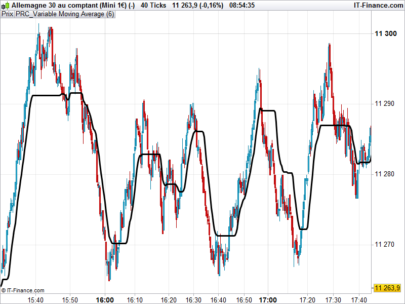

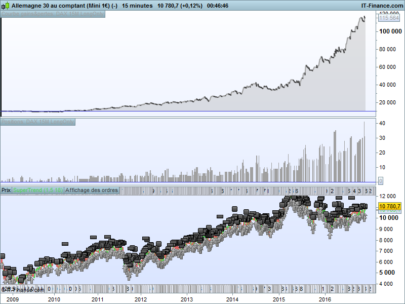

Hello, I want to share this strategy of Semi Swing Trading on DAX 4H

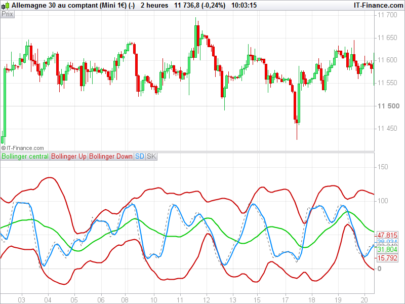

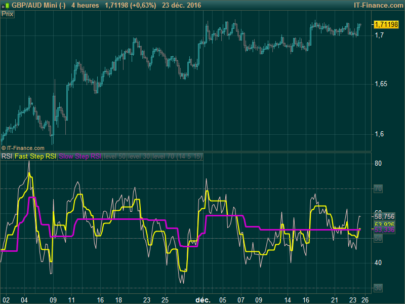

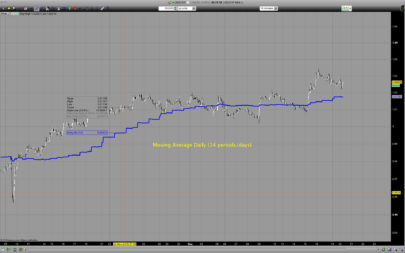

It includes a non-conventional PSAR setup, an RSI and 1 simple moving average. Only for Longs looking for brief small trends.

WF with 100000 bars attached.

Any suggestions to improve ratio win/loss or % of wins are always welcome =D

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 |

//ROCK CLIMBER DAX 4 HR defparam cumulateorders = false Positionsize = 2 MyPSAR = SAR[0.09,0.08,0.2] If BarIndex = 0 then xClose = TotalPrice xOpen = Open xHigh = max(High,max(xOpen, xClose)) xLow = min(Low,min(xOpen,Xclose)) ELSE xClose = Totalprice xOpen = (xOpen[1] + xClose[1])/2 xHigh = max(High,max(xOpen, xClose)) xLow = min(Low,min(xOpen,Xclose)) ENDIF MyRSI = RSI[6](close) If MyRSI crosses over 60 and close> Average[25] then Buy Positionsize contracts at market ENDIF If LongonMarket and ((xOpen > xClose and XHigh-XOpen and XLow < Xclose) or (MyPSAR crosses over close)) then Sell at market ENDIF set stop loss 80 |

Best T.

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello David, thanks for your strategy !!

I have a question on your code, can you explain me the condition below :

(xOpen > xClose and XHigh-XOpen and XLow < Xclose)

I don't understand the condition XHigh-XOpen ?

Do you want to test XHigh < XOpen ??

I improve your stategy with a trailing stop but the performance is less but with a better drawdown !

Regards.

JM

Hello JM, thanks for your comment.

Actually i should have name it XMid instead of Xopen. xHigh means Highest value in the set, while xMid means Midpoint of the previous bar. XMid = [xOpen(Previous Bar) + Close(Previous Bar)]/2

Also, an upper bollinger band crossing over close instead of PSAR works too as an exit.

Regards

David thanks for your return and your explication !

But I have a problem of interstand the logical sequence of programmation : “XHigh-XOpen” -> this must be equal at 1 or 0 in the condition if …. ??

Anyway perhaps I have to search in the ProBuilder language…

Do you have test this strategy in real mode with the DAX ?

I want to test with my IG account with CFD.

Regards.

JM,

Actually you can remove that part of the code. Look at below:

//ROCK CLIMBER DAX 4 HR

defparam cumulateorders = false

Positionsize = 2

//MyPSAR = SAR[0.09,0.03,0.2]

If BarIndex = 0 then

xClose = TotalPrice

xOpen = Open

//xHigh = max(High,max(xOpen, xClose))

xLow = min(Low,min(xOpen,Xclose))

ELSE

xClose = Totalprice

xOpen = (xOpen[1] + xClose[1])/2

//xHigh = max(High,max(xOpen, xClose))

xLow = min(Low,min(xOpen,Xclose))

ENDIF

MyRSI = RSI[7](close)

If MyRSI crosses over 60 and close> Average[25] then

Buy Positionsize contracts at market

ENDIF

If LongonMarket and (xOpen > xClose and XLow < Xclose) or BollingerUp[7] crosses over close then

Sell at market

ENDIF

set stop loss 80

No, I currently don't have this system in my real portfolio but it is a good candidate.

David,

Thanks a lot and next week I begin the test of this strategy in real…

You have other strategy in real account better then that one ??

hello david,

i’ll try it

could you tell me wich strategy do you use in real?

thanks

Hello,

I have a couple of DAX strategies of breakout and mean reversion. I’ll try to post them later on.

Regards,

Hi David, I just saw your strategy and it’s good!!! I’m going to try it from today in real and I’ll tell you. I’ve also tried it on the Dow Jones and it also works very well. I know this post is from many years ago but it’s great that to this day it keeps working. Thank you so much for this job.