Good afternoon,

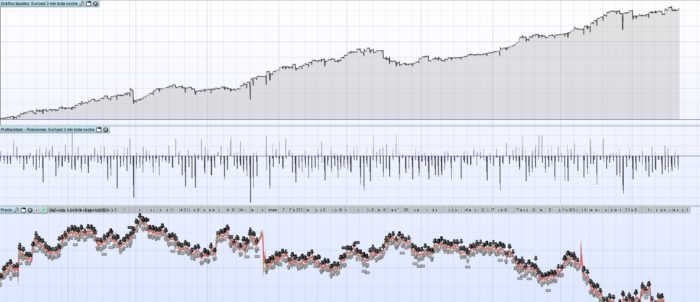

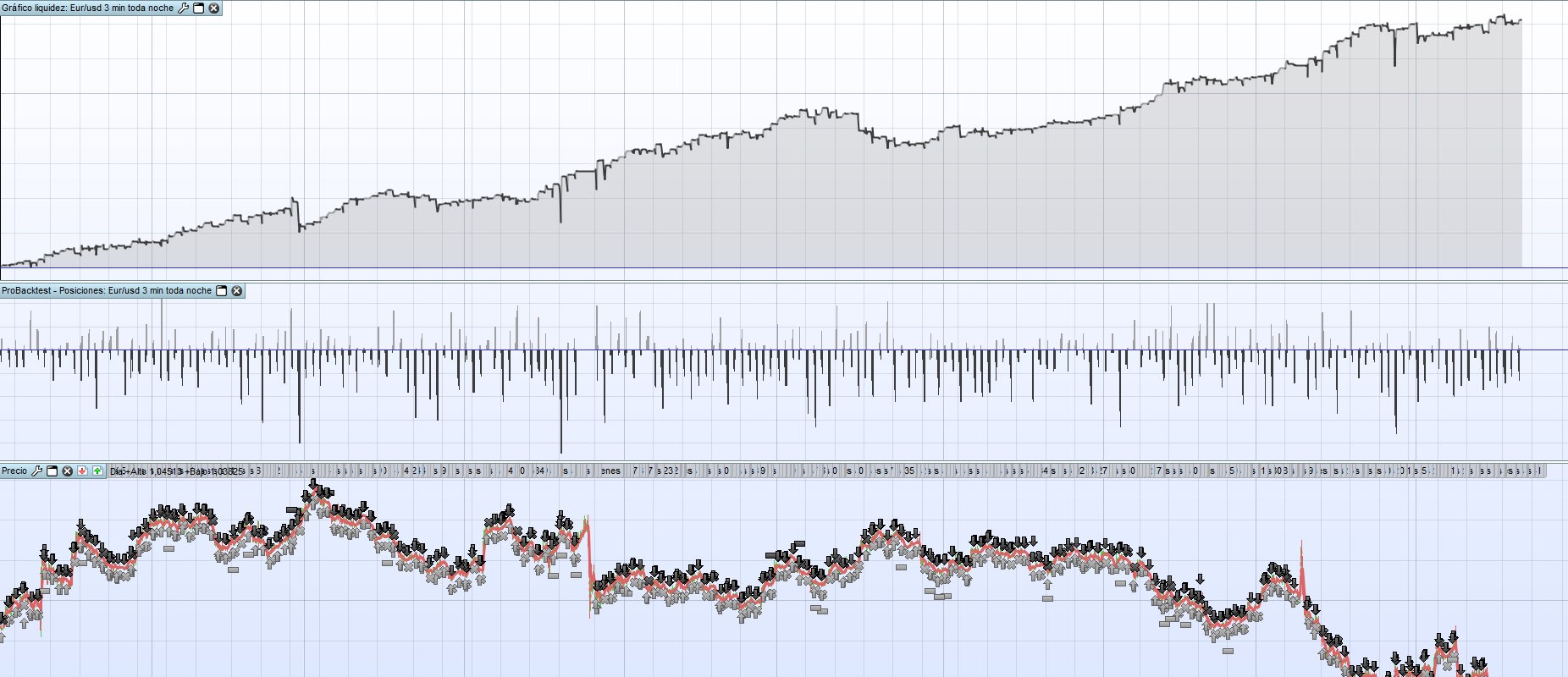

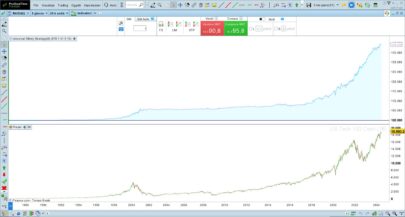

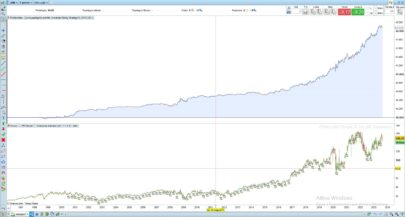

This strategy is designed for the Eur / Usd mini 1 € with a 3-minute timeframe and a spread of 0.6 pips. It only works in the evenings. Let’s see what you think and if anyone is encouraged to improve it. 😉 I have already put it with real money for a month and the backtest corresponds to what the robot does in real.

Buenas tardes,

Esta estrategia esta diseñada para el Eur/Usd mini 1€ con un timeframe de 3 minutos y un spread de 0,6 pips. Exclusivamente funciona por las noches. A ver que os parece y si alguno se anima a mejorarlo. 😉 Ya lo tengo puesto con dinero real desde hace un mes y el backtest se corresponde a lo que hace el robot en real.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 |

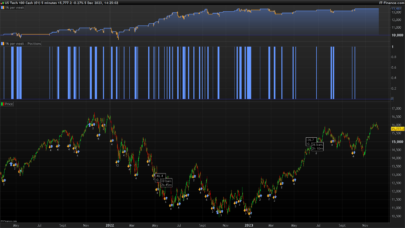

DEFPARAM CumulateOrders = true // Acumulación de posiciones desactivada DEFPARAM FlatAfter = 080300 // No se abren nuevas posiciones después de la vela que se cierra a las 5:15 