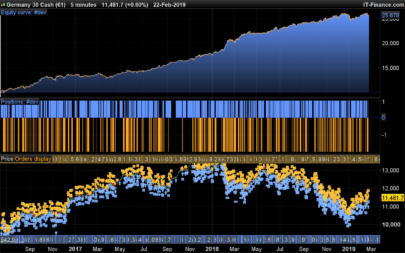

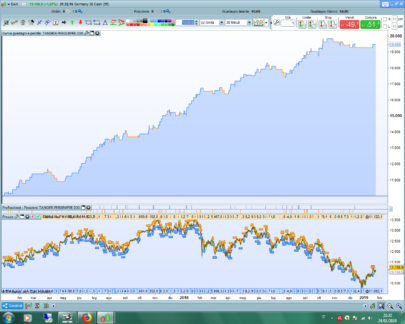

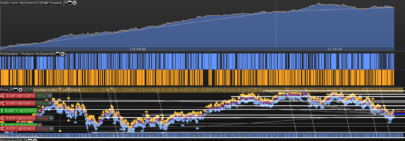

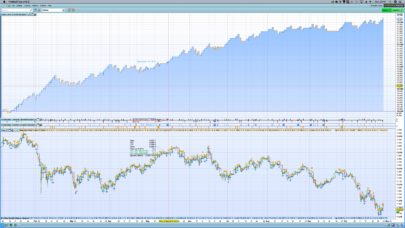

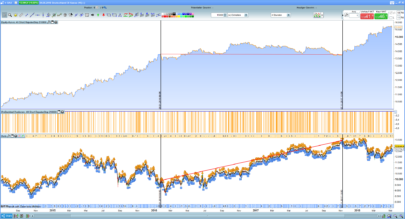

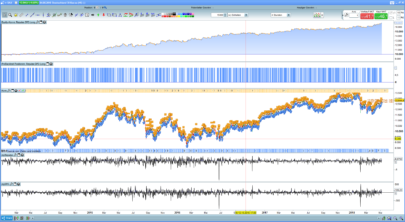

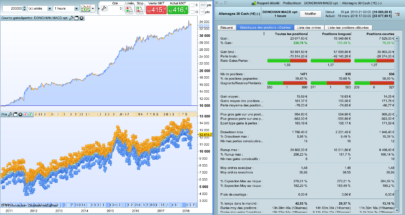

A simple code with differently weighted averages and a stop by repulse.

Supplemented by the seasonal pattern multiplier and a re-invest strategy.

If necessary, the latter can also be omitted, but it still remains a gain that achieves a higher performance than the Dax itself.

Time conditions should be adapted to your timezone. Timeframe = H4.

You can also do without the fixed TP and SL. The insurance can stay.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 |

