Hello.

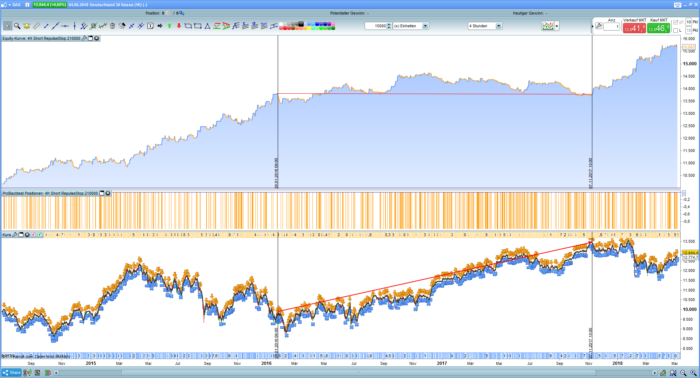

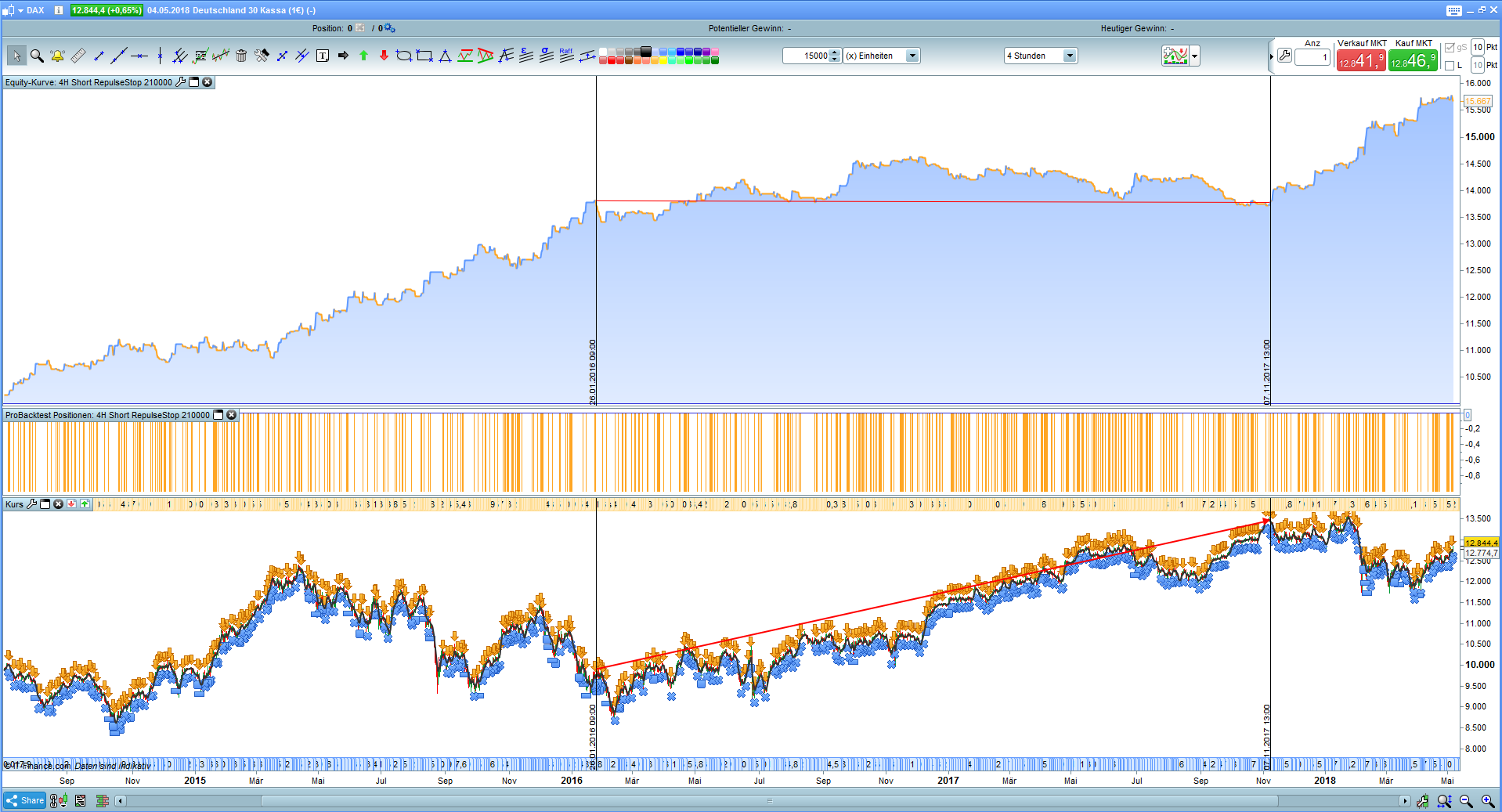

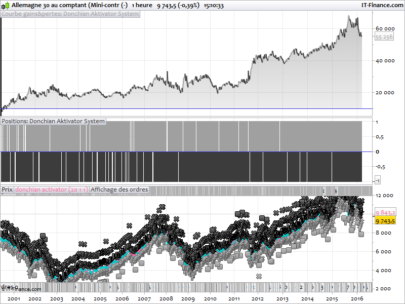

For this little OnlyShort-Strategy here in the Dax, we use the power of candles in the form of the Repulse indicator and provide the strategy with two three small filters.

Protected by the repulse stop and in percent, profits are generated when prices fall, while in the rising market with this OnlyShort-Strategy there are no significant losses.

We start the positions at 09.00 / 13.00 / if necessary 17.00 o’clock in timeframe 4H and in the time zone utc+2 (“Berlin-Time”). The position is closed for a peaceful sleep at 21.00 o´clock.

That’s all.

Until then

JohnScher

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 |

// OnlyShort-Strategy on Dax // Dax 1 Euro Mini // TimeFrame 4H // Hauptcode : 4H Short with Repulse-Stop flatafter 210000 // created by JohnScher defparam flatafter = 210000 defparam cumulateorders = false Once positionsize = 1 c1 = Exponentialaverage [1] (close) < Exponentialaverage [2] (close) c2 = cci[21] (close) >-95 c3 = TR (close) >24 //repulse-indicator from prt as a code q = 3 a = 100 * (3*close - 2*low - open) / close b = 100 * (open + 2*high - 3*close) / close c4 = Exponentialaverage[q](a) - Exponentialaverage[q](b) // define starttime TradingDayShort = Opendayofweek = 1 or Opendayofweek = 2 or Opendayofweek = 3 or Opendayofweek = 4 or Opendayofweek = 5 TradingTimeShort = time = 090000 or time = 