Jeffrey Kennedy from Elliot Wave International shared the PopGun Bar Pattern. He meant it as a way to find impulse waves for Elliot wave traders.

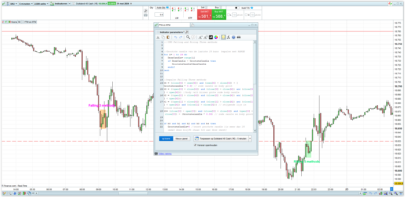

To trade the Popgun bar pattern, you must know what is an inside bar and an outside bar. (see attached screenshot)

An insidebar is one that is completely engulfed by the bar before it. It represents a contraction in range and a pause in directional trading activity.

An outside bar is one that completely engulfs the bar before it. It shows strength in both directions. Depending on the context, it is a sign of strength or a precursor to erratic movements.

The Popgun bar pattern consists of an inside bar followed by an outside bar.

Trading Rules – Popgun Bar Pattern

Long Trading Setup

- An inside bar

- An outside bar that closed higher than it opened

- Buy on close of outside bar

Short Trading Setup

- An inside bar

- An outside bar that closed lower than it opened

- Sell on close of outside bar

(In my opinion, if you want you can also trade the just direct reversal of the second outside. Maybe take profit with first close after second outside.)

In this way you have to go long direct after a red candle and you have to go direct short on green candle. Possible to close the trade with close of reversal candle.)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 |

// PopGun Indikator // coded by JohnScher //for the graphics PIP = 10*pipsize LIN = 3 //percentrange = Support or Resistance in Percent og the Range High-Low = 25% default //percentrange = 25 // default Support = (High-Low)*percentrange/100 Resistance = (High-Low)*percentrange/100 //indicator PopGun PG = High[2]>High[1] and Low[2]<Low[1] and High>High[1] and Low<Low[1] // the second outside candle PGLong = PG and Close>open // greencandle = long , as rerversal short PGShort = PG and Close<Open //redcandle = short, as reversal long // timewindow to show the popgun // tstart = 080000 fefautl // tend = 220000 IF time >= tstart and time <= tend then IF PGLong Then rL=250 gL=0 bL=0 DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL) DRAWSEGMENT(barindex,LOW-SUPPORT,barindex+LIN, LOW-SUPPORT )coloured(rL,gL,bL) // to trade as reversal red candle = Long rs=0 gs=0 bs=250 DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs) DRAWSEGMENT(barindex,High+Resistance,barindex+LIN, High+Resistance )coloured(rs,gs,bs) Endif IF PGShort then rS=0 gS=0 bS=250 DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs) DRAWSEGMENT(barindex,High+Resistance,barindex+LIN, High+Resistance )coloured(rs,gs,bs) // to trade as reversal red candle = Long rL=250 gL=0 bL=0 DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL) DRAWSEGMENT(barindex,LOW-SUPPORT,barindex+LIN, LOW-SUPPORT )coloured(rL,gL,bL) ENDIF ENDIF return |

until then

JohnScher

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

It seems a little mistake has crept in.

Here is the code in plain text.

// PopGun Indikator

// coded by JohnScher

//for the graphics

PIP = 10*pipsize

LIN = 3

//percentrange = Support or Resistance in Percent og the Range High-Low = 25% default

//percentrange = 25 // default

Support = (High-Low)*percentrange/100

Resistance = (High-Low)*percentrange/100

//indicator PopGun

PG = High[2]>High[1] and Low[2]High[1] and Lowopen // greencandle = long , as rerversal short

PGShort = PG and Close= tstart and time <= tend then

IF PGLong Then

rL=0

gL=0

bL=250

DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL)

DRAWSEGMENT(barindex,LOW-SUPPORT,barindex+LIN, LOW-SUPPORT )coloured(rL,gL,bL)

// to trade as reversal red candle = Long

rL=250

gL=0

bL=0

DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs)

DRAWSEGMENT(barindex,High+Resistance,barindex+LIN, High+Resistance )coloured(rs,gs,bs)

Endif

IF PGShort then

rS=0

gS=0

bS=250

DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs)

DRAWSEGMENT(barindex,High+Resistance,barindex+LIN, High+Resistance )coloured(rs,gs,bs)

// to trade as reversal red candle = Long

rL=250

gL=0

bL=0

DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL)

DRAWSEGMENT(barindex,LOW-SUPPORT,barindex+LIN, LOW-SUPPORT )coloured(rL,gL,bL)

ENDIF

ENDIF

return

If you have any problems, please feel freee to contact me again.

