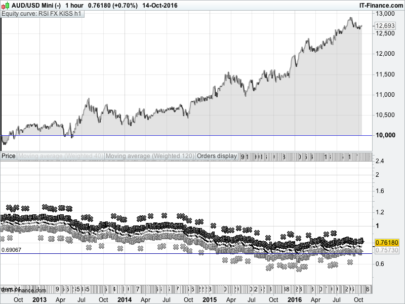

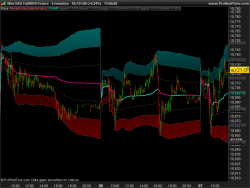

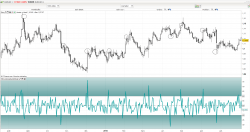

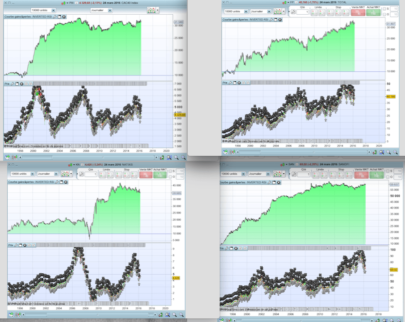

A volume indicator that indicates overbought and oversold based on rsi. this indicator allows you to identify the overbought and oversold areas of the rsi with the colors ;

blue (oversold)

orange (overbought )

on the volume indicator

(adaptation for the Prorealtime v 10.3 platform of the Tradingview indicator.)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 |

REM VOLUME RSI //// by JonathanDeneaul on platform Tradingview //adapted for the Prorealtime v10.3 platform by bolsatrilera //@version=3 //RSI src = close len = 14//minval=1, title="RSI") upper=70 //minval=1, title="Upper" lower=30 //minval=1, title="Lower" rmaup=max(src-src[1],0) up =WilderAverage[len](rmaup) rmadown=-min(src-src[1],0) down = WilderAverage[len](rmadown) if down =0 then rrsi= 100 elsif up = 0 then rrsi = 0 else rrsi = 100 - (100 / (1 + up / down)) endif //Volume if rrsi>upper then Vol =volume r=255 g=165 b=0 elsif rrsi<lower then Vol =volume r=0 g=0 b=255 elsif close<open then Vol =volume r=255 g=0 b=0 elsif close>=open then Vol =volume r=50 g=205 b=50 endif return Vol coloured(r,g,b)style(histogram)as "VOLRSI" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks, bolsatrilera, for a very good and solid screener!

sorry… indicator!

Gracias por el indicador, tengo una pregunta necesito programar un screener de valores que entre otras condiciones el RSI de ayer haya sido menor a 30 pero el de hoy es mayor a 30. Me podrías ayudar?