//83 trailing will start @trailinstart points profit

TrailingStep = 52 //50 trailing step to move the “stoploss”

Distance = 7 //7 pips Distance from caurrent price (if required by the broker)

PointsToKeep = 0 //0 pips to be gained when breakeven is set

//reset the stoploss value

newSL=0

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-TradePrice(1)>=(TrailingStart*PipSize+PointsToKeep*PipSize) THEN

newSL = TradePrice(1)+TrailingStep*PipSize+PointsToKeep*PipSize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=TrailingStep*PipSize THEN

newSL = newSL+TrailingStep*PipSize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND TradePrice(1)-close>=(TrailingStart*PipSize+PointsToKeep*PipSize) THEN

newSL = TradePrice(1)-TrailingStep*PipSize+PointsToKeep*PipSize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=TrailingStep*PipSize THEN

newSL = newSL-TrailingStep*PipSize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

IF LongOnMarket THEN

IF (close + Distance) > newSL THEN

SELL AT newSL STOP

ELSIF (close – Distance) < newSL THEN

SELL AT newSL LIMIT

ELSE

SELL AT Market

ENDIF

ELSIF ShortOnmarket THEN

IF (close + Distance) newSL THEN

EXITSHORT AT newSL LIMIT

ELSE

EXITSHORT AT Market

ENDIF

ENDIF

ENDIF

//*********************************************************************************

Buongiorno ADconsulting, è interessante il wall street 1 ora, ma ci sono degli errori di copia/incolla, non riesco a farlo girare, provo ad indicarli se puoi correggerli:

………….

IF StrategyProfit StrategyProfit[1] THEN ////////////////////// manca un segno ???

lotnumberlong = min(max(0.20, (MinLotsLONG*moltiplicatoresize)),MinLotsLONG*18)

//LotNumber = 1

ENDIF

IF StrategyProfit StrategyProfit[1] THEN ////////////////////// manca un segno ???

……………

……………

timeframe(daily)

d1=rsi[18]>35 and Williams[3](close)>-84 and abs(high-low)<close*0.055 and abs(high[1]-low[1])180 and Stochasticd[5,3,5](close)>25 //////////// manca un segno nella parte “abs(close-open)(high+low)/2 ”

………………

ONCE Capital = 800

once lotnumberlong=0.65

ONCE MinLotsLONG = 0.65

once lotnumbershort=1

ONCE MinLotsSHORT = 1

moltiplicatoresize = (StrategyProfit/capital)+1

IF StrategyProfit StrategyProfit[1] THEN

lotnumberlong = min(max(0.20, (MinLotsLONG*moltiplicatoresize)),MinLotsLONG*18)

//LotNumber = 1

ENDIF

IF StrategyProfit StrategyProfit[1] THEN

LotNumberSHORT = min(max(0.31, (MinLotsSHORT*moltiplicatoresize)),MinLotsSHORT*18)

//LotNumber = 1

ENDIF

d1=rsi[18]>35 and Williams[3](close)>-84 and abs(high-low)<close*0.055 and abs(high[1]-low[1])<close*0.055 and abs(close-open)(high+low)/2 and abs(highest[12]-lowest[12])>180 and Stochasticd[5,3,5](close)>25

prova a vedere se gira adesso

il segno è quello del diverso……………………………

non so perchè ma non me lo fa scrivere. metti il segno minore da quello seguito da quello maggiore… praticamente se il guadagno del programma dopo l’ultima chiusura è diverso da quello della chiusura precedente

Ciao ad! ho provato, ma ora mi esplodono altri errori, sono tutte causa del copia incolla del tuo codice originario, pare che manchino gran parte dei “<", inoltre ci sono altre cose strane che poi non riesco a capire: "…….and d1s and d2s and d3s and rsi[4]3 and close6”

Comunque senza fretta, quando riesci. Tu usi il pulsante “Add PRT code” oppure fai ctrlC-ctrlV ? se no potresti anche fare un altro post e allegare il codice come .itf …..:)))

