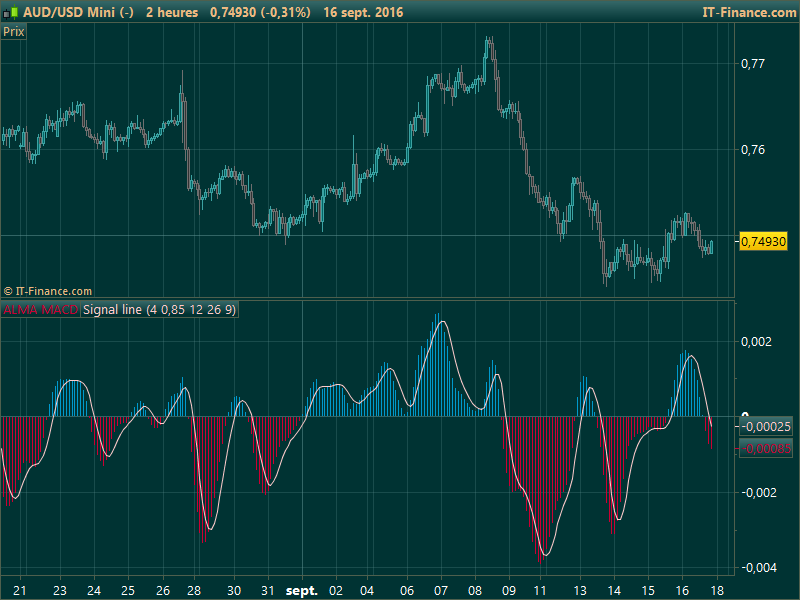

This technical indicator is the classical MACD (Moving Average Convergence Divergence) made with ALMA (Arnaud Legoux Moving Average) which formula can be found here in the Library: http://www.prorealcode.com/prorealtime-indicators/alma-arnaud-legoux-moving-average/ , instead of the normal MA.

Since this type of moving average considerably reduce lags, I thought it could be useful to rewrite the MACD with it.

Results are great on chart, the indicator react quickly than the classic MACD. While it can be accurate to detect new turning point of the trend, the false signals are reduced because of its quick adaptation to the price movement.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 |

//PRC_ALMA MACD | indicator //17.09.2016 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //parameters // Sigma = 4 // Offset = 0.85 // Fast = 12 // Slow = 26 // Signal = 9 Price = customclose //---Fast MA m = (Offset * (Fast - 1)) s = Fast/Sigma WtdSum = 0 CumWt = 0 for k = 0 to Fast - 1 do Wtd = Exp(-((k-m)*(k-m))/(2*s*s)) WtdSum = WtdSum + Wtd * Price[Fast - 1 - k] CumWt = CumWt + Wtd next FastMA = WtdSum / CumWt //---Slow MA n = (Offset * (Slow - 1)) t = Slow/Sigma SWtdSum = 0 SCumWt = 0 for k = 0 to Slow - 1 do SWtd = Exp(-((k-n)*(k-n))/(2*t*t)) SWtdSum = SWtdSum + SWtd * Price[Slow - 1 - k] SCumWt = SCumWt + SWtd next SlowMA = SWtdSum / SCumWt //---MACD ALMAMACD = FastMA-SlowMA //---Signal MA n = (Offset * (Signal - 1)) t = Signal/Sigma SWtdSum = 0 SCumWt = 0 for k = 0 to Signal - 1 do SWtd = Exp(-((k-n)*(k-n))/(2*t*t)) SWtdSum = SWtdSum + SWtd * ALMAMACD[Signal - 1 - k] SCumWt = SCumWt + SWtd next SignalMACD = SWtdSum / SCumWt RETURN ALMAMACD as "ALMA MACD", SignalMACD as "Signal line" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello Nicolas

to backtest this with some stock or commodities how woud you reccomend to test it ? when the lines crosses eachother go long or short but ho identify that they are overbought and oversold

This is only a classic MACD made with ALMA moving average. So you can trade it just like any other MACD. MACD doesn’t spot overbought or oversold areas, it’s a trend indicator, made of differences of 2 moving average values (1 short and 1 long period).

Hi , is it possible to write this code in Excel? i have some data in excel i want to test this against.

Should be possible in VBA, I can do it as a job with the programming services: https://www.prorealcode.com/trading-programming-services/

Great indicator, thank you!

Hi Nicolas, just reviewing this indicator and noticed that you have double assigned the variables n, t, SWtdSum and SCumWt under the ‘Slow MA’ and ‘Signal MA’ sections – is that intended or should the variable names be different?

That would not make any difference because the code is read from top to bottom.