1. Introduction

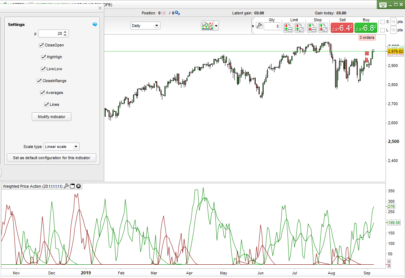

The Range Filtered Trend Signals indicator (by AlgoAlpha) is a composite tool designed to help traders identify both tentative “in-range” price movements and decisive trend changes. By combining three powerful elements

- a Kalman filter to smooth price noise,

- a SuperTrend algorithm to gauge directional bias on the filtered line, and

- a volatility-based range filter to spot mild breakouts—

this indicator offers clear visual cues for entries and exits on any market or timeframe.

Why combine these components?

- Noise reduction: The Kalman filter adaptively smooths price data, preserving real movements while suppressing random fluctuations.

- Trend bias: SuperTrend applied to the smoothed line defines when the market is trending up or down.

- Range filtering: Dynamic bands based on recent volatility highlight genuine momentum moves without overreacting to micro-noise.

Together, they produce two distinct signal types:

- “In-range” breakouts (dots when price crosses a volatility band but trend has not yet shifted), and

- Trend-change alerts (colored fills when the filtered line flips relative to the SuperTrend).

2. Input Parameters

| Parameter | Default | Description | Recommended Range |

|---|---|---|---|

| kalmanAlpha | 0.01 | Measurement noise coefficient; smaller values yield smoother filtering but slower response. | 0.005 – 0.05 |

| kalmanBeta | 0.10 | Process noise coefficient; controls adaptability of the error covariance update. | 0.05 – 0.2 |

| kalmanPeriod | 77 | Period factor in the Kalman update; higher values emphasize longer-term smoothing. | 50 – 150 |

| dev | 1.20 | Multiplier for the range bands; determines band width relative to recent volatility. | 1.0 – 2.0 |

| supertrendFactor | 0.70 | ATR multiplier for SuperTrend; larger values produce wider SuperTrend bands (less frequent flips). | 0.5 – 3.0 |

| supertrendAtrPeriod | 7 | ATR look-back for SuperTrend; controls sensitivity to true range fluctuations. | 5 – 14 |

Tip: Start with the default values, then tweak one group at a time (Kalman vs. SuperTrend vs. range factor) to match your preferred balance of responsiveness vs. noise suppression.

3. Internal Logic

3.1 Kalman Filter Smoothing

The Kalman filter produces a smoothed price line K by iteratively updating:

- Estimate update:

–v3 = kalmanAlpha * kalmanPeriod

–gain = v2 / (v2 + v3)

–v1 = v1_prev + gain * (close – v1_prev) - Error covariance update:

–v2 = (1 – gain) * v2 + kalmanBeta / kalmanPeriod

Here, v1 is the estimated true price, and v2 is its error variance. Smaller kalmanAlpha/larger kalmanPeriod yield heavier smoothing; a higher kalmanBeta adapts variance faster when volatility changes.

3.2 SuperTrend on the Filtered Line

Using the smoothed series K as the “price,” a standard SuperTrend computation defines two bands:

- UpperBand = K + supertrendFactor × ATR(supertrendAtrPeriod)

- LowerBand = K – supertrendFactor × ATR(supertrendAtrPeriod)

Logic ensures each band only moves in a favorable direction (Upper never decreases unless broken, Lower never increases unless broken). The SuperTrend line itself alternates between the latest Upper and Lower band depending on whether K is above or below the prior band—yielding a clean up/down bias on the Kalman-filtered price.

3.3 Volatility-Based Range Filter

A Weighted Average of the daily range (high – low) over 200 bars defines vola—a smoothed measure of recent volatility. Two dynamic range bands are then set:

- UpperRange = K + dev × vola

- LowerRange = K – dev × vola

These bands capture typical short-term swings around the Kalman line.

3.4 Signal Generation

The indicator produces two types of visual signals:

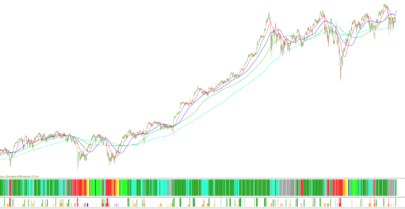

- In-Range Breakouts:

- When the current close crosses above UpperRange or below LowerRange, and the SuperTrend line has not just flipped (

isupertrend = isupertrend[1]), a small dot is plotted at the breakout point. This flags a potential pullback or continuation within the prevailing trend.

