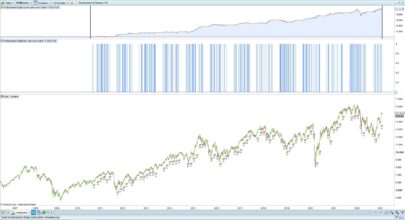

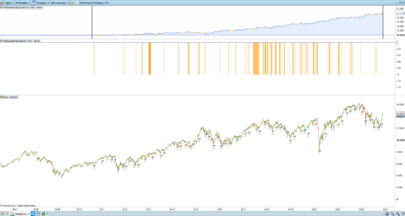

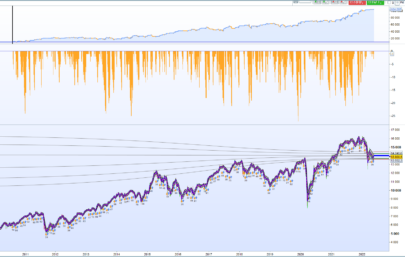

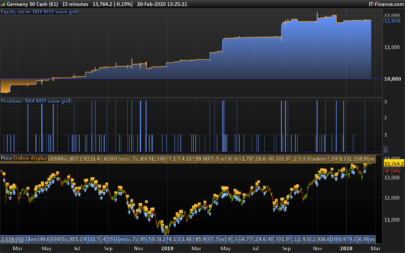

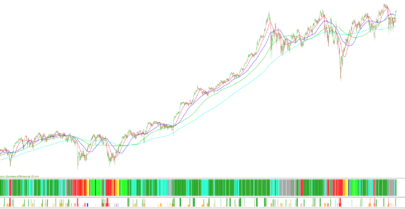

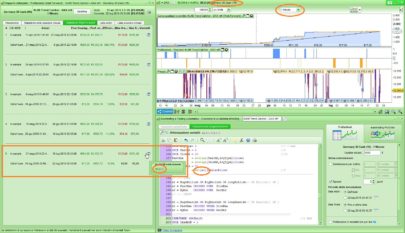

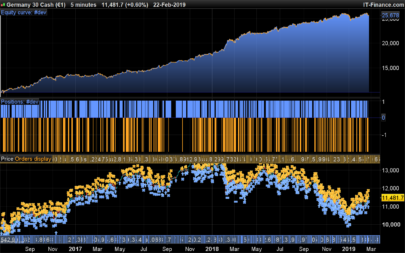

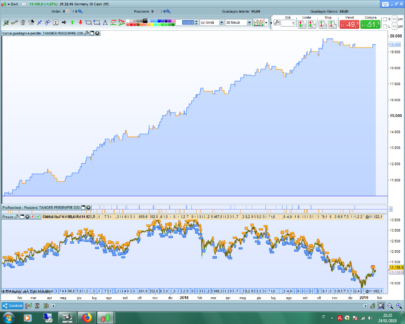

This is a Multiday Strategy on DAX cfd of Ig Market- Time Frame 1 Hour

Signals are taken from QQE indicator and Universal indicator participates as filter.

The Seasonal optimization is Reiner’s Idea, that work well which we know.

The position are followed by a trailing stop.

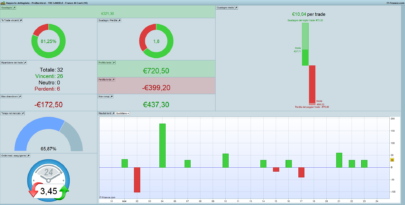

Test result are made with DAX 1 € mini Spread 2

Time Frame 1 Hour

Since 26.04.2006 to 01.11.2016

The strategy needs also 3 technical indicators that are also attached at the bottom of the post. These technical indicators are original ones found on the site and modified for the strategy.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 |