p.m. HoraEntradaLimite = 070000 // El análisis de mercado empieza en la vela de 15 minutos que cierra a las 9:30 a.m. HoraInicio = 010000 IF ((Month = 6 AND (Day = 23 or day=24))or (month=11 and day=9)) THEN DiaTrading = 0 ELSE DiaTrading = 1 ENDIf capital= 3000 + strategyprofit posicion= capital/3000 if posicion>1then posicion=1 endif if posicion<1then posicion=1 endif if Time >= HoraInicio and time < HoraEntradaLimite and diatrading=1 then // Condiciones para entrada de posiciones largas indicator1 = ExponentialAverage[35](close)-2*std[5](close) c1 = (close < indicator1[1]) indicator2 = RSI[11](close) c2 = (indicator2 < 30) IF c1 AND c2 THEN buy posicion CONTRACT AT MARKET ENDIF // Condiciones de entrada de posiciones cortas indicator3 = ExponentialAverage[35](close)+2*std[10](close) c3 = (close > indicator3[1]) indicator4 = RSI[5](close) c4 = (indicator4 > 70) IF c3 AND c4 THEN sellshort posicion CONTRACT AT MARKET ENDIF atr = AverageTrueRange[49](close) stopus = atr*300000 TP = atr*80000 SET STOP pLOSS stopus SET TARGET pPROFIT TP endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

