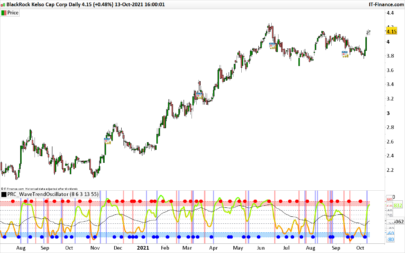

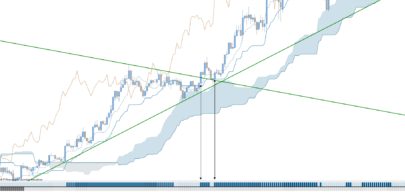

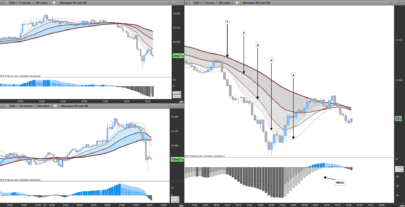

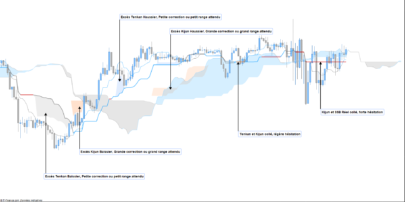

Based on a mean reversion hypothesis with the classic RSI 2 periods, this stock screener will fetch and find stocks that are in a long term trend and with sufficient Volumes.

The RSI 2 periods with oversold criteria (RSI is below 10) should give a good opportunity to set long order.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 |

//PRC_DeepOversold TrendingStock | screener //15.01.18 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //translated from AFL code ProfitSer = ROC[1](Close) ProfitSMA = average[100](ProfitSer) sqn = sqrt(100) * ProfitSMA / StD[100](ProfitSer) Filter = RSI[2] < 10 AND sqn >= 2.5 AND Average[52](Close*Volume) > 3000000 screener [Filter] |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello Nicolas,

Nice screener, I appreciate the way you always try to condense at maximum the code you propose.

Why do not use the Stochastic in this case? (in another way, for which reasons did you choose the RSI)?

Thanks

There’s no particular reason. RSI is widely use with its default period and results seems relevant for what it’s supposed to be found here.