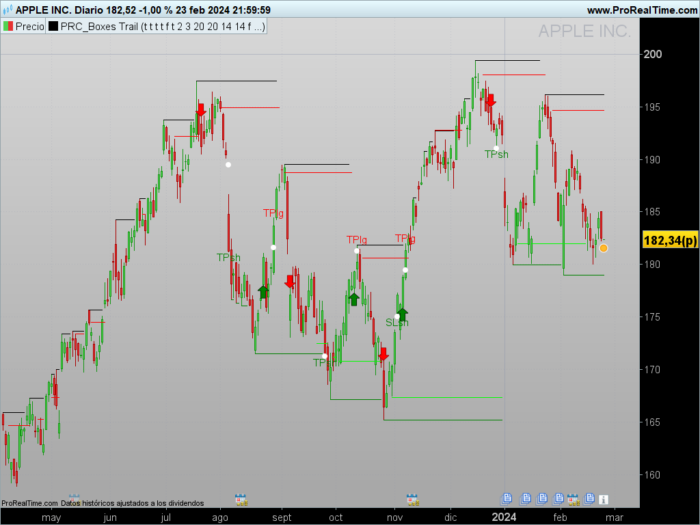

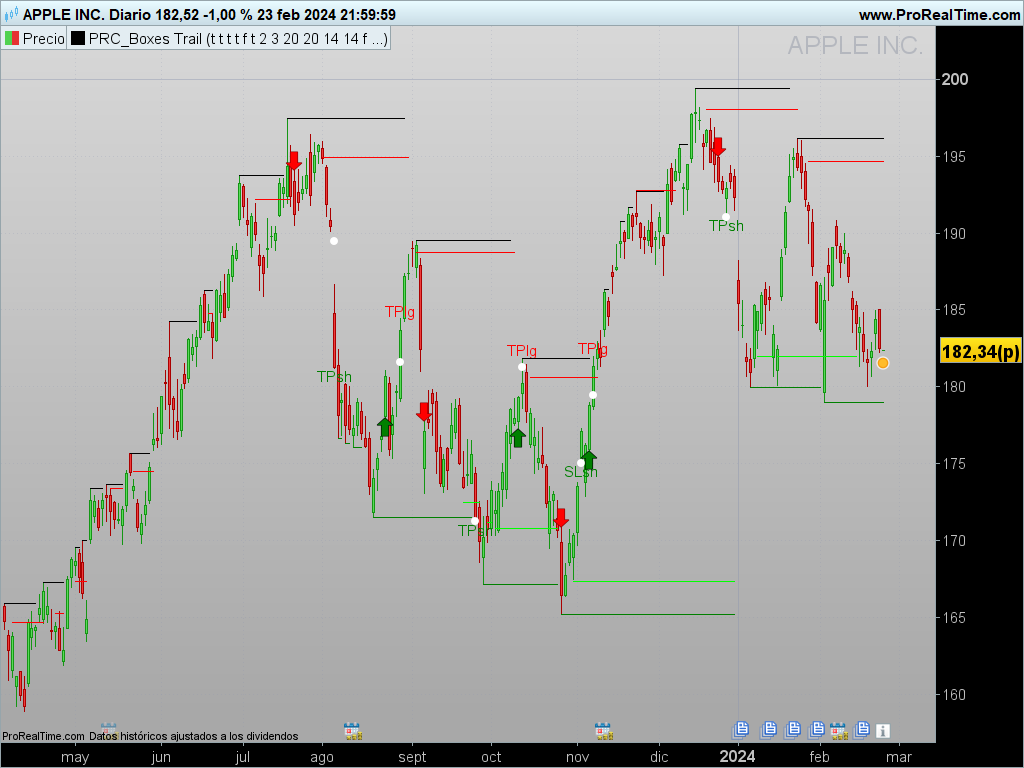

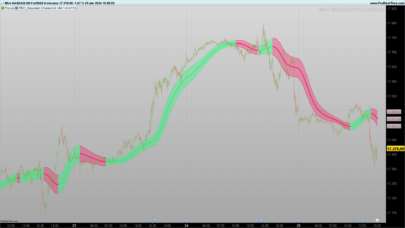

This is an indicator named Boxes Trail. It’s designed to identify trading opportunities based on the identification of dynamic support and resistance levels, in addition to applying a trading methodology trend indicators.