Defparam cumulateorders = false

DEFPARAM PreLoadBars = 10000

TradingDaylong = (dayofweek=1 and (time=020000 or time=040000 or time=050000 or time=100000 or time=120000 or time=130000 or time=160000 or time=170000 or time=180000)) or (dayofweek=2 and (time=040000 or time=060000 or time=160000 or time=170000 or time=220000)) or (dayofweek=3 and (time=170000 or time=200000)) or (dayofweek=4 and (time=010000 or time=020000 or time=050000 or time=170000)) or (dayofweek=5 and (time=010000 or time=080000 or time=090000 or time=200000))

//TradingDaylong = Dayofweek=5 and time=210000

ONCE Capital = 800

once lotnumberlong=0.65

ONCE MinLotsLONG = 0.65

once lotnumbershort=1

ONCE MinLotsSHORT = 1

moltiplicatoresize = (StrategyProfit/capital)+1

IF StrategyProfit <> StrategyProfit[1] THEN

lotnumberlong = min(max(0.20, (MinLotsLONG*moltiplicatoresize)),MinLotsLONG*18)

//LotNumber = 1

ENDIF

IF StrategyProfit <> StrategyProfit[1] THEN

LotNumberSHORT = min(max(0.31, (MinLotsSHORT*moltiplicatoresize)),MinLotsSHORT*18)

//LotNumber = 1

ENDIF

USCITALONG = TIME = 220000

// STOP LOSS & TAKE PROFIT (%)

SLL = 0.85

TPL = 3

IF USCITALONG and uscita and dayofweek<>1 THEN

SELL AT MARKET

ENDIF

timeframe(weekly)

w= Williams[2](close)>-84

timeframe(default)

timeframe(daily)

d1=rsi[18]>35 and Williams[3](close)>-84 and abs(high-low)<close*0.055 and abs(high[1]-low[1])<close*0.055 and abs(close-open)<close*0.05 and close>(high+low)/2 and abs(highest[12]-lowest[12])>180 and Stochasticd[5,3,5](close)>25

uscita=abs(close-open)>60 and rsi[14]<75

timeframe(default)

timeframe(4h)

r1=Williams[14](close)>-82 and close>(high+low)/2 and close>open and rsi[5]>37

uscita1=Stochasticd[5,3,5](close)<60

timeframe(default)

timeframe(6h)

dd1=Stochasticd[5,3,5](close)>22 and close>(high+low)/2

timeframe(default)

timeframe(2h)

dd2=abs(close-open)<close*0.03 and Stochasticd[5,3,5](close)>24

us2=low-150

timeframe(default)

if TradingDaylong and Williams[14](close)>-84 and r1 and d1 and RSI[3](close)>54 and dd1 and dd2 and Williams[14](close)<-4 and rsi[14]>28 and RSI[12](close)<95 and close>(high+low)/2 AND ABS(CLOSE-OPEN)>25 AND ABS(CLOSE[1]-OPEN[1])>8 and Williams[5](close)>-60 and close>14000*pipsize and w then

buy lotnumberlong shares at high+10 stop

set stop %loss SLL

set target %profit TPL

endif

if longonmarket and close<open and abs (close-open)> 90 or abs (close-open)> 250 then

sell at market

endif

TradingDayshort = (dayofweek=1 and (time=000000 or time=030000 or time=040000 or time=050000 or time=090000 or time=110000 or time=140000 or time=100000)) or (dayofweek=2 and (time=020000 or time=040000 or time=160000 or time=170000 or time=210000)) or (dayofweek=3 and (time=080000 or time=130000 or time=140000 or time=160000 or time=200000 or time=210000)) or (dayofweek=4 and (time=000000 or time=030000 or time=040000 or time=090000 or time=200000 or time=210000)) or (dayofweek=5 and (time=010000 or time=050000 or time=140000 or time=160000 or time=190000 or time=210000 or time=220000 or time=170000))

//TradingDayshort = dayofweek=5 and time =220000

TIMEFRAME(daily)

c3s = close<ExponentialAverage[18](close)

TIMEFRAME(default)

USCITASHORT = TIME = 220000

SLS = 0.75

TPS =3

//MARGINE = 300

IF USCITASHORT THEN

EXITSHORT AT MARKET

ENDIF

timeframe(daily)

dls= close<ExponentialAverage[16](close) and rsi[14]<53

timeframe(default)

timeframe(6h)