- When the current close crosses above UpperRange or below LowerRange, and the SuperTrend line has not just flipped (

- Trend-Change Alerts:

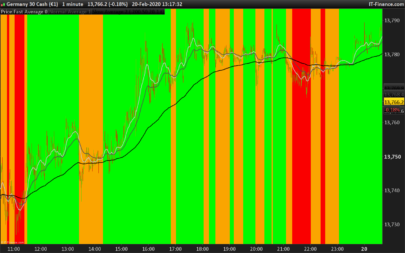

- When the SuperTrend line flips (i.e., its value differs from the prior bar) and K has crossed through the old band, the chart background (or the Kalman line) is filled in green for an up-flip or red for a down-flip. This highlights a more decisive shift in market direction.

4. Interpretation of Signals

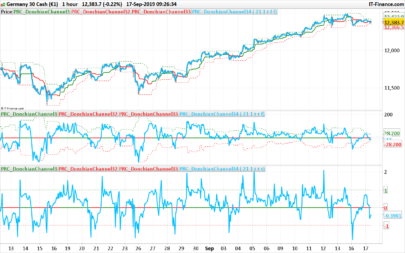

- In-Range Breakouts (Dots):

- Purpose: Catch smaller, intra-trend opportunities without waiting for a full trend flip.

- How to trade: Look for price retests of the breakout level or close-of-bar confirmation before entering in the direction of the predominant trend.

- Trend-Change Alerts (Fills):

- Purpose: Identify robust reversals when noise has been removed and volatility bands confirm momentum beyond typical ranges.

- How to trade: Consider these as primary entry/exit points—enter on the next bar after the fill appears, or wait for a retest of the SuperTrend line for a more conservative approach.

Example Scenario: On an hourly chart of EUR/USD, price may cross the upper range band (dot signal) three times, indicating small pullbacks within an uptrend. Eventually, the Kalman-filtered line pierces the SuperTrend band and the background turns green—a high-conviction signal to establish a new long position.

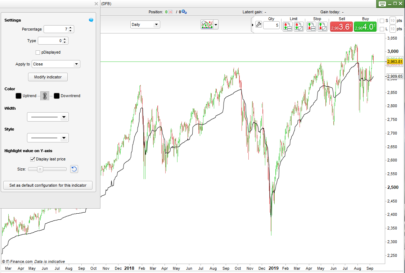

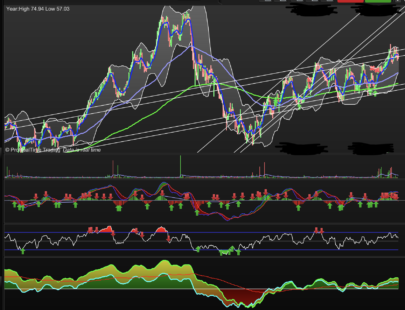

5. Configuration and Advanced Adjustments

- Adapting to Timeframes:

- Shorter timeframes (e.g., 5 min) often require a smaller

kalmanPeriod(e.g., 50) and slightly higherdev(e.g., 1.5) to avoid false dots. - Longer charts (daily/weekly) benefit from a larger

kalmanPeriod(100–150) and modestsupertrendFactor(1.5–2.0) for stable swings.

- Shorter timeframes (e.g., 5 min) often require a smaller

- Optimizing Kalman vs. SuperTrend:

- Increase

kalmanBetaif the filter is too sluggish to adapt after sudden volatility spikes. - Raise

supertrendAtrPeriodif you want the trend filter to ignore small whipsaws.

- Increase

- Volatility Regime Tuning:

- In trending, low-volatility markets, reduce

devtoward 1.0 to tighten bands and capture earlier in-range moves. - In choppy/high-volatility periods, raise

devtoward 2.0 to avoid over-signaling.

- In trending, low-volatility markets, reduce

- Combining with Other Tools:

- Use higher-timeframe Simple Moving Averages or RSI to confirm the direction flagged by this indicator.

- Overlay support/resistance zones to validate Swing entries on dot signals.

