Hello everyone.

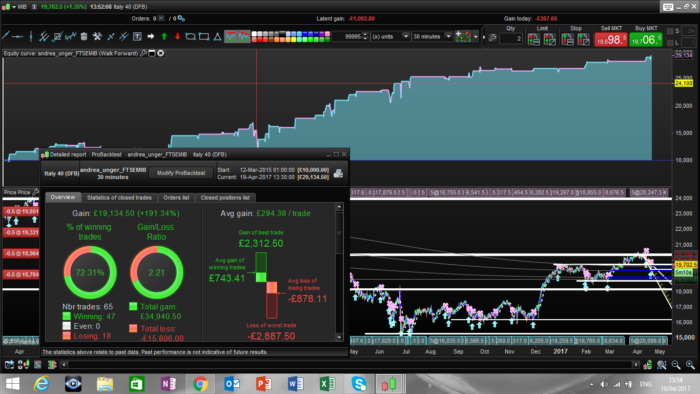

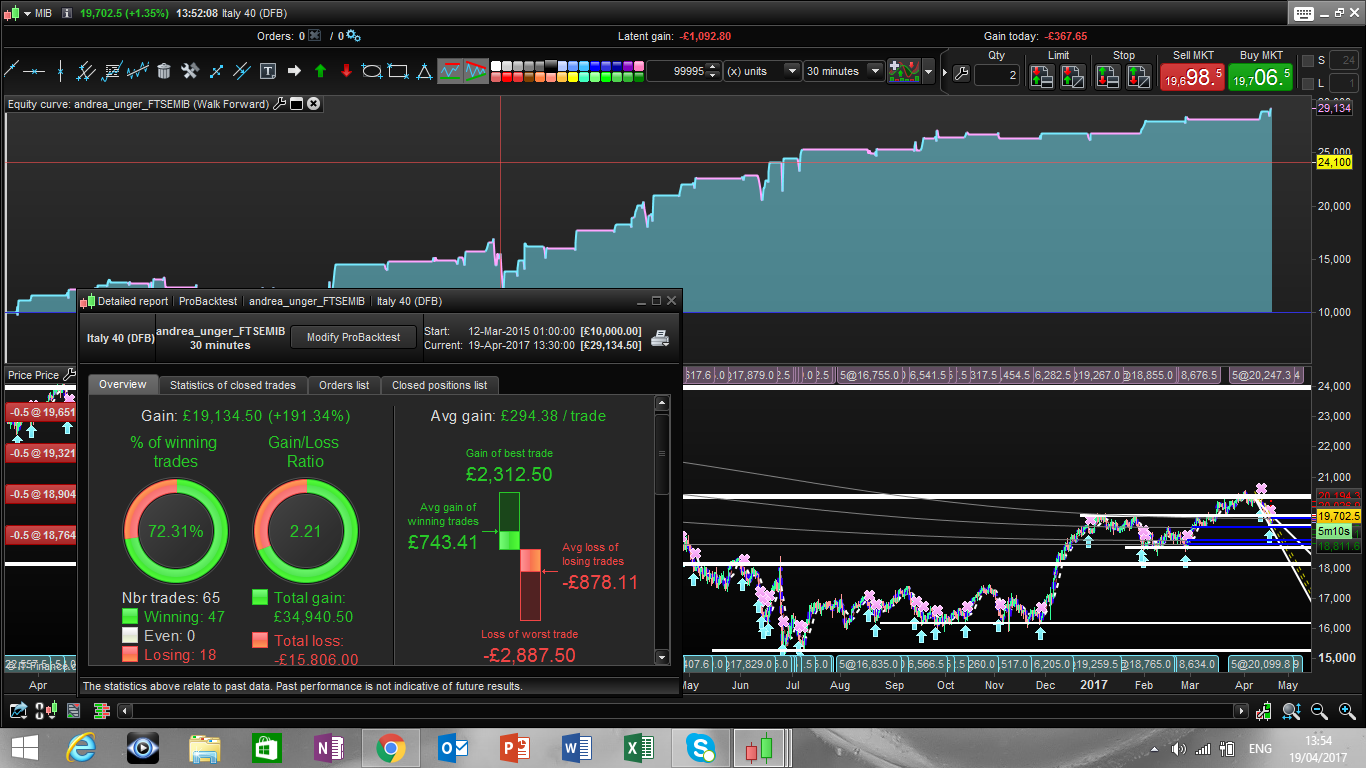

I have coded for PRT this strategy that is based on the publicly available informations on Andrea Unger idea which exploits the fact that the FTSE Mib goes up mainly during night hours.

