Introduction

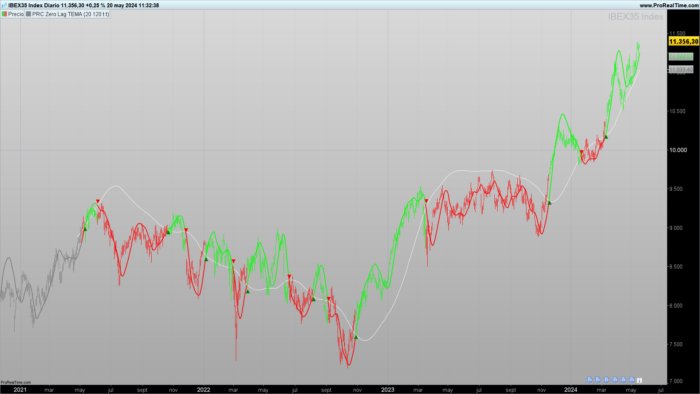

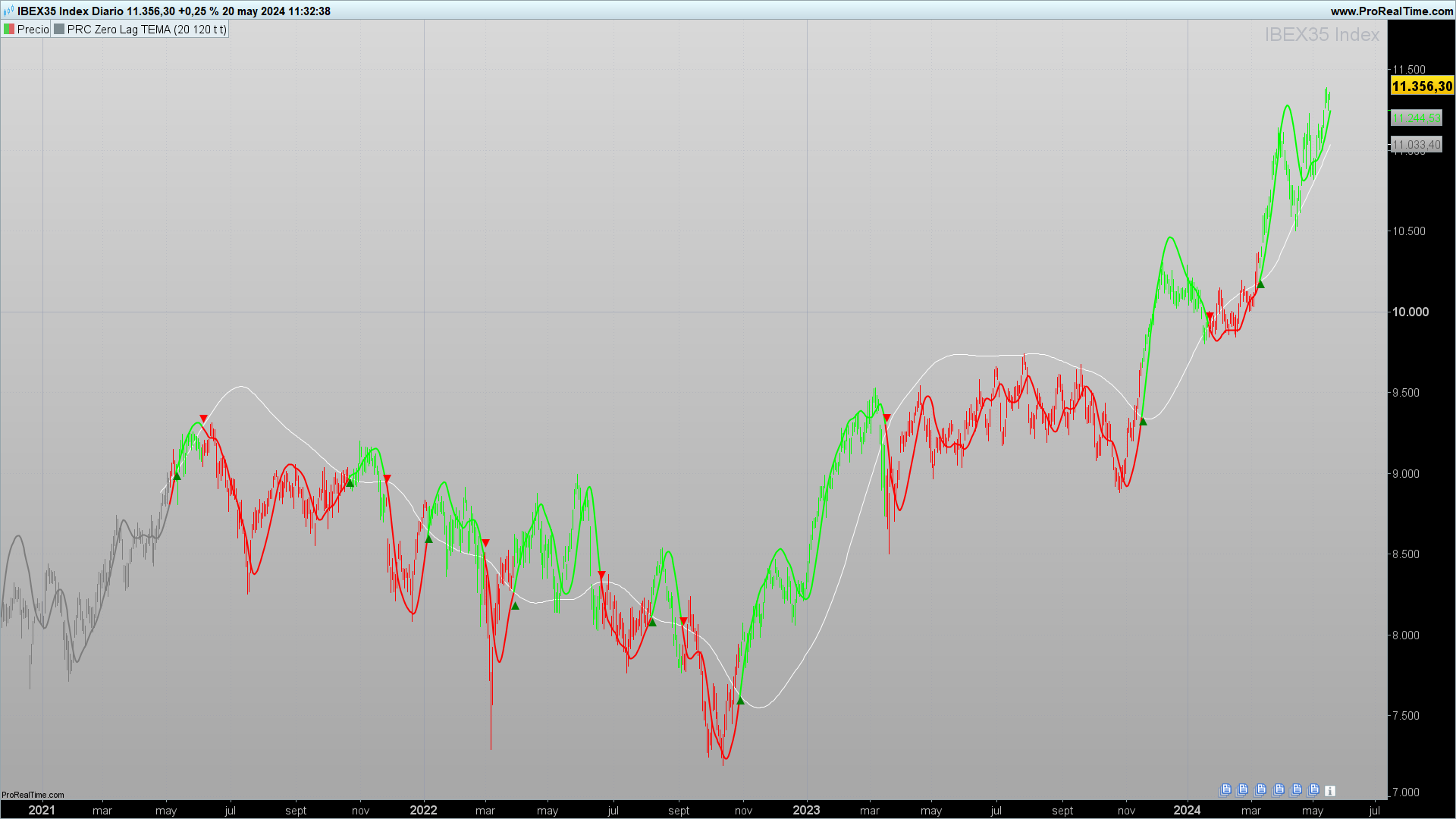

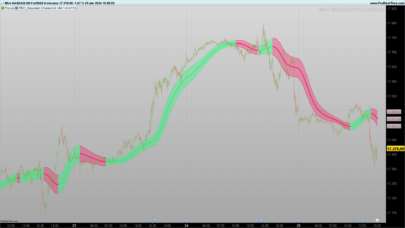

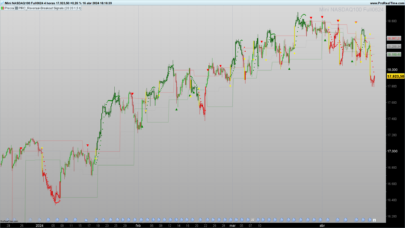

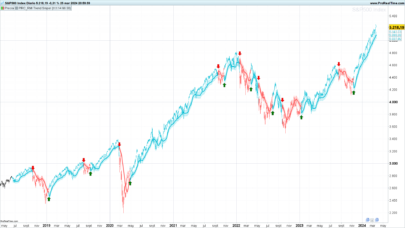

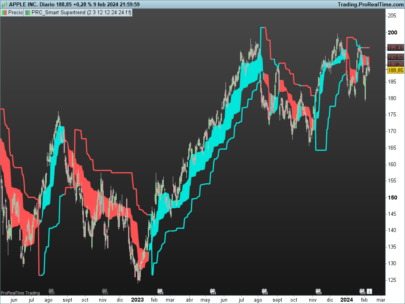

The ZERO LAG TEMA indicator is an advanced technical analysis tool that combines Exponential Moving Averages (EMA) and Triple Exponential Moving Averages (TEMA) to provide precise trading signals and minimize lag in detecting trend changes. This indicator is especially useful for traders seeking to identify early trend changes and optimize their entry and exit strategies.

Indicator Components

The ZERO LAG TEMA is based on two sets of Exponential Moving Averages: one with a fast period and the other with a slow period. The input parameters allow adjusting these periods to fit different timeframes and trading styles.

– src: Custom close price (customclose).

– inpPeriodFast: Fast period for the fast TEMA (default 22).

– inpPeriodSlow: Slow period for the slow TEMA (default 144).

– showsigs: Show signals on the chart (1 to show, 0 to hide).

– colorbars: Color the chart bars based on the TEMA conditions (1 to color, 0 not to color).

Indicator Calculation

Fast TEMA

