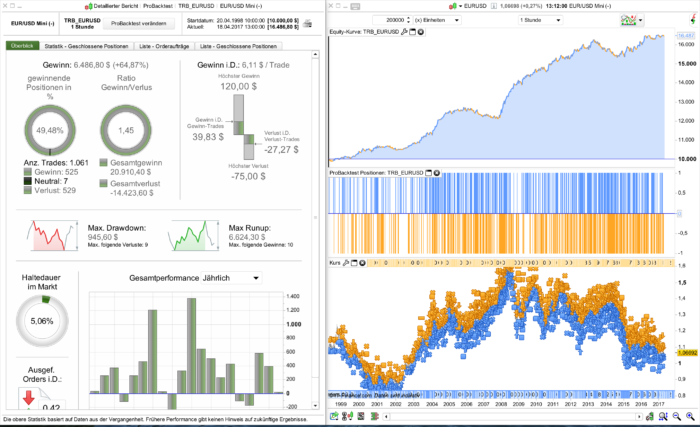

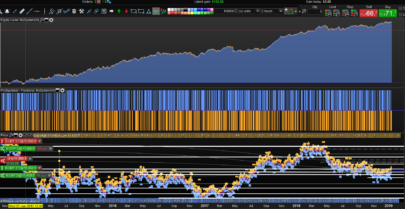

Simple 1 hour intraday trading strategy on EUR/USD (mini).

