Dear All,

I think it is the good timing to share with you the following strategy.

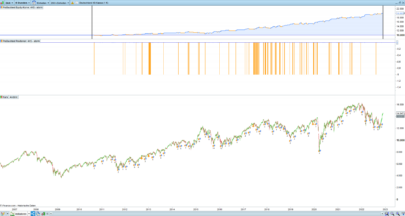

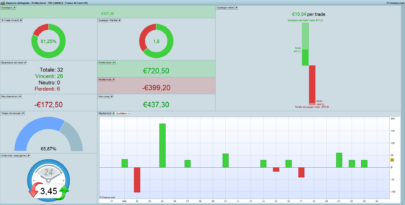

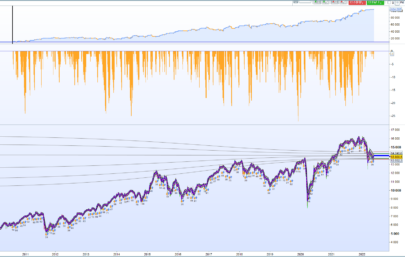

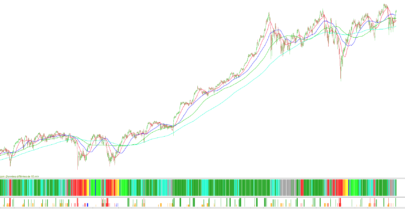

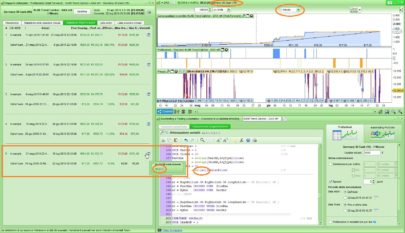

“Dax Short 15′” is nothing really complicated but works fairly.

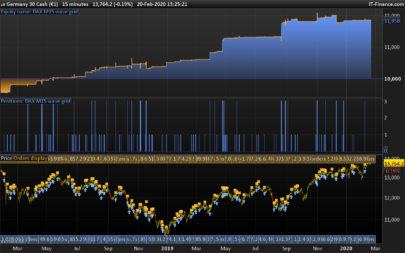

- TF 15′

- Instr. DAX

- Tested on “tick by tick”

- Tested with 200k bars.

- 1 pt spread.

- WF hasn’t been done.

Kindly note that I am not the coder of the century 😉 however I’ll be delighted to help as much as I can.

Thank you.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 |

//------------------------------------------------------------------------- // Code principal : Dax Short 15' //------------------------------------------------------------------------- //----------------------------------- // Code principal : Dax Short 15' //------------------------------------------------------------------------- // Définition des paramètres du code // From Inertia //Last optimization 26/07/2017 DEFPARAM Preloadbars = 3000 DEFPARAM CumulateOrders = False DEFPARAM FLATBEFORE = 091500 DEFPARAM FLATAFTER = 213000 noEntryBeforeTime = 091500 timeEnterBefore = time >= noEntryBeforeTime noEntryAfterTime = 213000 timeEnterAfter = time < noEntryAfterTime daysForbiddenEntry = OpenDayOfWeek = 1 OR OpenDayOfWeek = 3 OR OpenDayOfWeek = 6 OR OpenDayOfWeek = 0 REM Variables ordersize = 1 mafilter = 2000 // 2000 TS = 30 // 30 SL = 45 // 45 TP = 110 // 110 //MACD settings a = 12 // 12 b = 26 // 26 c = 9 // 9 // Conditions pour ouvrir une position en vente à découvert indicator1 = MACD[a,b,c](close) c1 = (indicator1 CROSSES UNDER 0) indicator2 = MACDline[a,b,c](close) c2 = (indicator2 < 0) indicator3 = ExponentialAverage[mafilter](close) c3 = (close < indicator3) indicator4 = ExponentialAverage[mafilter](close) indicator5 = ExponentialAverage[mafilter](close) c4 = (indicator4 < indicator5[1]) IF (c1 AND c2 AND c3 AND c4) AND timeEnterBefore AND timeEnterAfter AND not daysForbiddenEntry THEN SELLSHORT ordersize CONTRACT AT MARKET ENDIF //trailing stop trailingstop = TS//Best 30 //resetting variables when no trades are on market if not onmarket then MINPRICE = close priceexit = 0 endif //case SHORT order if shortonmarket then MINPRICE = MIN(MINPRICE,close) //saving the MFE of the current trade if tradeprice(1)-MINPRICE>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then priceexit = MINPRICE+trailingstop*pointsize //set the exit price at the MFE + trailing stop price level endif endif //exit on trailing stop price levels if onmarket and priceexit>0 then EXITSHORT AT priceexit STOP SELL AT priceexit STOP endif SET STOP Ploss SL Set Target PProfit TP |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

