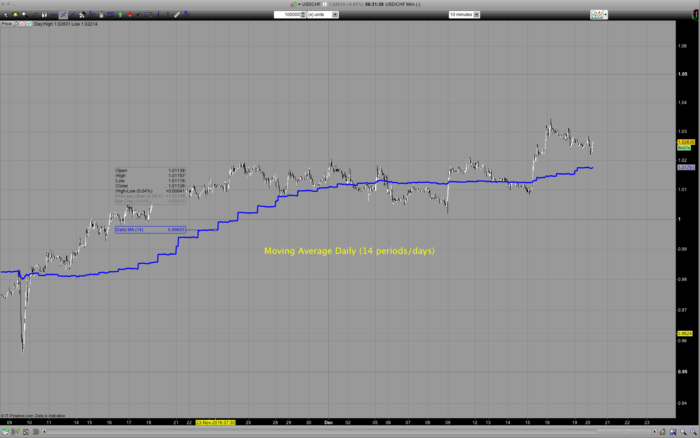

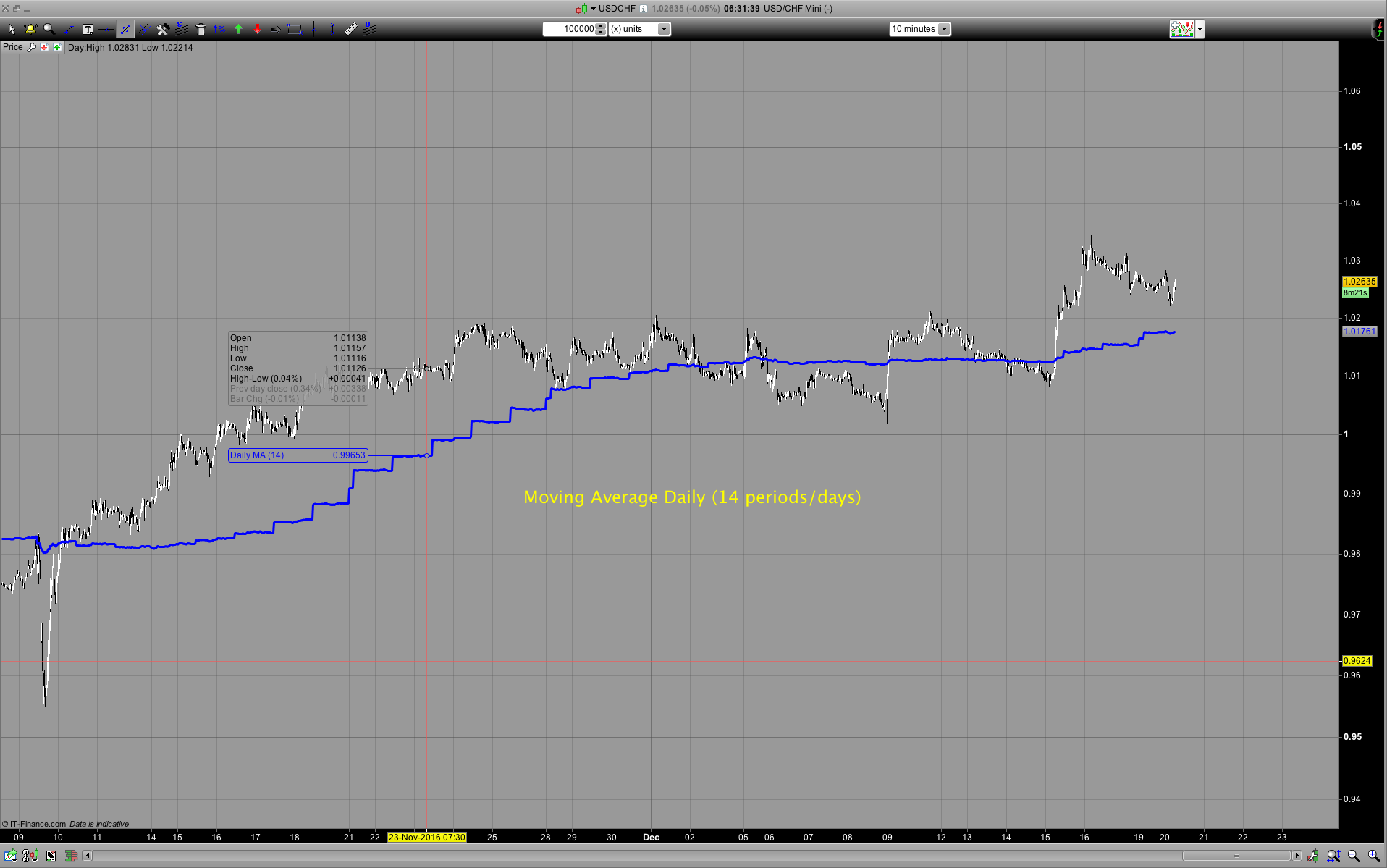

At this stage ProRealtime doesn’t have multi timeframe capabilities. However one easy possibility is to use the moving average of the daily timeframe with the options of DOpen, DHigh, DLow, DClose and that’s what this indicator enables you to do. You can select the number of periods ie. Days: number of periods/days (please note there’s a limit depending on the timeframe you use this on and there’s a difference between PRT and IG data periods) open/high/low/close, etc… If you are going to use this in a live trading account you will need to set: DEFPARAM Preloadbars = Here is the table of how much Preloadbars you will need depending how many periods you want to look back. The column max days shows the maximum of what you can set Preload to.

