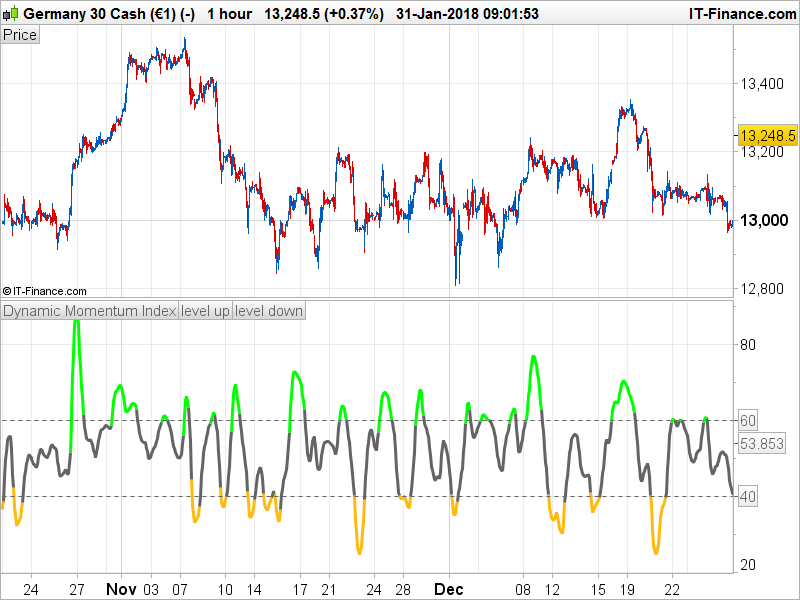

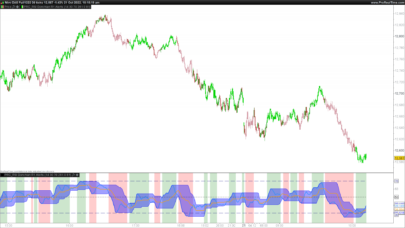

An indicator used in technical analysis that determines the overbought and oversold conditions of a particular asset. This indicator is very similar to the Relative Strength Index (RSI). The main difference between the two is that the RSI uses a fixed number of time periods (usually 14), while the Dynamic Momentum Index uses different time periods as volatility changes.

This indicator is interpreted in the same manner as the RSI where the readings below 30 are deemed to be oversold and more than 70 levels are deemed to be overbought. The number of time periods used in the dynamic momentum index decreases as the volatility of the underlying asset increases, making this indicator more sensitive to price changes than the RSI. This version has an additional smoothing in an RSX usage form for calculating the original RSI pitch. It has been added to make it a little more readable. The DMI Chande is less smooth than this original version and can raise more false signals. Using the RSX instead of RSI not add any lag at all, so we can say that using an RSX instead of RSI could be classified as “1% improvement” rule – which is sure it not be worse than the original Chande’s DMI.

(description found on internet). Indicator translated from Metatrader5 version by a request in forum.

Settings explanation:

_ MAStdDevMode : moving average type for smoothing the ATR value used to get the volatility of the current instrument

_ DmiLowerLimit & DmiUpperLimit : bounds for DMI periods (DMI calculated period can’t be less or more than these 2 limits)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 |

//PRC_DMI of RSX | indicator //31.01.18 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //translated from MT5 code //https://www.prorealcode.com/topic/tushar-chandes-dmi-conversion-code-mq5-to-prorealtime/ // --- settings StdDevPeriod = 5 // Period of Standard Deviation MAStdDevPeriod = 8 // Period of smoothing MAStdDevMode = 0 // Mode of smoothing MA DMIPeriod = 15 // Dynamic Momentum Index Period DmiLowerLimit = 10 // Dynamic Periods Lower Bound DmiUpperLimit = 50 // Dynamic Periods Upper Bound LevelUp = 60 // Lower level LevelDown = 40 // Upper level // --- end of settings if barindex>DMIperiod then SD = STD[StdDevPeriod](customclose) ASD = Average[MAStdDevPeriod,MAStdDevMode](SD) RSIterm = max(1,ROUND(DMIPeriod / (SD/ASD))) RSIterm = Max(Min(RSIterm,DmiUpperLimit),DmiLowerLimit) //RSI calculation plus = summation[max(1,round(RSIterm))](customclose-customclose[1]>0) minus = summation[max(1,round(RSIterm))](customclose-customclose[1]<0) //plus pow = 1 per = RSIterm if barindex>per then beta = 0.45*(per-1)/(0.45*(per-1)+2) if pow=1 then alpha = beta elsif pow=2 then alpha = beta*beta elsif pow=3 then alpha = beta*beta*beta elsif pow=4 then alpha = beta*beta*beta*beta elsif pow=5 then alpha = beta*beta*beta*beta*beta else alpha = beta endif tmp0 = (1-alpha)*plus + alpha*tmp0[1] tmp1 = (plus - tmp0[0])*(1-beta) + beta*tmp1[1] tmp2 = tmp0[0] + tmp1[0] tmp3 = (tmp2[0] - tmp4[1])*((1-alpha)*(1-alpha)) + (alpha*alpha)*tmp3[1] tmp4 = tmp4[1] + tmp3[0] avgplus = tmp4 ftmp0 = (1-alpha)*minus + alpha*ftmp0[1] ftmp1 = (minus - ftmp0[0])*(1-beta) + beta*ftmp1[1] ftmp2 = ftmp0[0] + ftmp1[0] ftmp3 = (ftmp2[0] - ftmp4[1])*((1-alpha)*(1-alpha)) + (alpha*alpha)*ftmp3[1] ftmp4 = ftmp4[1] + ftmp3[0] avgminus = ftmp4 endif RS = avgplus/avgminus DMIRSX = 100 - 100 / ( 1 + RS ) r=100 g=100 b=100 if DMIRSX>LevelUp then r=0 g=255 b=0 elsif DMIRSX<LevelDown then r=255 g=185 b=15 endif endif return DMIRSX coloured(r,g,b) style(line,3) as "Dynamic Momentum Index", levelup coloured(100,100,100) style(dottedline) as "level up", leveldown coloured(100,100,100) style(dottedline) as "level down" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour, merci pour l’indicateur, j’utilise un RSI de 7 période, sur du 1 min, est’il possible de changer sa base de période ? si oui comment faire ? merci encore j’avais pas pensé que le RSI pouvait avoir du retard !

