@traderfred: all algos are implemented .. see this post

I tried gasoline (RB) .. but since we have a small history until 2007, I get only 5 trades out of it.

The algo looks curve fitted, but very nice gains.

I added it to a /highroller directory in the dropbox.

wp01

wp01Participant

Master

@Pfeiler,

If i load the Coffee BT for May 1 i have the data from 1976. Yours is from 1995.

The results between these years show a huge DD and also looks like a high roller.

I’m not sure if we can rely on this information so long a go, but i just want you and others to know.

Kind regards,

Patrick

Platin algo opened another position:

| A2 |

27.04.2017 |

|

|

|

Platin ($10 Mini) |

1 |

953,00 |

@Patrick: Thanks for pointing out the high DD in the coffee algo. Be careful with this algo, since it has a high DD in 1995.

For me personally, good results for the last 20 years are ok. Its nice when the algo also works for the time before, but I also rule out weird incidents that happened before to make the algo working.

Definitly curve fitted, so please, handle with care.

I pointed this out in the remarks column of the Comparison sheet.

Hope this helps for your decision to trade or not.

I had a thought about SB… Min contract size for SB is 5, but the code says pos size 1 but multiplied by 7 with max size 15. Is that correct?

Best regards, David

US Dollar basket looks like a perfect candidate for may: http://www.seasonalcharts.com/classic_usdindex.html

But can’t get good numbers from it. I’ll save it under backup.

@David: Jep, I started with May1 = 5 to always have the min.size, but with May1 = 7 the result are better. It pyramides 3 times to 14, so max.size should be 15 (or 14).

Gold algo opened a position:

| A2 |

28.04.2017 |

|

|

|

Spot Gold (E1 Contract) |

10 |

1.264,50 |

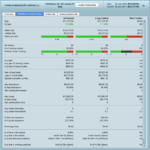

Period APRIL2 is almost over, no more trades will be triggered. Time for a quick sum-up for the month April.

A lot of trades have been issued and closed in April. Unfortunately I got cold feed, after market had a little crash after UK announced earlier elections, and closed some trades manually at the lowerst point possible. *autsch*

My thinking has been: I was in the market with an underlying of 400k€ (with PF 4H trades) and had only 20k€ cash. This was ridiciously underfinanced and two more days like 18.04. would have kicked me out the race with a huge loss. So I sold out to get to 150k€ underlying, and fortunately this kept me in the profits at the end of the month. Not so bad, avoiding the huge risk that was in the market. But of course, if you stayed in it (maybe you got more cash), this was your golden month.

Please keep in mind with what real values we are trading in the market, and the risk that comes with it. My max. underlying in the future will be 10x my capitalization, so 10x20k€=200k€.

I will not trigger further trades above this line. I hope this is enough to avoid that that horrendious “margin call”.

So, all trades that closed in April made me a sum of 914€, could have been more, but also could have been a lot less. So I am fine with it.

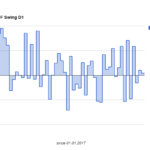

The overall results of all PF-Swing trades sums up to 6051€ .

Hi guys,

Hope you are all well. Greetings to all especially to pfeiler, Patrick and David the backbone of this thread.

The first 4 Month of the year are behind us and it’s time to check how profitable and reliable are the Pathfinder swing trade signals in life.

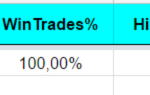

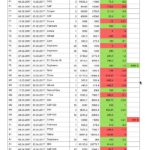

- we had so far 56 trades in the first 4 month, 40 winners and 16 losers, that means 71,4% profitable life trades

- 14.840 Euro!!! profit before fees when you traded all signals automatically

- best month so far was January with 5.448 Euro profit, the worst was March with -191 Euro

- best trade was the F1 cooper trade with 3.114 Euro profit, the worst trade was the M1 gold trade with -706 Euro loss

In my experience the best times for Pathfinders swing idea are from October until April. For that reason the equity curve will probably flatten now from May until mid of September.

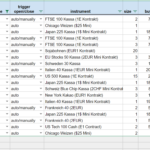

Please find attached the list of all trades.

Good trades and best regards,

Reiner

wp01

wp01Participant

Master

@Pfeiler,

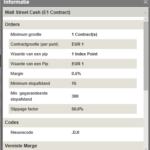

Minor detail but regarding the Wall Street 1 EURO the Excel shows a minimum amount of 2 contracts.

In the code for M1 is also 2 positions used, but according to my information the minimum is just 1 contract.

See picture attached.

Kind regards,

Patrick

wp01

wp01Participant

Master

The contract for trading the US Dollar Basket (EUR1) is only available in ProRealtime and not in IG.

In IG you only see futures.

If someone activated the code for May1 it will not be triggerd when there is a signal.

I’ve sett IG an email and ask them to add the 1EUR contract for future trading.

Patrick

I just came to install the algos for MAY1 this morning, I hope I haven’t missed a trade.

I will not trade RB, DX, DOW and MIB for various reasons .. please check the remarks column in the comparison or the attachment.

CAC will have a very close look, because of the election.

RB is very tempting but by changing only small numbers in the algo, huge losses occur. Please don’t trade it!

As Reiner pointed out, the following periods are the times to maximize risk reduction.

By checking the Roadmap on the first page, I guess JULY1 will be more rewarding on a broader scale.

If you are looking for a kick inbetween have a look at the ethereum goldrush: https://cryptowat.ch/kraken/etheur/1d

The gains are crazy and far from over (Gnosis Tokens on Kraken at 17:09:49 UTC).

FYI, i will stop all my open trades on friday evening, even if there is an huge DD, in order to avoid a bad surprise on monday..just my french point of view 🙂