Here’s a summary of how it works:

Core Structure

Dynamic Support and Resistance:

It uses an approach to plot support and resistance lines based on the highest and lowest prices within a defined period (length1 for support/resistance and barlength for additional calculations). These lines dynamically adjust based on specific conditions related to price and volume.

Modified Hull Moving Average (SHMMA):

A SHMMA is calculated to identify the trend and generate buy or sell signals based on the price’s position relative to this modified average.

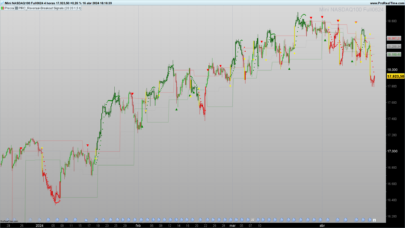

Trading Strategy

Entry and Exit Conditions:

The system defines specific conditions for buy (longCond) and sell (shortCond) signals, based on the crossing of dynamically calculated support and resistance lines.

Pyramiding:

Allows controlling the accumulation of positions under certain conditions, limiting the number of consecutive entries without an exit.

Risk Management:

Incorporates options to define a Take Profit (TP) and Stop Loss (SL) as a percentage of the entry price, allowing traders to secure profits and limit losses.

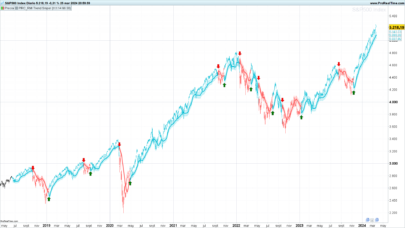

Climax Indicators and Market Condition

Climax Analysis:

Uses various conditions based on price analysis to classify bars into categories like climax up/down. This helps to identify the strength behind price movements and potentially predict trend changes.

Trend Conditions:

The script assesses the current market trend to adjust entry and exit strategies, as well as to optimize the placement of TP and SL orders.

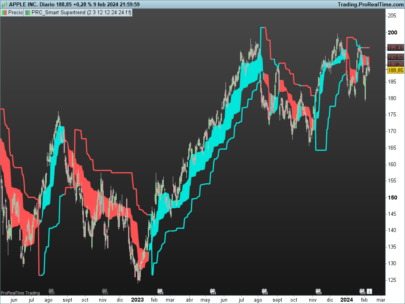

Alerts and Signals

Offers the ability to generate conditional alerts for buy and sell signals, as well as for reaching TP and SL targets. This allows traders to be informed of critical moments to make decisions.

Customization and Configuration

Customizable Inputs:

Allows users to adjust various parameters, such as the length of support/resistance, the length of the SHMMA, the brick size for ATR or traditional values, and the sensitivity of entry and exit conditions.

Visualization and Overlay:

Provides options to visualize or hide certain elements on the chart, enabling users to focus on the most relevant information for their trading strategy.

This script represents a complex and customizable tool for traders looking for strategies based on dynamic support/resistance, trend and price analysis, with a focus on risk management through TP and SL. The flexibility in settings allows adapting the system to different trading styles and individual preferences.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 290 291 292 293 294 295 296 297 298 299 300 301 302 303 304 305 306 307 308 309 310 311 312 313 314 315 316 317 318 319 320 321 322 323 324 325 326 327 328 329 330 331 332 333 334 335 336 337 338 339 340 341 342 343 344 345 346 347 348 349 350 351 352 353 354 355 356 357 358 359 360 |

