Introduction

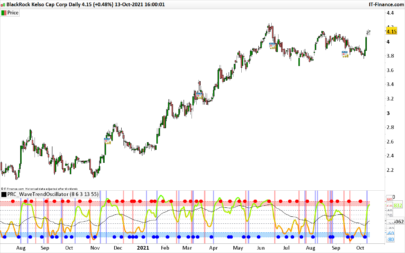

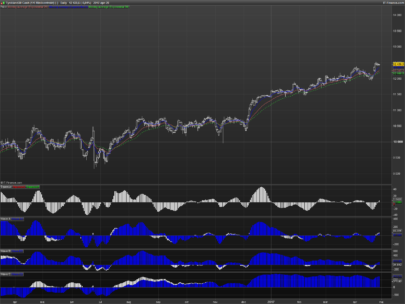

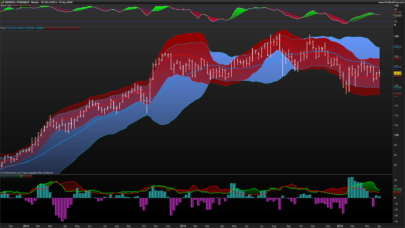

The “WaveTrend Ribbon” indicator allows the detection of critical overbought and oversold moments. This article delves into how this indicator works, how to set it up, and how to interpret its signals for more informed trading decisions.

Description of the Indicator

The “WaveTrend Ribbon” is a technical indicator that combines several analytical methods to provide a clear view of market trends and potential reversal points. Below, we break down its key components:

- Price Average (ap): Calculated as the average of the high, low, and closing prices.

- Esa and D: Esa (exponential average) smooths the price, and D (mean deviation) provides a measure of volatility.

- CI and TCI: CI (Inertia Channel) is a ratio between the current price and the Esa adjusted by D, while TCI (average of CI) smooths these values.

- Z-Score: Normalizes the TCI to determine how deviated the price is from the mean.

- High/Low Pivots: Uses the lbR and lbL parameters to detect local maximums and minimums, essential for identifying market turning points.

Visualization

- Colors and Markers: The indicator changes color based on the Z-Score condition and marks overbought and oversold conditions to alert traders about potential entry or exit points.

Setting Up the Indicator

Configuring the “WaveTrend Ribbon” involves adjusting several parameters:

- Channel and average lengths (n1, n2)

- Overbought and oversold levels (oblevel, oslevel)

- Lengths for the calculation of the Z-Score and its smoothing (lengthZ, hmaLength, wmaLength)

Interpretation of Results

- Buy and Sell Signals: Signals are generated when the Z-Score crosses the established levels of overbought and oversold.

- Divergences: Identifying regular and hidden divergences provides a powerful signal of potential trend reversals.

Conclusion

The “WaveTrend Ribbon” is a versatile indicator that, when used correctly, can be a valuable tool in any trader’s arsenal.

