Hi guys,

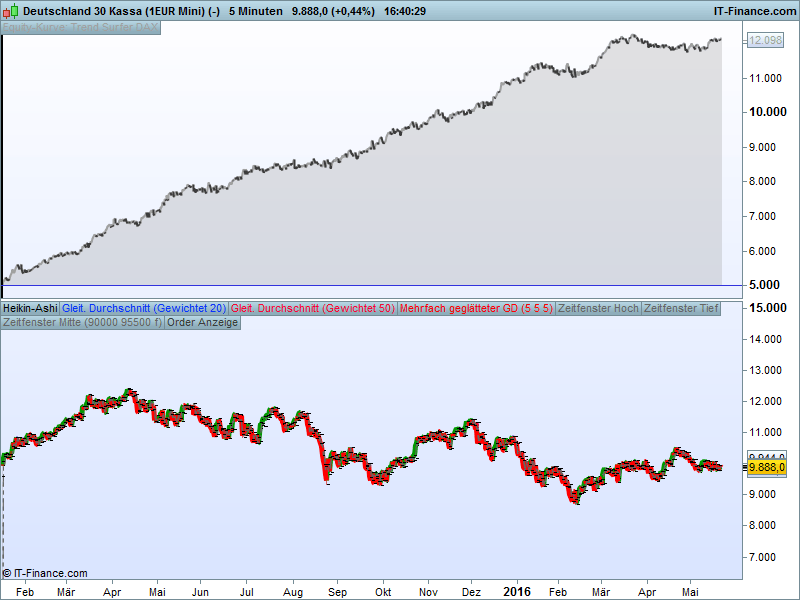

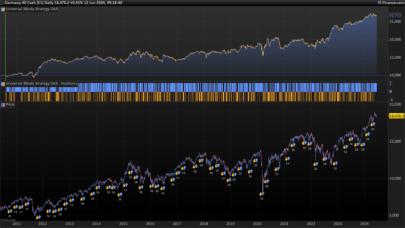

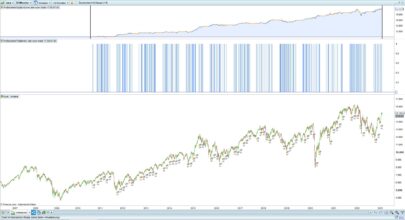

my first post 🙂 is one of my DAX systems based on the TDI indicator working on a 5 minute chart.

have fun

Reiner

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 |

// Trend Surfer DAX // code-Parameter DEFPARAM FlatAfter = 170000 // DAX trading window ONCE BuyTimeMorning = 90000 ONCE SellTimeMorning = 110000 ONCE BuyTimeAfternoon = 150000 ONCE SellTimeAfternoon = 170000 // traders dynamic indicator ONCE q = 14 ONCE r = 4 ONCE t = 29 // tdi filter parameter ONCE longPriceLevel = 35 ONCE shortPriceLevel = 40 ONCE middleBandLevel = 40 // trading parameter ONCE PositionSize = 1 ONCE sl = 250 ONCE tp = 50 // position management during trading window IF (Time >= BuyTimeMorning AND Time <= SellTimeMorning) OR (Time >= BuyTimeAfternoon AND Time <= SellTimeAfternoon) THEN // calculate TDI indicator RSIasPrice = RSI[q](customclose) Priceline = Average[r](RSIasPrice) MiddleBand = Average[t]((RSIasPrice)) // open position // long IF Not LONGONMARKET AND Priceline > MiddleBand AND Priceline > longPriceLevel AND MiddleBand > middleBandLevel THEN BUY PositionSize CONTRACT AT MARKET ENDIF // short IF Not SHORTONMARKET AND Priceline CROSSES UNDER MiddleBand AND Priceline > shortPriceLevel THEN SELLSHORT PositionSize CONTRACT AT MARKET ENDIF // close position IF Time = SellTimeMorning OR Time = SellTimeAfternoon THEN // long IF LONGONMARKET THEN SELL AT MARKET ENDIF IF SHORTONMARKET THEN EXITSHORT AT MARKET ENDIF ENDIF // stop and profit SET STOP pLOSS sl SET TARGET pPROFIT tp ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

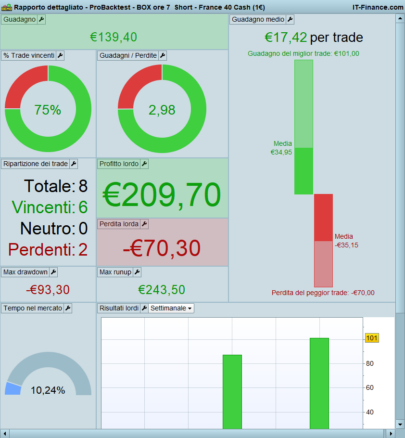

Hello Reiner and thank you a lot for your contribution. I made some tests on your code because I were not sure if it would work in real time environment because of SET STOP and SET TARGET.