Z6s= rsi[16]<55

timeframe(default)

timeframe(2h)

d3s=abs (high-low)<close*0.0085 and Williams[14](close)<Williams[14](close)[1]

timeframe(default)

timeframe(4h)

d1s= close<ExponentialAverage[2](close) and Stochasticd[5,3,5](close)<80 and Williams[3](close)<-58

d2s=Stochastic[14,3](close)<81

timeframe(default)

if TradingDayshort AND close<open and ABS(CLOSE-OPEN)>close*0.0022 and ABS(CLOSE-OPEN)=< close*0.0085 and rsi[14]<70 and d1s and d2s and d3s and rsi[4]<42 and Stochasticd[3,3,5](close)<67 and c3s and Williams[2](close)>-94 and rsi[3]>3 and close<ExponentialAverage[21](close) and ABS(CLOSE[1]-OPEN[1])>6 and close>16000*pipsize and dls and z6s then

SELLSHORT lotnumberSHORT shares AT close-28 stop

set stop %loss SLS

set target %profit TPS

endif

// Stop Loss & Take Profit

//****************************************************

if shortonmarket then

exitshort at high+close*0.00125 stop

endif

if shortonmarket and ABS(CLOSE-OPEN)>= close*0.0085 or rsi[14]>70 then

exitshort at market

endif

IF NOT ONMARKET THEN

TrailingStart = 85//83 trailing will start @trailinstart points profit

TrailingStep = 52 //50 trailing step to move the “stoploss”

Distance = 7 //7 pips Distance from caurrent price (if required by the broker)

PointsToKeep = 0 //0 pips to be gained when breakeven is set

//reset the stoploss value

newSL=0

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-TradePrice(1)>=(TrailingStart*PipSize+PointsToKeep*PipSize) THEN

newSL = TradePrice(1)+TrailingStep*PipSize+PointsToKeep*PipSize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=TrailingStep*PipSize THEN

newSL = newSL+TrailingStep*PipSize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND TradePrice(1)-close>=(TrailingStart*PipSize+PointsToKeep*PipSize) THEN

newSL = TradePrice(1)-TrailingStep*PipSize+PointsToKeep*PipSize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=TrailingStep*PipSize THEN

newSL = newSL-TrailingStep*PipSize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

IF LongOnMarket THEN

IF (close + Distance) > newSL THEN

SELL AT newSL STOP

ELSIF (close – Distance) < newSL THEN

SELL AT newSL LIMIT

ELSE

SELL AT Market

ENDIF

ELSIF ShortOnmarket THEN

IF (close + Distance) < newSL THEN

EXITSHORT AT newSL STOP

ELSIF (close – Distance) > newSL THEN

EXITSHORT AT newSL LIMIT

ELSE

EXITSHORT AT Market

ENDIF

ENDIF

ENDIF

//*********************************************************************************

Ora è tutto ok e gira correttamente!!! Grazie, mi sembra veramente notevole a prima simulazione…. metto la size fissa, non in proporzione al capitale per capirci e lo faccio girare un po’.

Per ora stavo provando il sistema sul Japan-1h, nonostante mi sono messo la size fissa senza cumulare le posizioni che lo penalizza un po’ (Defparam cumulateorders = false) devo dire va moto bene, ha retto anche gli ultimi periodi di mercato.

Hi @adconsulting,

Thanks a lot for these contributions.

I am currently running live 2 of your systems.

Do you mind if I create a thread in the english forum of course citing this thread and your name as I am convinced that

> you are delivering high value content

> it woud be easier to immediatly visualize the backtests

> and I have a couple of questions to understand better how you built this system for my own education.

Are you at ease in english or is it complicated for you ?;-)

But of course you can create this thread yourself ^^

Please let me know

Chris

Ciao @adconsulting, stavo rifacendo un check dei tuoi sistemi, quello su eurusd-30 min… onon capisco se è un problema delle mie simulazioni, ma fa una performance strabiliante fino a giugno/2023 dove inizia prendere dei loss…. hai revisioni di questo?