// Definizione dei parametri del codice DEFPARAM CumulateOrders = FALSE // Posizioni cumulate disattivate // define position and money management parameter ONCE positionSize = 1 // define saisonal position multiplier >0 - long ONCE Januaryl = 1 ONCE Februaryl = 1 ONCE Marchl = 2 ONCE Aprill = 1 ONCE Mayl = 1 ONCE Junel = 3 ONCE Julyl = 2 ONCE Augustl = 1 ONCE Septemberl = 1 ONCE Octoberl = 3 ONCE Novemberl =2 ONCE Decemberl = 2 // saisonal pattern long position IF CurrentMonth = 1 THEN saisonalPatternMultiplierl = Januaryl ELSIF CurrentMonth = 2 THEN saisonalPatternMultiplierl = Februaryl ELSIF CurrentMonth = 3 THEN saisonalPatternMultiplierl = Marchl ELSIF CurrentMonth = 4 THEN saisonalPatternMultiplierl = Aprill ELSIF CurrentMonth = 5 THEN saisonalPatternMultiplierl = Mayl ELSIF CurrentMonth = 6 THEN saisonalPatternMultiplierl = Junel ELSIF CurrentMonth = 7 THEN saisonalPatternMultiplierl = Julyl ELSIF CurrentMonth = 8 THEN saisonalPatternMultiplierl = Augustl ELSIF CurrentMonth = 9 THEN saisonalPatternMultiplierl = Septemberl ELSIF CurrentMonth = 10 THEN saisonalPatternMultiplierl = Octoberl ELSIF CurrentMonth = 11 THEN saisonalPatternMultiplierl = Novemberl ELSIF CurrentMonth = 12 THEN saisonalPatternMultiplierl = Decemberl ENDIF // define saisonal position multiplier >0 short ONCE Januarys = 2 ONCE Februarys = 1 ONCE Marchs = 1 ONCE Aprils = 1 ONCE Mays = 3 ONCE Junes = 2 ONCE Julys = 1 ONCE Augusts = 1 ONCE Septembers = 3 ONCE Octobers = 1 ONCE Novembers = 1 ONCE Decembers = 1 // saisonal pattern short position IF CurrentMonth = 1 THEN saisonalPatternMultipliers = Januarys ELSIF CurrentMonth = 2 THEN saisonalPatternMultipliers = Februarys ELSIF CurrentMonth = 3 THEN saisonalPatternMultipliers = Marchs ELSIF CurrentMonth = 4 THEN saisonalPatternMultipliers = Aprils ELSIF CurrentMonth = 5 THEN saisonalPatternMultipliers = Mays ELSIF CurrentMonth = 6 THEN saisonalPatternMultipliers = Junes ELSIF CurrentMonth = 7 THEN saisonalPatternMultipliers = Julys ELSIF CurrentMonth = 8 THEN saisonalPatternMultipliers = Augusts ELSIF CurrentMonth = 9 THEN saisonalPatternMultipliers = Septembers ELSIF CurrentMonth = 10 THEN saisonalPatternMultipliers = Octobers ELSIF CurrentMonth = 11 THEN saisonalPatternMultipliers = Novembers ELSIF CurrentMonth = 12 THEN saisonalPatternMultipliers = Decembers ENDIF // Condizioni per entrare su posizioni long ignored, indicator1, ignored = CALL "QQE_QUDAX1HBUY" ignored, indicator3, ignored = CALL "QQE_QUDAX1HSELL" indicator2, ignored = CALL "UNIV_QUDAX1H_LOW" c1 = (indicator1 CROSSES OVER 50) c2 = (indicator2 <= 0) c3=(indicator1>68) c4=(indicator1<34) // Condizioni per entrare su posizioni short c5 = (indicator3 CROSSES UNDER 50) c6 = (indicator2 >= 0) C7 = (indicator3<35) C8=(indicator3>56) IF c1 AND c2 THEN IF saisonalPatternMultiplierl > 0 THEN // check saisonal booster setup and max position size BUY positionSize * saisonalPatternMultiplierl CONTRACT AT MARKET ENDIF ENDIF IF C3 OR C4 THEN SELL AT MARKET ELSIF c5 AND c6 THEN IF saisonalPatternMultipliers > 0 THEN // check saisonal booster setup and max position size SELLSHORT positionSize * saisonalPatternMultipliers CONTRACT AT MARKET ENDIF ENDIF IF C7 OR C8 THEN EXITSHORT AT MARKET ENDIF // TRAILING STOP LOGIK TGL =131 TGS= 100 if not onmarket then MAXPRICE = 0 MINPRICE = close PREZZOUSCITA = 0 ENDIF if longonmarket then MAXPRICE = MAX(MAXPRICE,close) if MAXPRICE-tradeprice(1)>=TGL*pointsize then PREZZOUSCITA = MAXPRICE-TGL*pointsize ENDIF ENDIF if shortonmarket then MINPRICE = MIN(MINPRICE,close) if tradeprice(1)-MINPRICE>=TGS*pointsize then PREZZOUSCITA = MINPRICE+TGS*pointsize ENDIF ENDIF if onmarket and PREZZOUSCITA>0 then EXITSHORT AT PREZZOUSCITA STOP SELL AT PREZZOUSCITA STOP ENDIF ONCE maxCandlesShortWithoutProfit =68// limit short loss latest after 85 candles // stop and profit management posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize ms = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithoutProfit IF SHORTONMARKET AND ms THEN EXITSHORT AT MARKET ENDIF set stop Ploss 500 set target Pprofit 500 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

