Dear all

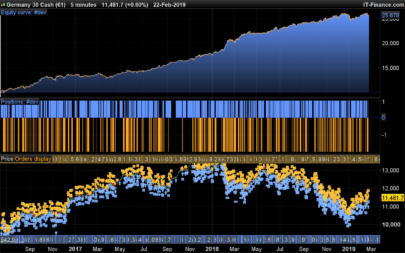

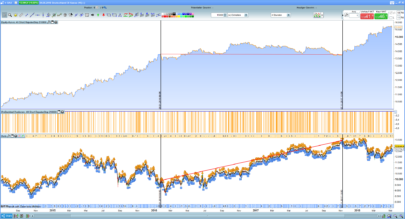

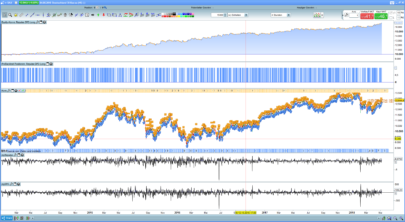

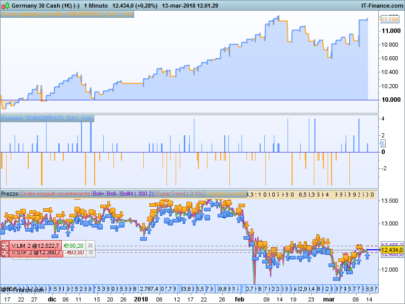

I have tested a slight variation on the them of my previously described strategy on short TF.

This time I took a very long timeseries, used Daily timeframe and modified the exit strategy in term of number of bars, all is optimized with Reiner’s seasonal parameters

Although the return of 180% with a drawdown of ~20k on a such a long timeseries is not great, I though it was worth posting because of the ability of this strategy to survive all the 1998/2001/2008 shocks and because it’s relative smoothness.

Any idea to reduce the drawdown even more would be greatly appreciated.

