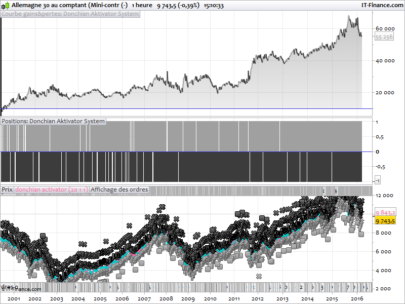

While searching for profitable strategies, I came across something really simple in various forums and websites.

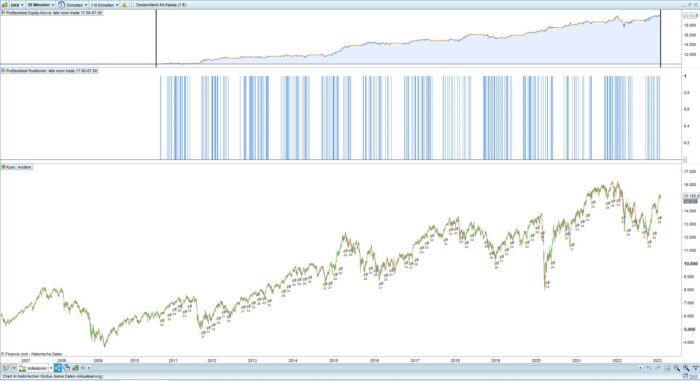

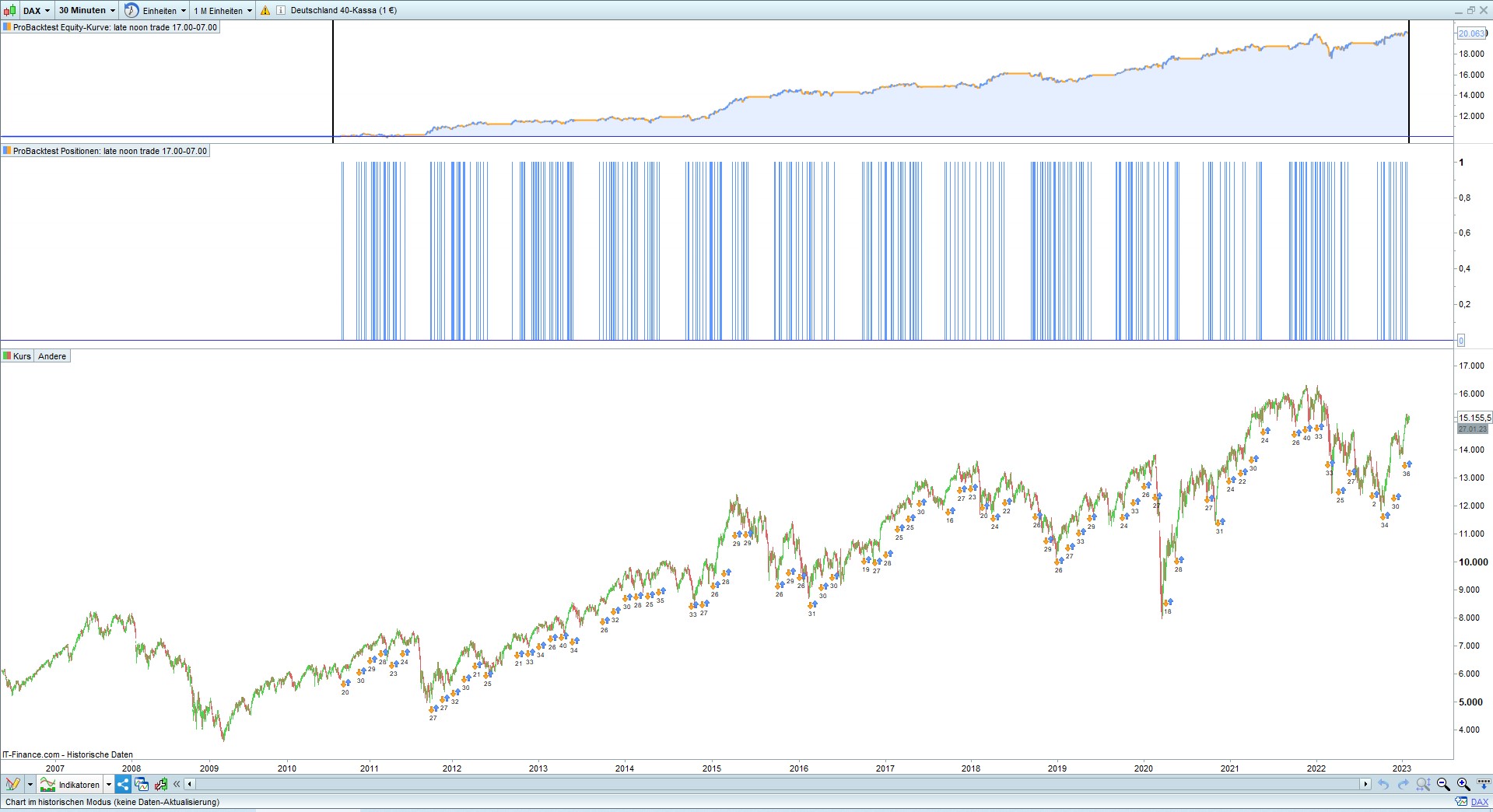

Basically it’s a trend following system and here we are only looking at the long side.

The trend is long when the price is above a higher average.

If the trend is long we take a long position after the morning tussle in the Dax at a late lunch. We hold the position overnight until the next morning and then liquidate it.

In my systems I like to set a filter after the time. Here for seasonal reasons some months and because of the over-weekend-risk friday are excluded.

As an explanation can be considered that the Dax follows the strong development of the S&P500 and DowJones shortly before and with their opening bell.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 |

//------------------------------------------------------- // late lunch trade // instrument dax40 // timezone europe, berlin // timeframe 30m // created and coded by JohnScher //------------------------------------------------------- defparam cumulateorders= false //defparam flatafter = 213000 // works too once ordersize = 1 tm = openmonth <> 6 and openmonth <> 7 and openmonth <> 8 td = opendayofweek >= 1 and opendayofweek <= 4 tt = time = 133000 c = close > exponentialaverage [6] (close) if tm and td and tt and c then buy ordersize contracts at market endif if onmarket and time = 080000 then sell at market endif set target %profit 1.5 // until then |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hallo JohnScher