// MainCode : DailyOpenLong // Dax 1 Euro // TimeFrame4H // created by JohnScher // with SainsonalPatternMultiplier from Pathfinder-Systems // with Re-Invest-Strategie //.............................................................. // Start //.............................................................. defparam cumulateorders = false // saisonal pattern muliplier ONCE January1 = 3 //0 risk(3) ONCE January2 = 0 //3 ok ONCE February1 = 3 //3 ok ONCE February2 = 3 //0 risk(3) ONCE March1 = 3 //0 risk(3) ONCE March2 = 2 //3 ok ONCE April1 = 3 //3 ok ONCE April2 = 3 //3 ok ONCE May1 = 1 //0 risk(1) ONCE May2 = 1 //0 risk(1) ONCE June1 = 1 //1 ok 2 ONCE June2 = 2 //3 ok ONCE July1 = 3 //1 chance ONCE July2 = 2 //3 ok ONCE August1 = 2 //1 chance 1 ONCE August2 = 3 //3 ok ONCE September1 = 3 //0 risk(3) ONCE September2 = 0 //0 ok ONCE October1 = 3 //0 risk(3) ONCE October2 = 2 //3 ok ONCE November1 = 1 //1 ok ONCE November2 = 3 //3 ok ONCE December1 = 3 // 1 chance ONCE December2 = 2 //3 ok // set saisonal multiplier currentDayOfTheMonth = Day midOfMonth = 15 IF CurrentMonth = 1 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = January1 ELSE saisonalPatternMultiplier = January2 ENDIF ELSIF CurrentMonth = 2 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = February1 ELSE saisonalPatternMultiplier = February2 ENDIF ELSIF CurrentMonth = 3 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = March1 ELSE saisonalPatternMultiplier = March2 ENDIF ELSIF CurrentMonth = 4 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = April1 ELSE saisonalPatternMultiplier = April2 ENDIF ELSIF CurrentMonth = 5 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = May1 ELSE saisonalPatternMultiplier = May2 ENDIF ELSIF CurrentMonth = 6 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = June1 ELSE saisonalPatternMultiplier = June2 ENDIF ELSIF CurrentMonth = 7 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = July1 ELSE saisonalPatternMultiplier = July2 ENDIF ELSIF CurrentMonth = 8 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = August1 ELSE saisonalPatternMultiplier = August2 ENDIF ELSIF CurrentMonth = 9 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = September1 ELSE saisonalPatternMultiplier = September2 ENDIF ELSIF CurrentMonth = 10 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = October1 ELSE saisonalPatternMultiplier = October2 ENDIF ELSIF CurrentMonth = 11 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = November1 ELSE saisonalPatternMultiplier = November2 ENDIF ELSIF CurrentMonth = 12 THEN IF currentDayOfTheMonth <= midOfMonth THEN saisonalPatternMultiplier = December1 ELSE saisonalPatternMultiplier = December2 ENDIF Endif // end sainsonal pattern multiplier // code re-invest Capital = 10000 Equity = Capital + StrategyProfit Position = Max(1, Equity * (1/Capital)) Position = Round(Position*100) Position = Position/100 // start maincode TradingDayLong = dayofweek = 1 or dayofweek = 2 or dayofweek = 3 or dayofweek = 4 or dayofweek = 5 TradingtimeLong = time = 080000 //or time = 130000 or time = 170000 c1 = TR (close) > 25 c2 = TEMA [4] (close) > ExponentialAverage [4] (close) IF TradingDayLong and TradingTimeLong Then If c1 and c2 THEN buy position*saisonalpatternmultiplier CONTRACT AT MARKET Endif ENDIF // set stop loss IF time = 080000 or time = 120000 or time = 160000 or time = 200000 then If Repulse[3](close)< -0.3 Then sell at market Endif ENDIF // set target profit set stop loss //set target %profit 3 Set stop %loss 5 // end maincode |

kind regards

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

JohnScher has requested that I post my very slightly modified version of his strategy that gives better profits and a higher win/loss ratio on here but unfortunately I am unable to post code for some strange reason. Please go to

https://www.prorealcode.com/topic/wanted-small-code-snippet/#post-57152

where you can find the new code. You may wish to adjust the SET Target %Profit to 3.75 instead of the 3 that it is as this is a more optimized number.

What does the last sentence mean: The insurance can stay. (A typical german is over-insured, but a “Robot insurance” is really the final straw). Thx.

The “insurance” is against the general dangers such as the sudden appearance of a black hole in the middle of the earth or simply against an exploding nuclear power plant.

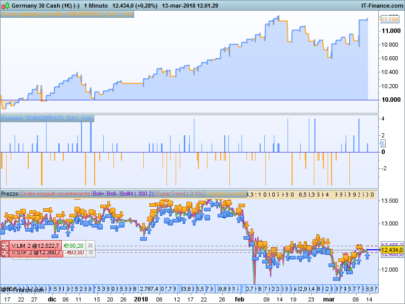

I’m trying to make a probacktest in the suggested 4H timeframe and don’t perform any operations…

@Kv6

Try this code, see below.

Please pay attention to the correct time settings.

The trade starts at 09:00 GMT+1 or 08:00 GMT.

Correspondingly then the closes

09.00/13.00/17.00/21.00 GMT+1

08.00/12.00/16.00/22.00 GMT

Here in the code i use GMT+1

Then it should work.