optimized

// Definizione dei parametri del codice

DEFPARAM CumulateOrders = FALSE // Posizioni cumulate disattivate

// define position and money management parameter

ONCE positionSize = 1

// define saisonal position multiplier >0 - long

ONCE Januaryl = 1

ONCE Februaryl = 1

ONCE Marchl = 2

ONCE Aprill = 1

ONCE Mayl = 1

ONCE Junel = 3

ONCE Julyl = 2

ONCE Augustl = 1

ONCE Septemberl = 1

ONCE Octoberl = 3

ONCE Novemberl =2

ONCE Decemberl = 2

// saisonal pattern long position

IF CurrentMonth = 1 THEN

saisonalPatternMultiplierl = Januaryl

ELSIF CurrentMonth = 2 THEN

saisonalPatternMultiplierl = Februaryl

ELSIF CurrentMonth = 3 THEN

saisonalPatternMultiplierl = Marchl

ELSIF CurrentMonth = 4 THEN

saisonalPatternMultiplierl = Aprill

ELSIF CurrentMonth = 5 THEN

saisonalPatternMultiplierl = Mayl

ELSIF CurrentMonth = 6 THEN

saisonalPatternMultiplierl = Junel

ELSIF CurrentMonth = 7 THEN

saisonalPatternMultiplierl = Julyl

ELSIF CurrentMonth = 8 THEN

saisonalPatternMultiplierl = Augustl

ELSIF CurrentMonth = 9 THEN

saisonalPatternMultiplierl = Septemberl

ELSIF CurrentMonth = 10 THEN

saisonalPatternMultiplierl = Octoberl

ELSIF CurrentMonth = 11 THEN

saisonalPatternMultiplierl = Novemberl

ELSIF CurrentMonth = 12 THEN

saisonalPatternMultiplierl = Decemberl

ENDIF

// define saisonal position multiplier >0 short

ONCE Januarys = 2

ONCE Februarys = 1

ONCE Marchs = 1

ONCE Aprils = 1

ONCE Mays = 3

ONCE Junes = 2

ONCE Julys = 1

ONCE Augusts = 1

ONCE Septembers = 3

ONCE Octobers = 1

ONCE Novembers = 1

ONCE Decembers = 1

// saisonal pattern short position

IF CurrentMonth = 1 THEN

saisonalPatternMultipliers = Januarys

ELSIF CurrentMonth = 2 THEN

saisonalPatternMultipliers = Februarys

ELSIF CurrentMonth = 3 THEN

saisonalPatternMultipliers = Marchs

ELSIF CurrentMonth = 4 THEN

saisonalPatternMultipliers = Aprils

ELSIF CurrentMonth = 5 THEN

saisonalPatternMultipliers = Mays

ELSIF CurrentMonth = 6 THEN

saisonalPatternMultipliers = Junes

ELSIF CurrentMonth = 7 THEN

saisonalPatternMultipliers = Julys

ELSIF CurrentMonth = 8 THEN

saisonalPatternMultipliers = Augusts

ELSIF CurrentMonth = 9 THEN

saisonalPatternMultipliers = Septembers

ELSIF CurrentMonth = 10 THEN

saisonalPatternMultipliers = Octobers

ELSIF CurrentMonth = 11 THEN

saisonalPatternMultipliers = Novembers

ELSIF CurrentMonth = 12 THEN

saisonalPatternMultipliers = Decembers

ENDIF

// Condizioni per entrare su posizioni long

ignored, indicator1, ignored = CALL \"QQE_QUDAX1HBUY\"

ignored, indicator3, ignored = CALL \"QQE_QUDAX1HSELL\"