//PRC_BOXES TRAIL //version = 0 //26.02.24 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge ////////////////////////////////////////////////// //inputs length1 = 20 //Support / Resistance length barlength = 20 //Bar length length = 14 //Length src = customclose //Source mode = 0 //ATR or Traditional modevalue = 14 showoverlay=0//Boolean use2bars=0//Boolean lookback=100 isTPl = 1 //Boolean // take profit long isTPs = 1 //Boolean // take profit short tp = 2 //% take profit isSLl = 1 //Boolean // stop loss long isSLs = 1 //Boolean // stop loss short sl = 3 //% stop loss ////// ////Resistance lines if high>=highest[length1](high) then t1 = 0 top1 = high else top1 = top1 t1 = t1+1 drawsegment(barindex - t1,top1,barindex,top1)coloured("black") endif ////Support lines if low<=lowest[length1](low) then b1 = 0 bot1 = low else bot1 = bot1 b1 = b1+1 drawsegment(barindex - b1,bot1,barindex,bot1)coloured("green") endif ///// factor = 0 slope = 0 for i=1 to length do factor = 1+2*(i-1) slope = slope + (src[i-1])*(length-factor)/2 next shmma = average[length](src)+6*slope/((length+1)*length) if shmma >= highest[barlength](shmma) then top2 = shmma t2 = 0 else top2 = top2 t2 = t2+1 drawsegment(barindex-t2,top2,barindex,top2)coloured("red") endif if shmma <= lowest[barlength](shmma) then bot2 = shmma b2 = 0 else bot2 = bot2 b2 = b2+1 drawsegment(barindex-b2,bot2,barindex,bot2)coloured("lime") endif ////bricksize if mode then bricksize = averagetruerange[round(modevalue)] else bricksize = modevalue endif //// if barindex < 2 then propen = 0 ropen = 0 rclose = 0 else propen = ropen[1] if close > propen+bricksize or high > propen+bricksize then ropen = propen+bricksize elsif close < propen-bricksize or low < propen-bricksize then ropen = propen-bricksize else ropen = propen endif if ropen > propen then rclose = ropen-bricksize elsif ropen < propen then rclose = ropen+bricksize else rclose = rclose[1] endif if ropen > propen then direction = 1 r=0 g=255 b=0 elsif ropen < propen then direction = -1 r=120 g=0 b=0 else direction = direction[1] endif if showoverlay then drawtext("✚",barindex,ropen)coloured(r,g,b) drawtext("•",barindex,rclose)coloured("gray") endif endif /////////// range1=high-low+0.000000001 range2=highest[2](high)-lowest[2](low)+0.000000001 if close > open and range1<>0 then value1=(range1/(2*range1+open-close))*close elsif close < open and range1<>0 then value1=((range1+close-open)/(2*range1+close-open))*close elsif close=open then value1=close else value1 = value1 endif value2=close-value1 ///using only one bar value3 = abs(value1+value2) value4 = value1*range1 value5 = (value1-value2)*range1 value6 = value2*range1 value7 = (value2-value1)*range1 value8 = value1/range1 value9 = (value1-value2)/range1 value10 = value2/range1 value11 = (value2-value1)/range1 value12 = value3/range1 // Using two bars if use2bars then value13 = value3+value3[1] value14 = (value1+value1[1])*range2 value15 = (value1+value1[1]-value2-value2[1])*range2 value16 = (value2+value2[1])*range2 value17 = (value2+value2[1]-value1-value1[1])*range2 value18 = (value1+value1[1])/range2 value19 = (value1+value1[1]-value2-value2[1])/range2 value20 = (value2+value2[1])/range2 value21 = (value2+value2[1]-value1-value1[1])/range2 value22 = value13/range2 endif // one bar conditions condition1 = value3 = lowest[lookback](value3) condition2 = value4 = highest[lookback](value4) and close > open condition3 = value5 = highest[lookback](value5) and close > open condition4 = value6 = highest[lookback](value6) and close < open condition5 = value7 = highest[lookback](value7) and close < open condition6 = value8 =lowest[lookback](value8) and close < open condition7 = value9 =lowest[lookback](value9) and close < open condition8 = value10 =lowest[lookback](value10) and close > open condition9 = value11 =lowest[lookback](value11) and close > open condition10 = value12 =highest[lookback](value12) // two bar conditions condition11 = use2bars and value13 = lowest[lookback](value13) condition12 = use2bars and value14 =highest[lookback](value14) and close > open and close[1] > open[1] condition13 = use2bars and value15 =highest[lookback](value15) and close > open and close[1] > open[1] condition14 = use2bars and value16 =highest[lookback](value16) and close < open and close[1] < open[1] condition15 = use2bars and value17 =highest[lookback](value17) and close < open and close[1] < open[1] condition16 = use2bars and value18 =lowest[lookback](value18) and close < open and close[1] < open[1] condition17 = use2bars and value19 =lowest[lookback](value19) and close < open and close[1] < open[1] condition18 = use2bars and value20 =lowest[lookback](value20) and close > open and close[1] > open[1] condition19 = use2bars and value21 =lowest[lookback](value21) and close > open and close[1] > open[1] condition20 = use2bars and value22 =highest[lookback](value22) //Classifying the bars using one bar conditions, or using both one bar and two bar conditions simultaneosly if "use2bars" button selected. lowvolume = (condition1 or condition11) climaxupvolume = (condition2 or condition3 or condition8 or condition9 or condition12 or condition13 or condition18 or condition19) climaxdownvolume = (condition4 or condition5 or condition6 or condition7 or condition14 or condition15 or condition16 or condition17) churnvolume = (condition10 or condition20) climaxchurnvolume = (condition10 or condition20) and (condition2 or condition3 or condition4 or condition5 or condition6 or condition7 or condition8 or condition9 or condition12 or condition13 or condition14 or condition15 or condition16 or condition17 or condition18 or condition19) if barindex<2 then trend=1 supplyline=high supportline=low elsif close>supplyline[1] then trend=1 elsif close<supportline[1] then trend=-1 else trend=trend[1] endif if trend=1 then if climaxdownvolume then supplyline=highest[2](high) elsif high>supplyline[1] then supplyline=high else supplyline=supplyline[1] endif else if climaxdownvolume then supplyline=highest[2](high) else supplyline=supplyline[1] endif endif if trend=-1 then if climaxupvolume then supportline=lowest[2](low) elsif low < supportline[1] then supportline=low else supportline=supportline[1] endif else if climaxupvolume then supportline=lowest[2](low) else supportline=supportline[1] endif endif if trend=-1 then trailing2 = supportline else trailing2 = supplyline endif if trend=1 then trailing1 = supportline else trailing1 = supplyline endif longcond = trailing2 crosses over trailing1 shortcond = trailing2 crosses under trailing1 if barindex < 2 then sectionlongs=0 sectionshorts=0 else if longcond then sectionlongs=sectionlongs+1 sectionshorts=0 elsif shortcond then sectionlongs=0 sectionshorts=sectionshorts+1 endif endif // Pyramiding pyrl = 1 // These check to see your signal and cross references it against the pyramiding settings above // These check to see your signal and cross references it against the pyramiding settings above longCondition = longCond and sectionLongs <= pyrl shortCondition = shortCond and sectionShorts <= pyrl if barindex < 2 then lastopenlongCondition=0 lastopenshortCondition=0 lastlongCondition = 0 lastshortCondition = 0 else // Get the price of the last opened long or short if longCondition then lastopenlongCondition = open else lastopenlongCondition = lastopenlongCondition[1] endif if shortCondition then lastopenshortCondition = open else lastopenshortCondition = lastopenshortCondition[1] endif // Check if your last postion was a long or a short if longCondition then lastlongCondition = barindex else lastlongCondition = lastlongCondition[1] endif if shortCondition then lastshortCondition = barindex else lastshortCondition = lastshortCondition[1] endif endif inlongcondition = lastlongcondition > lastshortcondition inshortcondition = lastlongcondition < lastshortcondition // Take profit longTP = isTPl and high crosses over (1+(tp/100))*lastopenlongCondition and longcondition = 0 and inlongcondition shortTP = isTPs and low crosses under (1-(tp/100))*lastopenshortCondition and shortcondition = 0 and inshortcondition // Stop Loss longSL = isSLl and low crosses under (1-(sl/100))*lastopenlongCondition and longcondition = 0 and inlongcondition shortSL = isSLs and high crosses over (1+(sl/100))*lastopenshortCondition and shortcondition = 0 and inshortcondition // Create a single close for all the different closing conditions. if barindex < 2 then lastlongClose = 0 lastshortClose = 0 else if longTP or longSL then longclose = 1 lastlongclose = barindex else longclose = 0 lastlongclose = lastlongclose[1] endif if shortTP or shortSL then shortclose = 1 lastshortclose = barindex else shortclose = 0 lastshortclose = lastshortclose[1] endif endif // Signals if longcondition then drawarrowup(barindex,low-0.15*averagetruerange[10](close))coloured("green") elsif shortcondition then drawarrowdown(barindex,high+0.15*averagetruerange[10](close))coloured("red") endif if longTP and lastlongCondition>lastlongclose[1] then drawtext("TPlg",barindex,high+0.15*averagetruerange[10](close))coloured("red") drawpoint(barindex,(1+(tp/100))*lastopenlongcondition,2)coloured("white") elsif shortTP and lastshortCondition>lastshortclose[1] then drawtext("TPsh",barindex,low-0.15*averagetruerange[10](close))coloured("green") drawpoint(barindex,(1-(tp/100))*lastopenshortcondition,2)coloured("white") elsif longSL and lastlongcondition>lastlongclose[1] then drawtext("SLlg",barindex,high+0.15*averagetruerange[10](close))coloured("red") drawpoint(barindex,(1-(sl/100))*lastopenlongcondition,2)coloured("white") elsif shortSL and lastshortcondition>lastshortclose[1] then drawtext("SLsh",barindex,low-0.15*averagetruerange[10](close))coloured("green") drawpoint(barindex,(1+(sl/100))*lastopenshortcondition,2)coloured("white") endif return |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hallo Ivan, vielen Dank für diesen sehr schönen Indikator. Könnte man den Code ändern, so das man auf das Kauf- und Verkaufssignal ein Alarm setzen kann um schnell in ein Trade zu gehen. Gruß und Danke im Voraus

