Hi guys,

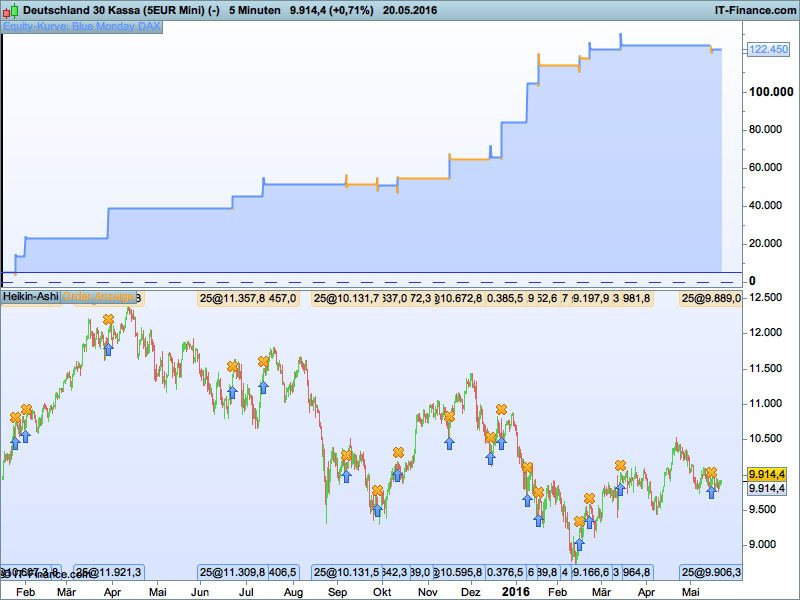

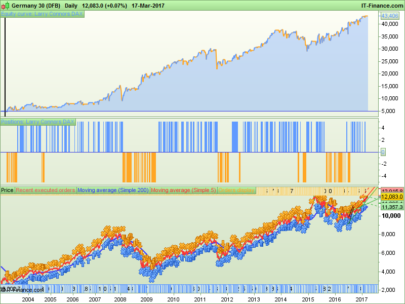

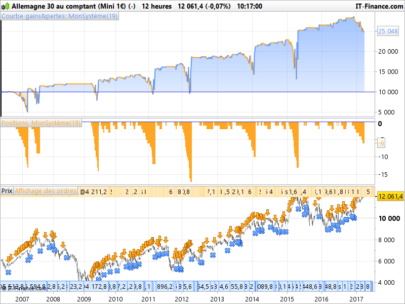

here is another DAX trading idea. It is very simple and generates only few trades but it seems very profitable if it happens.

Have fun

Reiner

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 |

// Blue Monday DAX // Code-Parameter DEFPARAM FlatAfter = 095500 // trading window ONCE BuyTime = 85500 ONCE SellTime = 95500 ONCE CloseDiff = 50 ONCE PositionSize = 25 ONCE sl = 50 // Long all in, if it's Monday and the market is 50 points higher IF Not LongOnMarket AND Time = BuyTime AND (CurrentDayOfWeek = 1) THEN Diff = close - DClose(1) IF Diff > CloseDiff THEN BUY PositionSize CONTRACT AT MARKET ENDIF ENDIF // exit position IF LongOnMarket AND Time = SellTime THEN SELL AT MARKET ENDIF // stop SET STOP pLOSS sl |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

I only have 1 trade for this backtest… where is the bug ?

Anyway, thanks for sharing.

Oh, sorry, it works fine !

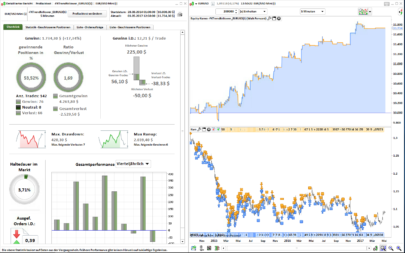

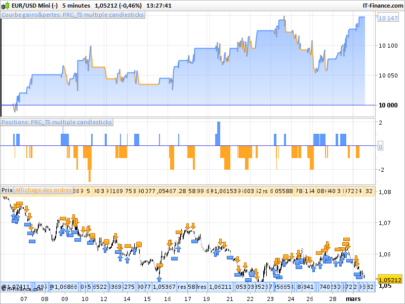

Few signals, but very performing since 2015.

For end 2013 and 2014, no gain.

It’s an interesting concept.

Very, very interesting and simple strategy. Many times it’s only neccesary see what happened day by day on the markets instead search and search complicated indicators.

Thanks for share.

Andrés.

Hi Reiner,

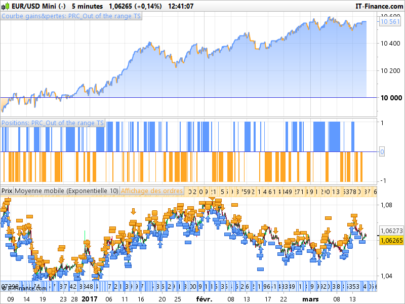

Thanks for sharing! I have seen this trend quite often on blue Monday as your strategy, and also the next day (Tuesday) on same time very often goes opposite!!!

