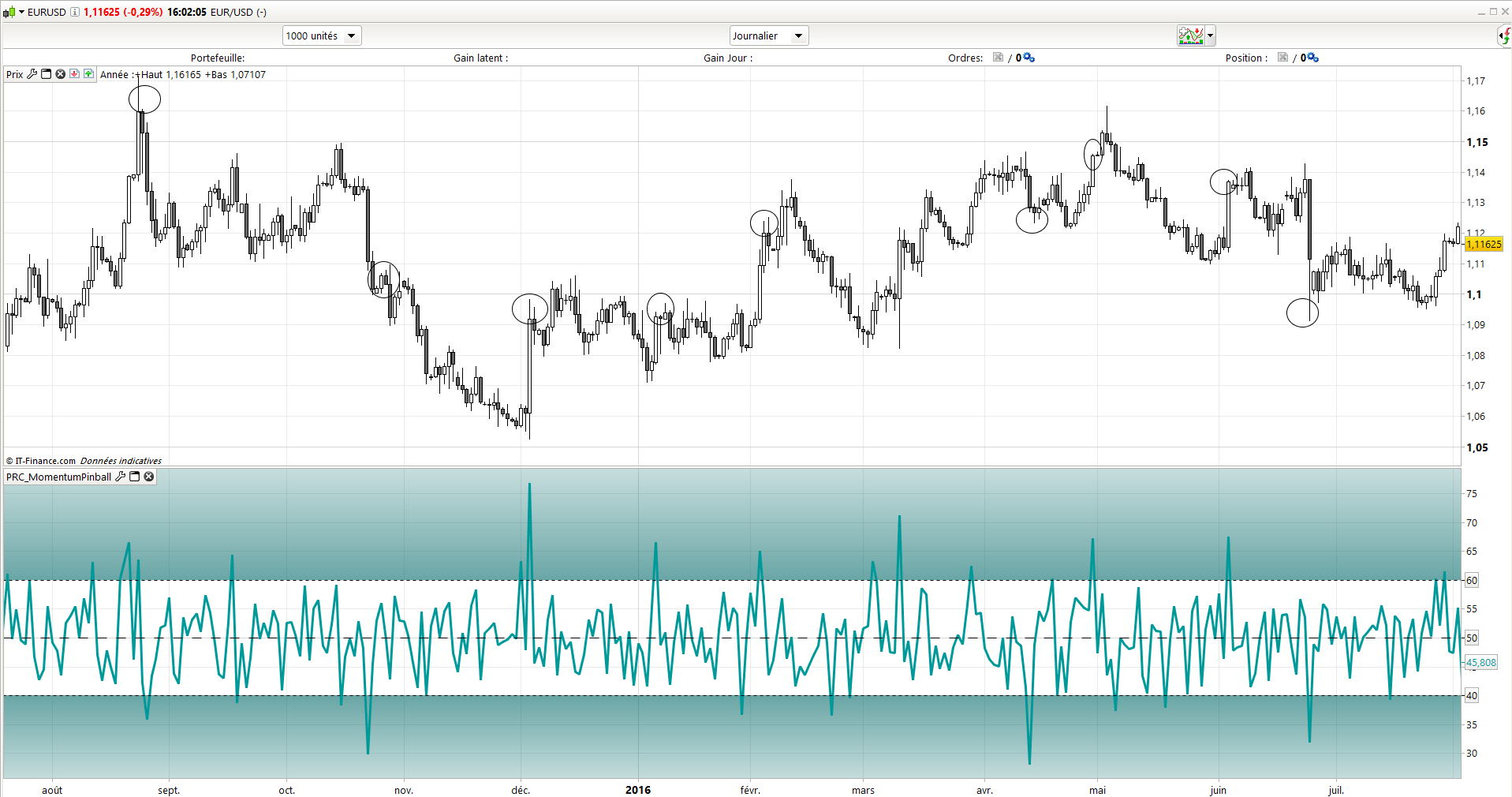

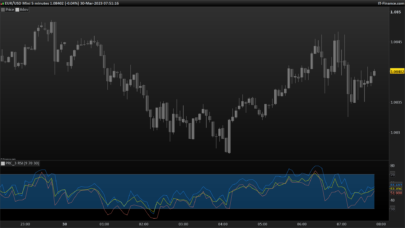

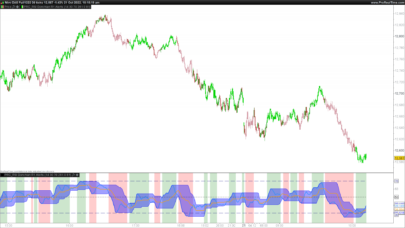

Based on a classical RSI formula, this indicator use the intraday price changed difference from the previous day, instead of the close.

It results a fast and accurate view of price acceleration (great momentum) of the current daily candlestick compared to analysed periods (14 periods in the code example).

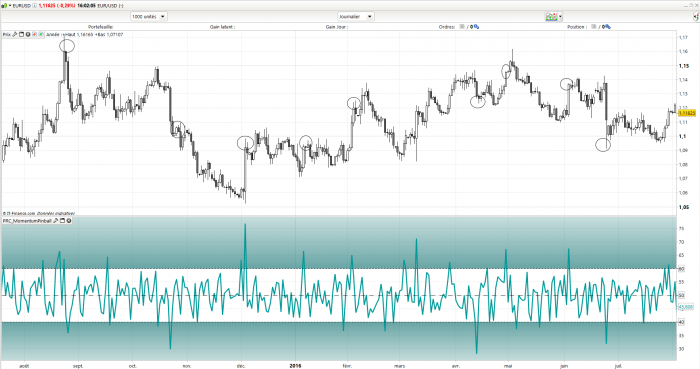

I marked examples of how to interpret the indicator on the above screenshot. When the oscillator value exceed the 60 level area, it should warn you of a large bullish pressure, and a bearish one when its below the 40 level.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 |

//PRC_MomentumPinball //02.09.2016 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge periods = 14 diff = Dclose(0)-Dclose(1) if diff-diff[1]>=0 then u = diff-diff[1] d = 0 else u = 0 d = diff[1]-diff endif mp = 100-(100/(1+(exponentialaverage[periods](u)/exponentialaverage[periods](d)))) RETURN mp as "Momentum Pinball", 60 as "60 level", 50 as "50 level", 40 as "40 level" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Your trading indicators are awesomes.

Thanks a lot Bon Zo. Spread the news everywhere you go 🙂

i don’t really want to tell others my secret but maybe i could share this page on my facebook account.

Hi Nicolas; what is Dclose?

It’s the Daily close. Dclose

ok, clear; I understand that Dclose(0) is not constant during the current day and is equal to the close of the last intraday bar, while Dclose(1) is obviously constant during the current day. Correct.

Is there some reason for this choice instead of using a more “normal” sliding close? I think there is.

@Renato

I have this code in my indicators list since a while and honestly I don’t remember from what I converted it from .. Daily OHLC used in intraday charts also make sense, even if this one is I think much clearer on a Daily one.

Agree; thanks.

Hi Nicolas, thanks a loto for sharing your knowliedge, Wasn’t the original momentum pinball with ROC rather than exponential average? Best regards

Thank you!

Buonasera sig. Nicolas……sarebbe possibile far in modo che quando l’indicatore raggiunga livelli si 40 oppure di 60 vengano indicati mediante simboli ( o frecce) direttamente sul grafico dei prezzi? Grazie.