indicator2, ignored = CALL \"UNIV_QUDAX1H_LOW\"

c1 = (indicator1 CROSSES OVER 50)

c2 = (indicator2 <= 0)

c3=(indicator1> 72 )

c4=(indicator1< 39 )

// Condizioni per entrare su posizioni short

c5 = (indicator3 CROSSES UNDER 50)

c6 = (indicator2 >= 0)

C7 = (indicator3< 28 )

C8=(indicator3> 56 )

IF c1 AND c2 THEN

IF saisonalPatternMultiplierl > 0 THEN // check saisonal booster setup and max position size

BUY positionSize * saisonalPatternMultiplierl CONTRACT AT MARKET

ENDIF

ENDIF

IF C3 OR C4 THEN

SELL AT MARKET

ELSIF c5 AND c6 THEN

IF saisonalPatternMultipliers > 0 THEN // check saisonal booster setup and max position size

SELLSHORT positionSize * saisonalPatternMultipliers CONTRACT AT MARKET

ENDIF

ENDIF

IF C7 OR C8 THEN

EXITSHORT AT MARKET

ENDIF

// TRAILING STOP LOGIK

TGL = 131

TGS= 100

if not onmarket then

MAXPRICE = 0

MINPRICE = close

PREZZOUSCITA = 0

ENDIF

if longonmarket then

MAXPRICE = MAX(MAXPRICE,close)

if MAXPRICE-tradeprice(1)>=TGL*pointsize then

PREZZOUSCITA = MAXPRICE-TGL*pointsize

ENDIF

ENDIF

if shortonmarket then

MINPRICE = MIN(MINPRICE,close)

if tradeprice(1)-MINPRICE>=TGS*pointsize then

PREZZOUSCITA = MINPRICE+TGS*pointsize

ENDIF

ENDIF

if onmarket and PREZZOUSCITA>0 then

EXITSHORT AT PREZZOUSCITA STOP

SELL AT PREZZOUSCITA STOP

ENDIF

ONCE maxCandlesShortWithoutProfit = 72// limit short loss latest after 72 candles

// stop and profit management

posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize

ms = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithoutProfit

IF SHORTONMARKET AND ms THEN

EXITSHORT AT MARKET

ENDIF

set stop Ploss 950

set target Pprofit 500

Hi,

have you change stop loss only? Have you test 200.000 Bars?

Ale max 100.000 con la mia piattaforma

how can I put a picture here?

CiaoI’ve seen your version with 100.000 Bars, yes is better; but with 200.000 results are quite the same and increase drawdown.

We may look for to run the strategy with Gold and Oil.. Grazie!

Miguel do you find picture of your version near the others files above. It’s tested with 200.000 bars

HI MIGUEL, WHAT IS THE TRADING TIME ? 08:00 – 22:00? ROME TIME ZONE

THANKS

Paste here Miguel and send link? https://snag.gy/

Cosmic I will attach here the result with photos

Ciao Ale,

Are you running this code on real account? The results are the same of backtests?Duccio

Ciao Ducci,

yes the same..

Oh perfetto. Very good job.

Ti posso contattare tramite un metodo privato (email o cellulare)per chiederti alcune cose che non c’entrano direttamente con la strategia?

