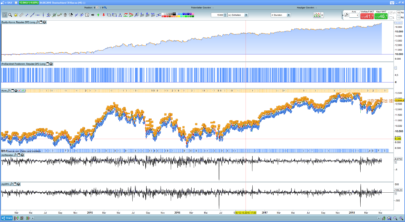

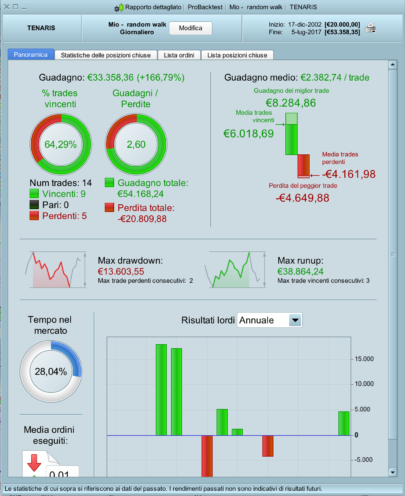

This simple strategy is a LONG only. It enters the market when the modified SHARPE index crosses definitely above 1 (I used 1 to cut false signals but 0 could work just fine) and exits in one of the following cases:

1. price crosses below SMA256

2. when, at a trimester check, SHARPE index is not anymore above 1

3. after one year of investment

It works best with 20-30 stocks portfolios, so this strategy should be launched on a selection of stocks.

Blue skies!!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 |

// Definizione dei parametri del codice DEFPARAM CumulateOrders = False // Posizioni cumulate disattivate //n=1 //p=254 // Condizioni per entrare su posizioni long idx, ignored = CALL "Mio - indice di Sharpe PRT"[254] sma254=average[254](close) lim=n*5*1.1 c1=summation[5](idx)>lim c11=close>sma254 IF c1 and c11 THEN BUY 10000 CASH AT market ENDIF c3=longonmarket and (barindex-tradeindex)>p c4=close crosses under sma254 c5=longonmarket and (barindex-tradeindex)>66 and (barindex-tradeindex)<71 c6=longonmarket and (barindex-tradeindex)>130 and (barindex-tradeindex)<135 c7=longonmarket and (barindex-tradeindex)>196 and (barindex-tradeindex)<201 IF c3 then SELL AT market ENDIF if c4 then sell at market //sell at low*0.99 stop endif if (c5 or c6 or c7) and (summation[5](idx)<lim) then sell at market endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Gabri, thanks a lot for this code and for all the others you already shared with us 🙂

I think there would be an error in line 31? about the indicator and its limit, if you want to test if the indicator is under the limit for the last 5 periods, the code should be: summation[5](idx < lim)=5

But I may be wrong?

Nicolas,

line 31 is making sure that, on the trimester check, if the summation is below the limit the stock is sold. The way is written works for me. Thanks for keeping en eye on my work!!

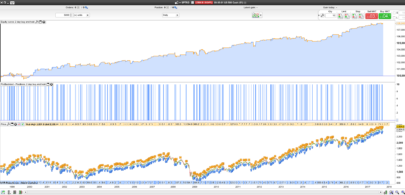

Hi Gabri, below code buy sell optimized with money management on DAX 4H. Thank’s.

//————————————————————————-

// Code principal : mio – sharpe DAX 4h

//————————————————————————-

// Definizione dei parametri del codice

DEFPARAM CumulateOrders = False // Posizioni cumulate disattivate

// Money Management

Equity = 500+(StrategyProfit*3)

Risk = 0.1

n = Max(1,Equity*Risk/51/PipValue)

// ————

Losses = positionperf(38)>0

Wins = positionperf(38)limh

c11=close>sma1

c2=summation[4](idx)<limb

c21=closep

c4=close crosses under sma1

c5=longonmarket and (barindex-tradeindex)>8 and (barindex-tradeindex)<52

IF c3 or c4 or (c5 and (summation[5](idx)p

c7=close crosses over sma2

c8=shortonmarket and (barindex-tradeindex)>8 and (barindex-tradeindex)limb)) then

EXITSHORT AT market

ENDIF

// Stops et objectifs

SET STOP %LOSS sl

SET TARGET %PROFIT tp

Thanks a lot!!

ciao gabri, puoi spiegarmi in italiano di cosa si tratta???

Dani,

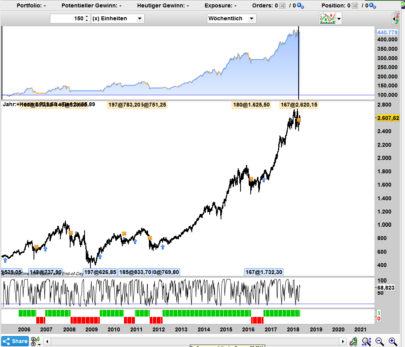

questo e’ un sistema di investimento (non trading) o buy and hold come qualcuno lo chiama. Entri lungo quando l’indice di Sharpe supera il valore di 1 (ma va bene anche 0 – trovo che uno lavori meglio come filtro) e tieni il titolo per un anno. Ho aggiunto anche altre due possibili uscite. La prima e’ quando il valore del titolo scende sotto la SMA254 (media mobile semplice a 254 periodi) e la seconda e’ quando il titolo dopo tre mesi non e’ piu’ sopra il valore 1 dell’indice di Sharpe. In realta’ questa sarebbe una strategia da seguire usando solo l’analisi finanziaria ma ho cercato di adattare (per quel poco che e’ possibile) il sistema anche per coloro che preferiscono l’analisi tecnica.

Gabriele

pensavo fosse un trading system

non hai niente del genere??

La differenza tra trading e investing rimane nel tempo di hold. Meno di tre mesi (per qualcuno 6 mesi) e diventa trade, piu’ di tre mesi (per qualcuno 6) e’ investing. Un indicatore fornisce solo segnali e niente piu’.

Hi Gertrde,

your code gives error at line 24

Wins = positionperf(38)limh

is it correct?

ciao Gabri, potresti il modo più efficace per selezionare il paniere di 20-30 titoli su cui applicare la strategia? grazie

Simoneb, puoi creare uno screener che cerchi i titoli con un modified sharpe index inferiore a zero (o a uno) e poi manualmente scegli quelli che hanno un trend a salire.

Dimenticavo, i titoli che performano meglio sono quelli che crossano la linea dello zero (o dell’uno se vuoi essere sicuro) ma che arrivano da un price to book (P/B) basso. Io seleziono quasi tutti i miei titoli usando il P/B e il P/E e poi, tra quelli che ho filtrato in questo modo, applico le mie strategie.