Best Regards

Francesco

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 |

// DAX(mini) - IG MARKETS // TIME FRAME 1Day // SPREAD 1.0 Point DEFPARAM CumulateOrders = False //DEFPARAM FLATBEFORE =090000 //DEFPARAM FLATAFTER =210000 golong = 1 goshort = 1 exitafternbars =1 // the strategy has an exit strategy of the type n bars // variables optimized adxvallong = 36 // set the adx value for long position under which the strategy is mean reverting and above which the strategy is breakout atrmaxlong = 100//set the max vol accetable for long position adxvalshort = 24// set the adx value for short poistions under which the strategy is mean reverting and above which the strategy is breakout atrmaxshort = 200//set the max vol acceptable for short positions along= 30//number of cons bar for a long trade mlong = 1// sets the atr multiplier to enter into a mean reverting strategy for long positions nlong = 1//sets the atr multiplier to enter into a breakout strategy for long positions ashort=5//number of cons bars for a short trade mshort = 1//sets the atr multiplier to enter into a mean reverting strategy for short positions nshort = 2//sets the atr multiplier to enter into a breakout strategy for short positions // vollongok = atr<atrmaxlong volshortok = atr<atrmaxshort brekoutlong = marketregimeindicator>adxvallong meanreversionlong = marketregimeindicator <adxvallong brekoutshort = marketregimeindicator>adxvalshort meanreversionshort = marketregimeindicator<adxvalshort adxperiod = 14 atrperiod = 14 marketregimeindicator = adx[adxperiod] atr = AverageTrueRange[atrperiod] positionshort = round(1000/atr) //define the size of short positions positionlong = saisonalpatternmultiplier*round(1000/atr/2.16666) // define the size of long positions // define saisonal position multiplier for each month 1-15 / 16-31 (>0 - long / <0 - short / 0 no trade) ONCE January1 = 3 //0 risk(3) ONCE January2 = 0 //3 ok ONCE February1 = 3 //3 ok ONCE February2 = 3 //0 risk(3) ONCE March1 = 3 //0 risk(3) ONCE March2 = 2 //3 ok ONCE April1 = 3 //3 ok ONCE April2 = 3 //3 ok ONCE May1 = 1 //0 risk(1) ONCE May2 = 1 //0 risk(1) ONCE June1 = 1 //1 ok 2 ONCE June2 = 2 //3 ok ONCE July1 = 3 //1 chance ONCE July2 = 2 //3 ok ONCE August1 = 2 //1 chance 1 ONCE August2 = 3 //3 ok ONCE September1 = 3 //0 risk(3) ONCE September2 = 0 //0 ok ONCE October1 = 3 //0 risk(3) ONCE October2 = 2 //3 ok ONCE November1 = 1 //1 ok ONCE November2 = 3 //3 ok ONCE December1 = 3 // 1 chance ONCE December2 = 2 //3 ok // set saisonal multiplier currentDayOfTheMonth = Day midOfMonth = 15 IF CurrentMonth = 1 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = January1 ELSE saisonalPatternMultiplier = January2 ENDIF ELSIF CurrentMonth = 2 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = February1 ELSE saisonalPatternMultiplier = February2 ENDIF ELSIF CurrentMonth = 3 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = March1 ELSE saisonalPatternMultiplier = March2 ENDIF ELSIF CurrentMonth = 4 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = April1 ELSE saisonalPatternMultiplier = April2 ENDIF ELSIF CurrentMonth = 5 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = May1 ELSE saisonalPatternMultiplier = May2 ENDIF ELSIF CurrentMonth = 6 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = June1 ELSE saisonalPatternMultiplier = June2 ENDIF ELSIF CurrentMonth = 7 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = July1 ELSE saisonalPatternMultiplier = July2 ENDIF ELSIF CurrentMonth = 8 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = August1 ELSE saisonalPatternMultiplier = August2 ENDIF ELSIF CurrentMonth = 9 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = September1 ELSE saisonalPatternMultiplier = September2 ENDIF ELSIF CurrentMonth = 10 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = October1 ELSE saisonalPatternMultiplier = October2 ENDIF ELSIF CurrentMonth = 11 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = November1 ELSE saisonalPatternMultiplier = November2 ENDIF ELSIF CurrentMonth = 12 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = December1 ELSE saisonalPatternMultiplier = December2 ENDIF endif //long meanreversion IF (abs(open-close) > (atr*mlong) and close < open and golong and vollongok and meanreversionlong) THEN buy positionlong CONTRACTS AT MARKET ENDIF // long breakout IF (abs(open-close) > (atr*nlong) and close > open and golong and vollongok and brekoutlong) THEN buy positionlong CONTRACTS AT MARKET ENDIF //short meanrevesrion IF (abs(open-close) > (atr*mshort) and close > open and goshort and volshortok and meanreversionshort) THEN sellshort positionshort CONTRACTS AT MARKET ENDIF // short IF (abs(open-close) > (atr*nshort) and close < open and goshort and volshortok and brekoutshort) THEN sellshort positionshort CONTRACTS AT MARKET ENDIF if exitafternbars then IF shortonmarket and BarIndex - TradeIndex >= ashort Then exitshort positionshort contracts at Market EndIF endif if exitafternbars then IF longonmarket and BarIndex - TradeIndex >= along Then sell positionlong contracts at Market EndIF endif //set target profit p*atr //set stop ploss l*atr |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Francesco, thanks for your hard work. I have been playing around with your strategy but can’t get an IN/OUT /WF sample to work. The best I can get is either a slight decline, flat or very slight profit on the out sample for the last period and no where near 50% efficiency. Did you test in this way, what are your views?

Hi Cosmic1

Thank you for your comments.

what I did is to optimize the code for different time frames, we could optimized in order for the strategy to work for the last 2 years or 5 years, but in my opinion by doing so we will get an insufficient number of trades in order to make the sample statistically significative.

From what I remember I agree with you, if you do WF from the beginning of the time series then the last period is flat or slightly negative, if instead you make the optimization starting from more recent time, i.e. 2007 in that case you get an upward slope.

Id be happy to discuss further.

Best Regards

Francesco

Ciao Francesco78, i tried to put your strategy in real mode but did not generate any movement.

What am I doing wrong ?

Thank you.