The idea is simple: buy the index at 5.30 PM and sell it at 9.30 AM.

In the code I added some filters that were discussed in a webinar by Andrea Unger, basically you buy the index at 5.30PM if the open price at 09.30 is < of the previous close and if the closing price at 5.30 pm is lower than the 2 previous daily lowest.

Results and code is attached.

Let me know what you think!

Many thanks

Francesco

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 |

// Definition of code parameters DEFPARAM CumulateOrders = False // Cumulating positions deactivated timenter = time = 173000 timexit = time = 093000 timeobsopen = time = 093000 if timeobsopen Then priceopen = open endif timeobsclose = time = 173000 if timeobsclose then priceclose = open endif c1 = priceopen < DClose(1) min1 = Dlow(1) min2 = Dlow(2) //min3 = Dlow(3) result = Min(min1,min2) //minimo = Min(result,min3) c2 = (priceclose <= result) size = 5 c3 = c1 and c2 IF c3 AND timenter THEN BUY size PERPOINT AT MARKET ENDIF if timexit then sell at market endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Francesco. Did you try and test with a stoploss and take profit code, so there was an RR>1? Also it could be great to have it tested on a 200k unit. Even though the numbers are great, 65 trades is a bit low for a statistic.

Cheers Kasper

Hi Kasper and thank you for your comment, unfortunately I cant test more than that with my PRT because I dont have a premium membership. Would be really great if someone could do more deeper tests indees.

Regards

Francesco

Hi Francesco do you think it would differ if the backtesting had tick data? It’s my understanding it only has tick data for 500 periods!

What is the spread that time of day in Italy40?

6 ticks noramlly here in Italy.

Peter,

Tick by tick test here is not necessary as the strategy doesnt have stop losses and take profits. I acknowledge the fact that the sample I used is quite limited, as far as I know the strategy works well also in the past but I was not able to test it with PRC.

Best Regards

Dear Francesco,

nice code …. I have added the stop loss and and the check with ATR 50

What do you think? Should be interest to test with 200k unit

// Definition of code parametersDEFPARAM CumulateOrders = False // Cumulating positions deactivatedtimenter = time = 173000timexit = time = 093000

timeobsopen = time = 093000if timeobsopen Thenpriceopen = openendif

timeobsclose = time = 173000if timeobsclose thenpriceclose = openendif

c1 = priceopen < DClose(1)min1 = Dlow(1)min2 = Dlow(2)//min3 = Dlow(3)result = Min(min1,min2)//minimo = Min(result,min3)

c2 = (priceclose <= result)size = 1/// New

indicator1 = AverageTrueRange[50](close)volfilter= indicator1>30

c3 = c1 and c2//Indicatore1 = CALL “ALE_secure”//if currentmonth <> 8 then//IF Indicatore1 thenif currentdayofweek <> 5 thenIF c3 AND timenter and volfilter THENBUY size PERPOINT AT MARKETENDIFendif

//endifif timexit thensell at marketendifset stop ploss 350

Many thanks JR1976 for your improvement,

although results with your filter looks better there is a problem of lack of proper statistic in both mine and yours, as with 100000 observation we get less than 100 trades.

That being said the code is well known as it is a strategy Andrea Unger presented in his webinar and Im quite confident that it was working even in the past.

I really hope someone will test it with 200K bars sometime soon.

Regards

Francesco

HI Francesco,

in effect 3 consecutive lose in May and today …. doesn’t work well , need to test and optimize with more bars

Regards

Hi JR, yes indeed quite disappointing in may and today, but still within the max drawdown shown historically, any idea to improve the strategy will be very welcome!