Introduction

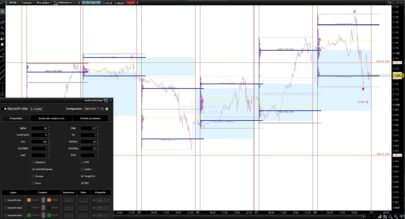

In modern technical analysis, understanding where traders are most active is crucial for identifying key support and resistance zones. The “Rolling POC Volume Profile” indicator is an advanced tool designed to visualize volume and the Point of Control (POC) within a specified range, thereby helping traders identify price levels where significant trading activity has occurred.

Description of the Indicator

The “Rolling POC Volume Profile” uses several components for its configuration:

Lookback Period (plook): Defines the number of bars back that the indicator considers to calculate volume.

Resolution (res): Determines the number of divisions within the analyzed price range.

Scale (scale): Adjusts the visual size of the volume bars on the chart.

Trend Length (hlen): Sets moving average POC length.

POC Smoothing (smoothPOC): Decides whether the POC is smoothed to facilitate visualization.

Show Channel (showchannel): Enables the display of the maximum and minimum prices within the lookback period.

Show Trend (showtrend): Activates the graphical representation of the trend based on the POC movement.

Functioning of the Indicator

POC Concept

The Point of Control (POC) is the price level within a specified range that has had the highest trading volume. This concept is fundamental because it indicates a price level to which traders have assigned the greatest importance, based on the amount of trading that has occurred.

POC Calculation

The indicator calculates the POC by analyzing the trading volume that occurs in different “bins” or price segments, within the range defined by the highest and lowest of the last plook bars. Each bin accumulates the volume of the price bars that fall within its range.

Next, the bin with the highest accumulated volume is identified, which is designated as the POC. This is visualized on the chart as a bar or line in a highlighted color, in this code yellow, to indicate that this price level has been the most traded.

Practical Applications

The indicator can be used to identify zones of high trading activity, which often correspond to key support or resistance levels. Traders can use this information to plan trade entries or exits, expecting prices to react at these levels.

Configuration and Customization

Traders can customize the indicator by adjusting the parameters of plook, res, and scale to adapt the analysis to different trading styles or time frames. This allows great flexibility in adapting the indicator to various market conditions.

Conclusions

The “Rolling POC Volume Profile” is a robust tool for traders looking to better understand market dynamics through trading volume. By providing a clear visualization of the most traded price levels, this indicator is invaluable for making informed trading decisions.

Indicator Code

The code for the indicator in ProBuilder of ProRealTime is provided below.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 |

//------------------------------------------------------// //PRC_Rolling POC Volume profile //version = 0 //26.04.24 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //------------------------------------------------------// defparam drawonlastbaronly = true //-----Inputs-------------------------------------------// plook=40 res=15 scale=30 hlen=25 smoothPOC=1 showchannel=1 showtrend=0 //------------------------------------------------------// //-----Create arrays for High, Low and volume-----------// maxx = highest[plook](high) minn = lowest[plook](low) step = (maxx-minn)/res //height of the rectangle volsum=summation[plook](volume) startbar = barindex+7 //------------------------------------------------------// //-----Calculation POC----------------------------------// for i=0 to res-1 do binsize=0 volsize=0 mybot=minn+(i*step) mytop=minn+((i+1)*step) $bottomboundaries[i]=mybot $topboundaries[i]=mytop for j=0 to plook-1 do if close[j]>=mybot and close[j]<=mytop then volsize=volsize+volume[j] endif next $VolLen[i]=volsize volbar = (volsize*res/volsum)*scale drawrectangle(startbar,mytop,startbar+volbar,mybot)fillcolor("black",70) next for k=0 to res-1 do if $VolLen[k]=ArrayMax($VolLen) then x = k break endif next poc = ($topboundaries[x]+$bottomboundaries[x])/2 //------------------------------------------------------// //-----POC Bar and line---------------------------------// drawrectangle(startbar,$topboundaries[x],startbar+($VolLen[x]*res/volsum)*scale,$bottomboundaries[x])fillcolor("yellow",90) drawsegment(barindex,poc,startbar,poc)coloured("purple")style(dottedline) mypoc = round(poc,2) drawtext("POC = #mypoc#",round((startbar+startbar+($VolLen[x]*res/volsum)*scale)/2),poc+0.35*tr)coloured("red") //-----POC Smoothed if smoothPOC then smPOC = average[max(1,round(sqrt(plook)))](poc) else smPOC = poc endif if close > smpoc then r=0 g=255 b=80 else r=255 g=0 b=0 endif colorbetween(close,smPOC,r,g,b,50) //------------------------------------------------------// //-----Trend--------------------------------------------// if showtrend then hpoc = weightedaverage[hlen](poc) if hpoc >= hpoc[1] then rhpoc=0 ghpoc=255 else rhpoc=255 ghpoc=0 endif else hpoc = undefined endif //------------------------------------------------------// //-----Max and Min Channel------------------------------// if showchannel then rh = highest[plook](high) rl = lowest[plook](low) else rh = undefined rl = undefined endif //------------------------------------------------------// return smPOC as "POC smoothed" coloured(r,g,b),rh as "Max High"coloured("blue"), rl as "Min Low"coloured("blue"),hpoc as "Trend" coloured(rhpoc,ghpoc,0)style(line,3) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Great Indicator Ivan!! Thanks a lot for all your very useful incator you are posting!!!!

😉

Magnífico !!!. Al menos para mí. Gran trabajo con tus aportes Iván. Mira a ver si le incluyes alguna de tus estrategias secretas….jajjaja…seguro que tienes alguna en el cajón de los buenos. Un saludo

jajaja gracias 🙂

Very good Iván !

However what would be the modification to add to the code in order to display the indicator for the previous day only with, let’s say, a time slot between 14:00 and 22:00 ?

grazie mille magnifico,si in effetti se ci fosse la possibilta di impostare orai predefiniti di vari giorni di trading darebbe ancora piu preciso..esempio: ci vorrebbe una funziona che uno possa dire “dammi il gli ultimi 8 gg di trading (no sabato oh domentica come fa di default pro real time ,e poi regolabile le ore da prendere in considerazione ,per trovare poi i profesionali grazieeeeeeeee

Very good! A nice job