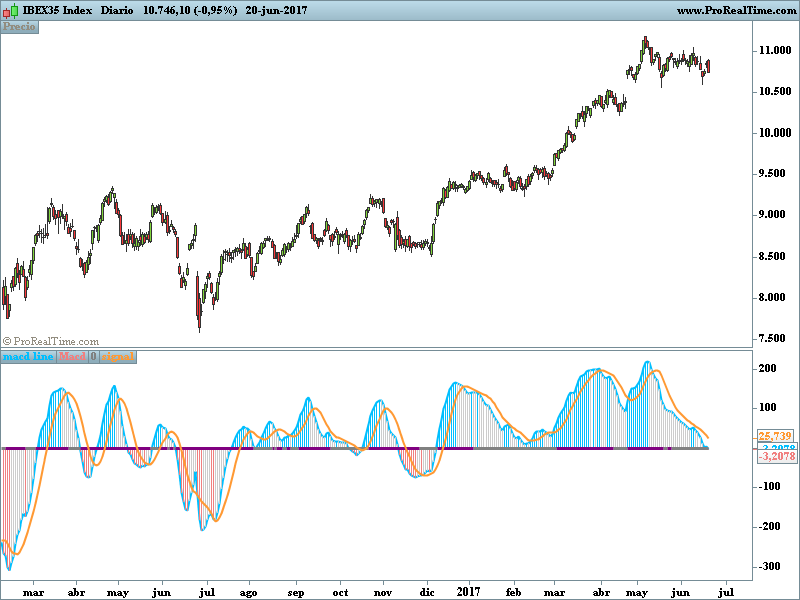

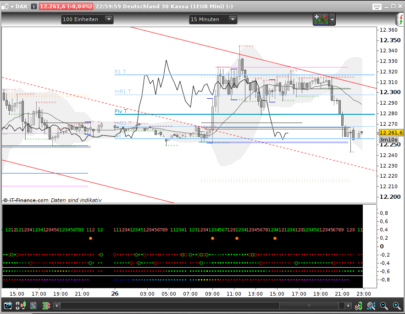

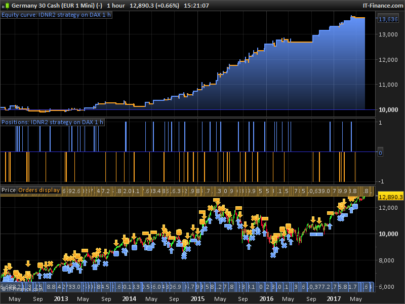

Prorealtime adaptation of the indicator code 4CMACDSqueeze appeared on the Tradinview platform.

The 4CMACDSqueeze is a macd which has been added a squeeze derived from John Carter’s TTM Squeeze, an indicator of volatility appeared in his book “Mastering the Trade”.

The central zero line of the indicator created with a Bollinger Bands and a Keltner channel alerts us to the color change of market volatility.

In gray: low volatility

In purple: increased volatility

Adaptación para Prorealtime del código del indicador 4CMACDSqueeze aparecido en la plataforma Tradinview.

El 4CMACDSqueeze es un macd al que se le ha añadido un squeeze derivado del TTM Squeeze de John Carter , un indicador de volatilidad aparecido en su libro “Mastering the Trade”.

La linea central cero del indicador creada con unas Bandas Bollinguer y un canal Keltner nos avisa al cambio de color de la volatilidad del mercado.

En gris : baja volatilidad

en púrpura : aumento de volatilidad.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 |

REM 4CMACDSqueeze //@version=3 //study("4CMACDSqueeze" // por edin228 para la plataforma Tradingview //adaptación para Prorealtime //===============macd================// source = close fastLength = 12 slowLength=26 signalLength=9 fastMA =ExponentialAverage[fastLength](source) slowMA =ExponentialAverage[slowLength](source) macdd = fastMA - slowMA signal =Average [signalLength](macdd) outMacD = macdd outSignal = signal //=========================4CHistogram===================// //currMacd = MACD[fastLength,slowLength,9](close[0]) //prevMacd = MACD[fastLength,slowLength,9](close[1]) if outMACD <0 then if outMACD <outMACD[1] then r = 240 g = 128 b = 128 else r=204 g=204 b=204 endif elsif outMACD >0 then if outMACD >outMACD[1] then r=0 g=191 b=255 else r=204 g=204 b=204 endif endif //========================Squeeze==================// length = 20 //title="Bollinger Band Length" lengthKC=20 //title="Keltner Channel Length" multKC =1.5 //title="KC Deviations" //useTrueRange =true title="Use TrueRange (KC)", type=bool) // Calculate BB basis =Average [length](source) dev = multKC *STD[length](source) upperBB = basis + dev lowerBB = basis - dev // Calculate KC ma = Average [lengthKC](source) rango=useTrueRange if rango = useTrueRange then useTrueRange=TR(close) else useTrueRange=(high - low) endif rangema =Average[lengthKC](rango) upperKC = ma + rangema * multKC lowerKC = ma - rangema * multKC sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC) sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC) noSqz = sqzOn and sqzOff val =LinearRegression(source) - (highest[lengthKC]( high)and lowest[lengthKC] (low))and Average [lengthKC](close) and lengthKC and 0 if noSqz then sr=128 sg=128 sb=128 elsif sqzOn then sr=128 sg=128 sb=128 else sr=128 sg=0 sb=128 endif return outmacd coloured (0,191,255)style(line,2)as "macd line",outmacd coloured(r,g,b)style (histogram,1)as "Macd", val coloured (sr,sg,sb)style(line,3) as "0",outsignal coloured(255,153,51)style (line,2)as "signal" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

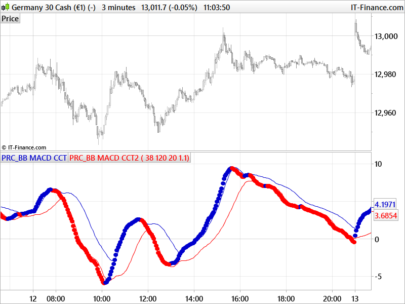

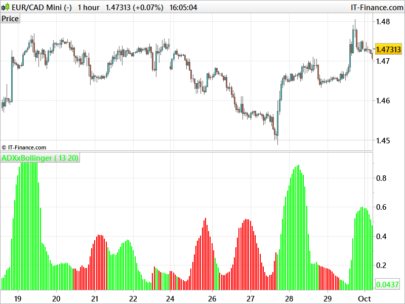

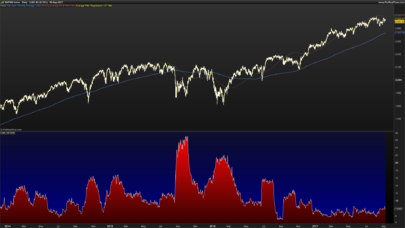

Thanks for this indicator. Working on a 3 M timeframe with the DJI, it can produce some interesting results and if I have the patience and sufficient liquidity, it can produce some useful returns even on a 1 hour timeframe; however as a ‘belt and braces’ safeguard, I also use a crossover with 3 and 12 EMA in the price line because that crossover usually indicates change of direction that is subsequently confirmed by the 4CMACDsqueeze indicator.

One little request, to improve clarity, can I change the colour and thickness of the MACD and Signal line; the current blue and gold colours as in use at present are a little faint against some backgrounds.

Hi there,

I downloaded the Indicator but the indicator does not show up on my charts.

Am I doing something incorrectly.

Regards

JAe

Hi,

Worked it out.

Thanks