I saw there almost none entries and exit on the same candle, so I guess this is good. Also my test were made with 1 point spread, since you are trading it in intraday hours.

Nice implementation of the TDI strategy! My thought is that your code deserve to feature in the library, so here it is. Don’t hesitate to continue sharing your knowledge with everyone! Well done.

Hello Reiner,

I’ve just seen your post. I’ve not tested your code, but it seems very nice.As Nicolas said, the problem is when the SL and the TP are on the same candle ; but as the SL is 5x times greater than the TP, avec as it is important, it seems that we don’t have often this problem.Maybe this strategy could be test on timeframe M15, in orders to have more historical data.Thanks for sharing !

Best regards,

Hi Guy

‘the problem is when the SL and the TP are on the same candle’

I having this problem in some other trading strategy , but why?

On ProRealTime CFD, you can backtest since 2014 July.I don’t know why but… it is loosing money until 2015 January.After, it is winning.

(spread 1 point)

Hi guys,

Thanks for your comments.

the backtest results are almost the same when working without tp/sl. The basic idea of this system seems to be reliable. I personally trade the TDI idea together with tick charts and it works.

The problem with sl/tp and backtesting is, that in my opinion PR don’t know the tick history during a candle and therefore close sl/tp lead to incorrect results.

regards

Reiner

Hi Reiner,

Thanks for your work

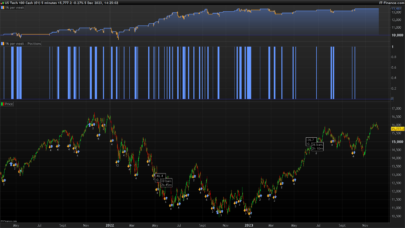

In 5 mn UT I haven’t the same results 🙁

http://zupimages.net/up/16/20/kerv.png

In my expererience the problem with TARGET PROFIT is that it cuts Profit too soon, and if you haven’t a very very good system (on all UT) with win/loose>80 % the results are bad

As we say

“Let the profits run…”

Have a nice week-end

Zilliq

And you have a Stop loss of 250 points (it’s very very big) for a Take profit of 50

That means that with a 80 % winning system you are neutral

Oups 83.3 % (250*1/6-50*5/6)=0

Whatever, it’s just impossible to have a >80 % winning system on all UT

Nice code Reiner,

Question: Why short condition are not exactly opposite to long condition?

@Zilliq: As I understand, in this code SL and TP are not supposed to be reach: Main conditions to close are time conditions.

The Time conditions are only here to close the positions outside the volatility period of the DAX

The more probable is to touch the take profit or the stop loss, unfortunately

Because the stop loss is 5 times wider than the take profit, is one of the reason why the back test seems reliable. But, I don’t remember exactly what were the TDI periods. Did you adapt them Reiner?

hello REINER

it’s normal that i have a entry at 11 00 00 and a exit at 15 00 00 ?

if i look the backtest,i see that the 1st april 2016 at 110000 i have an entry …..

and an exit at 150000 with a loose about 137 points.

how can explain this this ?

ty

Hi larouedegann,

I can confirm your observation but to be honest I have no clue why this happens. PR backtest modul has some unexlained phenomena.

regards

Reiner

hello reiner

when i look the backtest i see that the 1st april 2016 at 110000 i have an entry

and an exit at 150000.

haw can explain this ?

hello reiner

in fact, this problem arrive several times on the backtest

Hi guys,

Thanks for your comments.

Trend Surfer based on the TDI indicator from Dean Malone. http://www.forexmt4.com/_MT4_Systems/Traders%20Dynamics/TDI_1.pdf

Cross over/under of the priceline and the middle line as trade trigger seems to be very profitable scenarios in combination with the volatile DAX trading times (9:00 – 11:00, 15:00 – 17:00). That is the main idea of Trend Surfer the rest is optimization. tp/sl are not necessary but backtests show better results.