Doesn´t work on PRT V10.3

Hello … Error Syntax Line 14

// PopGun Indikator

// coded by JohnScher

// without timewindow, working on prt10.3

//for the graphics

PIP = 10*pipsize

LIN = 5

//percentrange = Support or Resistance in Percent og the Range High-Low = 25% default

//percentrange = 25 // default

Support = (High-Low)*percentrange/100

Resistance = (High-Low)*percentrange/100

//indicator PopGun

PG = High[2]>High[1] and Low[2]High[1] and Lowopen // greencandle = long , as rerversal short

PGShort = PG and Close<Open //redcandle = short, as reversal long

// timewindow to show the popgun

// tstart = 080000 fefautl

// tend = 220000

IF PGLong Then

rL=250

gL=0

bL=0

DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL)

DRAWSEGMENT(barindex,LOW-SUPPORT,barindex-LIN, LOW-SUPPORT )coloured(rL,gL,bL)

// to trade as reversal red candle = Long

rL=250

gL=0

bL=0

DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs)

DRAWSEGMENT(barindex,High+Resistance,barindex-LIN, High+Resistance )coloured(rs,gs,bs)

Endif

IF PGShort then

rS=0

gS=0

bS=250

DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs)

DRAWSEGMENT(barindex,High+Resistance,barindex-LIN, High+Resistance )coloured(rs,gs,bs)

// to trade as reversal red candle = Long

rL=250

gL=0

bL=0

DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL)

DRAWSEGMENT(barindex,LOW-SUPPORT,barindex-LIN, LOW-SUPPORT )coloured(rL,gL,bL)

ENDIF

return

Re … Error syntax line 14 (Low [2] (<) High [1]) I guess. And how to define lowopen and pglong ???

//indicator PopGun

PG = High[2]>High[1] and Low[2]High[1] and LowHigh[1] and Low[2]High[1] and Lowopen // greencandle = long , as rerversal short

PGShort = PG and Close<Open //redcandle = short, as reversal long

// timewindow to show the popgun

// tstart = 080000 fefautl

// tend = 220000

IF PGLong Then

rL=250

gL=0

bL=0

DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL)

DRAWSEGMENT(barindex,LOW-SUPPORT,barindex-LIN, LOW-SUPPORT )coloured(rL,gL,bL)

// to trade as reversal red candle = Long

rL=250

gL=0

bL=0

DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs)

DRAWSEGMENT(barindex,High+Resistance,barindex-LIN, High+Resistance )coloured(rs,gs,bs)

Endif

IF PGShort then

rS=0

gS=0

bS=250

DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs)

DRAWSEGMENT(barindex,High+Resistance,barindex-LIN, High+Resistance )coloured(rs,gs,bs)

// to trade as reversal red candle = Long

rL=250

gL=0

bL=0

DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL)

DRAWSEGMENT(barindex,LOW-SUPPORT,barindex-LIN, LOW-SUPPORT )coloured(rL,gL,bL)

ENDIF

return

@nicolas

Here are some problems with the code.

Can you put in the correct code as attached?

// PopGun Indikator

// coded by JohnScher

//for the graphics

PIP = 10*pipsize

LIN = 5

//percentrange = Support or Resistance in Percent og the Range High-Low = 25% default

//percentrange = 25 // default

Support = (High-Low)*percentrange/100

Resistance = (High-Low)*percentrange/100

//indicator PopGun

PG = High[2]>High[1] and Low[2]<Low[1] and High>High[1] and Low<Low[1]

// the second outside candle

PGLong = PG and Close>open // greencandle = long , as rerversal short

PGShort = PG and Close<Open //redcandle = short, as reversal long

// timewindow to show the popgun

// tstart = 080000 fefautl

// tend = 220000

IF PGLong Then

rL=250

gL=0

bL=0

DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL)

DRAWSEGMENT(barindex,LOW-SUPPORT,barindex-LIN, LOW-SUPPORT )coloured(rL,gL,bL)

// to trade as reversal red candle = Long

rL=250

gL=0

bL=0

DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs)

DRAWSEGMENT(barindex,High+Resistance,barindex-LIN, High+Resistance )coloured(rs,gs,bs)

Endif

IF PGShort then

rS=0

gS=0

bS=250

DRAWARROWDOWN(barindex,HIGH+PIP)coloured(rs,gs,bs)

DRAWSEGMENT(barindex,High+Resistance,barindex-LIN, High+Resistance )coloured(rs,gs,bs)

// to trade as reversal red candle = Long

rL=250

gL=0

bL=0

DRAWARROWUP(barindex,LOW-PIP)coloured(rL,gL,bL)

DRAWSEGMENT(barindex,LOW-SUPPORT,barindex-LIN, LOW-SUPPORT )coloured(rL,gL,bL)

ENDIF

return

Hi, please send it to contact[at]prorealcode.com . Many thanks.

@nicolas

done, in this moment

After a small error crept in, a correct itf.file has been uploaded.

Great Indicator, Is there a way to use this as an alert ?

I created the screener with some help here from PRT. It is surely somewhere in one of the forum posts.On the start page of the ProRealcode-website there is a search function. In the library it is not to be found.

Helpful are the PopGuns the higher the time unit is. In stocks best daily and higher up.