Norbert

I’ve created a screener to show [longcondition or shortcondition]

Hi

You should delete from the indicator code all drawing functions and all variables not used for screener calculations.

//PRC_BOXES TRAIL

//version = 0

//26.02.24

//Iván González @ http://www.prorealcode.com

//Sharing ProRealTime knowledge

//////////////////////////////////////////////////

//inputs

length1 = 20 //Support / Resistance length

barlength = 20 //Bar length

length = 14 //Length

src = customclose //Source

mode = 0 //ATR or Traditional

modevalue = 14

use2bars=0//Boolean

lookback=100

////Resistance lines

if high>=highest[length1](high) then

t1 = 0

top1 = high

else

top1 = top1

t1 = t1+1

endif

////Support lines

if low<=lowest[length1](low) then

b1 = 0

bot1 = low

else

bot1 = bot1

b1 = b1+1

endif

/////

factor = 0

slope = 0

for i=1 to length do

factor = 1+2*(i-1)

slope = slope + (src[i-1])*(length-factor)/2

next

shmma = average[length](src)+6*slope/((length+1)*length)

if shmma >= highest[barlength](shmma) then

top2 = shmma

t2 = 0

else

top2 = top2

t2 = t2+1

endif

if shmma <= lowest[barlength](shmma) then

bot2 = shmma

b2 = 0

else

bot2 = bot2

b2 = b2+1

endif

////bricksize

if mode then

bricksize = averagetruerange[round(modevalue)]

else

bricksize = modevalue

endif

////

if barindex < 2 then

propen = 0

ropen = 0

rclose = 0

else

propen = ropen[1]

if close > propen+bricksize or high > propen+bricksize then

ropen = propen+bricksize

elsif close < propen-bricksize or low < propen-bricksize then

ropen = propen-bricksize

else

ropen = propen

endif

if ropen > propen then

rclose = ropen-bricksize

elsif ropen < propen then

rclose = ropen+bricksize

else

rclose = rclose[1]

endif

if ropen > propen then

direction = 1

elsif ropen < propen then

direction = -1

else

direction = direction[1]

endif

endif

///////////

range1=high-low+0.000000001

range2=highest[2](high)-lowest[2](low)+0.000000001

if close > open and range1<>0 then

value1=(range1/(2*range1+open-close))*close

elsif close < open and range1<>0 then

value1=((range1+close-open)/(2*range1+close-open))*close

elsif close=open then

value1=close

else

value1 = value1

endif

value2=close-value1

///using only one bar

value4 = value1*range1

value5 = (value1-value2)*range1

value6 = value2*range1

value7 = (value2-value1)*range1

value8 = value1/range1

value9 = (value1-value2)/range1

value10 = value2/range1

value11 = (value2-value1)/range1

// Using two bars

if use2bars then

value14 = (value1+value1[1])*range2

value15 = (value1+value1[1]-value2-value2[1])*range2

value16 = (value2+value2[1])*range2

value17 = (value2+value2[1]-value1-value1[1])*range2

value18 = (value1+value1[1])/range2

value19 = (value1+value1[1]-value2-value2[1])/range2

value20 = (value2+value2[1])/range2

value21 = (value2+value2[1]-value1-value1[1])/range2

endif

// one bar conditions

condition2 = value4 = highest[lookback](value4) and close > open

condition3 = value5 = highest[lookback](value5) and close > open

condition4 = value6 = highest[lookback](value6) and close < open

condition5 = value7 = highest[lookback](value7) and close < open

condition6 = value8 =lowest[lookback](value8) and close < open

condition7 = value9 =lowest[lookback](value9) and close < open

condition8 = value10 =lowest[lookback](value10) and close > open

condition9 = value11 =lowest[lookback](value11) and close > open

// two bar conditions

condition12 = use2bars and value14 =highest[lookback](value14) and close > open and close[1] > open[1]