Hello adconsulting, after the 2024 performance are you going to adjust the japan parameters?

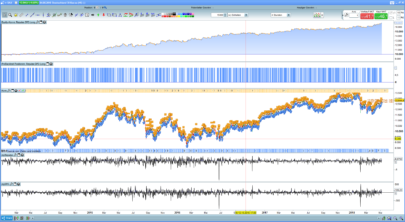

ciao, ho fatto delle modifiche. mi sono spostato sul time frame a 15 minuti per ridurre gli stop. prova a dare un occhio . ti giro il codice e dimmi cosa ne pensi. sta girando e sta andando bene. se hai consigli fammi sapere . grazie

Defparam cumulateorders = TRUE

DEFPARAM PreLoadBars = 10000

legale=Month=11 or month=12 or Month=1 or month=2 or month=3

solare=Month=4 or month=5 or Month=6 or month=7 or month=8 or Month=9 or month=10

TradingDaylong = (dayofweek=1 and (time=150000)) or (dayofweek=2 and (time=021500 or time=030000 or time=031500 or time=043000 or time=050000 or time=053000 or time=061500 or time=064500 or time=083000 or time=120000 or time=124500 or time=134500 or time=144500 or time=153000 or time=161500 or time=173000 or time=174500 or time=203000 or time=220000)) or (dayofweek=3 and (time=051500 or time=143000 or time=153000 or time=161500 or time=064500 or time=174500 or time=111500 or time=214500 or time=133000 or time=063000 or time=100000 or time=034500 or time=203000 or time=091500 or time=160000 or time=171500 or time=063000 or time=053000 )) or (dayofweek=4 and ( time=023000 or time=024500 or time=030000 or time=054500 or time=060000 or time=061500 or time=071500 or time=074500 or time=080000 or time=094500 or time=120000 or time=121500 or time=141500 or time=144500 or time=161500 or time=170000)) or (dayofweek=5 and ( time=143000 or time=093000 or time=101500 or time=064500 or time=120000 or time=061500 or time=110000 or time=024500 or time=051500 or time=103000 or time=040000 or time=170000 or time=060000 or time=104500 or time=054500 or time=044500 or time=074500)) or (dayofweek=1 and legale AND TIME>=010000 AND TIME<=020000) or (dayofweek=1 AND TIME>=150000 AND TIME<=153000) or (dayofweek=2 and legale AND TIME>=011500 AND TIME<=030000) or (dayofweek=2 and solare AND TIME>=021500 AND TIME<=031500) or (dayofweek=2 AND TIME>=154500 AND TIME<=154500) or (dayofweek=3 and legale AND TIME>=051500 AND TIME<=080000) or (dayofweek=3 AND TIME>=130000 AND TIME<=160000) or (dayofweek=3 AND TIME>=170000 AND TIME<=173000) OR (dayofweek=4 and legale AND TIME>=011500 AND TIME<=050000) OR (dayofweek=4 and legale AND TIME>=050000 AND TIME<=070000) OR (dayofweek=4 and SOLARE AND TIME>=040000 AND TIME<=080000) OR (dayofweek=4 AND TIME>=180000 AND TIME<=213000) OR (dayofweek=5 AND legale AND TIME>=050000 AND TIME<=054500) OR (dayofweek=5 AND SOLARE AND TIME>=020000 AND TIME<=040000) OR (dayofweek=5 AND TIME>=080000 AND TIME<=130000) OR (dayofweek=5 AND TIME>=140000 AND TIME<=143000) OR (dayofweek=5 AND TIME>=170000 AND TIME<=200000)

//TradingDaylong = (dayofweek=5 AND TIME>=170000 AND TIME<=200000)

lotnumberlong = 1

lotnumbershort=1

if longonmarket and positionperf>0 then

sell at low-105 STOP //0.028

ENDIF

if longonmarket then

sell at CLOSE-114 STOP //0.028

ENDIF

// STOP LOSS & TAKE PROFIT (%)

SLL = 0.40

TPL = 4.75

timeframe(daily)

dly= abs(close-open)<close*0.0055 and abs(close-open)>2 AND RSI[5]>15 AND Stochasticd[14,3,5](close)>14 AND Williams[5](close)>-85