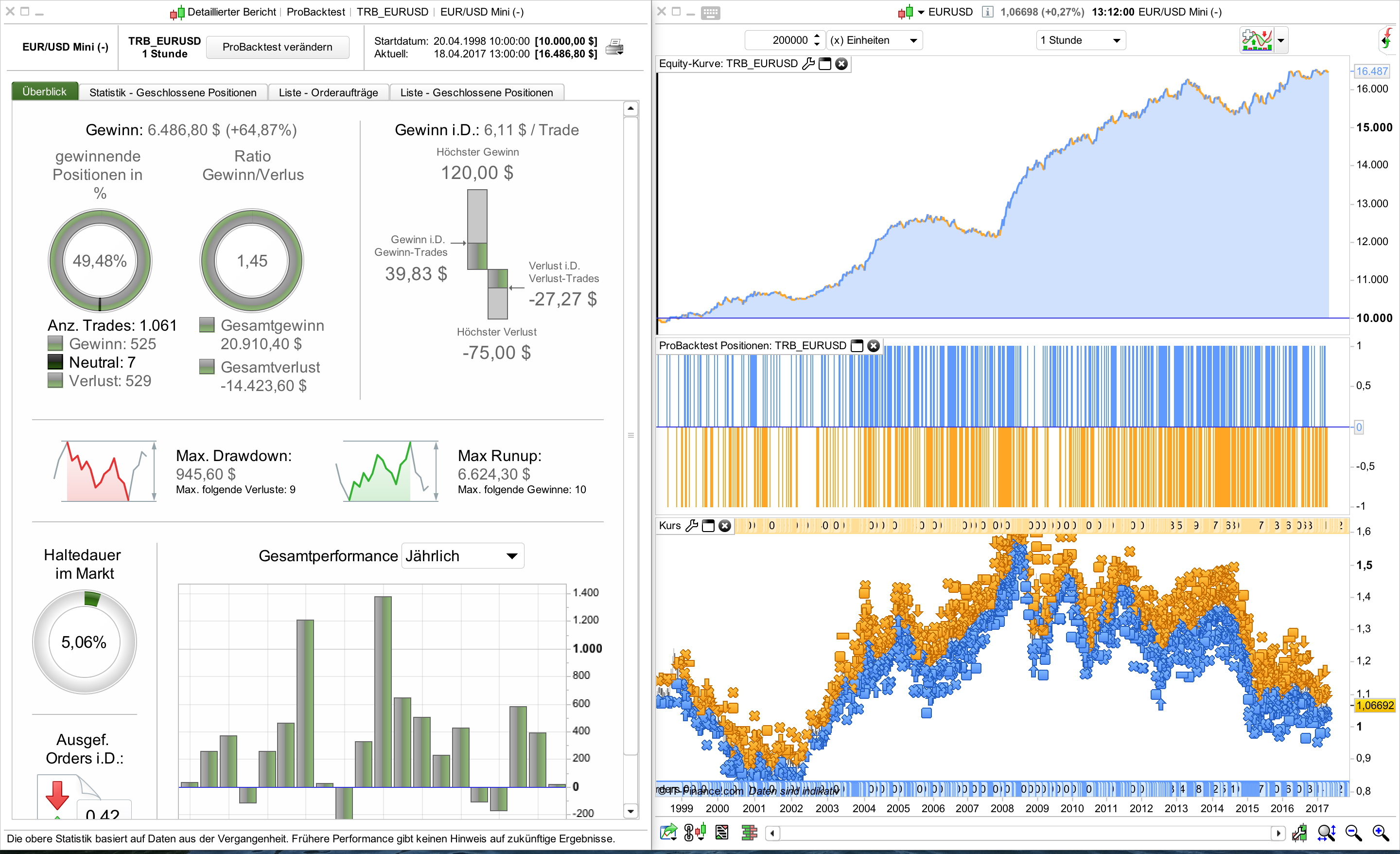

This automated trading strategy takes orders if the current candlestick is wider than the 12 periods average true range. Trades direction are chosen with this breakout candlestick color. If the current candlestick is green, then the trend seems bullish and a long order is initiated. If the breakout candle is red, a new bearish trend is forming and a short trade is launched at market.

It is a simple and a quite effective strategy with 3/1 risk reward ratio.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 |

// EUR/USD(mini) - IG MARKETS // TIME FRAME 1H // SPREAD 2.0 PIPS DEFPARAM CumulateOrders = False DEFPARAM FLATBEFORE = 080000 DEFPARAM FLATAFTER = 210000 atr = AverageTrueRange[12] // LONG IF (abs(open-close) > (atr*2) and close > open) THEN BUY 1 CONTRACTS AT MARKET SET STOP pLOSS 40 SET TARGET pPROFIT 120 ENDIF //SHORT IF (abs(open-close) > (atr*2) and close < open) THEN SELLSHORT 1 CONTRACTS AT MARKET SET STOP pLOSS 40 SET TARGET pPROFIT 120 ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

So simple and nice strategy. Thanks a lot for our enlightening of this particular setup bjoern! It deserves to spend some time trying to find ways to improve!

Thanks 🙂

Very Nice!

Works also good on BUND – 2H – Multiplicator 1 – TP/SL 60 for each long and short

Very nice! I like the look on BUND.

Very nice.

Would it be possilbe to see the test results on the bund?

I dont have enough data on my PRT I guess its because is not a premium account…

Thanks!

Sure, please find attached the backtest for BUND tick-by-tick

Hi Bjoern

I have added a filter in your code to avoid “choppy market” by using an oscillator defined by the difference between the 50 and the 200 moving average, divided by the close and set the condition for the abs of this indicator to be greater than x% and optimized again.

// EUR/USD(mini) – IG MARKETS// TIME FRAME 1H// SPREAD 2.0 PIPS

DEFPARAM CumulateOrders = FalseDEFPARAM FLATBEFORE =080000DEFPARAM FLATAFTER =210000

indicator1 = Average[200](close)indicator2 = Average[50](close)c1 = (indicator2-indicator1)/closec2= abs(c1)<0.012

atr = AverageTrueRange[30]

if c2 thenm = 2profits = 130losses = 40// LONGIF (abs(open-close) > (atr*m) and close > open) THENbuy 1 CONTRACTS AT MARKETSET STOP pLOSS lossesSET TARGET pPROFIT profitsENDIF

//SHORTIF (abs(open-close) > (atr*m) and close < open) THENsellshort 1 CONTRACTS AT MARKETSET STOP pLOSS lossesSET TARGET pPROFIT profitsENDIFendif

I could only do it for the last 3 years but I got nice results so I write the code here.

Thanks! Will take a look at it!

Thank you!

