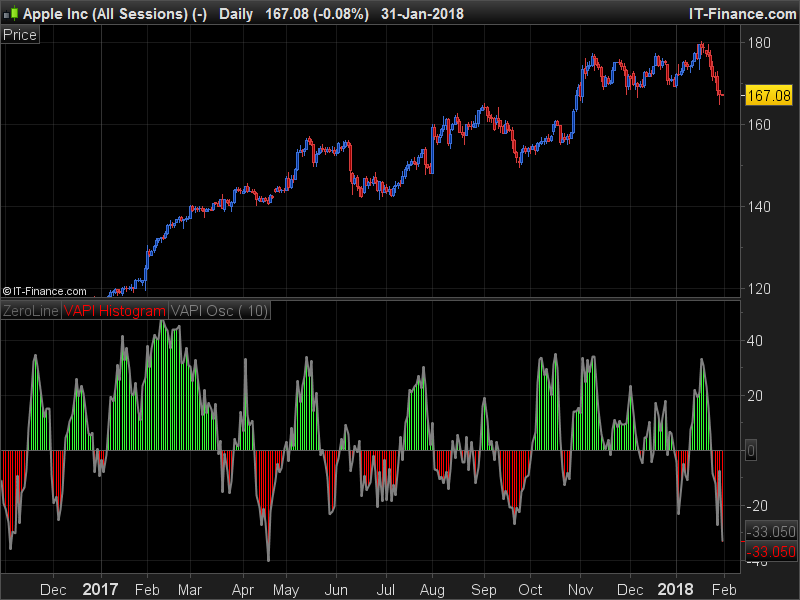

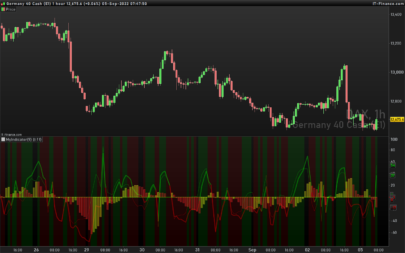

Volume Accumulation Percentage Indicator (VAPI) is a variation of the classic volume-accumulation indicators. It uses volume the same way as OBV except that it assigns volume weights based on intraday volatility .

In a positive trend, if the stock price is close to a (local) new high, the VAPI should be at its maximum as well (and vice versa for a negative trend). If the market is looking for a direction, if the price is in the bottom side of his current trading range and if, at the same moment the VAPI osc slopes up, there is accumulation on the stock and that the prices should start to climb. The SELL signal is given when the VAPI decreases (distribution). Divergences are usually very effective too.

(description from its original author LazyBear, code original from tradingview platform).

Translated by a request in the Italian ProRealTime’s indicators section.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 |

//PRC_VolumeAccumPercent VAPI | indicator //31.01.18 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //translated from tradingview code //original author: LazyBear // --- settings length=10 // --- x=(2*close-high-low)/(high-low) tva=summation[length](volume*x) tv=summation[length](volume) va=100*tva/tv r=50 g=255 b=50 if va<0 then r=255 g=0 b=0 endif return 0 coloured(100,100,100) as "ZeroLine", va coloured(r,g,b) style(histogram,1) as "VAPI Histogram", va coloured(128,128,128) style(line,2) as "VAPI Osc" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hola Nicolas, a ver si me puedes ayudar. Hay un indicador que se llama volumen stop de bolsatrilera que esta aqui en prorealcode.Este indicador da buenas señales.El indicador pinta la vela en azul cuando es alcista y en negro cuando es bajista.Yo necesitaria un proescreener que detecte las acciones que han pintado la vela azul, alcista.Gracias de antemano y un saludo.

Utilice los foros para hacer preguntas no relacionadas con la página actual …