Hello everyone,

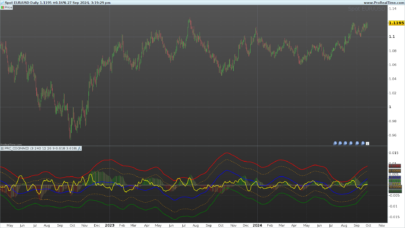

Here is a strategy that mixes the « % Bollinger » indicator, with the trend.

One of my readers made me discover an ebook of Charles Dereeper, who spoke of it. The concept does not come from him, it is well known.

But I found the idea of associating this indicator with the trend very relevant, so I tried to code this strategy.

As a reminder, the « % Bollinger » indicator is defined by :

% Bollinger = (closing price – lower Bollinger) / (upper Bollinger – lower Bollinger)

The ProRealTime indicator is coded by myself like this :

|

1 2 3 4 5 6 7 8 9 10 |

// Indicateur % Bollinger : pB // paramères : période et déviation : libre à vous de changer ces valeurs p = 10 dev = 1.5 BollInf = Average[p](close)-dev*std[p](close) BollSup = Average[p](close)+dev*std[p](close) pB = (close - BollInf) / (BollSup - BollInf) return pB |

We will associate this indicator with the trend.

In bull market, we go to purchase if :

close > MA100

MA20 > MA200

% Bollinger < 0.2 and % Bollinger < 0.2 on previous candle (consolidation)

We close the trade if :

% Bollinger > 1

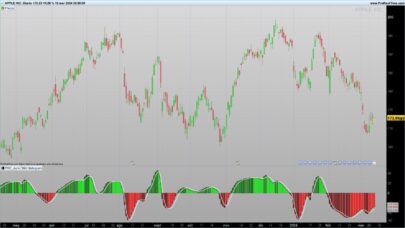

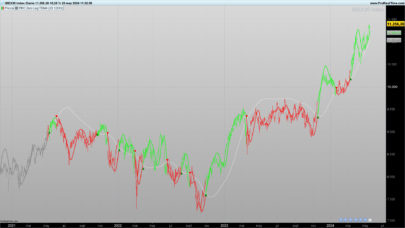

As you can see on the following test (S&P500 INDEX, daily chart, spread 1 point), the strategy is very successful in the bull market : profit factor> 7 !

However, there is very few position (very selective criterias), which means that there are not many gross profits, much less for example than the Swing S&P500 strategy that I personally use.

Quite sad, as I’m always looking for concepts that can improve my own algorithms.

Actually, it would be quite possible to attempt to adapt this strategy to short positions, but it seems less profitable.

You are free to try to improve this strategy.

On the S&P500, it was profitable.

It is quite possible that the parameters for the CAC40, the DAX, the stocks, etc. can be adapted.

It’s up to you.

Best regards and happy trading !

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 |

// % Bollinger en tendance Defparam cumulateorders = false // Taille des positions n = 1 // Indicateur % Bollinger : pB // Paramètres 5/1 BollInf = Average[5](close)-1*std[5](close) BollSup = Average[5](close)+1*std[5](close) pB = (close - BollInf) / (BollSup - BollInf) // ACHAT ca1 = close > average[100](close) ca2 = average[20](close) > average[200](close) ca3 = pB[1] < 0.2 and pB < 0.2 IF ca1 and ca2 and ca3 THEN buy n shares at market ENDIF // SORTIE ACHAT IF pB crosses over 1 THEN sell at market ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks for sharing. The backtest is made on a weekly chart in your example (that’s why PF is superior to 7). However, the strategy is also in gain on a daily timeframe. For everyone’s information, SP500 Index is not a tradable instrument, this strategy must be launched on a CFD account (ticked is US 500).

Hello Nicolas,

You’re right ! I forgot to say that I wanted to make the strategy for long term trading, so I like the weekly timeframe.

I wanted to join also a picture for daily timeframe, but the equity curve was more “sexy” on weekly timeframe, I could only join 1 picture.

Best regards,

Dear Doc ,

excellent concept

Regards

Nice job! It makes good results also on DOW JONES Weekely and on DAX Daily, but also with the short.

// short position

ca1s = close < average[100](close)

ca2s = average[20](close) 1 and pB > 1

IF ca1s and ca2s and ca3s THEN

sellshort n shares at market

ENDIF

// exit short position

if pB crosses under 0.2 THEN

EXITSHORT at market

ENDIF

Excellent, thanks SimoneDasGupta !

bonjour j ai un probleme avec ce code modifié, apparement PRT ne veut pas…avez vous une solution? merci

could someone make this a screener for me 🙂 ?

Hello,

about this, i have problem with the code below

this line “”””””””ca2s = average[20](close) 1 and pB > 1″”””

and i dont have ca3s

could you help me?

thanks

// short position

ca1s = close 1

IF ca1s and ca2s and ca3s THEN

sellshort n shares at market

ENDIF

// exit short position

if pB crosses under 0.2 THEN

EXITSHORT at market

ENDIF

Hello rejo007,

I don’t really understand your question. The code works fine for “long” trades. I didn’t make it for “short” trades.

Give us you full code and we will fix it.

Best regards,

C’est à propos de la partie “short” proposée par SimoneDasGupta un peu plus haut dans les commentaires.

L’avez vous testé?

AH ok, I think the ca3 is the same :

ca3 = pB[1] < 0.2 and pB < 0.2

Best regards,

Hello everybody,

First, thank you so much for all your advices, I’m a begginer in trading and I think you are very helpful !

I tried to make a screener with this indicator above but it doesn’t work, here is the screener as I write it :

myMonindicateurBB = CALL “MonindicateurBB”(close)

Trigger = myMonindicateurBB >= 1

SCREENER[trigger](myMonindicateurBB)

Could anyone help me for this !

Thank’s very much in advance 🙂