Hi Bjoern, I have created a strategy largely based on your nice and simple idea applied on Dax, and created a forum topic for it

https://www.prorealcode.com/topic/dax-adaptable-strategy-breackoutmean-reversion/

Many thanks

Francesco

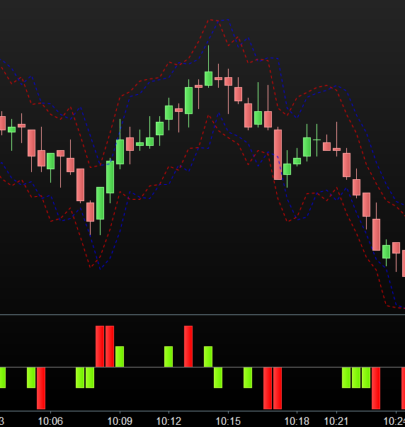

Hi, I would just like to share my own take on this strategy. I’m using 30 min on EURUSD but it works on 1H as well.

//-------------------------------------------------------------------------

// Main code : ATR breakout EURUSD 30M

//-------------------------------------------------------------------------

// EUR/USD(mini) - IG MARKETS

// TIME FRAME 30M

// SPREAD 2.0 PIPS

DEFPARAM CumulateOrders = False

DEFPARAM Preloadbars = 100

DEFPARAM FLATBEFORE = 100000

DEFPARAM FLATAFTER = 230000

once optimization = 1

once stopandtarget = 2 // 1=dynamic, 2=fixed

// VALUES

If optimization = 1 then

atrtargetlong = 1 //2

atrsllong = 1 //1

atrtargetshort = 4 //2

atrslshort = 2 //1

atrperiod = 25

atrmulit1 = 3

atrmulit2 = 2

atrtrailingstop = 1.85

elsif optimization = 2 then

atrtargetlong = 1 //2

atrsllong = 1 //1

atrtargetshort = 4 //2

atrslshort = 2 //1

atrperiod = 25

atrmulit1 = 3

atrmulit2 = 2

atrtrailingstop = 0.5

endif

// INDICATOR

atr = AverageTrueRange[atrperiod]

// LONG ENTRY

b1 = (abs(open-close) > (atr*atrmulit1))

b2 = close > open

b3 = b1 AND b2

IF b3 THEN

BUY 1 CONTRACTS AT MARKET

ENDIF

//LONG STOP AND TARGET

//Dynamic stop and target

If stopandtarget = 1 then

SET TARGET pPROFIT (atr * atrtargetlong) / pointSize

SET STOP PLOSS (atr * atrsllong) / pointSize

//Fixed stop and target

elsif stopandtarget = 2 then

SET TARGET pPROFIT 120

SET STOP PLOSS 40

ENDIF

//SHORT ENTRY

s1 = (abs(open-close) > (atr*atrmulit2))

s2 = close < open

s3 = s1 AND s2

IF s3 THEN

SELLSHORT 1 CONTRACTS AT MARKET

ENDIF

// SHORT STOP AND TARGET

//Dynamic stop and target

If stopandtarget = 1 then

SET TARGET pPROFIT (atr * atrtargetshort) / pointSize

SET STOP PLOSS (atr * atrslshort) / pointSize

//Fixed stop and target

elsif stopandtarget = 2 then

SET TARGET pPROFIT 120

SET STOP PLOSS 40

ENDIF

//trailing stop

trailingstop = (atr * atrtrailingstop) / pointSize

//resetting variables when no trades are on market

if not onmarket then

MAXPRICE = 0

MINPRICE = close

priceexit = 0

endif

//case SHORT order

if shortonmarket then

MINPRICE = MIN(MINPRICE,close) //saving the MFE of the current trade

if tradeprice(1)-MINPRICE>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MINPRICE+trailingstop*pointsize //set the exit price at the MFE + trailing stop price level

endif

endif

//case LONG order

if longonmarket then

MAXPRICE = MAX(MAXPRICE,close) //saving the MFE of the current trade

if MAXPRICE-tradeprice(1)>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MAXPRICE-trailingstop*pointsize //set the exit price at the MFE - trailing stop price level

endif

endif

//exit on trailing stop price levels

if onmarket and priceexit>0 then

EXITSHORT AT priceexit STOP

SELL AT priceexit STOP

endif

Thanks. I will run a Test.

Hi! bjoern

May i know what timing should i change for time zone (Singapore (GMT +8:00)

DEFPARAM FLATBEFORE =080000

DEFPARAM FLATAFTER =210000