The approach was published by Dion Kurczek – the founder of Wealth-Lab.com – in ‘Traders 03/23’.

The trading rules

The author has investigated that Monday is a very weak day in the Nasdaq 100, while Friday is a very strong day in the week.

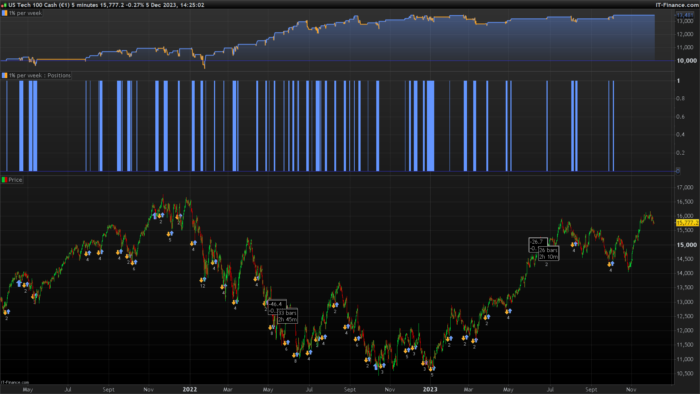

He therefore waits for the cash open on Monday at 3:30 p.m. and enters the market long as soon as the 3:30 p.m. open falls by one percent.

We exit the trade when the price has regained the original opening price of Monday 3.30 pm (a return to the open but only strategy).

If the price falls a further 0.5%, the take profit goes to breakeven.

Trading ends with a time stop on Friday 9.30 pm at the latest.

