Hello friends,

After several attempts and after much annoying Nicholas, I have managed to realize the Screener of the complete kumo break.

This time he takes into account all the scenarios.

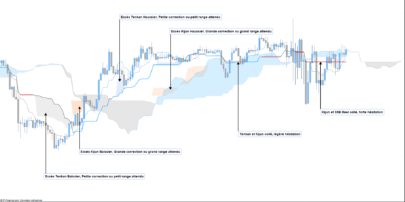

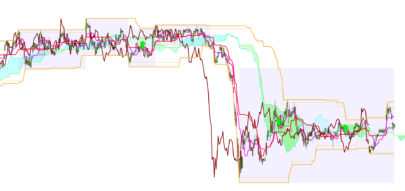

In this strategy the line Chikou Span is important because it is of confirmation, that is why the Screener only takes into account the crosses of Chikou with the cloud.

Break in Length: Several conditions. A) Current price> than the Cloud; B) (Option 1) the Span A in n periods> Span B in n periods then the break occurs when Chikou Span crosses Span A, c) (Option 2) Span A in n periods <Span B in n periods Break occurs when Chikou Span Crosses on SpanB long.

Following the same example but in reverse the conditions for Short are established.

As notes there are other conditions that are not used, but that are valid for other strategies with Ichimoku, Depending on the strategy you can “activate” or “disable” conditions, so I left it that way.

Hola amigos,

Tras varios intentos y después de molestar mucho a Nicolás, he conseguido realizar el Screener de la rotura de kumo completa.

En esta ocasión tiene en cuenta todos los escenarios.

En esta estrategia la línea Chikou Span es importante porque es de confirmación, es por esto por lo que el Screener sólo tiene en cuenta los cruces de Chikou con la nube.

Rotura en Largo: Varias condiciones. a) Precio actual > que la Nube; b) (Opción 1) la Span A en n periodos > Span B en n periodos entonces la rotura se produce cuando Chikou Span cruza en largo Span A, c) (Opción 2) Span A en n periodos < Span B en n periodos la rotura se produce cuando Chikou Span Cruza en largo SpanB.

Siguiendo el mismo ejemplo pero a la inversa se establece las condiciones para Corto.

PS. Como notas hay otras condiciones que no se usan, pero que son válidas para otras estrategias con Ichimoku, Dependiendo de la estrategia se puede “activar” o “desactivar” condiciones, por eso lo dejé así.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 |

//**************************************************************** //* Estrategia Rotura de Kumo Completa //* Autor: Rafa Barreto: Ayuda Nicolás //**************************************************************** // ===== VALORES MODIFICABLES ===== // -- Construyendo la graficación Ichimoku -- // -- Valores NO Standar: Fibonacci: 8; 21; 55 -- // -- Valores NO Standar: Actuales : 7;22;44 // -- Valores Standar: 9; 26; 52 PeriodoCorto = 7 PeriodoMedio = 22 PeriodoLargo = 44 Tenkan = (highest[PeriodoCorto](High) + lowest[PeriodoCorto](Low)) / 2 Kijun = (highest[PeriodoMedio](High) + lowest[PeriodoMedio](Low)) / 2 SpanA = (TenKan[PeriodoMedio] + Kijun[PeriodoMedio]) / 2 SpanB = (highest[PeriodoLargo](High[PeriodoMedio]) + lowest[PeriodoLargo](Low[PeriodoMedio])) / 2 Chikou = Close // ===== A partir de aquí no se toca el código ===== // --- Condiciones de Posiciones Largas --- Condicion1Larga = (close > SpanA) AND (close > SpanB) //Condicion2Larga = (Tenkan > SpanA) AND (Tenkan > SpanB) //Condicion3Larga = (Kijun > SpanA) AND (Kijun > SpanB) //Condicion4Larga = (Chikou > SpanA) AND (Chikou > SpanB) Condicion5Larga = (SpanA[PeriodoMedio] > SpanB[PeriodoMedio]) Condicion6Larga = (SpanA[PeriodoMedio] < SpanB[PeriodoMedio]) RoturaLargoOpcion1 = Chikou CROSSES OVER SpanA[PeriodoMedio] AND (Condicion1Larga AND Condicion5Larga) RoturaLargoOpcion2 = Chikou CROSSES OVER SpanB[PeriodoMedio] AND (Condicion1Larga AND Condicion6Larga) // -- Condiciones de Posiciones Cortas --- Condicion1Corta = (close < SpanA) AND (close < SpanB) //Condicion2Corta = (Tenkan < SpanA) AND (Tenkan < SpanB) //Condicion3Corta = (Kijun < SpanA) AND (Kijun < SpanB) //Condicion4Corta = (Chikou < SpanA) AND (Chikou < SpanB) Condicion5Corta = (SpanA[PeriodoMedio] < SpanB[PeriodoMedio]) Condicion6Corta = (SpanA[PeriodoMedio] > SpanB[PeriodoMedio]) RoturaCortoOpcion1 = Chikou CROSSES UNDER SpanA[PeriodoMedio] AND (Condicion1Corta AND Condicion5Corta) RoturaCortoOpcion2 = Chikou CROSSES UNDER SpanB[PeriodoMedio] AND (Condicion1Corta AND Condicion6Corta) // ===== SCREENER ===== SCREENER [RoturaLargoOpcion1 OR RoturaLargoOpcion2 OR RoturaCortoOpcion1 OR RoturaCortoOpcion2] |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