To calculate the fast TEMA, three Exponential Moving Averages are applied sequentially:

|

1 2 3 4 5 6 7 8 9 10 |

ema1f = average[inpPeriodFast,1](src) ema2f = average[inpPeriodFast,1](ema1f) ema3f = average[inpPeriodFast,1](ema2f) outf = 3 * (ema1f - ema2f) + ema3f ema1af = average[inpPeriodFast,1](outf) ema2af = average[inpPeriodFast,1](ema1af) ema3af = average[inpPeriodFast,1](ema2af) temafast = 3 * (ema1af - ema2af) + ema3af |

Slow TEMA

Similarly, the slow TEMA is calculated using a longer period:

|

1 2 3 4 5 6 7 8 9 10 |

ema1 = average[inpPeriodSlow,1](src) ema2 = average[inpPeriodSlow,1](ema1) ema3 = average[inpPeriodSlow,1](ema2) out = 3 * (ema1 - ema2) + ema3 ema1a = average[inpPeriodSlow,1](out) ema2a = average[inpPeriodSlow,1](ema1a) ema3a = average[inpPeriodSlow,1](ema2a) temaslow = 3 * (ema1a - ema2a) + ema3a |

Theory of Exponential Moving Averages and TEMA

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) is a variant of the simple moving average that gives more weight to recent data. This allows the EMA to respond more quickly to price changes. The EMA formula is as follows:

\[ \text{EMA}_t = (\text{Price}_t \times \alpha) + (\text{EMA}_{t-1} \times (1 – \alpha)) \]

Where:

– \( \text{EMA}_t \) is the current EMA value.