@zilliq: I’m using IG Data and have no clue why you can’t reproduce the results.

@noisette: you can use Priceline CROSSES OVER MiddleBand as well for the long trades but Priceline > MiddleBand bring better results

@Nicolas: I adapt the TDI parameter, the origin values are 13/2/35

Here is the code for the TDI indicator that i use for my DAX trading:

// Trader Dynamic Index

// Standard Setting

// Priceline is SMA(2) of RSI(13)

// Signalline is SMA(7) of RSI(13)

// Midband is SMA(35) of RSI(13)

// BolingerBand around SMA(35) using 1.62 StdDev

// Midline = 50

// SignallineUp = 70

// SignallineDown = 30

q = 13

r = 2

t = 35

u = 1.62

// Priceline (red)

RSIasPrice = RSI[q](customclose)

Priceline = Average[r](RSIasPrice)

// Signalline (green)

Signalline = Average[q](RSIasPrice)

// Bands

// MiddleBand (yellow)

StdDevRSI = STD[t](RSIasPrice)

MiddleBand = Average[t]((RSIasPrice))

// Upper-, Lowerband (blue)

UpperBand = MiddleBand + u*StdDevRSI

LowerBand = MiddleBand - u*StdDevRSI

Return Priceline AS \"Priceline\", UpperBand AS \"UpperBand\", LowerBand AS \"LowerBand\", MiddleBand AS \"MiddleBand = Market Base Line\", Signalline AS \"Signalline\", 68 AS \"68\", 32 AS \"32\", 50 AS \"50\"

have fun

Reiner

Hallo Reiner,Ich komme auch aus Deutschland, hoffe wir können uns bisschen unterhalten.Habe den Trendsurfer bei PRT eingebaut und alles klappt super, aber habe ne Frage zur Funktionsweise…Welche Bedingungen müssen für einen Long erfüllt sein?Grüße

Hallo Lennard,

ein Long Trade wird erzeugt, wenn die folgenden 5 Bedingungen erfüllt sind

Zeit ist zwischen 9-11:00 oder 15-17:00 Uhr

System ist noch nicht long

TDI Priceline ist grösser TDI MiddleBand

TDI Priceline ist grösser 35

TDI Middleband ist grösser 40

Viel Spass

Reiner

hello reiner

ty for your codes,very interesting.

I am looking if during time 11h-15h,it will be possible to do something with a code based on 3 mn with exponential averages and pivot points.

But for this moment,I have to much trades.

bye

Hi larouedegann,

You are on the right way. All of my highly profitable strategies work together with certain times. The good old open range breakout strategy between 9:00 – 10:00 is still one of my best performing algos over the last months.

I found the following statistical accumulations between 11:00 – 14:00, but nothing that unfortunately was good enough for a reliable strategy over a longer period.

around 11:30 the DAX tends short (buy 11:30, sell 12:00)

around the noon auction 13:00 the DAX tends long (buy 12:45-1250, sell 13:00), this works sometimes reliable but not profitable over a longer period

around 13:30 the DAX tends long (buy 13:20, sell 13:00), sometimes promising

around 13:45 the DAX tends short (sell 13:30, bus 13:45 – 13:55)

better times are:

9:00 – 9:45-10:00 open range breakout works profitable and reliable

9:30 countertrend strategies are very promising

10:00 – 10:30 countertrend, tends short 10:15 – 10:30

10:30 trade the opposite of the trend 10:00 – 10:30

10:45 the trend switch quite often

11:00 – 11:30 close your postions

Hope it’s helpful for your trading ideas. Let me know if you find something reliable.

regards

Reiner

Hi,

FYI : Code for the famous Traders Dynamic Index aka the “TDI” by Nicolas 😉 http://www.prorealcode.com/prorealtime-indicators/traders-dynamic-index-tdi/

Reiner, in your code for the TDI indicator :

// Priceline (red) -> green

RSIasPrice = RSI[q](customclose)

Priceline = Average[r](RSIasPrice)

// Signalline (green) -> red

Signalline = Average[q](RSIasPrice)

shame on me 🙂

Don’t worry, thanks for your work!// Signalline est SMA (7) du RSI (13)

Signalline = Average[q](RSIasPrice) ->

ONCE s = 7

Signalline = Average[s](RSIasPrice)

bonjour

bon au final les amis je recherche un robot de scalping ou de day trading court qui rapporte qui se déclenche et se referme suivant un environnement déterminé et un tendance haussière déterminée quil détercte tout seul, est ce que quelqu’un ici sur ce site à un vrai robot autonome qui donne de vrais résultats .. et qui est totalement abouti ou presque merci de me tenir au courant

Hello,

what is the final Code for this Setup ?

