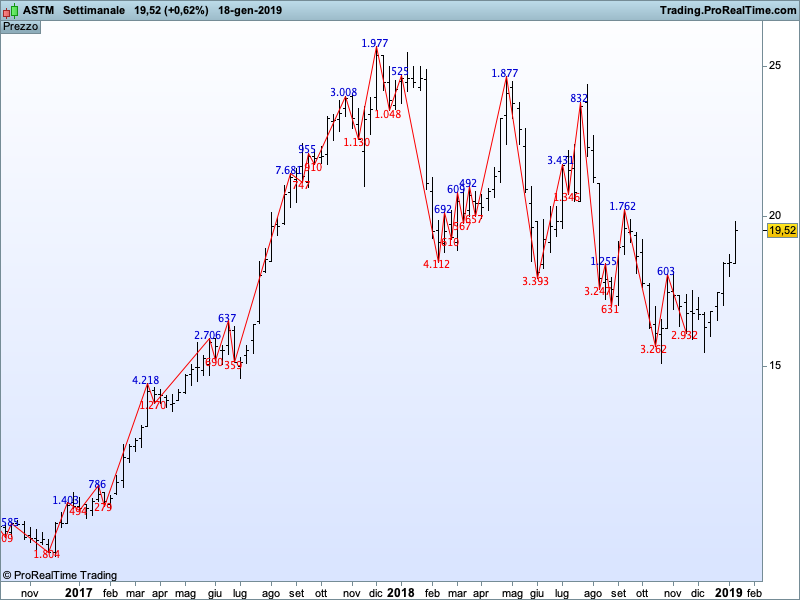

This code draws the Weis wave (or Wyckoff wave) on the price line and print the volume traded on the up or down leg. It comes from the book “trades about to happen”. For whoever likes to use Wyckoff it will be useful.

The code allows you to chose ATR (with Wilder’s average/SMA/EMA/WMA..) or a traditional box. When the box cell is zero the code uses automatically the ATR.

Blue skies!!!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 |

//parameters : //MM=0 //periodo=14 //box=0 (in case the boxsize has to be based on ATR) or any other value for traditional computation //coeff=1 if box=0 then boxsize = coeff*average[periodo,MM](tr) else boxsize=box endif once topprice = close once bottomprice = close - boxsize once barold=0 once posold=close if barindex>2*periodo then if (close > topprice) THEN valup=round((close-topprice)/boxsize)+1 topprice=topprice + valup*boxsize bottomprice = topprice - boxsize up=1 down=0 ELSIF (close < bottomprice ) THEN valdown=round((bottomprice-close)/boxsize)+1 bottomprice = bottomprice - valdown*boxsize topprice = bottomprice + boxsize up=0 down=1 ELSE topprice = topprice bottomprice = bottomprice ENDIF //calcolo linee zig zag //trend up if up=1 then if up[1]=0 then drawsegment(barold,posold,barnew,posnew) coloured (250,0,0) drawtext("#downvol#",barnew,posnew*0.995) coloured (250,0,0) barold=barnew posold=posnew upvol=0 downvol=0 endif if close>posnew then posnew=high barnew=barindex endif upvol=upvol+round(volume/1000) endif //trend down if down=1 then if down[1]=0 then drawsegment(barold,posold,barnew,posnew) coloured (250,0,0) drawtext("#upvol#",barnew,posnew*1.005) coloured (0,0,210) barold=barnew posold=posnew upvol=0 downvol=0 endif if close<posnew then posnew=low barnew=barindex endif downvol=downvol+round(volume/1000) endif endif RETURN |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Would love a link or description to better understand the Weis/Wyckoff wave above

https://www.youtube.com/watch?v=1lzgjJL1Ar4&t=2s

I would be, at least for me, a good idea if you can draw the accumulative wave of volumes with the same parameters. Thanks in advance.

Tamir, I am not sure I understand what you mean

Hi gabri,

sorry for my late response.

Weis Wave comes also wit accumulative volume on a separate indicator window using vertical bar, showing the accumulated volume on each wave, day by day.

If you still don’t understand me, look at this link – https://files.constantcontact.com/d491ca79201/26b1b1b7-8d3c-44bb-b04a-4c03f48f30a1.pdf.

Thanks in advance.

Tamir, it’s the same. You can use either a different indicator for the volume of the volume reported on the peaks and throughs.

Hi gabri,

I know this, yet I am not familiar with coding of indicators. So my question was in fact, is it possible to have a separate indicator for the accumulated volume.

thanks

Great work gabri. I have this coded on Amibroker and I have done lots of backtesting but never found anything profitable. I emailed Weis and it seems like he never backtested his ideas. Have you found differently? Thanks a lot.

Hi Real Pro, this indicator assists novices of the Wyckoff system. Wyckoff himself thought this technique and he was using it with ticker tape. Weiss adapted this system to various timeframe charts. The system helps only the trader in his decision making since the Wyckoff system is a pure discretionary system. if you are planning to use this indicator for AT I think you might be disappointed.

hi Gabri,

I just came across the wyckoff method and was looking for the weiss wave indicator for PRT and found your post. knowing nothing elses about how this indicator is calculated….how should I define the following parameters in your code?

//parameters :

//MM=0

//periodo=14

//box=0 (in case the boxsize has to be based on ATR) or any other value for traditional computation

//coeff=1

any guidance is appreciated!

thanks in advance,

Tatie