If it doesn’t work, please use ScreenShots.

// MainCode: DailyOpenLong

// Dax 1 Euro

// TimeFrame 4H

// created by JohnScher

// with SaisonalPatternMultiplier from Pathfinder-Systems

// with Re-Invest-Strategie

//……………………………………………………..

// Start

//……………………………………………………..

defparam cumulateorders = false

// saisonal pattern muliplier

ONCE January1 = 3 //0 risk(3)

ONCE January2 = 0 //3 ok

ONCE February1 = 3 //3 ok

ONCE February2 = 3 //0 risk(3)

ONCE March1 = 3 //0 risk(3)

ONCE March2 = 2 //3 ok

ONCE April1 = 3 //3 ok

ONCE April2 = 3 //3 ok

ONCE May1 = 1 //0 risk(1)

ONCE May2 = 1 //0 risk(1)

ONCE June1 = 1 //1 ok 2

ONCE June2 = 2 //3 ok

ONCE July1 = 3 //1 chance

ONCE July2 = 2 //3 ok

ONCE August1 = 2 //1 chance 1

ONCE August2 = 3 //3 ok

ONCE September1 = 3 //0 risk(3)

ONCE September2 = 0 //0 ok

ONCE October1 = 3 //0 risk(3)

ONCE October2 = 2 //3 ok

ONCE November1 = 1 //1 ok

ONCE November2 = 3 //3 ok

ONCE December1 = 3 // 1 chance

ONCE December2 = 2 //3 ok

// set saisonal multiplier

currentDayOfTheMonth = Day

midOfMonth = 15

IF CurrentMonth = 1 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = January1

ELSE

saisonalPatternMultiplier = January2

ENDIF

ELSIF CurrentMonth = 2 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = February1

ELSE

saisonalPatternMultiplier = February2

ENDIF

ELSIF CurrentMonth = 3 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = March1

ELSE

saisonalPatternMultiplier = March2

ENDIF

ELSIF CurrentMonth = 4 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = April1

ELSE

saisonalPatternMultiplier = April2

ENDIF

ELSIF CurrentMonth = 5 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = May1

ELSE

saisonalPatternMultiplier = May2

ENDIF

ELSIF CurrentMonth = 6 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = June1

ELSE

saisonalPatternMultiplier = June2

ENDIF

ELSIF CurrentMonth = 7 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = July1

ELSE

saisonalPatternMultiplier = July2

ENDIF

ELSIF CurrentMonth = 8 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = August1

ELSE

saisonalPatternMultiplier = August2

ENDIF

ELSIF CurrentMonth = 9 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = September1

ELSE

saisonalPatternMultiplier = September2

ENDIF

ELSIF CurrentMonth = 10 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = October1

ELSE

saisonalPatternMultiplier = October2

ENDIF

ELSIF CurrentMonth = 11 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = November1

ELSE

saisonalPatternMultiplier = November2

ENDIF

ELSIF CurrentMonth = 12 THEN

IF currentDayOfTheMonth 25

c2 = TEMA [4] (close) > ExponentialAverage [4] (close)

c3 = Repulse [3] (close) > 0.3

IF TradingDayLong and TradingTimeLong Then

If c1 and c2 and c3 THEN

buy position*saisonalpatternmultiplier CONTRACT AT MARKET

Endif

ENDIF

// set stop loss

IF time = 090000 or time = 130000 or time = 170000 or time = 210000 then

If Repulse[3](close)< -0.3 Then

sell at market

Endif

ENDIF

// set target profit set stop loss

//set target %profit 3

Set stop %loss 5

// end maincode

Line 111: I replaced “IF CurrentDayOfTheMonth 25” with “IF CurrentDayOfTheMonth <= 25 THEN"

In the end, when I try to validate, the error shown in the screenshot comes out.

Are you sure you changed in my code the line 111?

…

Add PRT code – function don´t work correct on my personal computer

i try againe

next try

doesn´t work

so here it is

// MainCode : DailyOpenLong

// Dax 1 Euro

// Timezone GMT

// TimeFrame4H

// created by JohnScher

// with SainsonalPatternMultiplier from Pathfinder-Systems

// with Re-Invest-Strategie

//……………………………………………………..

