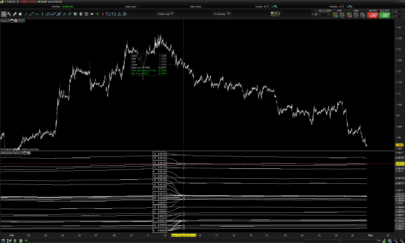

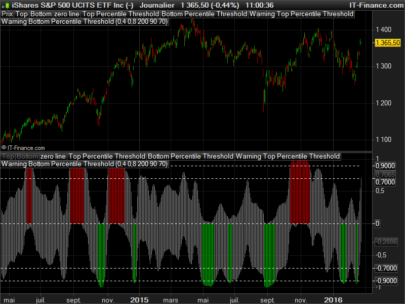

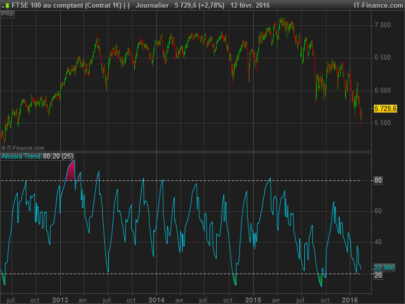

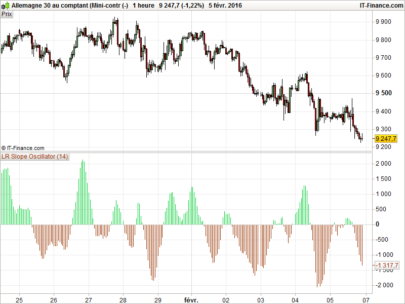

The field “Trend Force” indicates the strength of the current bullish/bearish trend. The more strong the trend is, the more significant the reversal will be.

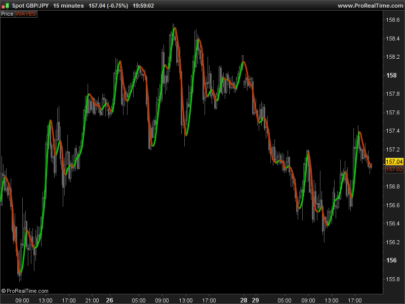

This indicator has been developed with the help of ProRealTime to regroup in the same indicator both bullish and bearish trends.

|

1 2 3 4 5 6 7 8 |

REM Determines strength of bullish trend BullTrend = (CLOSE - LOWEST[20](LOW)) / AVERAGETRUERANGE[10] REM Determines strength of bearish trend BearTrend = (HIGHEST[20](HIGH) - CLOSE) / AVERAGETRUERANGE[10] RETURN BullTrend AS"BullTrend", -BearTrend AS"BearTrend" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Lolo.

If you put on the graph only the difference between both values, the result is much clearer:

REM Determines strength of bullish trend

BullTrend = (CLOSE - LOWEST[20](LOW)) / AVERAGETRUERANGE[10]

REM Determines strength of bearish trend

BearTrend = (HIGHEST[20](HIGH) - CLOSE) / AVERAGETRUERANGE[10]

dif=BullTrend-BearTrend

RETURN dif AS \"Difference\", 0 AS \"Zero\"

Trend Force with Background Color

// — property setting

//Alpha = 40 // Transparency backgroundcolor

// — end

// Determines strength of bullish trend

BullTrend = (close – lowest[20](low)) / averagetruerange[10]

// Determines strength of bearish trend

BearTrend = (highest[20](high) – close) / averagetruerange[10]

// Add Background Color in green if BullTrend Market or red if BearTrend Market

if BullTrend > BearTrend then

BackgroundColor(0,135,0,alpha) // green color

else

BackgroundColor(157,0,0,alpha) // red color

endif

return BullTrend coloured by BullTrend style(histogram,1) as “▲ Bull”, -BearTrend coloured by BearTrend style(histogram,1) as “▼ Bear”