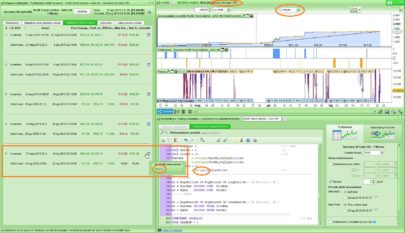

6. Full ProBuilder Code

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 |

//-----------------------------------------------------// //PRC_Range Filtered Trend Signals | indicator //16.06.2025 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //translated from tradingview code //-----------------------------------------------------// // --- Parámetros de Entrada --- //-----------------------------------------------------// // Grupo Filtro Kalman kalmanAlpha = 0.01 kalmanBeta = 0.1 kalmanPeriod = 77 dev = 1.2 // Grupo Supertrend supertrendFactor = 0.7 supertrendAtrPeriod = 7 //-----------------------------------------------------// // --- Lógica del Filtro Kalman --- //-----------------------------------------------------// ONCE v2 = 1.0 IF BarIndex <= 1 THEN v1 = close[1] else v3 = kalmanAlpha * kalmanPeriod v5 = v1 v4 = v2 / (v2 + v3) v1 = v5 + v4 * (close - v5) v2 = (1 - v4) * v2 + kalmanBeta / kalmanPeriod ENDIF k = v1 // Línea del Filtro Kalman //-----------------------------------------------------// // --- Lógica del Supertrend --- //-----------------------------------------------------// src=k atr=averagetruerange[supertrendAtrPeriod] upperband=src+supertrendFactor*atr lowerband=src-supertrendFactor*atr if barindex<=supertrendAtrPeriod then upperband=src lowerband=src direction=1 isupertrend=src else if lowerband>lowerband[1] or k[1]<lowerband[1] then lowerband=lowerband else lowerband=lowerband[1] endif if upperband<upperband[1] or k[1]>upperband[1] then upperband=upperband else upperband=upperband[1] endif if isupertrend[1]=upperband[1] then if k>upperband then direction=-1 else direction=1 endif else if k<lowerband then direction=1 else direction=-1 endif endif if direction=-1 then isupertrend=lowerband else isupertrend=upperband endif endif //-----------------------------------------------------// // --- Lógica Principal del Indicador --- //-----------------------------------------------------// vola = WeightedAverage[200](high - low) // Bandas del Filtro de Rango upper = k + vola * dev lower = k - vola * dev midbody = (close + open) / 2 //-----------------------------------------------------// // --- Visualización y Dibujo --- //-----------------------------------------------------// rk=124 gk=124 bk=124 ak=255 if close crosses over upper and isupertrend=isupertrend[1] then r=124 g=124 b=124 a1=255 a2=255 inrange=1 elsif close crosses under lower and isupertrend=isupertrend[1] then r=124 g=124 b=124 a1=255 a2=255 inrange=1 elsif isupertrend<>isupertrend[1] and k<isupertrend then r=255 g=0 b=0 a1=255 a2=0 inrange=0 elsif isupertrend<>isupertrend[1] and k>isupertrend then r=0 g=255 b=0 a1=0 a2=255 inrange=0 endif if inrange=1 then ak=0 endif //-----------------------------------------------------// colorbetween(k,midbody,r,g,b,ak*0.1) colorbetween(lower,upper,124,124,124,30*inrange) //-----------------------------------------------------// return k as "K" style(line,3)coloured(rk,gk,bk,ak), upper as "Upper" coloured(r,g,b,a1)style(point,2), lower as "Lower" coloured(r,g,b,a2)style(point,2) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

format de fichier incorrect ???

ohh! I exported from V13… If you are working with V12 you will not be able to load. Sorry

You can copy and paste the code

Hi Ivan, thanks a lot, very useful. I trieed to put a timeframe of 3 minutes on the first line and a timeframe default before the colorbwtween instractions, in order to use it in the windows of 1 minutes

Unfortunatelly it doesn’t work , please could you check what it is wrong?