TIMEFRAME(default)

timeframe(6h)

sei= abs(close-open)<close*0.0057 and abs(close-open)>2 AND Stochasticd[14,3,5](close)>14

TIMEFRAME(default)

timeframe(4H)

quattro =RSI[12]>33 and Cycle(close)<27 and abs(close-open)>2

uscitashort=high+250

TIMEFRAME(default)

timeframe(2H)

due =RSI[21]>36 and abs (close-open)>4

TIMEFRAME(default)

timeframe(1h)

uno=RSI[26]>32 and Stochasticd[5,3,5](close)>29

TIMEFRAME(default)

TIMEFRAME(default)

timeframe(30mn)

trenta=RSI[21]>26 and Williams[5](close)<-6

TIMEFRAME(default)

if TradingDaylong and not LONGONMARKET and abs(close-open)>10 AND dly and Stochasticd[14,3,5](close)>20 and rsi[14]> 27 and quattro AND due and abs(highest[24]-lowest[24])>55 and Williams[5](close)<-5 and close>(high+low)/2 and Cycle(close)<25 and trenta and uno and sei then

buy lotnumberlong shares at high+AverageTrueRange[14](close)*1.12 stop //0.000003

set stop %loss SLL

set target %profit TPL

endif

if TradingDaylong and LONGONMARKET AND POSITIONPERF >0 AND COUNTOFLONGSHARES<=lotnumberlong*3 and abs(close-open)>10 AND dly and Stochasticd[14,3,5](close)>20 and rsi[14]> 27 and quattro AND due and abs(highest[24]-lowest[24])>55 and Williams[5](close)<-5 and close>(high+low)/2 and Cycle(close)<25 and trenta and uno and sei and close-close[20]>105 and barindex-tradeindex>20 then

buy lotnumberlong shares at high+AverageTrueRange[14](close)*1.12 stop //0.000003

set stop %loss SLL

set target %profit TPL

endif

if longonmarket and abs(close-open)>close*0.009 then

sell at market

endif

if longonmarket and rsi[14]< 14 then

sell at market

endif

d1= close- close[1]>110 and close<open

d2= close-close[2]>130 and close<open

d3= close-close[3]>150 and close<open and close[1]<open[1]

if longonmarket and d1 or d2 or d3 and positionperf>0 then

sell at market

endif

if longonmarket and barindex-tradeindex>350 and positionperf>0 then

sell at market

endif

TradingDayshort = (dayofweek=1 and legale and time>=010000 and time<=010000) or (dayofweek=1 and solare and time>=063000 and time<=080000) or (dayofweek=1 and time>=100000 and time<=130000) or (dayofweek=1 and time>=160000 and time<=163000) or (dayofweek=1 and time>=200000 and time<=201500) or (dayofweek=2 and solare and time>=020000 and time<=030000) or (dayofweek=2 and time>=093000 and time<=130000) or (dayofweek=2 and time>=210000 and time<=230000) OR (dayofweek=3 and time>100000 and time<=103000) OR (dayofweek=3 and time>=160000 and time<=164500) OR (dayofweek=3 and time>=190000 and time<=221500) OR (dayofweek=4 and legale and time>=030000 and time<=050000) OR (dayofweek=4 and solare and time>=051500 and time<=053000) OR (dayofweek=4 and solare and time>=080000 and time<=094500) OR (dayofweek=4 and solare and time>=193000 and time<=193000) or (dayofweek=4 and legale and time>=104500 and time<=110000) or (dayofweek=4 and legale and time>=141500 and time<=143000) or (dayofweek=4 and legale and time>=154500 and time<=160000) or (dayofweek=4 and legale and time>=163000 and time<=164500) or (dayofweek=5 and legale and time>=010000 and time<=010000) or (dayofweek=5 and legale and time>=020000 and time<=020000) or (dayofweek=5 and legale and time>=041500 and time<=080000) or (dayofweek=5 and legale and time>=080000 and time<=090000) or (dayofweek=5 and legale and time>=170000 and time<=171500) or (dayofweek=5 and solare and time>=070000 and time<=070000) or (dayofweek=5 and solare and (time= 103000 or time=124500))

