The KRev indicator – aka the Reversal amount indicator tells you the amount of dollar/pound/euro risk you’re exposed to on a unit basis if your position hits Kase Dev Stop 3 (Please see PRC Library for an explanation of the Kase Dev Stops: https://www.prorealcode.com/prorealtime-indicators/kase-dev-stop/).

The correct application of this KRev indicator will easily let you decide what time frame you can trade on to meet your fixed currency risk limit, per unit exposure.

For a better explanation as to why this indicator is so useful, please watch the following Kase StatWare presentation at 22 mins 08 secs to 31 mins 04 secs: https://www.youtube.com/watch?v=cd2gK8179u8

In the attached screen shot of BNP Bank the current price is €53.

The Euro risk is €3.74/share at Dev Stop 3.

Cynthia Kase: “The Dev Stop is the closest we can come to an ideal stop level in the real world. The indicator mathematics accounts for volatility (which is directly proportional to risk), and also for the variance of volatility (how much risk changes from bar to bar) and volatility skew (the propensity for volatility to spike higher from time to time). Specifically, the Dev Stop places exit points at 1, 2 and 3 standard deviations over the mean two bar true range, are corrected for skew. So we can take profit or cut losses at levels at which the probability of a trade remaining profitable is low, without taking more of a loss or cutting profits any sooner than necessary.”

Dev Stop 3 represents the “Get out of your position NOW!” statistically significant 3 standard deviation move against your trade with only a 0.1% chance of reversal. This is the point of no return to break even or profit – i.e. the highly improbable reversal that we as traders hope for when holding losses and which rarely happens.

It is calculated from a mathematically and statistically sound basis – 70 years worth of commodity/stocks and currency backtesting by Cynthia Kase and her team and includes an adjustment to account for price volatility skew in the market. This allows the data to reflect a normal distribution of ATR values and therefore confidence intervals and percentile probabilities – see the so-called 68–95–99.7 rule below. Skewness is a measure of the asymmetry of the probability distribution of a real-valued random variable about its mean. (Market price skew occurs because prices are not normally distributed and are bounded by zero – the price can never go below zero – but can potentially reach extreme values on the right hand side of the bell curve).

For a normal distribution bell curve, for example, a stop placed at the one standard deviation level has an 85% chance of being hit. Cynthia Kase designed the Dev Stop to withstand any 2 bar reversal so you’re not unnecessarily stopped out. Kase: “Our stops can be as the doorway that most (97.5 percent) of our two-bar reversals can pass through. Only the tallest sets of bars (candlesticks) will be blocked. (ie Allows position to remain open and only stop us out when prices hit extreme values ie. the remaining 2.5% of the price distribution).”

1 Std Devs = 68.2% of data falls within this range with a 84.1% chance of being hit — i.e. that a value will hit this probability percentile.

2 Std Devs = 95.4% of data falls within this range with a 97.7% chance of being hit.

3 Std Devs = 99.7% of data falls within this range with a 99.9% chance of being hit.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 |

//pararemeters: n = 30 //30 representing a statistically significant sample size DTR = max(max(High - Low[2], abs(High - Close[2])),max(abs(Low - Close[2]),(abs(Low - Close[2])))) price = typicalprice avg = average[n](DTR) st = std[n](DTR) WarningLine = avg //30 Bar Ave, of 2 Bar Average True Range KRev1 = avg + st KRev2 = avg + 2.2*st //To account for volatility skew KRev3 = avg + 3.6*st RETURN Warningline coloured(255,0,0) as "WarningLine", KRev1 coloured(2, 118, 253) as “Rev1", KRev2 coloured(20, 100, 244) as “Rev2", KRev3 coloured(1, 71, 250) as “Rev3" |

The “hope and pray” approach to an open trading loss reversing (back to break even) is no longer required 😁

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

An important point about the moving averages that determine whether Kase’s Dev Stops are above or below the price:

The moving average crossovers are not important. They should be used and changed to a faster cross if you have entered a position and the 5 and 21 day cross has not reflected the direction of your trade. I.e. change the averages to a 3 and 8 day moving average cross over (or whatever is suitable) so that the Kase Dev Stops are on the correct side (above or below) of your position.

See: Kase Chat – Stops and Kase DevStops (around the 21 min mark)

https://www.youtube.com/watch?v=u8pFuM2TNfA (link button not working using Mac and Safari)

I have changed the moving averages to exponential and personally use the 9ema and 21ema

You could also just calculate the bands on both sides of price

Thanks Juanj, Kase developed the double sided KaseX Xstops:

https://www.dropbox.com/s/0shxnxe83334iah/CAT-Daily-with-Stochastic-and-Xstops.png

with faster Mov Averages for the counter trend.