hi,

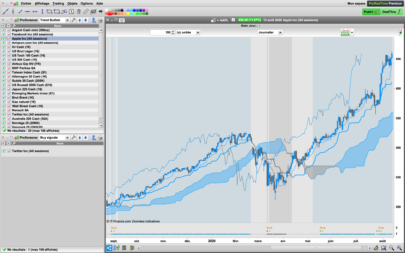

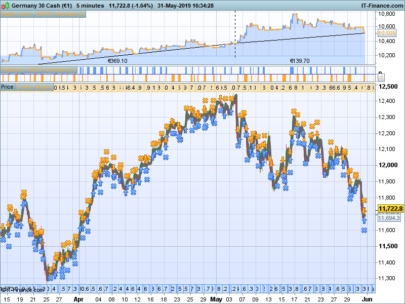

I have developed some strategy with ichimoku and I can developed other based on your screener. In which time frame do you use your screener ? Thanks emanuele

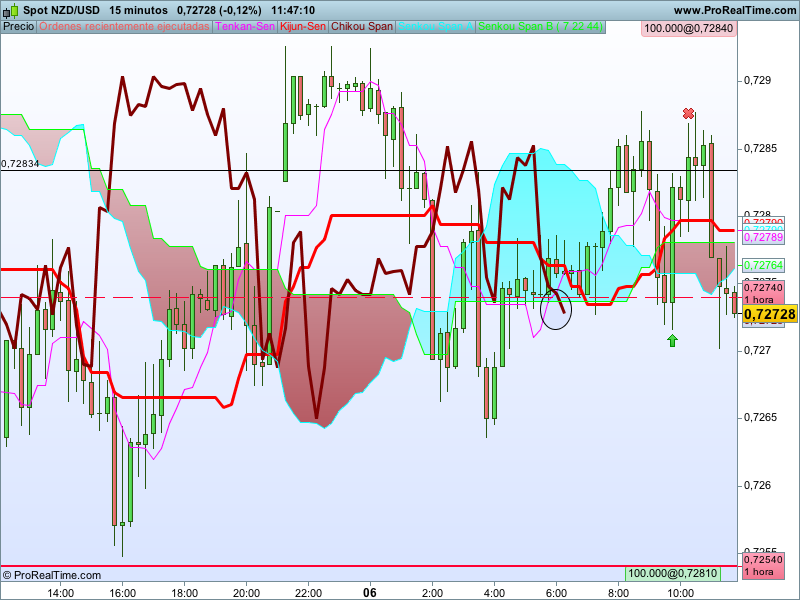

Hi Emanuale, I am using it in 15 minutes but I cross check H1 and H4

Thanks, in the next days I developed a stretegy based on your screener… I attach here the code and the results.

Thanks Emanuele,

It would be very interesting to see…

Best regards

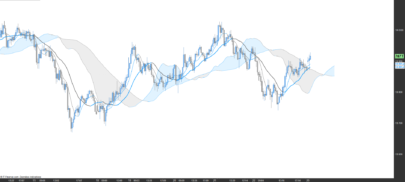

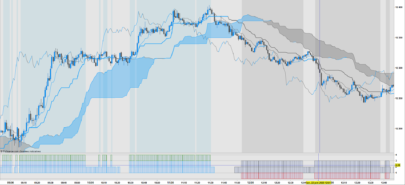

I have just realized is not finished yet. If we want to make it complete, we need to compare prices in different timeframes for example 4 hours and 1; or daily and 4 hours. I tried few things but is not working. Any ideas?