what timezone? not getting similar results 🙂

GMT +1

Hi Inertia ,

first of all , congrats for the good strategy

one questions : the average 2000 in the code Time frame 15min, rapresent the Average 100 in Daily Time frame ?

thanks

Thank you JR1976.

It was not meant to be a conversion from a daily TF but mostly a “larger and round” filter for this 15’TF.

However, i did an excel breakdown as attached (fyi)…

Thank you Inertia.

Can you think if it’s possible to applicate this strategy (Long Only) ?

Sorry lysan2, the exact one for long only doesn’t work well.

Perhaps, you may have to look with roughly the same trigger for entries but on a smaller TF to possibly find an edge.

thx.

Long version… not very good

//DEFPARAM Preloadbars = 3000

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE = 090000

DEFPARAM FLATAFTER = 210000

noEntryBeforeTime = 090000

timeEnterBefore = time >= noEntryBeforeTime

noEntryAfterTime = 213000

timeEnterAfter = time 2)

indicator3 = ExponentialAverage[mafilter](close)

c3 = (close > indicator3)

indicator4 = ExponentialAverage[mafilter](close)

indicator5 = ExponentialAverage[mafilter](close)

c4 = (indicator4 > indicator5[1])

IF (c1 AND c2 AND c3 AND c4) AND timeEnterBefore AND timeEnterAfter AND not daysForbiddenEntry THEN

buy ordersize CONTRACT AT MARKET

ENDIF

//trailing stop

trailingstop = TS//Best 30

//resetting variables when no trades are on market

if not onmarket then

MINPRICE = close

priceexit = 1

endif

//case long order

if longonmarket then

MINPRICE = MIN(MINPRICE,close) //saving the MFE of the current trade

if tradeprice(1)-MINPRICE>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MINPRICE+trailingstop*pointsize //set the exit price at the MFE + trailing stop price level

endif

endif

//FINE LONG

//exit on trailing stop price levels

if onmarket and priceexit>0 then

EXITSHORT AT priceexit STOP

SELL AT priceexit STOP

endif

SET STOP Ploss SL

Set Target PProfit TP

@Andreag76

Thank you but your code is broken.

Variables are missing and the trailing stop, if long only should be MAXPRICE instead of MINPRICE.

However, yes the long version on a TF 15′ doesn’t work well enough.

Kind regards,

Hi,

What do you think about this ?

//————————————————————————-

// Code principal : Dax Short 15′

//————————————————————————-

//———————————–

// Code principal : Dax Short 15′

//————————————————————————-

// Définition des paramètres du code

// From Inertia

//Last optimization 26/07/2017

DEFPARAM Preloadbars = 3000

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE = 100000

DEFPARAM FLATAFTER = 180000

noEntryBeforeTime = 100000

timeEnterBefore = time >= noEntryBeforeTime

noEntryAfterTime = 213000

timeEnterAfter = time < noEntryAfterTime

daysForbiddenEntry = OpenDayOfWeek = 1 OR OpenDayOfWeek = 3 OR OpenDayOfWeek = 6 OR OpenDayOfWeek = 0