Indicator Code

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 |

//-------------------------------------------------------------------------------// //PRC_WaveTrend Ribbon //version = 0 //17.04.24 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //-------------------------------------------------------------------------------// //-----Inputs--------------------------------------------------------------------// //-----WaveTrend n1=10//Channel length n2=21//Average length oblevel=2//Overbought Z-score level oslevel=-2//Oversold Z-score level lengthZ=20//Length for Z-score Calculation hmaLength=12//HMA Length for Z-score Smoothing wmaLength=3//WMA Length for Z-Score //-----Divergences plotdivergences=1//show bullish and bearish divergences plothiddendiv=1//show hidden bullish and bearish divergences //-----Pivots lbR=1//lookback Right lbL=20//lookback Left //-------------------------------------------------------------------------------// //-----WaveTrend Calculation-----------------------------------------------------// ap=(high+low+close)/3 esa=average[n1,1](ap) d=average[n1,1](abs(ap-esa)) ci=(ap-esa)/(0.0015*d) tci=average[n2,1](ci) //-------------------------------------------------------------------------------// //-----Z-Score Calculation-------------------------------------------------------// meanWT=average[lengthZ](tci) stdDevWT=std[lengthZ](tci) zScoreaux=(tci-meanWT)/stdDevWT zScore=hullaverage[hmaLength](zScoreaux) zma=weightedaverage[wmaLength](zScore) //-------------------------------------------------------------------------------// //-----Colors--------------------------------------------------------------------// if zScore > 0 then r=0 g=255 b=187 else r=255 g=17 b=0 endif colorbetween(zScore,zma,r,g,b,70) //-------------------------------------------------------------------------------// //-----Overbought/Oversold conditions--------------------------------------------// obCondition = zScore > obLevel osCondition = zScore < osLevel if obCondition then backgroundcolor(255,17,0,30) elsif osCondition then backgroundcolor(0,255,187,30) endif if obCondition and zScore[1]>zScore then drawtext("▼",barindex,3)coloured("red") elsif osCondition and zScore[1]<zScore then drawtext("▲",barindex,-3)coloured("green") elsif zscore crosses over zma or zscore crosses under zma then drawpoint(barindex,zma,2)coloured(r,g,b) endif //-------------------------------------------------------------------------------// //-----Pivots High-Low Z-Score---------------------------------------------------// osc=zScore //-----pivots low if osc > osc[lbR] and lowest[lbR](osc) > osc[lbR] and osc[lbR] < lowest[lbL](osc)[lbR+1] then $pl[z+1] = osc[lbR] $plx[z+1] = barindex[lbR] $priceL[z+1] = low[lbR] //drawpoint(barindex[lbR],osc[lbR],2)coloured("blue",50) z = z + 1 endif //-----pivots high if osc < osc[lbR] and highest[lbR](osc)<osc[lbR] and osc[lbR]>highest[lbL](osc)[lbR+1] then $ph[t+1]=osc[lbR] $phx[t+1]=barindex[lbR] $priceH[t+1]=high[lbR] //drawpoint(barindex[lbR],osc[lbR],2)coloured("blue",50) t=t+1 endif //-------------------------------------------------------------------------------// //-----Regular Bullish oscHL = $pl[z] > $pl[max(0,z-1)] and $plx[max(0,z)] - $plx[max(0,z-1)]<=80 priceLL = low[lbR] < $priceL[max(0,z-1)] bullCond = priceLL and oscHL and isset($pl[z]) //-----Hidden Bullish oscLL = $pl[z] < $pl[max(0,z-1)] and $plx[max(0,z)] - $plx[max(0,z-1)]<=80 priceHL = low[lbR] > $priceL[max(0,z-1)] hiddenbullCond = priceHL and oscLL and isset($pl[z]) //-----Regular Bearish oscLH = $ph[t] < $ph[max(t-1,0)] and $phx[t] - $phx[max(0,t-1)]<=80 priceHH = high[lbR] > $priceH[max(0,t-1)] bearCond = priceHH and oscLH and isset($ph[t]) //-----HiddenBearish oscHH = $ph[t] > $ph[max(t-1,0)] and $phx[t] - $phx[max(0,t-1)]<=80 priceLH = high[lbR] < $priceH[max(0,t-1)] hiddendbearCond = priceLH and oscHH and isset($ph[t]) if z<>z[1] and bullCond and plotdivergences then drawsegment($plx[max(0,z-1)],$pl[max(0,z-1)],$plx[z],$pl[z])coloured("green")style(line,2) drawtext("Bull",$plx[z],$pl[z]-tr)coloured("green") elsif z<>z[1] and hiddenbullCond and plothiddendiv then drawsegment($plx[max(0,z-1)],$pl[max(0,z-1)],$plx[z],$pl[z])coloured("green",50) drawtext("H.Bull",$plx[z],$pl[z]-tr)coloured("green",80) elsif t<>t[1] and bearCond and plotdivergences then drawsegment($phx[max(0,t-1)],$ph[max(0,t-1)],$phx[t],$ph[t])coloured("red")style(line,2) drawtext("Bear",$phx[t],$ph[t]+tr)coloured("red") elsif t<>t[1] and hiddendbearCond and plothiddendiv then drawsegment($phx[max(0,t-1)],$ph[max(0,t-1)],$phx[t],$ph[t])coloured("red",50) drawtext("H.Bear",$phx[t],$ph[t]+tr)coloured("red",80) endif //-------------------------------------------------------------------------------// //-------------------------------------------------------------------------------// return zScore as "Z-Score"coloured(r,g,b)style(line,1),zma as "Avg Z-Score"coloured(r,g,b)style(line,1),0 as "0" coloured("gray"),obLevel as "Overbought"coloured(255,17,0)style(dottedline),osLevel as "Overshold"coloured(0,255,187)style(dottedline) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

It might be the most powerful tool you have shared. Congratulations.

🙂

Hello Ivan, thanks a lot for all these beautiful and useful indicator!! Great Job!!

Thanks 😉

BONJOUR

je lai mis sur du renko , il est complexe car toujours a l’envers???

Peut être ne s’utilise t il pas sur ce type de bougies en renko?

cdlt

Great tool again and great job, thank you!

So from what I see everytime Z-Score is over 0 means that you have a positive trend (no matter if Z-score is going down because the important thing is Zscore being over 0). But here there is the issue. How would you filter out those many irrelevant trends and try to find a good powerful trend? What indicators (because there are too many and they also give contradictory results one from another) do you recommend to filter out irrelevant trends?

Also what would be your advice regarding timeframes (in general)? Because I see trends on 5 minutes, 30 min, 1 hour, 3 hour, 1 day but most of the times you can get a 5 minutes trend but at the same time the indicators (any of them) tells you that this 5 minutes trend does not exist for 15 minutes indicators) and so on. For example if you have a setup in which your indicators give you a Buy signal on 1 day timeframes… then you go to that chart in lower timeframes (1 hour o 15 minutes) and the price is going down…, so there is no signal to buy. And at the end of the day you have many entry points in 1 day but they convert to 0 entry points in 1 hour, or many entry points in 1 hour that your indicators don´t give you Buy signal in 1 day. So, you are stuck with insecurity and indecision. I am talking for US stocks (NYSE and Nasdaq basically).

So since you are good at creating indicators, what would be your setup regarding timeframes? I don´t want small trends (5-15min) but several days trends (but in many times they don´t give entry points in lower timeframes and the price can go down again if you buy just using the 1 day timeframes). Thank you again.