there isn’t any SL, is it a choice or you didn t find any accurate ?

An SL is not needed. If necessary, you can use an optimized SL.

Short variant, see at

https://www.prorealcode.com/topic/late-lunch-trade-dax40-strategy/

Hi JohnScher,

Thanks a lot for your contribution.

Consider this release to avoid overfit.

Some others suggestions?

Kind Regards.

//——————————————————-

// late lunch trade

// instrument dax40

// timezone europe, berlin

// timeframe 30m

// created and coded by JohnScher

//——————————————————-

defparam cumulateorders= false

EntraLong=1

EntraShort=1

TagliaPosizione=1

MySL=3

MyTP=3

time2trade = time = 133000

TriggerL = close > exponentialaverage [6] (close)

TriggerS = close < exponentialaverage [6] (close)

PatternL=rsi[2](Close)>65

PatternS=not (dlow(1)>dlow(5))

if EntraLong AND time2trade AND TriggerL AND PatternL then

buy TagliaPosizione contracts at market

endif

if EntraShort AND time2trade AND TriggerS AND PatternS then

sellshort TagliaPosizione contracts at market

endif

ExitL=time=080000

ExitS=time=213000

If LongOnMarket AND ExitL then

sell at market

endif

If ShortOnMarket AND ExitS then

exitshort at market

endif

If OnMarket AND MySL>0 then

set stop %loss MySL

endif

If OnMarket AND MyTP>0 then

set target %profit MyTP

endif

Thank you so much for exploring the Late Lunch Strategy.

For discussion and in answer to your question, see here

https://www.prorealcode.com/topic/discuss-the-late-lunch-strade-dax40-strategy/