Hi Keemax, I dont have it on real at the moment, in any case the strategy is very long term and dont generate a big number of trade so it is reasonable that you dont have any signal if you put it just for few days, I suggest to do a backtesting starting from the day you you have chosen to put in on real and see if there is a discrepancy from back test and real.

I hope that helps.

Francesco

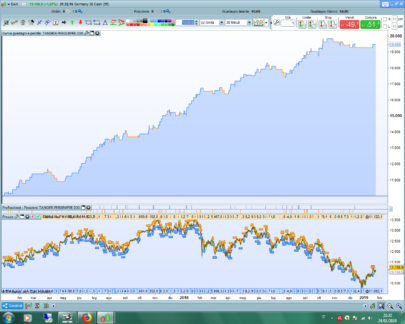

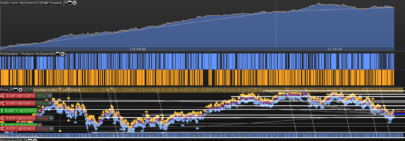

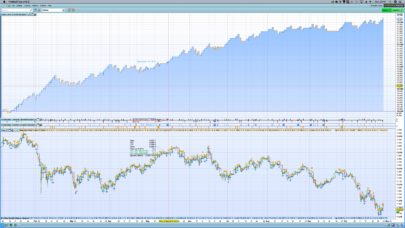

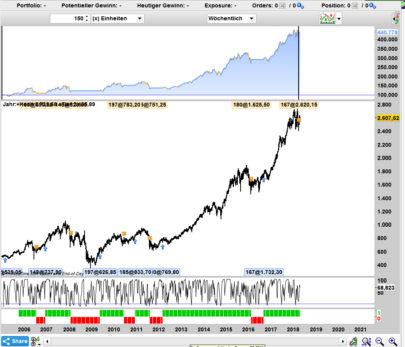

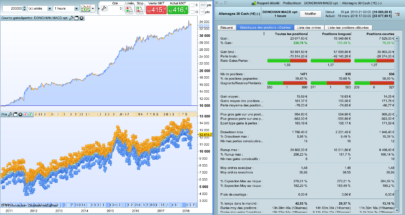

I did a little bit of work on that and now the results looks better and more stable.

Please let me know what you think!

Regards

Francesco

I did a little bit of work on that and now the results looks better and more stable.

Please let me know what you think!

// DAX(mini) - IG MARKETS

// TIME FRAME 1Day

// SPREAD 1.0 Point

DEFPARAM CumulateOrders = False

//DEFPARAM FLATBEFORE =090000

//DEFPARAM FLATAFTER =210000

golong = 1

goshort = 1

exitafternbars =1 // the strategy has an exit strategy of the type n bars

// variables optimized

adxvallong = 28 // set the adx value for long position under which the strategy is mean reverting and above which the strategy is breakout

atrmaxlong = 250//set the max vol accetable for long position

adxvalshort = 20// set the adx value for short poistions under which the strategy is mean reverting and above which the strategy is breakout

atrmaxshort = 250//set the max vol acceptable for short positions

along= 30//number of cons bar for a long trade

mlong = 1// sets the atr multiplier to enter into a mean reverting strategy for long positions

nlong = 1.2//sets the atr multiplier to enter into a breakout strategy for long positions

ashort=7//number of cons bars for a short trade

mshort = 1//sets the atr multiplier to enter into a mean reverting strategy for short positions

nshort = 2//sets the atr multiplier to enter into a breakout strategy for short positions

//

vollongok = atr<atrmaxlong

volshortok = atr<atrmaxshort

brekoutlong = marketregimeindicator>adxvallong

meanreversionlong = marketregimeindicator <adxvallong

brekoutshort = marketregimeindicator>adxvalshort

meanreversionshort = marketregimeindicator<adxvalshort

adxperiod = 17

atrperiod = 13

marketregimeindicator = adx[adxperiod]

atr = AverageTrueRange[atrperiod]

positionshort = round(1000/atr) //define the size of short positions

positionlong = saisonalpatternmultiplier*round(1000/atr/2.16666) // define the size of long positions