I did change mine to the Serial Dependency Index before realising it doesn’t really matter what you use as long as the Dev Stop is on the right side of your trade. Umm added the code here and it’s not showing…

Maybe you would like to post the double sided code and the code for the SAR here?

The real problem for me with the current PRT Dev Stop code that I provided from another forum is that there is something I’ve become aware of regarding the Kase Dev Stops indicator, having read and seen more of Cynthia Kase’s work:

On the PRT version the Dev Stops just hug the price. I rarely see the candlesticks actually hit the Warning Line (the mean of the 2 day ATR) or penetrate into the three Dev Stops (1, 2 and 3 Std Deviation ATR Stops)? The price does hit the Dev Stops if the 10 and a 21 period moving average cross just happens to also occur at the same time – and which makes the Dev Stops flip from being, for example, above the price to below it.

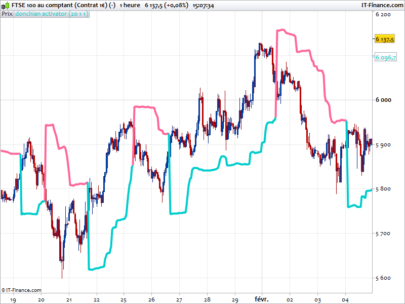

Here are a few examples of Kase’s charts showing the price penetrating into the Dev Stops as they were intended – after all this is the point you’re meant to get out…

https://www.dropbox.com/sh/dcyksl47a7hzldc/AACkbsrQg2I19gw-jrZs5rY5a

Here’s another site that had worked out the Dev Stop code: https://www.mql5.com/en/code/19926

Maybe with your coding skills Juanj you can figure out why this is?

Cheers

Bard

Thanks for the tip on calculating both sides Juanj. As Dean Rogers of Kase StatWare said about the moving averages: “I cannot stress how meaningless that 10 and 21 day MVG actually is. It’s just the way we control the flipping of the Stops.”

Bard,

where do you use the variable price in the code?

Apologies Gabri, that line (price = typicalprice) is stripped out in my PRT charts, but not the text edit version I save all code into and play around with and which was used here. It’s a volatility indicator based on DTR which includes price highs and lows. (I’m hoping @nicolas will find time to put up the correct screen image with just the price and the KRev indicator pane below the price chart. I’ll post the dropbox link with that cleaner image in a fresh comment below.

Small inquiry.

Can any of you reprogram it so that the lines are directly “onChart” visible?

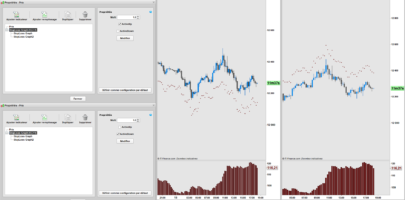

After importing the itf file, I get this image…

Hi JohnScher, “I get this image…” There’s no image, what are you seeing?

Clear screenshot of just the BNP price chart and the indicator KRev pane below it,

here: https://www.dropbox.com/s/qb9e3dp722dpfbs/Kase-KRev-Amounts.png?dl=0

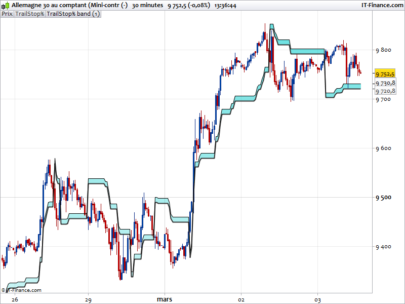

I have found an ingenious way of deciding which side the lines should be projected! I basically apply the same logic as SAR. In other words, if short and price closes above the lowest KRev3 I switch them to long and then if long and price close below the highest KRev3 I switch back to short. This is statistically in line with what the indicator is supposed to tell us in the first place. Actually, surprised KaseCo haven’t thought of this themselves and instead opted for a MA crossover.

Nice idea! Keep up the good work 😉

Kase Dev Stop Using Serial Dependency Index to Flip Stops

//pararemeters:

n = 20 //30

d = 40 //21

DTR = max(max(High – Low[2], abs(High – Close[2])),max(abs(Low – Close[2]),(abs(Low – Close[2])))) //Double True Range

price = typicalprice

avg = average[n](DTR)

st = std[n](DTR)

If DI[d](close) < 0 then

WarningLine = price+avg

Dev1 = price+avg + st

Dev2 = price+avg + 2.4*st

Dev3 = price+avg + 3.6*st

else

WarningLine = price-avg

Dev1 = price-avg – st

Dev2 = price-avg – 2.4*st

Dev3 = price-avg – 3.6*st

endif

RETURN Warningline coloured(255,0,0) as "WarningLine", Dev1 coloured(2, 118, 253) as "DevStop1", Dev2 coloured(20, 100, 244) as "DevStop2", Dev3 coloured(1, 71, 250) as "DevStop3"