// Start

//……………………………………………………..

defparam cumulateorders = false

// saisonal pattern muliplier

ONCE January1 = 3 //0 risk(3)

ONCE January2 = 0 //3 ok

ONCE February1 = 3 //3 ok

ONCE February2 = 3 //0 risk(3)

ONCE March1 = 3 //0 risk(3)

ONCE March2 = 2 //3 ok

ONCE April1 = 3 //3 ok

ONCE April2 = 3 //3 ok

ONCE May1 = 1 //0 risk(1)

ONCE May2 = 1 //0 risk(1)

ONCE June1 = 1 //1 ok 2

ONCE June2 = 2 //3 ok

ONCE July1 = 3 //1 chance

ONCE July2 = 2 //3 ok

ONCE August1 = 2 //1 chance 1

ONCE August2 = 3 //3 ok

ONCE September1 = 3 //0 risk(3)

ONCE September2 = 0 //0 ok

ONCE October1 = 3 //0 risk(3)

ONCE October2 = 2 //3 ok

ONCE November1 = 1 //1 ok

ONCE November2 = 3 //3 ok

ONCE December1 = 3 // 1 chance

ONCE December2 = 2 //3 ok

// set saisonal multiplier

currentDayOfTheMonth = Day

midOfMonth = 15

IF CurrentMonth = 1 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = January1

ELSE

saisonalPatternMultiplier = January2

ENDIF

ELSIF CurrentMonth = 2 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = February1

ELSE

saisonalPatternMultiplier = February2

ENDIF

ELSIF CurrentMonth = 3 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = March1

ELSE

saisonalPatternMultiplier = March2

ENDIF

ELSIF CurrentMonth = 4 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = April1

ELSE

saisonalPatternMultiplier = April2

ENDIF

ELSIF CurrentMonth = 5 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = May1

ELSE

saisonalPatternMultiplier = May2

ENDIF

ELSIF CurrentMonth = 6 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = June1

ELSE

saisonalPatternMultiplier = June2

ENDIF

ELSIF CurrentMonth = 7 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = July1

ELSE

saisonalPatternMultiplier = July2

ENDIF

ELSIF CurrentMonth = 8 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = August1

ELSE

saisonalPatternMultiplier = August2

ENDIF

ELSIF CurrentMonth = 9 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = September1

ELSE

saisonalPatternMultiplier = September2

ENDIF

ELSIF CurrentMonth = 10 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = October1

ELSE

saisonalPatternMultiplier = October2

ENDIF

ELSIF CurrentMonth = 11 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = November1

ELSE

saisonalPatternMultiplier = November2

ENDIF

ELSIF CurrentMonth = 12 THEN

IF currentDayOfTheMonth 25

c2 = TEMA [4] (close) > ExponentialAverage [4] (close)

IF TradingDayLong and TradingTimeLong Then

If c1 and c2 THEN

buy position*saisonalpatternmultiplier contracts at market

Endif

ENDIF

// condition to exit

IF time = 080000 or time = 120000 or time = 160000 or time = 200000 then

If Repulse[3](close)< -0.3 Then

sell at market

Endif

ENDIF

// set target profit set stop loss

//set target %profit 3

Set stop %loss 5

// Stop Loss as an insurace e.g. an exploiting nuclear power plant

// end maincode

// end

all right?

Sorry don’t get your system to work. Miss definition of c1, december etc.

Pls try again!

Hello It doesn’t work for me also

this one runs

// MainCode : DailyOpenLong

// Dax 1 Euro

// TimeFrame4H

// created by JohnScher

// with SainsonalPatternMultiplier from Pathfinder-Systems

// with Re-Invest-Strategie

//……………………………………………………..

