For the porponents of simple trading strategies, I would like to share one of these strategies that I found myself as part of my time-based-strategy-series.

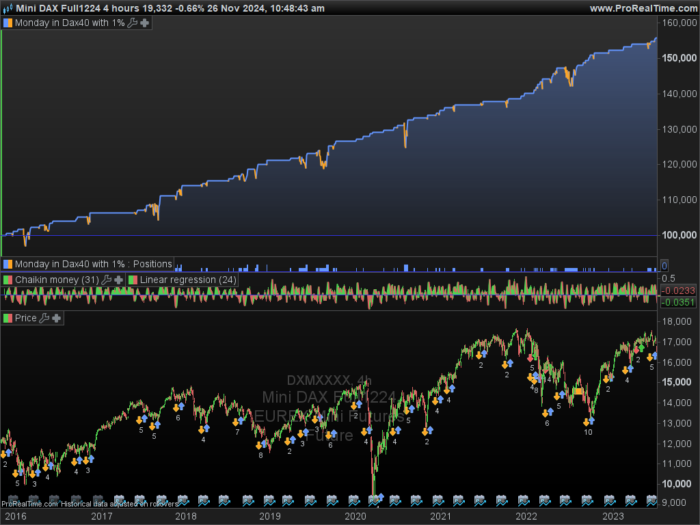

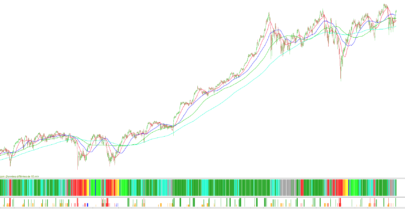

It is a long-only strategy. Long-only strategies would have always led to gains in the major indices depending on the holding period and transaction costs, take a look at their recent all-time highs.

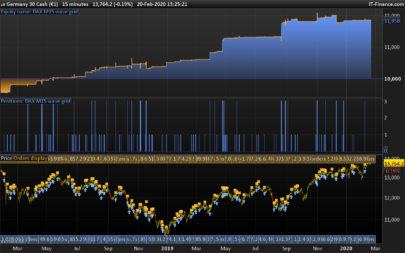

It is quite simple. We buy the Dax in the 4H on Monday between 09.00 and 21.00 when the close is below the EMA50 and the EMA1 crosses the EMA2 upwards.

We want a TP of 1%. We do not use an SL, which is the difficulty of the strategy, we need money in our pockets – we should be able to withstand a corona dip. Here, 10.000 euros were sufficient.

The strategy is probably not suitable for Zack and Rich, but you can think about it as an addition to your portfolio.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 |

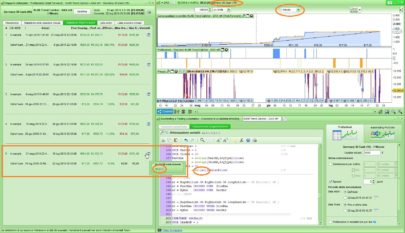

//------------------------------------------------------- // timebased serie // timezone europe, berlin // timeframe 4H // created and coded by JohnScher //------------------------------------------------------- defparam cumulateorders = true once ordersize = 1 td = opendayofweek = 1 tt = time >= 090000 and time <= 210000 c1 = exponentialaverage [1] (close) crosses over exponentialaverage [2] (close) c2 = exponentialaverage [1] (close) < exponentialaverage [50] (close) if td and tt and c1 and c2 then buy ordersize contracts at market endif set target %profit 1 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

buongiorno Jhon grazie della condivisione ma come faccio a capire con quanti contratti sono in posizione?

dal report riesco a vederlo? dato che ho questa funzione true

defparam cumulateorders = true

un saluto

max

Very simple and proficient!!! I add the information that with my account I can reduce the size to 0.5 therefore even a smaller capital than you mention in the description could be required to run safetly the strategy.