Hello Duccio;If you need to contact me don’t hesitate..

Ciao

vuoi darmi il numero che ti chiamo?

Te lo posso mandare via mail evitando di scriverlo qui pubblico?

tradale1980@gmail.com

Ciao

manda pure..

Grandi idee….grazie Ale!!

Ciao Ale, intanto ti volevo fare i complimenti per tutto quello che posti!!Premetto che sono un newbie, e mi piacerebbe migliorare la mia programmazione. Leggendo il tuo TS, faccio fatica a capirlo… posso farti alcune domande? Scusa se sono banali… Spero che possano essere utili anche ad altri nella community…sopratutto la prima parte… dalla riga 7 alla 84.. grazie mille

Certo!

Off topic: but is it possible to change the language of the PRT interface (eg to English)? Cant find a setting for that.

No it’s not possible. The platform language is linked to your country language account.

qualcuno puo aiutarmi per il mio ts? avrei bisogno solo di mettere un entrata per un tf 1m come secondo incrocio ma non trovo come fare qualcuno mi puo contattare?

grazie

martina

Hello ALE,Thanks for your good strategies,Have you calculated how overnight CFD charges will affect overall gain as ie. for the last 4 years, 77 long trades last an average of 20 days and 32 short trades, an average of 9 days?Thank you for your answer.

Hi Arnaudp63,Not yet

Hi Arnaudp63

Daliy itenterests are about 1700€ since 26.april.2006 to last trade.

RegardsAle

Salve a tutti sono nuovo nel forum ma no nel trading,bella strategia ma nel trading medi lungo periodo non puo bastare il calcolo dello spread 2, ma bisognerebe calcolarlo almeno il doppio per compensare le spese degli interessi che applicano giornalmente.

Hi AlemalizAt Christmas time I’ll count interest..

Thanks

Ale

Hi Alemaliz

Daliy itenterests are about 1700€ since 26.april.2006 to last trade.

RegardsAle

ciao Ale, mi da questo errore quando copio il codice su PRT

\"QQE_QUDAX1HBUY\"come posso risolvere?Grazie.

Ciao

Devi fare il download di tutti i file e successivamente dal menù della piattaforma dove trovi tutti gli indicatori e tutte le strategie, cliccata sul tasto importa, alla fine li troverai disponibili nel menù

Please write in English

you must download every files

and import them in your platform

ciao Ale, grazie…non riesco a metterli sul desktop…ti ho inviato una mail…

risolto…

https://www.prorealcode.com/import-export-prorealtime-code-platform/

ok bene!

Ciao Ale le stagionalita sono ottimizzate in base al guadagno% ho in %Trade vincenti Grazie?

CiaoGuadagno.

Ciao Ale scusa se ti disturbo ancora possiamo sentirci in privato per un chiarimento su questa strategia per il bene di tutti?

Ma certo nel mio profilo trovi le info

ciao Ale, scusa il disturbo .. ho messo in macchina demo versione 10.03 questa strategia dal 03 gennaio e non ha fatto nessuna operazione cosa ho sbagliato … ?

a 1 ora su dax mini 1 euro punto..

grazie .

Ciaol’ultima operazione long l’ha eseguita il 3 dicembre ed uscito l’8 dicembre.

a ok quindi potrei anche non aver sbagliato nulla … grazie ..

scusate sono nuovo del forum ,dove posso chiedere come posso generare un codice che mi permetta di acquistare ad una data ora e vendere ad un altra data ora tutti i giorni?

Ciao

Puo andare nel forum

Supporto pro order

In fondo troverai lo spazio per inserire un nuovo topic

li ci sarà lo spazio per spiegarti come fare..

ciao

Ciao Ale,

anche a me da questo errore

“QQE_QUDAX1HBUY”

“QQE_QUDAX1HSELL”

“UNIV_QUDAX1H_LOW”

dove trovo questi indicatori

Grazie

Hi Ale

do you trade these QU strategies?

Are the results same as backtests

Thnaks in advance

Reb

Hi anyone that has run this lately?