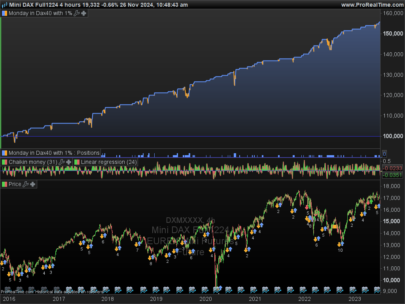

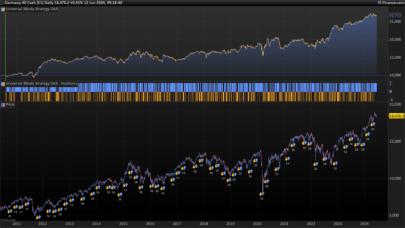

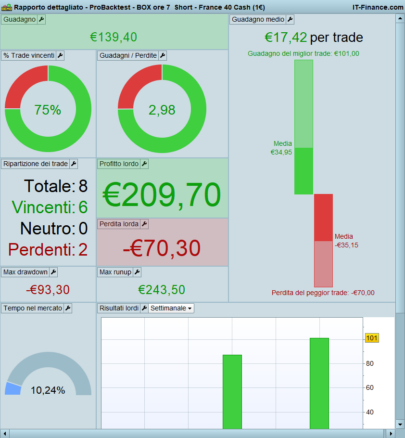

Thank you Raul for sharing your strategy with the community. Every code sharing is appreciated. I have successfully backtest your strategy with new backtest engine of the new PRT version, and results are accurate. I found that you use averaging down to compensate loosing orders, even if you cut all orders at the beginning of a new day, the drawdown of the money equity can be huge sometimes. Maybe you could de-leverage a bit or avoid stacking orders at each new candle if the takeprofit was not met at the first glance. This is just my own thoughts by now, will be happy to discuss more.

Thanks Nicolas, I’m sorry, my English is bad, I will translate it in google hehe. In the code, I have put that it does not operate the night of the brexit or of the elections of the usa,These days better not have automatismes. In the code you can change the number of contracts as the benefits of the strategy increase, currently limited to a contract.

Great code but those drawdowns is huge!

Hi,

Could somebody translate this code into english for me?

Regards, Mark

I think Google Translate can do this job for you 🙂

Hola, gracias primero de todo.

Por la mañana entre 7 y 12 también fuciona.

Chao

Hola Raul VG, muchas gracias por compartir la estrategia, parece muy interesante el concepto.

Saludos,

Jesús

Hi Raul. Thanks for this code. I understand it all apart from the stop and target code. Can I ask a stupid question: where do you get the 300000 and the 80000 numbers from? I understand what the ATR is but I can’t get my head around why you then multiply by these numbers. Thanks

Hi jonjon, these figures are the most appropriate for the strategy. Atr is an average true range indicator, in eur / usd it has values of 0.001, so multiply by that amount. Anyway is a very risky strategy, to accumulate orders, can be all night accumulating orders without stopping and produce large losses

Hola Raul,gracias por compartir sistema, muy interesante. Tengo unicamente una duda sobre el spread que me parece verdaderamente muy bajo. Has probado otra combinaciòn aumentandolo? A la noche normalmente no està tan bajo.Otra pregunta: el sistema ya està optimizado?

graciasGiovanni

Hi Raul. Just a thought, is there a way to limit the maximum number or orders that can be accumulated? This could help a little with risk? With the following:

DEFPARAM CumulateOrders = true

is it possible to limit it to a maximum to 4 accumulated orders, for example? If so do you, or anyone else, know the code as I’m being a little slow today? Thanks

Hi jonjon. If you want to exit at the 4th bar only if the trade is losing money, you have to add following code (for exiting long):

IF POSITIONPERF<0 THENperd=(Barindex-Tradeindex)=3ELSEperd=0ENDIF

IF LongOnMarket AND perd THENSELL AT MARKET

For exiting short:

IF ShortOnMarket AND perd THENSELLSHORT AT MARKET

Hi, I would like to do a test by doing it by day, but I’m not able to change the start and end times. Someone could help me to set up for example: start time 9.30 am, late at 7 pm Thanks to who will help me