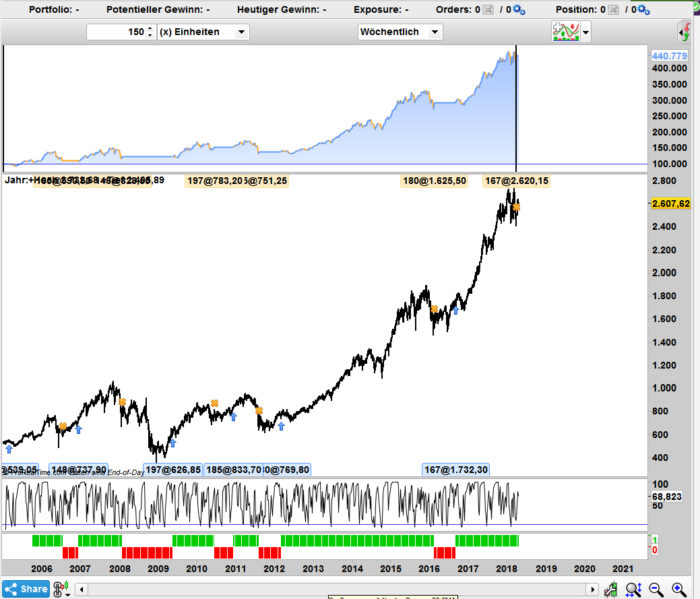

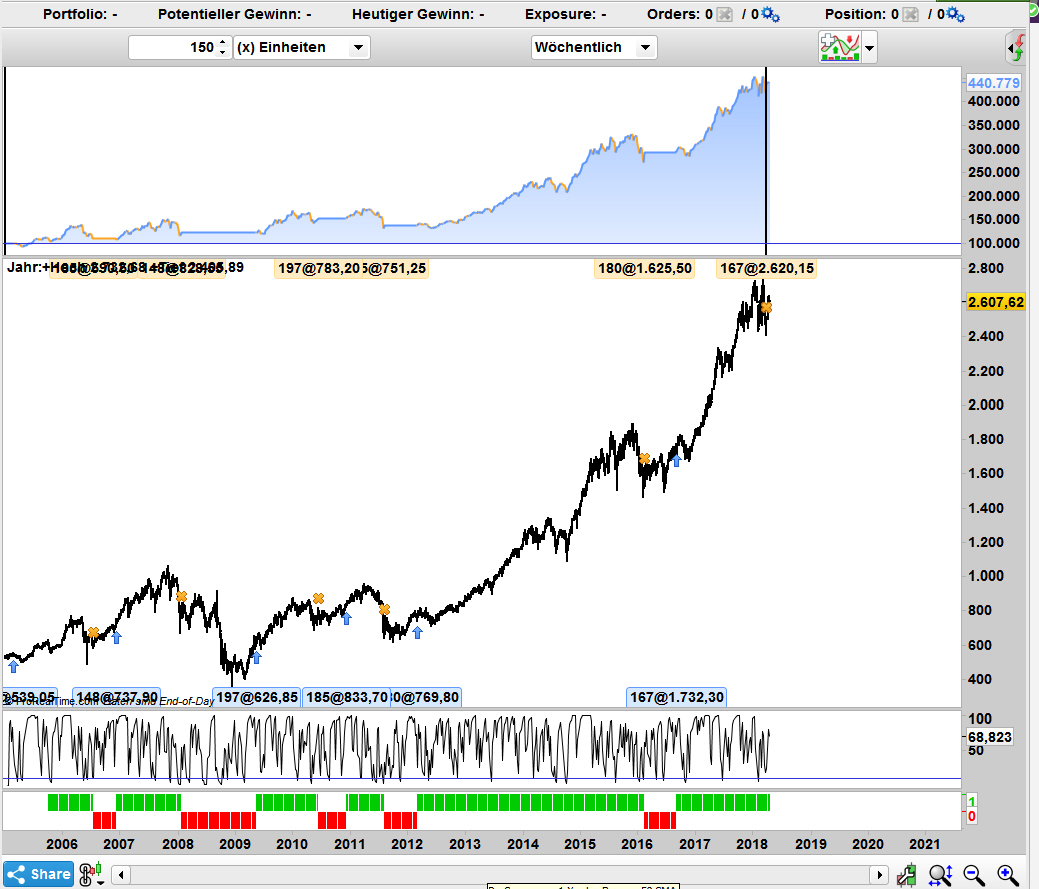

This Trading System is “long only” to play because stock markets should going up in the long run. (long only) bias.