// define saisonal position multiplier for each month 1-15 / 16-31 (>0 - long / <0 - short / 0 no trade)

ONCE January1 = -3//3 //0 risk(3)

ONCE January2 = 2//0 //3 ok

ONCE February1 = 3 //3 ok

ONCE February2 = -3//3 //0 risk(3)

ONCE March1 = 0//3 //0 risk(3)

ONCE March2 = 3//2 //3 ok

ONCE April1 = 3 //3 ok

ONCE April2 = 3 //3 ok

ONCE May1 = 3//1 //0 risk(1)

ONCE May2 = 1 //0 risk(1)

ONCE June1 = -2//1 //1 ok 2

ONCE June2 = 3//2 //3 ok

ONCE July1 = -2//3 //1 chance

ONCE July2 = 1 //3 ok

ONCE August1 = 3 //1 chance 1

ONCE August2 = 3 //3 ok

ONCE September1 = 2//3 //0 risk(3)

ONCE September2 = 0 //0 ok

ONCE October1 = 3 //0 risk(3)

ONCE October2 = 3//2 //3 ok

ONCE November1 =3// 1 //1 ok

ONCE November2 = 3 //3 ok

ONCE December1 = 3 // 1 chance

ONCE December2 = 3//2 //3 ok

// set saisonal multiplier

currentDayOfTheMonth = Day

midOfMonth = 15

IF CurrentMonth = 1 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = January1

ELSE

saisonalPatternMultiplier = January2

ENDIF

ELSIF CurrentMonth = 2 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = February1

ELSE

saisonalPatternMultiplier = February2

ENDIF

ELSIF CurrentMonth = 3 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = March1

ELSE

saisonalPatternMultiplier = March2

ENDIF

ELSIF CurrentMonth = 4 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = April1

ELSE

saisonalPatternMultiplier = April2

ENDIF

ELSIF CurrentMonth = 5 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = May1

ELSE

saisonalPatternMultiplier = May2

ENDIF

ELSIF CurrentMonth = 6 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = June1

ELSE

saisonalPatternMultiplier = June2

ENDIF

ELSIF CurrentMonth = 7 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = July1

ELSE

saisonalPatternMultiplier = July2

ENDIF

ELSIF CurrentMonth = 8 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = August1

ELSE

saisonalPatternMultiplier = August2

ENDIF

ELSIF CurrentMonth = 9 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = September1

ELSE

saisonalPatternMultiplier = September2

ENDIF

ELSIF CurrentMonth = 10 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = October1

ELSE

saisonalPatternMultiplier = October2

ENDIF

ELSIF CurrentMonth = 11 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = November1

ELSE

saisonalPatternMultiplier = November2

ENDIF

ELSIF CurrentMonth = 12 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = December1

ELSE

saisonalPatternMultiplier = December2

ENDIF

endif

//long meanreversion

IF (abs(open-close) > (atr*mlong) and close < open and golong and vollongok and meanreversionlong) THEN

buy positionlong CONTRACTS AT MARKET

ENDIF

// long breakout

IF (abs(open-close) > (atr*nlong) and close > open and golong and vollongok and brekoutlong) THEN

buy positionlong CONTRACTS AT MARKET

ENDIF

//short meanrevesrion

IF (abs(open-close) > (atr*mshort) and close > open and goshort and volshortok and meanreversionshort) THEN

sellshort positionshort CONTRACTS AT MARKET

ENDIF

// short

IF (abs(open-close) > (atr*nshort) and close < open and goshort and volshortok and brekoutshort) THEN

sellshort positionshort CONTRACTS AT MARKET

ENDIF

if exitafternbars then

IF shortonmarket and BarIndex - TradeIndex >= ashort Then

exitshort positionshort contracts at Market

EndIF

endif

if exitafternbars then

IF longonmarket and BarIndex - TradeIndex >= along Then

sell positionlong contracts at Market

EndIF

endif

p = 6

l = 7

set target profit p*atr

set stop ploss l*atr

Regards

Francesco

Hi Francesco , thank you for sharing your hard work. Any idea why all orders are executed at 01.00 am (French/Italian time)?

Thanks

Khaled