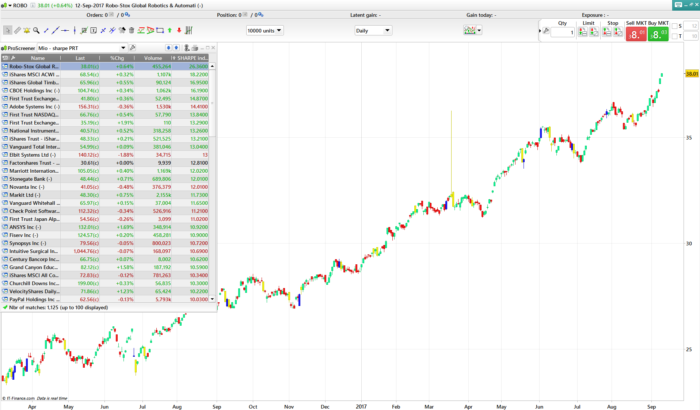

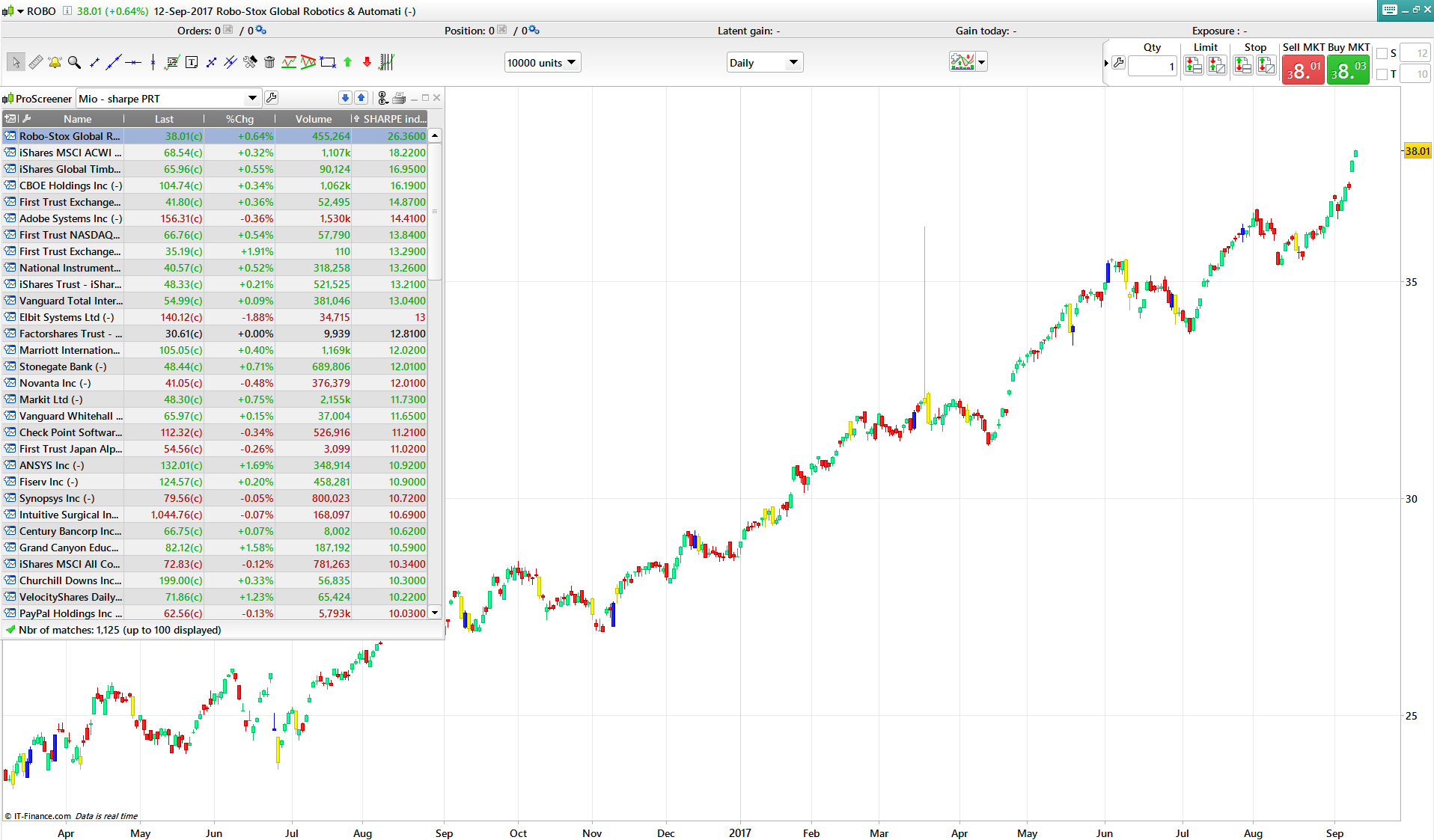

This screener uses a modified Sharpe index to identify stocks with a strong momentum. The rules are as follows:

1. screen the markets and select the strongest 20-30 stocks (the first stocks on the screener are the strongest)

2. buy those stocks position-sizing them based on the Yhang-Zhan variation of Garman-Klass volatility (indicator I posted previously) :

3. after 3 months run the same procedure and get rid of the stocks that are out of the first tier of the list and get the new entries

OR

3. hold the stocks for 1 year and then sell.

I’ve been using this portfolio for 6 years now and the average gain of the folio was excellent for me. You can improve the profit by buying at the SMA60 point.

Blue skies!!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 |

//computation of return and volatility on annual bases periodo=254 RitMensNoRiskTitle=0 a=log(close/close[1]) b=summation[periodo](a) s=sqrt(254)*std[periodo](a) //computation of modified Sharpe index sharpe=(b-RitMensNoRiskTitle/100)/(s*s) //launch of screener c1 = (sharpe > 0) SCREENER[c1] (sharpe AS "SHARPE index") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

What a nice addition to our library gabri! Thanks a lot, should help a lot of people.

Thanks!!

@Gabri, what average yearly return % have you been able to manage using this approach?

juanj,

I used this system for the last 13 years approximately and I got a Compound annual growth rate (CAGR) of approximately 23%. Using also some fundamentals you can get more though.

@Gabri with an ROI track record like that you should be a fund manager 🙂

juanj,

