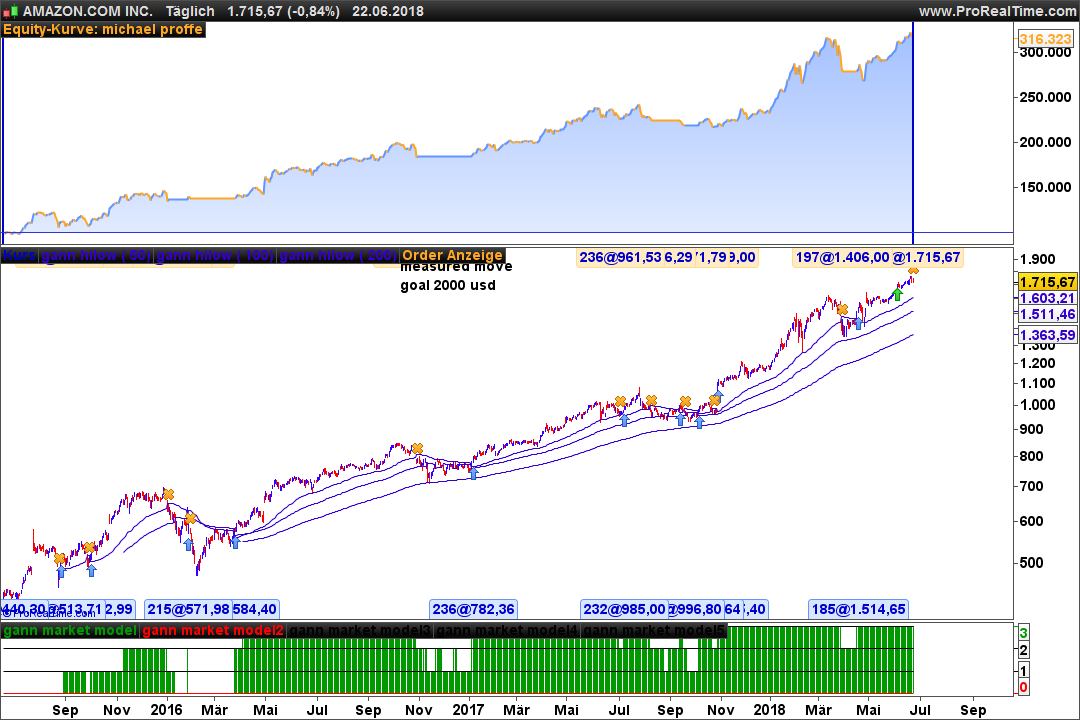

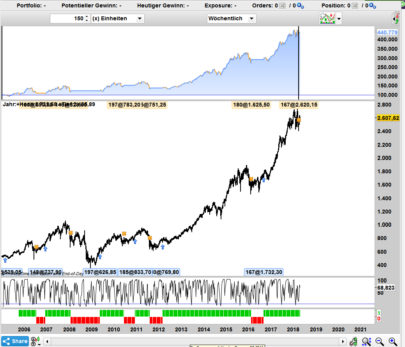

Buy in bulltrend when short term correction is ended.

Orders are triggered when a short term correction has ended and in a well established bullish trend. I used the indicator you can find here: Gann Market Model to determine the point entries.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 |

// Festlegen der Code-Parameter DEFPARAM CumulateOrders = False // Kumulieren von Positionen deaktiviert capital = 100000 + strategyprofit n = capital / close //short term a1= ExponentialAverage[50](high)[1] b1=ExponentialAverage[50](low)[1] if customclose > a1 then c1 = 1 Else IF customclose < b1 then c1=-1 endif ENDIF if c1= -1 then D1 = a1 ELSE D1=b1 endif a2= ExponentialAverage[100](high)[1] b2=ExponentialAverage[100](low)[1] if customclose > a2 then c2 = 1 Else IF customclose < b2 then c2=-1 endif ENDIF if c2= -1 then D2 = a2 ELSE D2=b2 endif a3= ExponentialAverage[200](high)[1] b3=ExponentialAverage[200](low)[1] if customclose > a3 then c3 = 1 Else IF customclose < b3 then c3=-1 endif ENDIF if c3= -1 then D3 = a3 ELSE D3=b3 endif if D1 < close then result = 1 else result = 0 endif if D2 < close then result1 = 1 else result1 = 0 endif if D3 < close then result2 = 1 else result2 = 0 endif c10 = (result+result1+result2) // Bedingungen zum Einstieg in Long-Positionen IF c10 > 2 THEN BUY n shares AT MARKET ENDIF // Bedingungen zum Ausstieg von Long-Positionen IF c10 < 3 THEN SELL AT MARKET ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks a lot for the new strategy.

I just run it on the DAX, it gives not yet steady results. (on different time frames, from 5 min till a full day)

1. What timeframe do you suggest to use for this strategy ?

2. Is the Gann Market Model Short Term Correction strategy also useful for short positions / preferably both short and low positions ?

Kind regards,

i use it on daily Chart only. i use it on stock market for long only startegies. i´m no fan of short positions.

Hi Odin, Thank you for the code.

I made sone test with M1 timeframe and results have to be improved but so far interesting.

Please find here modified code:

https://www.prorealcode.com/topic/gann-market-model-short-term-correction-strategy-m1-timeframe/

Sorry, a quick question I cannot see on forum please ?…Using ProScreener, how can we get the full list of stocks that meet the criteria, not just the top 50 ?

Thank you,