Thanks

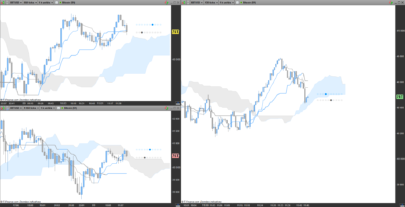

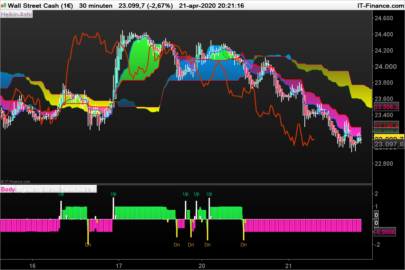

I have optimized it on Wallstreet cash 1 euro…tf 3h..best result

//****************************************************************

//* Estrategia Rotura de Kumo Completa

//* Autor: Rafa Barreto: Ayuda Nicolás

//****************************************************************

DEFPARAM CumulateOrders = false

// ===== VALORES MODIFICABLES =====

// -- Construyendo la graficación Ichimoku --

// -- Valores NO Standar: Fibonacci: 8; 21; 55 --

// -- Valores NO Standar: Actuales : 7;22;44

// -- Valores Standar: 9; 26; 52

PeriodoCorto = 9

PeriodoMedio = 26

PeriodoLargo = 52

X=24

Z=1.1

Tenkan = (highest[PeriodoCorto](High) + lowest[PeriodoCorto](Low)) / 2

Kijun = (highest[PeriodoMedio](High) + lowest[PeriodoMedio](Low)) / 2

SpanA = (TenKan[PeriodoMedio] + Kijun[PeriodoMedio]) / 2

SpanB = (highest[PeriodoLargo](High[PeriodoMedio]) + lowest[PeriodoLargo](Low[PeriodoMedio])) / 2

Chikou = Close

// ===== A partir de aquí no se toca el código =====

// --- Condiciones de Posiciones Largas ---

Condicion1Larga = (close > SpanA) AND (close > SpanB)

//Condicion2Larga = (Tenkan > SpanA) AND (Tenkan > SpanB)

//Condicion3Larga = (Kijun > SpanA) AND (Kijun > SpanB)

//Condicion4Larga = (Chikou > SpanA) AND (Chikou > SpanB)

Condicion5Larga = (SpanA[PeriodoMedio] > SpanB[PeriodoMedio])

Condicion6Larga = (SpanA[PeriodoMedio] < SpanB[PeriodoMedio])

//Condicion7Larga = chikou > close[PeriodoMedio]

if not onmarket and (Chikou CROSSES OVER SpanA[PeriodoMedio] AND (Condicion1Larga AND Condicion5Larga )) or (Chikou CROSSES OVER SpanB[PeriodoMedio] AND (Condicion1Larga AND Condicion6Larga)) then

buy 1 shares at market

endif

// -- Condiciones de Posiciones Cortas ---

Condicion1Corta = (close < SpanA) AND (close < SpanB)

//Condicion2Corta = (Tenkan < SpanA) AND (Tenkan < SpanB)

//Condicion3Corta = (Kijun < SpanA) AND (Kijun < SpanB)

//Condicion4Corta = (Chikou < SpanA) AND (Chikou < SpanB)

Condicion5Corta = (SpanA[PeriodoMedio] < SpanB[PeriodoMedio])

Condicion6Corta = (SpanA[PeriodoMedio] > SpanB[PeriodoMedio])

//Condicion8Larga = chikou < close[PeriodoMedio]

if not onmarket and (Chikou CROSSES UNDER SpanA[PeriodoMedio] AND (Condicion1Corta AND Condicion5Corta) ) or (Chikou CROSSES UNDER SpanB[PeriodoMedio] AND (Condicion1Corta AND Condicion6Corta) ) then

sellshort 1 shares at market

endif

set stop ploss X

SET TARGET PPROFIT X*Z

Thanks a lot..

Best regards

como seria el codigo del indicador no del screener

No entiendo la pregunta… El indicador viene por defecto en PRT, pero en el SCREENER tienes el código de todos los elementos del Ichimoku

mi pregunta es si se puede hacer un indicador que aparezca como alerta o chivato en la rotura de la nube

tambien con que indicador se puede compaginar el ichimoku

El chivato es el propio SCREENER, aparece cuando las condiciones se cumplen. Y se pueden combinar indicadores claro… con los que quieras.

El chivato es el propio SCREENER, aparece cuando las condiciones se cumplen. Y se pueden combinar indicadores claro… con los que quieras.