Hi All

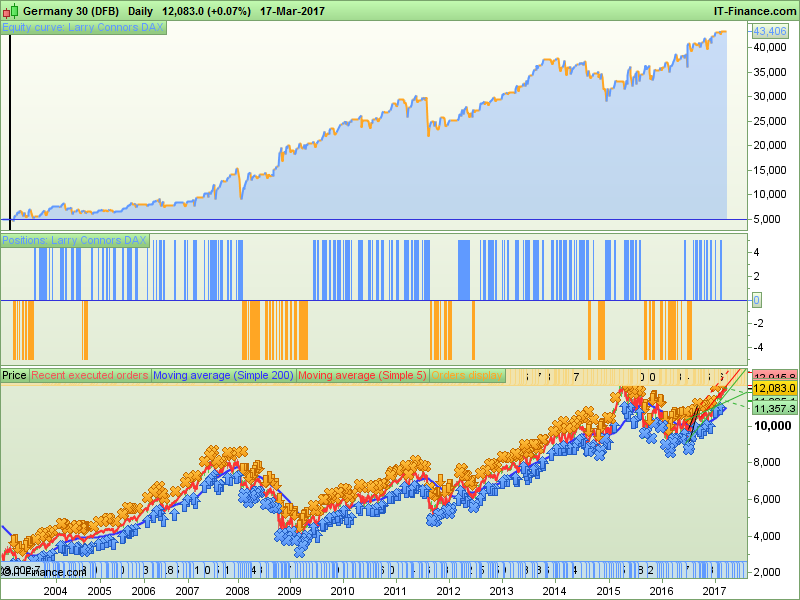

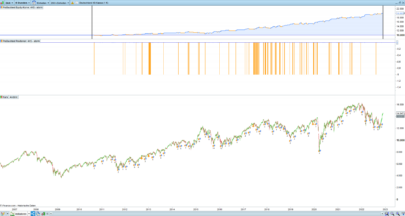

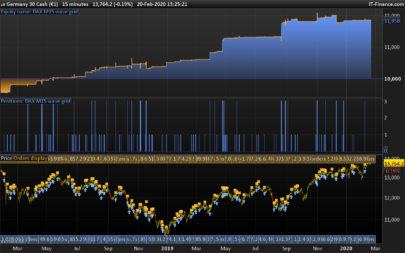

I would appreciate a simple second opinion on this spread-bet test strategy. I’ve been back-testing various versions over long and short timescales…a demo account is showing about 15% profit on the Dax since Sept 16…which if this was real ££££ I’d be quite satisfied with.

Any ideas, comments, improvements would be gratefully received!

Happy Trading!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 |

// Definition of code parameters DEFPARAM CumulateOrders = False // Cumulating positions deactivated // Conditions to enter long positions indicator1 = Average[200](close) c1 = (close > indicator1) indicator2 = Average[5](close) c2 = (close < indicator2) indicator3 = RSI[2](close) c3 = (indicator3 < 13) IF c1 AND c2 AND c3 THEN BUY 5 PERPOINT AT MARKET ENDIF // Conditions to exit long positions indicator4 = Average[9](close) c4 = (close CROSSES OVER indicator4) IF c4 THEN SELL AT MARKET ENDIF // Conditions to enter short positions indicator5 = Average[200](close) c5 = (close < indicator5) indicator6 = Average[5](close) c6 = (close > indicator6) indicator7 = RSI[2](close) c7 = (indicator7 > 83) IF c5 AND c6 AND c7 THEN SELLSHORT 5 PERPOINT AT MARKET ENDIF // Conditions to exit short positions indicator8 = Average[5](close) c8 = (close CROSSES UNDER indicator8) IF c8 THEN EXITSHORT AT MARKET ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

The “RSI 2 periods” is a strategy so many times coded and modified by traders worldwide 🙂 I’m sure it has already been added to the library before. But since you made your own research on it and made some adjustments and since it still performs well in the recent days, your code deserves to be featured in the library too. Thanks for contribution.

quindi mi dici che se lo metti in reale non funziona?

Non so …. da qui la mia domanda iniziale 🙂

Nice strategy.

Have you tried adding a stop loss since there are a few sharp drawdowns?

I thought about using this system in bear markets only since there is no panic buying when entering a bull market.

Hi Derek.

I have tried many different ways to apply SL’s to this and similar versions of the same…. and I invariably find invariably the results of backtests are worse with a SL. I fully appreciate your comments regarding bear markets though as the biggest drawdowns appear to occur when the uptrend changes but the strategy goes long…! It doesn’t appear to happen in reverse so the “short only” strategy may have some value. Thanks

PS. The last 7 days have been a particularly gruesome …it illustrates your point about bear markets well!!