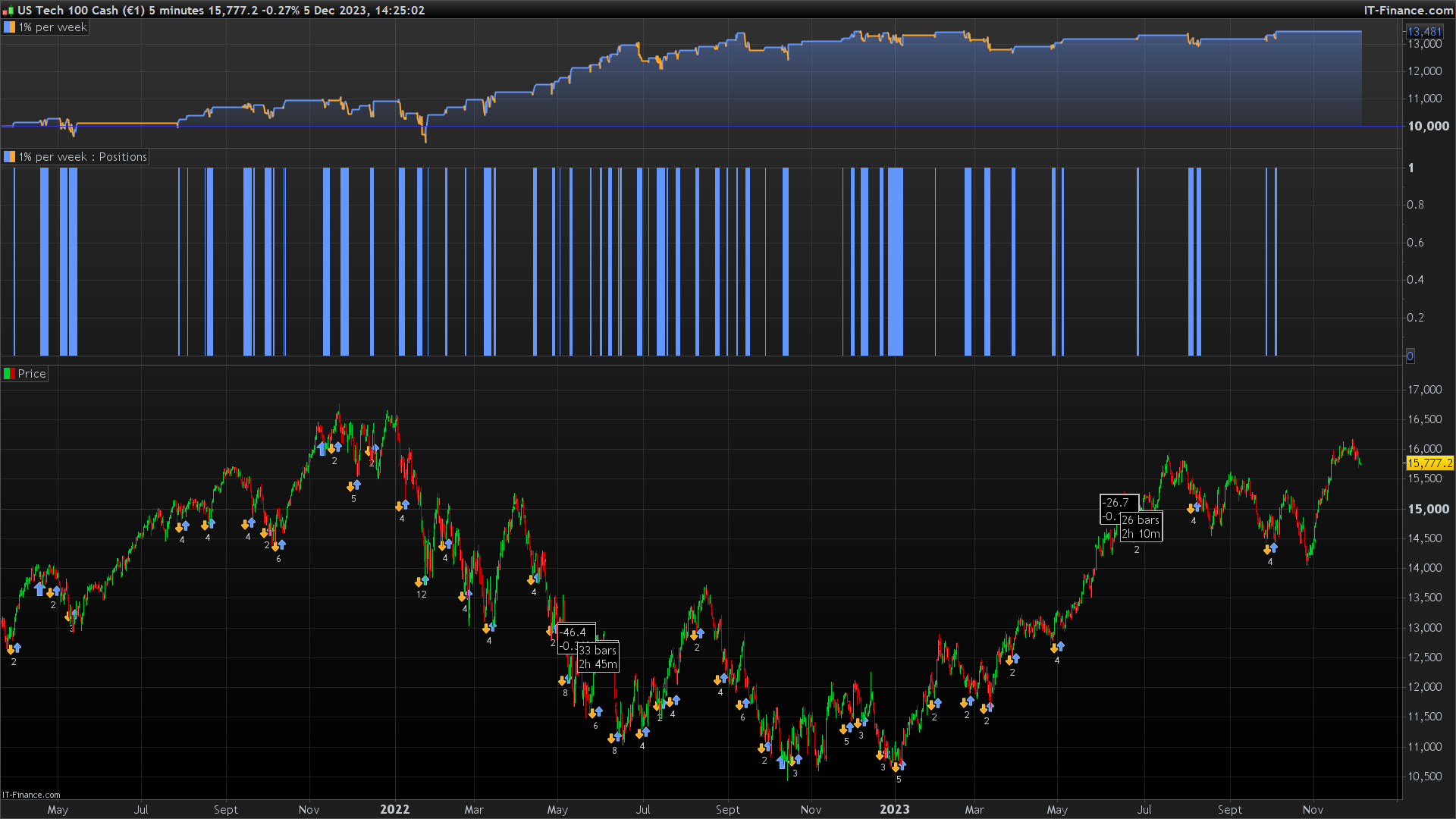

These simple rules have been slightly modified

the originally used daily chart was changed to a 5-minute chart

a (here arbitrarily chosen) time window in which buying is allowed was implemented

a stop of 5% has been added as insurance against major moves

Nothing else has been optimized

Optimizations can be made e.g. with regard to

the time window

for all percentages

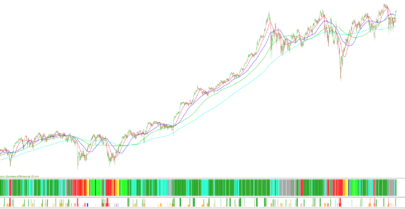

Various indicators could be added as additional filters.

Money management that works with a trailing trailing stop after the take profit or breakeven has been reached could further improve the result.

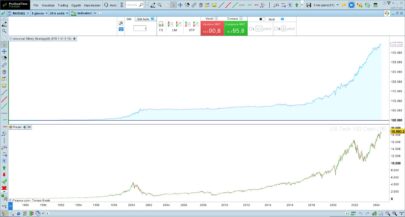

The system also runs profitably on the S&P500 here in the picture

………………………………………………………………………………………………………..

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 |

// ..................................... // 1% per week // published by Dion Kuzczek // here timezone europe, berlin // timeframe 5 mins // instrument nas100 // ..................................... defparam cumulateorders = false If opendayofweek = 1 and time = 153000 then Kauf = close - close/100*1 AnpassungTP = close - close/100*1.5 Endif timec1 = (opendayofweek = 1 and time >= 153000) or (opendayofweek > 1) timec2 = (opendayofweek < 2) or (opendayofweek = 2 and time <= 213000) If timec1 and timec2 then buy at Kauf limit set target %profit 1 Endif If longOnMarket and (close - tradePrice) =< AnpassungTP then set target profit Kauf Endif If longonmarket and opendayofweek = 5 and time = 213000 then sell at market Endif set stop %loss 5 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks for sharing this. I’ve tested it over 13 years, and each year has been profitable. I conducted robustness tests by adjusting the 1% range, profit targets, stop loss, and I experimented with trailing stops. It holds up quite well across various parameter values, but the original ones seem to return solid results.

One thing to consider would be to close positions on a Thursday night, but only if the trade is in profit. Otherwise, allowing it to run through to Friday as normal. This adjustment reduces the time in the market from 16% to 14%, it boosts profits by around 16%, and it doesn’t seem to increase the maximum drawdown.

Thank you for this code. looks robust and can easily be improved with trailing stop and adjusted stop loss.

Do you use it live?