condition13 = use2bars and value15 =highest[lookback](value15) and close > open and close[1] > open[1]

condition14 = use2bars and value16 =highest[lookback](value16) and close < open and close[1] < open[1]

condition15 = use2bars and value17 =highest[lookback](value17) and close < open and close[1] < open[1]

condition16 = use2bars and value18 =lowest[lookback](value18) and close < open and close[1] < open[1]

condition17 = use2bars and value19 =lowest[lookback](value19) and close < open and close[1] < open[1]

condition18 = use2bars and value20 =lowest[lookback](value20) and close > open and close[1] > open[1]

condition19 = use2bars and value21 =lowest[lookback](value21) and close > open and close[1] > open[1]

//Classifying the bars using one bar conditions, or using both one bar and two bar conditions simultaneosly if “use2bars” button selected.

climaxupvolume = (condition2 or condition3 or condition8 or condition9 or condition12 or condition13 or condition18 or condition19)

climaxdownvolume = (condition4 or condition5 or condition6 or condition7 or condition14 or condition15 or condition16 or condition17)

if barindex<2 then

trend=1

supplyline=high

supportline=low

elsif close>supplyline[1] then

trend=1

elsif close<supportline[1] then

trend=-1

else

trend=trend[1]

endif

if trend=1 then

if climaxdownvolume then

supplyline=highest[2](high)

elsif high>supplyline[1] then

supplyline=high

else

supplyline=supplyline[1]

endif

else

if climaxdownvolume then

supplyline=highest[2](high)

else

supplyline=supplyline[1]

endif

endif

if trend=-1 then

if climaxupvolume then

supportline=lowest[2](low)

elsif low < supportline[1] then

supportline=low

else

supportline=supportline[1]

endif

else

if climaxupvolume then

supportline=lowest[2](low)

else

supportline=supportline[1]

endif

endif

if trend=-1 then

trailing2 = supportline

else

trailing2 = supplyline

endif

if trend=1 then

trailing1 = supportline

else

trailing1 = supplyline

endif

longcond = trailing2 crosses over trailing1

shortcond = trailing2 crosses under trailing1

if barindex < 2 then

sectionlongs=0

sectionshorts=0

else

if longcond then

sectionlongs=sectionlongs+1

sectionshorts=0

elsif shortcond then

sectionlongs=0

sectionshorts=sectionshorts+1

endif

endif

// Pyramiding

pyrl = 1

// These check to see your signal and cross references it against the pyramiding settings above

// These check to see your signal and cross references it against the pyramiding settings above

longCondition = longCond and sectionLongs <= pyrl

shortCondition = shortCond and sectionShorts <= pyrl

if barindex < 2 then

lastopenlongCondition=0

lastopenshortCondition=0

lastlongCondition = 0

lastshortCondition = 0

else

// Get the price of the last opened long or short

if longCondition then

lastopenlongCondition = open

else

lastopenlongCondition = lastopenlongCondition[1]

endif

if shortCondition then

lastopenshortCondition = open

else

lastopenshortCondition = lastopenshortCondition[1]

endif

// Check if your last postion was a long or a short

if longCondition then

lastlongCondition = barindex

else

lastlongCondition = lastlongCondition[1]

endif

if shortCondition then

lastshortCondition = barindex

else

lastshortCondition = lastshortCondition[1]

endif

endif

screener[longcondition or shortcondition]

Hallo Ivan, Danke das ist Perfekt !! Kannst du bitte in der Screener-Bibliothek die itf. hochladen und was meinst du mit : ( Sie sollten aus dem Indikatorcode alle Zeichenfunktionen und alle Variablen löschen ) Läuft der Screener nicht unabhängig vom Indikator ??