As an example of you are using a 10 minute timeframe the maximum DEFPARAM Preloadbars = 5000 // maximum is 5000 and this is equal to the moving average of 35 days.

| DEFPARAM Preloadbars = | |||

| 60 | 24 | 5000 | |

| Minutes | bars per hour | bars per day | max days |

| 1 | 60 | 1440 | 3 |

| 5 | 12 | 288 | 17 |

| 10 | 6 | 144 | 35 |

| 15 | 4 | 96 | 52 |

| 30 | 2 | 48 | 104 |

| 60 | 1 | 24 | 208 |

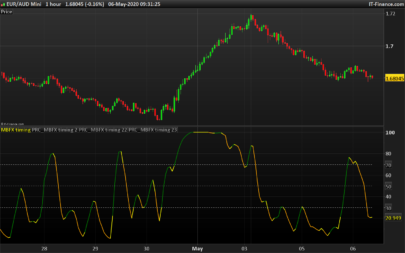

You should find this indicator useful if you are trading mean reversion system and want to make an entry a timeframe less than the daily while using the daily moving average as the mean.

REMINDER: if you want the indicator to appear in the Price section of the chart, you must add it by clicking on the spanner icon on the little Price tab in the Price window.

|

1 2 3 4 5 6 7 8 9 10 11 |

// Please note if you're using IG there's a smaller number of days you can use and the smaller the timeframe the small number of days you can use periods = p // days LMA=0 // Loop MA FOR i = 0 TO periods-1 DO // Need -1 so the Result is the number of periods we actually want LMA = DClose(i) + LMA // Don't think this is possible CustomClose[(i)] Next LMAactual = (LMA / (periods)) RETURN LMAactual AS "Daily MA" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks a lot, a lot of people will find it useful!

About customclose of the daily OHLC, you could have compute them this way: (totalprice for instance)

LMA = ((DOpen(i)+DHigh(i)+DLow(i)+DClose(i))/4) + LMA

Unfortunately the PRT is unreliable.

I made a simple 7 day moving average crosses over 30 day moving average but Pro Realtime opens position even though there’s no cross over.

I tried to provide a screenshot but I keeping getting a HTTP error.

Did you change trading hours or weekends data of the tested instruments? Calculate the daily moving average like the author do it in this code means a lot of preloaded bars, did you adapt this parameter correctly?

Nicolas, I wrote the code and I have DEFPARAM Preloadbars = 3000 on m60 so that’s plenty of preloadbars.

As far as I know I didn’t change the weekend data of FX. But the drawn moving average lines do not cross many times but the position open and they should not open. So no one else is having this issue?

I am running the Demo of 10.3 via IG so maybe that’s having an issue?

How do you call this indicator in you trading strategy code? Did you make a CALL? Have you tried to GRAPH the returned variables of the indicators while backtesting?

I’m using the call function. I checked again and it seems okay now on Demo and Live testing. Luckily I took a screen shot otherwise I wouldn’t believe that there was an entry issue as per my initial comment.

Nicolas I’ve looked at it again and there’s a problem.

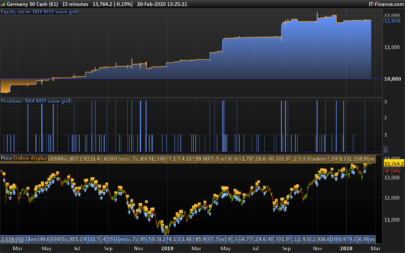

As an example here’s a simple cross over system and you can see the entry and exit is not at the cross over. It’s even worse if you use <> for the daily moving averages for the BUY. I made 2 instances of the indicator and Call the indicators Moving Average Daily with DHigh and DLow. I’m still having HTTP error when trying to upload a screen shot. Here’s a screenshot https://ibb.co/na7LDv

I look forward to hearing what results you have Nicolas.

// Definition of code parameters

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

// Conditions to enter long positions

indicator1 = CALL \"Moving Average Daily HIGH\"[14]

indicator2 = CALL \"Moving Average Daily LOW\"[50]

c1 = (indicator1 CROSSES OVER indicator2)

IF c1 THEN

BUY 1 CONTRACT AT MARKET

ENDIF

// Conditions to exit long positions

indicator3 = CALL \"Moving Average Daily HIGH\"[14]

indicator4 = CALL \"Moving Average Daily LOW\"[50]

c2 = (indicator3 CROSSES UNDER indicator4)

IF c2 THEN

SELL AT MARKET

ENDIF

You’ll need to preload bars to get the good calculations of you indicators. I did not test it myself though.

Nicolas I tried DEFPARAM Preloadbars = 5000

And still the same drawn output of entries/exits not at the drawn Cross Over around 2 days earlier than the drawn Cross Over /Cross Under.

Hi, Thank you very much for the Moving Average Daily indicator, I am using it as indicator in an intraday chart so I would like to preload bars. I tried to add at the beginning DEFPARAM CalculateOnLastBars = 5000 but it seems that it is doing nothing. If I use DEFPARAM Preloadbars = 5000 it claims that it is only used in Probacktest. Thanks in advance