So, I did some modification based on your code:

Decrease CloseDiff to increase entry %

Shorten the exit time

Add in similar strategy on Tuesday but Sellshort

Results is not bad too

// MonTue DAX 5m

// Code-Parameter

DEFPARAM FlatAfter = 095500

// trading window

ONCE BuyTime = 085500

ONCE SellTime = 093500

ONCE UCloseDiff = 30

ONCE DCloseDiff = 0

ONCE PositionSize = 5

ONCE sl = 50

// Long all in, if it\'s Monday and the market is 30 points higher

IF Not LongOnMarket AND Time = BuyTime AND (CurrentDayOfWeek = 1) THEN

Diff = close - DClose(1)

IF Diff > UCloseDiff THEN

Buy PositionSize CONTRACT AT MARKET

ENDIF

ENDIF

// Short all in, if it\'s Tuesday and the market is 30 points lower

IF Not ShortOnMarket AND Time = BuyTime AND (CurrentDayOfWeek = 2) THEN

Diff = close - DClose(1)

IF Diff < DCloseDiff THEN

Sellshort PositionSize CONTRACT AT MARKET

ENDIF

ENDIF

// exit position

IF LongOnMarket AND Time = SellTime THEN

SELL AT MARKET

ENDIF

IF ShortOnMarket AND Time = SellTime THEN

exitshort AT MARKET

ENDIF

// stop

SET STOP pLOSS sl

Hi CKW,

Thanks for your feedback. I have observed this behavior as well. The best rules are so simple.

regards

Reiner

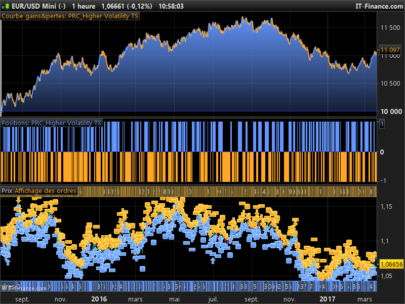

It seems very good also with cac40, and quite good with ftse100.

Thank you!

Any new updates or news about this strategy?

Hi Kenneth,

Sorry for the late answer.

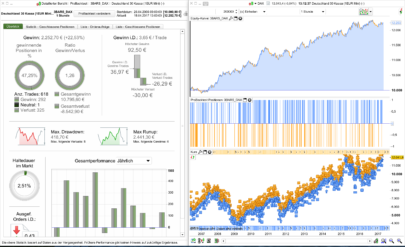

I have tested this little strategy with 200.000 candles and updated the parameters. I know some crazy guys trading this little beauty and make a lot money last week. Please find the code below:

// Blue Monday DAX

// Code-Parameter

DEFPARAM FlatAfter = 093500

// trading window

ONCE BuyTime = 85500

ONCE SellTime = 93500

ONCE CloseDiff = 50

ONCE PositionSize = 25

ONCE sl = 50

// Long all in, if it\'s Monday and the market is 50 points higher

IF Not LongOnMarket AND Time = BuyTime AND (CurrentDayOfWeek = 1) THEN

Diff = close - DClose(1) // with Sunday quotes

IF Diff > CloseDiff THEN

BUY PositionSize CONTRACT AT MARKET

ENDIF

ENDIF

// exit position

IF LongOnMarket AND Time = SellTime THEN

SELL AT MARKET

ENDIF

// stop

SET STOP pLOSS sl

best, Reiner

Hi,

I only have one trade:

25 contracts @10505,3 on 5th december 2016.

What I am doing wrong?

Regards!

Hi mamio,

Sorry for the late answer.

This strategy provides only few but very profitable trades. To see all trades you have to extend the number of 5M candles to the maximum possible value 100.000 or 200.000 for PRT premium.

Best, Reiner

Bonjour Reiner,

Merci pour la stratégie. Les résultats sont vraiment bons.Pour un compte de 10 000€, la taille de position est de 25. J’imagine que c’est un mini lot donc 25€/pips. Ce n’est pas trop ?Bonne journée

Bonjour morgan89,

You can trade this idea with every size that fit to your account size. This signal isn’t very frequent but when it happens the probability to make money with it is very high. I agree 10k is to small for a full contract.

Best, Reiner

Bonjour,

Je voudrai savoir comment réinvestir les gains avec cette stratégie svp ?

J’ai essayé ONCE PositionSize = 25 + strategyprofit

Mais ca ne fonctionne pas 🙂

Merci de votre aide

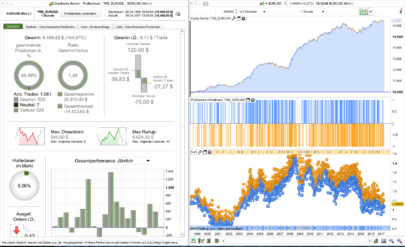

// smart position sizing

Capital = 10000

Risk = 0.1

StopCoefficient = 75

equity = Capital + StrategyProfit

maxrisk = round(equity * Risk)

PositionSize = MAX(10, abs(round((maxrisk / StopCoefficient) / PointValue)))

Merci Reiner,Ca fonctionne parfaitement.Je ne comprends pas à quoi correspond StopCoefficient

De même, MAX(10,........

Cela multiplie par 10 la valeur de abs() ?

you’ll find more details here:

https://www.prorealcode.com/blog/learning/money-management-prorealtime-code/

With the MAX-statement you can determine a minimum position size in that example the size is always 10 as long the money management algo delivers a higher value then 10

La formule est légèrement différente.

C’est normal ?

StopLoss = 10 // Could be our variable X

PositionSize = abs(round((maxrisk/StopLoss)/PointValue)*pipsize)

is the Monday strategy based on some kind of trade gap strategy ?

Hi Everybody

Sure.. this strategy works too with CAC40 for example,

Just necessary to adapt time, diff, & days which are specifics for each market..

About this strategy, i’m puzzled because i think there is maybe another possibility to the code concerning the exit position.. i’m currently checking ..