And can you post again please the total code for the TDI indicator?

Thanks.

you find the final code for the system and the TDI indicator above.

@ thebigdeal

Bonjour,

Va sur mon site (lien dans ma présentation), regarde dans “stratégies”, celle sur le DAX… tu ne seras pas déçu.Je ne peux pas te donner de lien direct ou t’en dire plus, car mon but n’est pas de faire de la pub ici.

Hallo Reiner,

ich habe Deine Strategie in PRT (IGMarkets) geladen und versuch die Performance nachzuvollziehen. Ich habe den 1EUR Mini Dax in den 5M eingestellt. Leider ist die Performance bei mir komplett negativ. Muss ich noch etwas an den Workstation-Optionen/Trading-Optionen verändern?

Bin für jeden Tipp dankbar.

Hallo DonDollar,

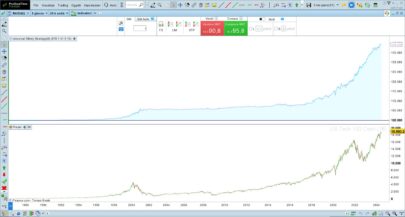

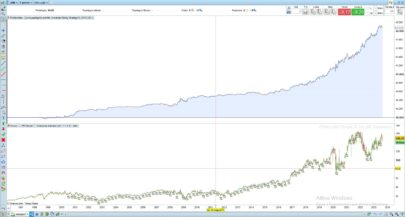

habe gerade das System laufen lassen. Mit einem Startkapital von 5.000 Euro und einem Spread von 1 Punkt komme ich bei 100.000 Kerzen von Juni 2015 bis heute auf eine Performance von circa 63% (8.191 Euro). Das System läuft allerdings mit den eingestellten Parametern seit Mitte März seitwärts. Spezielle Parameter ausser Startkapital und Spread müssen nicht gesetzt werden.

Gruss

Reiner

Hi!

Ich komme auf 6509 Euro Performance (37,9%) ab dem 01.05. bei exakt gleicher Einstellung. Extrem komisch. Ich habe noch nicht gefunden, wo bei mir der Fehler liegt. Welche Version benutzt Du? PRT Complete oder professionell ?

VG

Clemens

Ich nutze PRT 10.2 Standard

Dear Reiner,

could you post your update strategy below? It don’t work

thanks for your work

AleAle

Hi AleAle,

The strategy is unchanged and I tested the code from this side with capital 5.000 Euro and 11 point spread.

Reiner

You’ve solved I was using the strategy with oil

😛

Hallo Reiner

Ich finde deine verschiedenen Strategien sehr interessant. Vielen dank für deine Arbeit

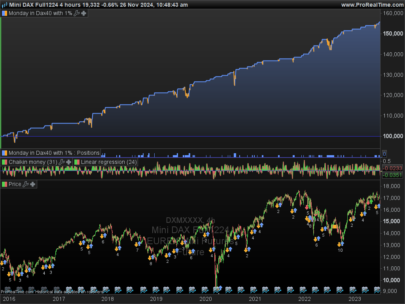

If I test this strategy over the last year, from sept 2015 to march, it was very profitable, and from march to today, it is flat (or loose a bit)

Do you have the same ? did you test it before this period (2014-2015) ? Is there a seasonal reason ?

Danke im Voraus

Reb

Hi Reb,

Sorry for the late response.

I traded this strategy only last year and stopped after the equity curve flattened. In my opinon this strategy works well in volatile long and short phases but to be honest I haven’t analyze this very deeply. I’m a fan of the TSI indicator and use it as signal trigger for my day trading. I think this esay strategy is valueable but requires some improvements. Unfortunately my time is limited and as you may have seen here in this forum at the moment I focused on the Pathfinder trading system.

regards

Reiner