//TradingDayshort = (dayofweek=5 and solare and (time= 170000 or time=203000))

SLS = 0.40

TPS = 1.75

TIMEFRAME(daily)

Z3 =Cycle(close)<15 and rsi[5]<52 and close<ExponentialAverage[20](close) and rsi[24]<62 and Stochasticd[5,3,5](close)<76 and Williams[8](close) <-30 and rsi[21]<70

TIMEFRAME(default)

timeframe(6h)

seis= abs(high-low)<430 and Cycle(close)<14 and Stochasticd[5,3,5](close)<68 and abs(close-open)>8 and Williams[8](close) <-30

TIMEFRAME(default)

timeframe(4h)

quattros=abs(high-low)<370 and rsi[14]<55 and rsi[24]<50 and Cycle(close)<14 and Stochasticd[5,3,5](close)<75

TIMEFRAME(default)

timeframe(2H)

dues =Cycle(close)<11 and Williams[5](close) <-50

TIMEFRAME(default)

timeframe(1h)

S1= Williams[14](close)<-50 and abs(close-open)<350 and Cycle(close)<14 and close<ExponentialAverage[20](close)

timeframe(default)

timeframe(30mn)

S2= rsi[14]<47 and rsi[5]<38

timeframe(default)

if TradingDayshort AND not onmarket and rsi[14]<46 and rsi[24]<50 and Cycle(close)<5 and Williams[5](close)>-96 and rsi[5]>4 and z3 and s2 and s1 and dues and seis and quattros and abs(highest[12]-lowest[12])>50 and seis and Williams[14](close) <-60 and AverageTrueRange[14](close)>22 and AverageTrueRange[14](close)<160 and rsi[5]<45 and Stochasticd[5,3,5](close)<60 then

SELLSHORT lotnumbershort shares AT close-AverageTrueRange[14](close)*0.98 stop

set stop %loss SLS

set target %profit TPS

endif

if TradingDayshort AND SHORTONMARKET and POSITIONPERF>0 and COUNTOFSHORTSHARES<lotnumbershort*3 and rsi[14]<46 and rsi[24]<50 and Cycle(close)<5 and Williams[5](close)>-96 and rsi[5]>4 and z3 and s2 and s1 and dues and seis and quattros and abs(highest[12]-lowest[12])>50 and seis and Williams[14](close) <-60 and AverageTrueRange[14](close)>22 and AverageTrueRange[14](close)<160 and rsi[5]<45 and Stochasticd[5,3,5](close)<60 then

SELLSHORT lotnumbershort shares AT close-AverageTrueRange[14](close)*0.98 stop

set stop %loss SLS

set target %profit TPS

endif

if shortonmarket then

exitshort at close+AverageTrueRange[14](close)*2.75 stop

endif

//TRAILING STOP

TGL =10000

TGS=180

if not onmarket then

MAXPRICE = 0

MINPRICE = close

PREZZOUSCITA = 0

ENDIF

if longonmarket then

MAXPRICE = MAX(MAXPRICE,close)

if MAXPRICE-tradeprice(1)>=TGL*pointsize then

PREZZOUSCITA = MAXPRICE-TGL*pointsize

ENDIF

ENDIF

if shortonmarket then

MINPRICE = MIN(MINPRICE,close)

if tradeprice(1)-MINPRICE>=TGS*pointsize then

PREZZOUSCITA = MINPRICE+TGS*pointsize

ENDIF

ENDIF

if onmarket and PREZZOUSCITA>0 then

EXITSHORT AT PREZZOUSCITA STOP

SELL AT PREZZOUSCITA STOP

ENDIF

ok grazie, ottimo lavoro, sto vedendo le simulazioni…

– a me non piace per principio il Defparam cumulateorders = TRUE perchè non da certezza su quante pos si aprono, ma anche mettendolo FALSE è ottimo

– i japan a 1 ora come mai è andato in difficoltà? cambiato il mercato definitivamente?

Japan sul 15 min lo faccio girare un po’ poi vedo …