REM Variables

// Taille des positions

REINV = 1

LEVIER = 5

IF REINV = 0 THEN

N = 1

ELSIF REINV = 1 THEN

capital = 500 + strategyprofit

N = round(capital / 500)*LEVIER

ENDIF

ordersize = N

mafilter = 250 // 2000

TS = 30 // 30

SL = 45 // 45

TP = 110 // 110

//MACD settings

a = 12 // 12

b = 26 // 26

c = 9 // 9

// Conditions pour ouvrir une position en vente à découvert

indicator1 = MACD[a,b,c](close)

c1 = (indicator1 CROSSES UNDER 0)

indicator2 = MACDline[a,b,c](close)

c2 = (indicator2 < 0)

indicator3 = ExponentialAverage[mafilter](close)

c3 = (close < indicator3)

indicator4 = ExponentialAverage[mafilter](close)

indicator5 = ExponentialAverage[mafilter](close)

c4 = (indicator4 =trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MINPRICE+trailingstop*pointsize //set the exit price at the MFE + trailing stop price level

endif

endif

//exit on trailing stop price levels

if onmarket and priceexit>0 then

EXITSHORT AT priceexit STOP

SELL AT priceexit STOP

endif

SET STOP Ploss SL

Set Target PProfit TP

Thank you.

Sorry, there is a bug on line 52…

//————————————————————————-

// Code principal : Dax Short 15′

//————————————————————————-

//———————————–

// Code principal : Dax Short 15′

//————————————————————————-

// Définition des paramètres du code

// From Inertia

//Last optimization 26/07/2017

DEFPARAM Preloadbars = 3000

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE = 100000

DEFPARAM FLATAFTER = 180000

noEntryBeforeTime = 100000

timeEnterBefore = time >= noEntryBeforeTime

noEntryAfterTime = 213000

timeEnterAfter = time < noEntryAfterTime

daysForbiddenEntry = OpenDayOfWeek = 1 OR OpenDayOfWeek = 3 OR OpenDayOfWeek = 6 OR OpenDayOfWeek = 0

REM Variables

// Taille des positions

REINV = 1

LEVIER = 3

IF REINV = 0 THEN

N = 1

ELSIF REINV = 1 THEN

capital = 500 + strategyprofit

n = (capital / 500)*LEVIER

N = round(n)

ENDIF

ordersize = N

mafilter = 2000 // 2000

TS = 30 // 30

SL = 45 // 45

TP = 110 // 110

//MACD settings

a = 12 // 12

b = 26 // 26

c = 9 // 9

// Conditions pour ouvrir une position en vente à découvert

indicator1 = MACD[a,b,c](close)

c1 = (indicator1 CROSSES UNDER 0)

indicator2 = MACDline[a,b,c](close)

c2 = (indicator2 < 0)

indicator3 = ExponentialAverage[mafilter](close)

c3 = (close < indicator3)

indicator4 = ExponentialAverage[mafilter](close)

indicator5 = ExponentialAverage[mafilter](close)

c4 = (indicator4 =trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MINPRICE+trailingstop*pointsize //set the exit price at the MFE + trailing stop price level

endif

endif

//exit on trailing stop price levels

if onmarket and priceexit>0 then

EXITSHORT AT priceexit STOP

SELL AT priceexit STOP

endif

SET STOP Ploss SL

Set Target PProfit TP

Bonjour Inertia, cette sais-tu si cette stratégie fonctionne sur un compte IG à “risque limité” ? Car je crois qu’il y a une restriction sur le fonctionnement des trailing stops. Mais peut-être que ton code contourne cette restriction de par sa conception ? Merci.

Bonjour tecknozic…. Je ne sais pas… Désolé.

Bonne chance 😉

This system is the only one running on my PC, which i didn´t developed my myself. My forcast was correct, the system makes money !! Gratulation, you understand the DAX.

Hi! Is this system still working good? Anyone has it in the live account? It looks great.

Thank you for sharing

Proformence will be beter with other starting hours and closing hours @Inertia