– \( \text{Price}_t \) is the current price.

– \( \alpha \) is the smoothing factor, calculated as \( \frac{2}{n + 1} \), where \( n \) is the EMA period.

Triple Exponential Moving Average (TEMA)

The Triple Exponential Moving Average (TEMA) is an advanced moving average that seeks to reduce the lag observed in simple and exponential moving averages. TEMA was introduced by Patrick Mulloy in 1994 and is calculated using three EMAs, making it more responsive to price changes, eliminating market noise, and providing clearer signals.

The TEMA formula is:

\[ \text{TEMA} = 3 \times \text{EMA1} – 3 \times \text{EMA2} + \text{EMA3} \]

Where:

– \( \text{EMA1} \), \( \text{EMA2} \), and \( \text{EMA3} \) are sequentially calculated exponential moving averages.

Advantages of Using TEMA

– **Lag Reduction**: TEMA offers a faster response to price changes compared to simple and exponential moving averages.

– **Greater Precision**: By using three layers of exponential smoothing, TEMA better eliminates market noise, providing more accurate signals.

– **Improved Trading Signals**: TEMA is ideal for traders looking to identify early trend changes and react promptly.

Trading Signals

The indicator generates buy and sell signals based on the crossovers between the fast TEMA and the slow TEMA:

|

1 2 3 4 5 6 7 8 |

golong = temafast crosses over temaslow goshort = temafast crosses under temaslow if showsigs and golong then drawtext("▲", barindex, temaslow - 0.3 * tr) coloured("green") elsif showsigs and goshort then drawtext("▼", barindex, temaslow + 0.3 * tr) coloured("red") endif |

Bar Coloring

The indicator can also color the chart bars to visually highlight market conditions:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 |

if temafast > temaslow then r = 0 g = 255 b = 0 else r = 255 g = 0 b = 0 endif if colorbars then DRAWCANDLE(open, high, low, close) coloured(r, g, b) endif |

Complete Code in ProBuilder

Below is the complete code for the ZERO LAG TEMA indicator in ProBuilder language:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 |

//PRC_ZERO LAG TEMA //version = 0 //05.03.24 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge ///inputs src = customclose inpPeriodFast=20 //Fast Period inpPeriodSlow=120 //Slow Period showsigs=1 //Show signals colorbars=1 //Color Bars ////Zlagtema : temafast ema1f = average[inpPeriodFast,1](src) ema2f = average[inpPeriodFast,1](ema1f) ema3f = average[inpPeriodFast,1](ema2f) outf = 3*(ema1f-ema2f)+ema3f ema1af = average[inpPeriodFast,1](outf) ema2af = average[inpPeriodFast,1](ema1af) ema3af = average[inpPeriodFast,1](ema2af) temafast = 3*(ema1af-ema2af)+ema3af ////Zlagtema : temaslow ema1 = average[inpPeriodSlow,1](src) ema2 = average[inpPeriodSlow,1](ema1) ema3 = average[inpPeriodSlow,1](ema2) out = 3*(ema1-ema2)+ema3 ema1a = average[inpPeriodSlow,1](out) ema2a = average[inpPeriodSlow,1](ema1a) ema3a = average[inpPeriodSlow,1](ema2a) temaslow = 3*(ema1a-ema2a)+ema3a ///DEFINE COLOR if barindex<=inpPeriodSlow*6 then r=124 g=124 b=124 else if temafast > temaslow then r=0 g=255 b=0 else r=255 g=0 b=0 endif endif ///plot signals golong = temafast crosses over temaslow goshort = temafast crosses under temaslow if showsigs and golong then drawtext("▲",barindex,temaslow-0.3*tr)coloured("green") elsif showsigs and goshort then drawtext("▼",barindex,temaslow+0.3*tr)coloured("red") endif ///Color bars if colorbars then DRAWCANDLE(open, high, low, close)coloured(r,g,b) endif return temaslow as "TEMA Slow" coloured("White")style(line,1), temafast as "TEMA Fast"coloured(r,g,b)style(line,2) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Indicatore interessante, ma non sono convinto se è meglio del Super trend, che cosa ne dici?

Ciao mi restituisce errore line 1; forse è perchè utilizzo la versione 11 ? in questo caso dovrei modificare qualche riga di codice?

Ciao IVAN , mi da errore per la riga 49 “print tema low”; puoi suggerirmi la modifica da metttere?

grazie

Avete provato a scaricare il file .itf?