//—————————————————–//

//PRC_Range Filtered Trend Signals | indicator

//16.06.2025

//Iván González @ http://www.prorealcode.com

//Sharing ProRealTime knowledge

//translated from tradingview code

//—————————————————–//

// — Parámetros de Entrada —

//—————————————————–//

// Grupo Filtro Kalman

TIMEFRAME(3 minutes, UPDATEONCLOSE )

kalmanAlpha = 0.01

kalmanBeta = 0.1

kalmanPeriod = 77

dev = 1.2

// Grupo Supertrend

supertrendFactor = 0.7

supertrendAtrPeriod = 7

//—————————————————–//

// — Lógica del Filtro Kalman —

//—————————————————–//

ONCE v2 = 1.0

IF BarIndex <= 1 THEN

v1 = close[1]

else

v3 = kalmanAlpha * kalmanPeriod

v5 = v1

v4 = v2 / (v2 + v3)

v1 = v5 + v4 * (close – v5)

v2 = (1 – v4) * v2 + kalmanBeta / kalmanPeriod

ENDIF

k = v1 // Línea del Filtro Kalman

//—————————————————–//

// — Lógica del Supertrend —

//—————————————————–//

src=k

atr=averagetruerange[supertrendAtrPeriod]

upperband=src+supertrendFactor*atr

lowerband=src-supertrendFactor*atr

if barindexlowerband[1] or k[1]<lowerband[1] then

lowerband=lowerband

else

lowerband=lowerband[1]

endif

if upperbandupperband[1] then

upperband=upperband

else

upperband=upperband[1]

endif

if isupertrend[1]=upperband[1] then

if k>upperband then

direction=-1

else

direction=1

endif

else

if k<lowerband then

direction=1

else

direction=-1

endif

endif

if direction=-1 then

isupertrend=lowerband

else

isupertrend=upperband

endif

endif

//—————————————————–//

// — Lógica Principal del Indicador —

//—————————————————–//

vola = WeightedAverage[200](high – low)

// Bandas del Filtro de Rango

upper = k + vola * dev

lower = k – vola * dev

midbody = (close + open) / 2

//—————————————————–//

// — Visualización y Dibujo —

//—————————————————–//

rk=124

gk=124

bk=124

ak=255

if close crosses over upper and isupertrend=isupertrend[1] then

r=124

g=124

b=124

a1=255

a2=255

inrange=1

elsif close crosses under lower and isupertrend=isupertrend[1] then

r=124

g=124

b=124

a1=255

a2=255

inrange=1

elsif isupertrendisupertrend[1] and k<isupertrend then

r=255

g=0

b=0

a1=255

a2=0

inrange=0

elsif isupertrendisupertrend[1] and k>isupertrend then

r=0

g=255

b=0

a1=0

a2=255

inrange=0

endif

if inrange=1 then

ak=0

endif

TIMEFRAME(default, UPDATEONCLOSE )

//—————————————————–//

colorbetween(k,midbody,r,g,b,ak*0.1)

colorbetween(lower,upper,124,124,124,30*inrange)

//—————————————————–//

return k as “K” style(line,3)coloured(rk,gk,bk,ak), upper as “Upper” coloured(r,g,b,a1)style(point,2), lower as “Lower” coloured(r,g,b,a2)style(point,2)

Change line 23 for this IF BarIndex <= 2 THEN

Thank you so much!!!!!! :):)

Hi Ivan, unfortunatelly I still hace some problem using timeframe 3 minutes in 1 minutes, the indicator it seems is not working fine. Using the original in 3 minutes the result is different. I opened a post in https://www.prorealcode.com/topic/use-of-indicator-with-timeframe-3-minutes-in-wiindow-with-1-minute/ in order to be able to attach the screenshot of the display. Please could you take a look? Thank you in advance!! Ciao Franco

No se puede importar a la PRTV12 porque formato es incorrecto, intente copiar codigo que has puesto en chat directamente, da error en terminacion, un poco lio Ivan, arreglalo si no es mucho pedir. La version actual es V12, no se como tienes ya V13

Hola. No puedo arreglarlo.

Puedes copiar/pegar (2 segundos) y tienes el indicador…

La V13 está disponible (versión beta) desde hace varias semanas. Lo están liberando a todos los usuarios poco a poco.

Grazie IVAN per questo lindicatore che mi sembra molto interessante, putroppo, non essendo un esperto, ho difficoltà ad individuare i punti in cui la tendenza diventa rialzista/ribassista. Ho provato con “isupertrendisupertrend[1] and k>isupertrend” ma non va bene; qualcuno può aiutarmi.

Grazie

Buongiorno, la risposta la trovi alle righe 115 e 122, che sono quelle che provocano il cambio di colore in rosso e verde.