The “Dynamic Trader OSCillator” was developed by Robert Miner (still him !), it was one of his favorite indicators.

It uses the “Stochastic RSI“, I did write the code on this website.

I’m not the author of this “DTOSC” code, I found it 2 years ago in order to use it.

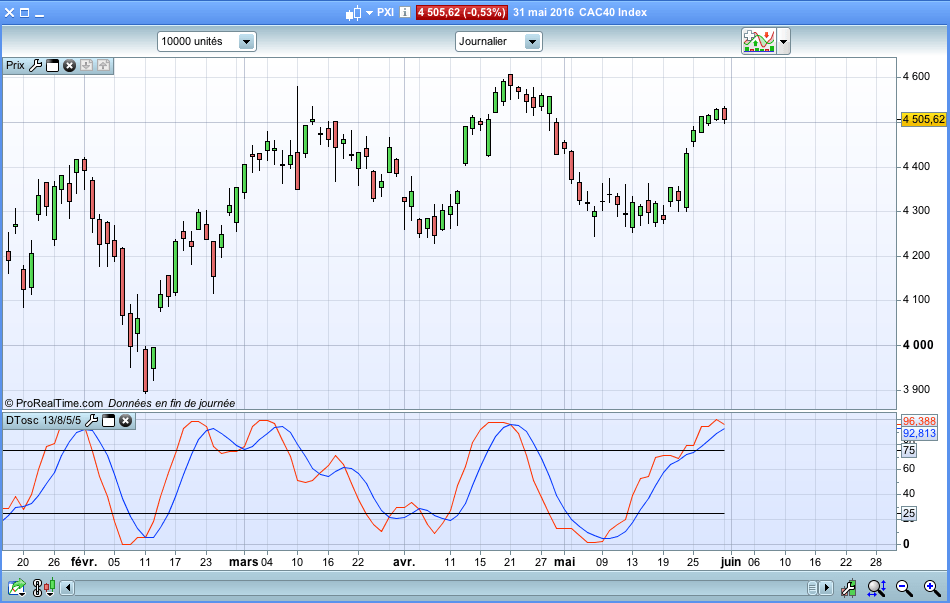

Here is an example of DTOSC with parameters 13/8/5/5.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 |

type = 2 if type = 1 then a = 8 b = 5 c = 3 d = 3 endif if type = 2 then a = 13 b = 8 c = 5 d = 5 endif if type = 3 then a = 21 b = 13 c = 8 d = 8 endif if type = 4 then a = 34 b = 21 c = 13 d = 13 endif storsi = 100 * ((rsi[a] - lowest[b](rsi[a])) / ((highest[b](rsi[a])) - lowest[b](rsi[a]))) dtosck = average[c](storsi) dtoscd = average[d](dtosck) Seuilhaut = 75 Seuilbas = 25 RETURN dtosck AS "DTOSCK" , dtoscd AS "DTOSCD" , Seuilhaut , Seuilbas |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

mettre type en variables ainsi vous pouvez choisir facilement les parametres qui vous conviennent.

Il faut bien entendu mettre deux // devant type = 2 dans code pour que les variables jouent leur ro^les.

Adepte de Pro-AT ? merci Bambi , dommage que ce site soit devenu une coquille vide !

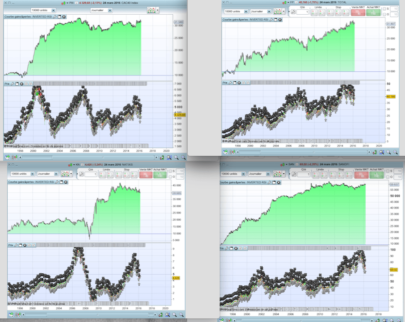

Pour ceux qui ne savent pas laquelle choisir, voici les 4 d\'un coup. On peut utiliser les croisements pour se déciderBonne journée// DTOSC DECOMPOSE PRC

a = 8

b = 5

c = 3

d = 3

storsi = 100 * ((rsi[a] - lowest[b](rsi[a])) / ((highest[b](rsi[a])) - lowest[b](rsi[a])))

dtosck = average[c](storsi)

dtoscd = average[d](dtosck)

/////////////////////////////////////////////////////////////////////////

a2 = 13

b2 = 8

c2 = 5

d2 = 5

storsi2 = 100 * ((rsi[a2] - lowest[b2](rsi[a2])) / ((highest[b2](rsi[a2])) - lowest[b2](rsi[a2])))

dtosck2 = average[c2](storsi2)

dtoscd2 = average[d2](dtosck2)

//////////////////////////////////////////////////////////////////////////

a3 = 21

b3 = 13

c3 = 8

d3 = 8

storsi3 = 100 * ((rsi[a3] - lowest[b3](rsi[a3])) / ((highest[b3](rsi[a3])) - lowest[b3](rsi[a3])))

dtosck3 = average[c3](storsi3)

dtoscd3 = average[d3](dtosck3)

//////////////////////////////////////////////////////////////////////

a4 = 34

b4 = 21

c4 = 13

d4 = 13

storsi4 = 100 * ((rsi[a4] - lowest[b4](rsi[a4])) / ((highest[b4](rsi[a4])) - lowest[b4](rsi[a4])))

dtosck4 = average[c4](storsi4)

dtoscd4 = average[d4](dtosck4)

////////////////////////////////////////////////////////////////////////

seuilbas = 10

seuilhaut = 90

RETURN dtosck AS \"DTOSCK\" , dtoscd AS \"DTOSCD\" , dtosck2 AS \"DTOSCK2\" , dtoscd2 AS \"DTOSCD2\" ,dtosck3 AS \"DTOSCK3\" , dtoscd3 AS \"DTOSCD3\", dtosck4 AS \"DTOSCK4\" , dtoscd4 AS \"DTOSCD4\", Seuilbas as \"Seuilbas\" , Seuilhaut as \" Seuilhaut \"

Hi, could you please suggest, what this codes gives, lowest[b](rsi[a]) — just trying to use this indicator in different scenario, generally lowest [b] (Close) is the syntax. How does this rsi [a] work.

lowest[b](rsi[a]) returns the lowest values of the RSI of “a” periods, over the last “b” periods.

Hi, what would be the code to get the price for last bullish DTOSC cross over. I am looking for something equivaluent to Close [1] which is last bar close. How to write a code to get the last indicator swing and the price of cross over?

thanks