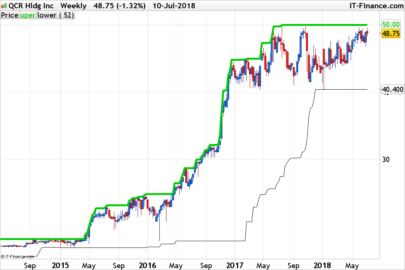

A daily breakout screener using the 40 day MA and the 120 MA using Volume that’s 1.5 times Average from the book ”The Honest Guide to Stock Trading” shares the exact trading strategy rules and money management systems that have a proven track-record of making market-beating returns.

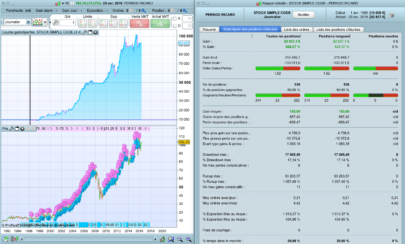

I found the code on youtube, thought I share it. The settings for stoploss is the value of ATR multiplied by 7 for counter trend strategy we setup the indicator ATR value to 20 periods and at the indicator Envelope to it. change the number of periods to 1 and verticaly shift the Envelope by 600 % then click envelope – and make it invisible. Now it calculates it automatic what your shares should be ( if i’m correct ).

Now let’s say you want to use 7 times the value of the ATR trailing stoploss for example you would risk 500 euro’s and like this example Loreal SA stock the ATR 20 period = € 3.30 * 7 = € 23.1 so the stoploss should be 23.1 euro below the entry price and this would trail behind every new high. So if we risk € 500 euro’s devided by 23.1 (500 / 23.1 = ) € 21,64 so we can buy 23 stocks of Loreal.

For the countertrend strategy our stoploss is 2.25 times of the ATR and our profit target is 3.5 times above the entry price so we add again the indicator Envelope and change the settings periods to 1 and vertically shift it to 125% and un check all boxes from envelope so we see 3 lines in the indicator window. Now to calculate the profit target we use again Envelope * 3.5 times ATR vertically shift it to 250% and periods 1. The Value of ATR color = Blue, Value of ATR times 2.5 = Black, the Value of ATR times 3.5 = Green and the Value of ATR times 7 the red line. Now you can see quickly where your stoploss should be!

Happy trading

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 |

// sample screener code c2 = close> 5.00 indicator2 = Volume indicator3 = (average[20](volume))*1.5 c3 = indicator2> indicator3 c4 =(average[20](volume))> 200000 indicator4 = average[40](close) indicator5 = average[120](close) c5 = (indicator4 >=indicator5) indicator6 = (highest[40](high[1])) c6 = (close >=indicator6) Criteria = volume screener[c2 And c3 And c4 And c5 And c6] (criteria AS"volume") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Perhaps you can also share the link to the YouTube video

https://www.youtube.com/watch?v=I1QOJgfHR5E

and this one

https://www.youtube.com/watch?v=YbmWgqSvLGU

Thanks for sharing. I tried it but i did not get any results. Just checking if that’s the case for you as well per 0405?

Works fine

great tool!

Thank you

appreciate your post mate!! it helped me.