I just read back my post….I made cagr of approx 13% in the last 13 years… sorry 🙂 now I understand why you mentioned the fund manager 🙂 sorry.

I would need way more than that for being a found manager 🙂

Hello, who can help me why the screener does not work

// Der folgende Code bezieht sich auf den Zeitraum:daily

TIMEFRAME(daily)

indicator1 = SuperTrend[2.5,10]

c1 = (close > indicator1)

// Der folgende Code bezieht sich auf den Zeitraum:1 hour

TIMEFRAME(1 hour)

indicator2 = SuperTrend[2.5,10]

c2 = (close > indicator2)

// Der folgende Code bezieht sich auf den Zeitraum:15 minutes

TIMEFRAME(15 minutes)

indicator3 = SuperTrend[2.5,10]

c3 = (close > indicator3)

SCREENER[c1 AND c2 AND c3]

It works when I launch it. Try to change the last row as follow:

SCREENER[c1 AND c2 AND c3] ( c3 as “ref”)

Complimenti Gabri era da un po’ che volevo provare a far un screener ed una metodologia come descrivi tu per periodi più lunghi ed holdare i titoli.. pensavo più su un paniere di etfs.

Thanks Garbri, I was thinking about this kind selection methodology for some time. Ale

Grazie,

con ETF to consiglio anche uno screener basato su questa strategia https://www.prorealcode.com/prorealtime-trading-strategies/price-index-6-months/ . Il price index a 6 mesi e

molto efficace, secondo me, con ETF.

Grazie della dritta.. testerò il tutto.

is this ” a= log(close/close[1])” better than a = ((close/close[1]) -1) *100 . I want to capture the daily returns in % ?¿?¿?¿?¿?

Hi gabri, thanks very much for your work, it helps me a lot. Have you ever tried to make the same thing with the sortino ratio ?

thanks for your screener. Do you have the code for original Sharp ratio in order to compare ? Do you have the same thing for Sortino ratio ?