Here is my SAR approach (I only initialize using the MA crossover):

*I do not make use of the warning line and DevStop1 as they are way too easily hit

//KASE Deviation Stoploss Bands

n = 30

DTR = max(max(High – Low[2], abs(High – Close[2])),max(abs(Low – Close[2]),(abs(Low – Close[2]))))

avg = average[n](DTR)

st = std[n](DTR)

maFast = average[9,1](close)

maSlow = average[21,1](close)

once DevInit = 1

If DevInit = 1 Then

If maFast > maSlow Then

DevLong = 1

DevLongC = 0

Else

DevLong = 0

DevShortC = 0

EndIf

DevInit = 0

ElsIf DevInit = 0 and DevLong = 1 Then

HighestDev3 = Dev3

For y = 1 to DevLongC Do

If Dev3[y] > HighestDev3 Then

HighestDev3 = Dev3[y]

EndIf

Next

If close < HighestDev3 Then

DevLong = 0

DevShortC = 0

EndIf

ElsIf DevInit = 0 and DevLong = 0 Then

LowestDev3 = Dev3

For x = 1 to DevShortC Do

If Dev3[x] LowestDev3 Then

DevLong = 1

DevLongC = 0

EndIf

EndIf

If DevLong = 1 Then

DevLongC = DevLongC + 1

//WarningLine = typicalprice-avg

//Dev1 = typicalprice-avg – st

Dev2 = typicalprice-avg – 2.2*st

Dev3 = typicalprice-avg – 3.6*st

ElsIf DevLong = 0 Then

DevShortC = DevShortC + 1

//WarningLine = typicalprice+avg

//Dev1 = typicalprice+avg + st

Dev2 = typicalprice+avg + 2.2*st

Dev3 = typicalprice+avg + 3.6*st

EndIf

Return Dev2 coloured(20, 100, 244) style(dottedline,1) as “DevStop2”, Dev3 coloured(255, 0, 0) style(dottedline,1) as “DevStop3”

Thanks very much Juanj, it through up some errors when I loaded it? What is the C in DevLongC refer to?

Nicolas is taking another look at the Dev Stop coding re: the issue of price not penetrating into the Dev Stops. The Warning Line and Dev 1 are important in that not only do they provide early warning of trend changes but they can be traded according to Kase’s Follow Through and Stop Beyond probability Tables.

https://cmtassociation.org/wp-content/uploads/2015/11/0610-kase.pdf

page 45

Cheers

Bard

DevLongC and DevShortC keeps track of the number of bars that the DevStops are either long or short. This is used to find the lowest and highest DevStop3 levels for the period.

C = Count

Thanks for the explanation. I couldn’t get it to load anyway.

Hello everyone, I’m coming late into this discussion… Brad cannot load the code because there is one operator “<" missing line 42 and one "Next" missing line 46. The below code codes works for me. If Juan wants to check…

//KASE Deviation Stoploss Bands

n = 30

DTR = max(max(High – Low[2], abs(High – Close[2])),max(abs(Low – Close[2]),(abs(Low – Close[2]))))

avg = average[n](DTR)

st = std[n](DTR)

maFast = average[9,1](close)

maSlow = average[21,1](close)

once DevInit = 1

If DevInit = 1 Then

If maFast > maSlow Then

DevLong = 1

DevLongC = 0

Else

DevLong = 0

DevShortC = 0

EndIf

DevInit = 0

ElsIf DevInit = 0 and DevLong = 1 Then

HighestDev3 = Dev3

For y = 1 to DevLongC Do

If Dev3[y] > HighestDev3 Then

HighestDev3 = Dev3[y]

EndIf

Next

If close < HighestDev3 Then

DevLong = 0

DevShortC = 0

EndIf

ElsIf DevInit = 0 and DevLong = 0 Then

LowestDev3 = Dev3

For x = 1 to DevShortC Do

If Dev3[x] < (LowestDev3) Then //try = or > or <

DevLong = 1

DevLongC = 0

EndIf

Next // next was missing

endif

If DevLong = 1 Then

DevLongC = DevLongC + 1

//WarningLine = typicalprice-avg

//Dev1 = typicalprice-avg – st

Dev2 = typicalprice-avg – 2.2*st

Dev3 = typicalprice-avg – 3.6*st

ElsIf DevLong = 0 Then

DevShortC = DevShortC + 1

//WarningLine = typicalprice+avg

//Dev1 = typicalprice+avg + st

Dev2 = typicalprice+avg + 2.2*st

Dev3 = typicalprice+avg + 3.6*st

EndIf

Return Dev2 coloured(20, 100, 244) style(dottedline,1) as “DevStop2”, Dev3 coloured(255, 0, 0) style(dottedline,1) as “DevStop3”