130000 //or time = 170000 r = 0.1 // variable as a digit, could be a indicator too, not tested //maincode IF TradingDayShort and TradingTimeShort Then If c1 and c2 and c3 Then If c4 <r Then sellshort positionsize CONTRACTS AT MARKET Endif Endif ENDIF IF c4 > r then Exitshort at market ENDIF set stop %loss 1 set target %profit 2 // not tested // on other major indizes // with Saisonalpatternmultipler from Pathfinder-Systems // with some Re-invest-Stategies // until then // JohnScher |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

thank you

this trading system, works every day?

Good evening John,

Thanks for your new strategy !

Is Exponentialaverage [1] (close) not exactly the same as just Close ? (just for my understanding, maybe you have used it for optimising this line earlier on?)

Not every day 1 trade, but it works every day

I think it is, but my programming skills are very limited, so I worked with the 2 EMA´s

Goodmorning John my compliments for your code,is there any way to convert this system in a “Long on declining market”?

Yes i did before, see library/strategys/repulse and dpo

https://www.prorealcode.com/prorealtime-trading-strategies/repulse-dpo-4hours-dax-strategy/

Hi

when I do back test I get 0 results, what do I do wrong?

Trade Well

Chris

Don’t know what you’re doing wrong.

Import ITF and observe time zone settings.

This should work.

If you have further problems, please describe them in more detail, if necessary add screenshots