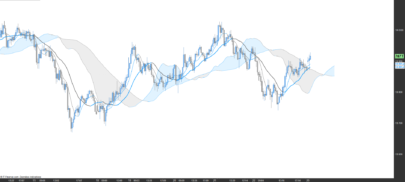

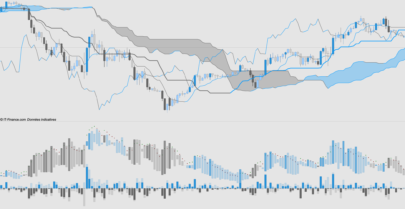

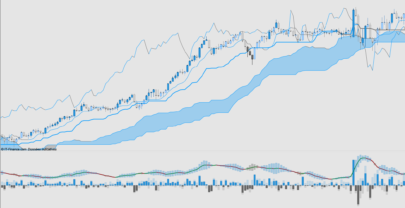

The Idea is to have the 200 day simple moving average and buy if the 38 day simple moving average is 3 % over the 200 day average and sell all when its cross 3 % under the 200 day moving average.

for lazy investors this is the weekly system. you have to check only on weekends the systems and place you bets on monday.

no stops, no money management. everytime all is investment long.

the advantge from the system is, you gain wealth long term with lower draw downs because you avoid the big bear markets with this simple system.

no optimization it needed.

when the sytem ist flat, you can invest in bond market, to profit more from bear market.

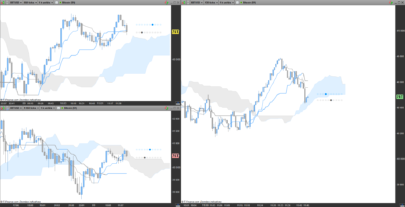

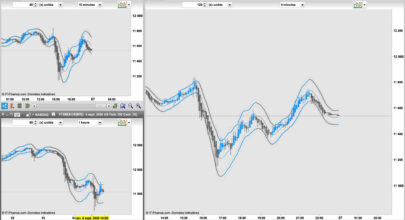

the system works stable with all big markets, for example

- DAX30

- MDAX (prefered)

- TecDAx (prefered)

- Nasdaq

- Dow Jones

- Nikkei

- SP500

- Stoxx 600

- MSCI World…

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 |

// Festlegen der Code-Parameter DEFPARAM CumulateOrders = False // Kumulieren von Positionen deaktiviert capital = 100000 + strategyprofit n = capital / close // orginial 200 day sma c1 = average[40](close) // the 3 % up band c2 = c1*1.03 // the 3 % low band c3 = c1*0.97 // the original 38 day sma c4 = Average[8](close) // Bedingungen zum Einstieg in Long-Positionen IF c4 > c2 THEN BUY n shares AT MARKET ENDIF // Bedingungen zum Ausstieg von Long-Positionen IF c4 < c3 THEN SELL AT MARKET ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks for this strategy, simple but efficient as i see

Thankyou! It would be nice to have this as a screener.

Quisiera saber si este modelo de cribador repinta. Saludos

look at the screener i upload a new rule based screener for this strategy to find long canditates.

dove si trova lo screener?

Very nice strategy, it does work indeed !! Very long time perspective. You can use this strategy to decide to sell or hold your stock index portfolio.

Disadvantage is that it sells by opening next bar, which is opening next monday;

Maybe it is possible to let this strategy trade, based upon the week end close value at the end of the week [close trade at close of the week].

KR Jan vd Wind

Hi Odin, thank you very much for the strategy. You said there is a screener you posted for this strategy, but when I look at your posts, there seems to be many screeners. Which one is the best one for this strategy? Thank you again.

Is it possible to make this indicator also suitable for dax30, s&p500, mdax50, and even for the continuous futuredata (xxxx), those do not work at this moment.

Hello, Odin , thanks for this amazing strategy. One question , would it work for indexes cfd and not only for their stocks ?? Thanks for your time

Hola, Gracias por la estrategia. Cuando comentas que funciona para todos los mercados, …¿funciona tambien para acciones?

HI

Wwhy you said avoiding bear market?

Don’t you think that we can use this code for short? when the indicator’s red bar is coming

It’s one months that i use in this way and it seems going well

Thanks…