// Start

//……………………………………………………..

defparam cumulateorders = false

// saisonal pattern muliplier

ONCE January1 = 3 //0 risk(3)

ONCE January2 = 0 //3 ok

ONCE February1 = 3 //3 ok

ONCE February2 = 3 //0 risk(3)

ONCE March1 = 3 //0 risk(3)

ONCE March2 = 2 //3 ok

ONCE April1 = 3 //3 ok

ONCE April2 = 3 //3 ok

ONCE May1 = 1 //0 risk(1)

ONCE May2 = 1 //0 risk(1)

ONCE June1 = 1 //1 ok 2

ONCE June2 = 2 //3 ok

ONCE July1 = 3 //1 chance

ONCE July2 = 2 //3 ok

ONCE August1 = 2 //1 chance 1

ONCE August2 = 3 //3 ok

ONCE September1 = 3 //0 risk(3)

ONCE September2 = 0 //0 ok

ONCE October1 = 3 //0 risk(3)

ONCE October2 = 2 //3 ok

ONCE November1 = 1 //1 ok

ONCE November2 = 3 //3 ok

ONCE December1 = 3 // 1 chance

ONCE December2 = 2 //3 ok

// set saisonal multiplier

currentDayOfTheMonth = Day

midOfMonth = 15

IF CurrentMonth = 1 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = January1

ELSE

saisonalPatternMultiplier = January2

ENDIF

ELSIF CurrentMonth = 2 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = February1

ELSE

saisonalPatternMultiplier = February2

ENDIF

ELSIF CurrentMonth = 3 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = March1

ELSE

saisonalPatternMultiplier = March2

ENDIF

ELSIF CurrentMonth = 4 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = April1

ELSE

saisonalPatternMultiplier = April2

ENDIF

ELSIF CurrentMonth = 5 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = May1

ELSE

saisonalPatternMultiplier = May2

ENDIF

ELSIF CurrentMonth = 6 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = June1

ELSE

saisonalPatternMultiplier = June2

ENDIF

ELSIF CurrentMonth = 7 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = July1

ELSE

saisonalPatternMultiplier = July2

ENDIF

ELSIF CurrentMonth = 8 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = August1

ELSE

saisonalPatternMultiplier = August2

ENDIF

ELSIF CurrentMonth = 9 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = September1

ELSE

saisonalPatternMultiplier = September2

ENDIF

ELSIF CurrentMonth = 10 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = October1

ELSE

saisonalPatternMultiplier = October2

ENDIF

ELSIF CurrentMonth = 11 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = November1

ELSE

saisonalPatternMultiplier = November2

ENDIF

ELSIF CurrentMonth = 12 THEN

IF currentDayOfTheMonth 25

c2 = TEMA [4] (close) > ExponentialAverage [4] (close)

IF TradingDayLong and TradingTimeLong Then

If c1 and c2 THEN

buy position*saisonalpatternmultiplier CONTRACT AT MARKET

Endif

ENDIF

// set stop loss

IF time = 090000 or time = 130000 or time = 170000 or time = 210000 then

If Repulse[3](close)< -0.3 Then

sell at market

Endif

ENDIF

// set target profit set stop loss

//set target %profit 3

Set stop %loss 5

// end maincode

// end

Why do i have problems to insert a code with “add prt code” ??

Hello

The problem of the code might the time of the candle if you modifiy by TradingtimeLong = time > 075900 and time<095000 For GMT/UTC +1 (Europe).

i have also a problem with add prt code

TradingDayLong = dayofweek = 1 or dayofweek = 2 or dayofweek = 3 or dayofweek = 4 or dayofweek = 5

TradingtimeLong = time > 075900 and time 25

c2 = TEMA [4] (close) > ExponentialAverage [4] (close)

IF TradingDayLong and TradingTimeLong Then

If c1 and c2 THEN

buy position*saisonalpatternmultiplier CONTRACT AT MARKET

Endif

ENDIF

// set stop loss

If Repulse[3](close)< -0.3 Then

sell at market

Endif

// set target profit set stop loss

set target %profit 3

Set stop %loss 5

// end maincode

Hey JohnScher,

your code works fine, but my results aren’t as good as yours. Even if I use the same timeframe as you.

What is wrong with my code? I just copied it.

Did I miss something?

Bha… this code dont work. gg