Changer la base de périodes du RSI original ? Le RSI a du “retard” puisqu’il est toujours nécessaire d’évaluer le terrain (et donc de regarder le passé) pour donner l’information sur la bougie courante.

merci, je voulais savoir quel paramètre il faut modifier sur votre indicateur pour le modifier sur la période 7 de votre indicateur

Cet indicateur est dynamique, il n’utilise pas de période fixe

Bonjour Nicolas,

Lorsque j’importe l’indicateur via l’itf et que je l’attache au graphique, il apparait ce message “Erreur dans l’indicateur : PRC_DMI of RSX (5 8 0 15 10 50 60 40) — Un parametre de type entier positif est attendu avec SUMMATION”.

Pourrais-tu m’eclairer à ce sujet stp ?

Je suis sur la v11 de prt.

Merci à toi,

Cordialement,

Romain

Dans ce cas, il faut changer les lignes qui comportent l’instruction SUMMATION comme ceci: summation[max(1,RSIterm)]

Bonjour Nicolas, je suis desolé mais cela ne fonctionne toujours pas …

Merci de ton retour

Hello Nicholas

Is it possible to attach a revised code?

I tried to change according to your instructions but the indicator is not working yet.

Thanks in advance for your help

Alex

PFA below a revised version:

//PRC_DMI of RSX | indicator

//31.01.18

//Nicolas @ http://www.prorealcode.com

//Sharing ProRealTime knowledge

//translated from MT5 code

//https://www.prorealcode.com/topic/tushar-chandes-dmi-conversion-code-mq5-to-prorealtime/

// — settings

StdDevPeriod = 5 // Period of Standard Deviation

MAStdDevPeriod = 8 // Period of smoothing

MAStdDevMode = 0 // Mode of smoothing MA

DMIPeriod = 15 // Dynamic Momentum Index Period

DmiLowerLimit = 10 // Dynamic Periods Lower Bound

DmiUpperLimit = 50 // Dynamic Periods Upper Bound

LevelUp = 60 // Lower level

LevelDown = 40 // Upper level

// — end of settings

if barindex>DMIperiod then

SD = STD[StdDevPeriod](customclose)

ASD = Average[MAStdDevPeriod,MAStdDevMode](SD)

RSIterm = max(1,ROUND(DMIPeriod / (SD/ASD)))

RSIterm = Max(Min(RSIterm,DmiUpperLimit),DmiLowerLimit)

//RSI calculation

plus = summation[max(1,round(RSIterm))](customclose-customclose[1]>0)

minus = summation[max(1,round(RSIterm))](customclose-customclose[1]per then

beta = 0.45*(per-1)/(0.45*(per-1)+2)

if pow=1 then

alpha = beta

elsif pow=2 then

alpha = beta*beta

elsif pow=3 then

alpha = beta*beta*beta

elsif pow=4 then

alpha = beta*beta*beta*beta

elsif pow=5 then

alpha = beta*beta*beta*beta*beta

else

alpha = beta

endif

tmp0 = (1-alpha)*plus + alpha*tmp0[1]

tmp1 = (plus – tmp0[0])*(1-beta) + beta*tmp1[1]

tmp2 = tmp0[0] + tmp1[0]

tmp3 = (tmp2[0] – tmp4[1])*((1-alpha)*(1-alpha)) + (alpha*alpha)*tmp3[1]

tmp4 = tmp4[1] + tmp3[0]

avgplus = tmp4

ftmp0 = (1-alpha)*minus + alpha*ftmp0[1]

ftmp1 = (minus – ftmp0[0])*(1-beta) + beta*ftmp1[1]

ftmp2 = ftmp0[0] + ftmp1[0]

ftmp3 = (ftmp2[0] – ftmp4[1])*((1-alpha)*(1-alpha)) + (alpha*alpha)*ftmp3[1]

ftmp4 = ftmp4[1] + ftmp3[0]

avgminus = ftmp4

endif

RS = avgplus/avgminus

DMIRSX = 100 – 100 / ( 1 + RS )

r=100

g=100

b=100

if DMIRSX>LevelUp then

r=0

g=255

b=0

elsif DMIRSX<LevelDown then

r=255

g=185

b=15

endif

endif

return DMIRSX coloured(r,g,b) style(line,3) as "Dynamic Momentum Index", levelup coloured(100,100,100) style(dottedline) as "level up", leveldown coloured(100,100,100) style(dottedline) as "level down"

Thanks Nicolas

Still a problem in line 29

Please take a look.

thanks again

Alex

code is modified in the above post, use that one.

Still a problem in line 29

Please take a look.

thanks again

Alex