1. Introduction

The Parabolic RSI is a custom technical indicator designed to combine two of the most recognized tools in technical analysis: the Relative Strength Index (RSI) and the Parabolic SAR, applied in an innovative way. Instead of applying the Parabolic SAR to prices, this indicator calculates it directly on the RSI value, allowing for more precise detection of directional changes in the market’s relative strength.

This hybrid approach facilitates the identification of potential trend reversal points before they are directly reflected in price, providing traders with an additional tool to anticipate market moves. Ideal for both short- and medium-term traders, the Parabolic RSI is especially useful in high-volatility scenarios or when more refined entry and exit signals are needed.

2. What is the Parabolic RSI?

To understand how the Parabolic RSI works, it is necessary to briefly explain the two indicators that compose it:

- RSI (Relative Strength Index): an oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is commonly interpreted as overbought when RSI exceeds 70 and oversold when it falls below 30.

- Parabolic SAR (Stop and Reverse): a trend-following indicator used to determine entry and exit points. It is plotted as a series of dots on the chart, appearing below price during an uptrend and above price during a downtrend.

The innovation of the Parabolic RSI lies in using the RSI value instead of price to apply the Parabolic SAR calculation. This allows for more sensitive detection of shifts in market dynamics, anticipating potential trend changes through the evolution of relative strength rather than just price.

3. Indicator Logic

The Parabolic RSI calculates a Parabolic SAR not on price, as is traditional, but directly on the RSI value. This adaptation follows the same mechanics as the standard SAR, but with RSI as the data source.

Here is a summary of the process:

- Calculation Start: At the beginning of the historical data, necessary variables are initialized: the RSI value as a base, the movement extremes (highs and lows), the initial acceleration factor (

initial), and its limit (limite). - SAR Update: Depending on the movement direction (bullish or bearish), the indicator adjusts its SAR:

- If the trend is bullish, the SAR is adjusted toward the most recent RSI high.

- If the trend is bearish, the SAR moves closer to the most recent RSI low.

- Conditions are included to prevent the SAR from exceeding previous values, in order to avoid false signals.

- Reversal: A direction change occurs when the RSI value crosses the calculated SAR level. At that point:

- The trend direction (

islong) is reversed. - Extremes are reset, and the acceleration factor is reinitialized.

- The trend direction (

- Dynamic Adjustment of the Acceleration Factor (

af): This factor increases as the movement continues in the same direction, causing the SAR to move closer to the RSI more quickly, enabling faster trend reversal detection.

This logic turns the Parabolic RSI into an adaptive tool, capable of dynamically responding to shifts in market strength, detecting both trend continuations and potential reversals in the RSI.

4. Generated Signals

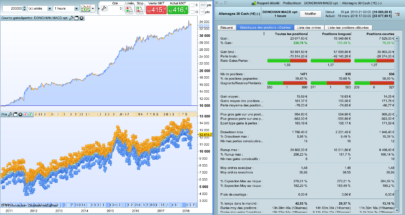

The Parabolic RSI not only provides a visual representation of the RSI trend through Parabolic SAR-style dots but also generates clear entry and exit signals:

- Buy Signal (sigUp): Triggered when the direction changes from bearish to bullish (the Parabolic SAR on RSI shifts from above to below the RSI), and the SAR value is below the oversold threshold (level 30). This combination suggests a possible bullish reversal with increasing strength.

- Sell Signal (sigDn): Triggered when the direction changes from bullish to bearish and the SAR value exceeds the overbought threshold (level 70). This condition signals a possible bearish correction or the end of buying strength.

Both signals are displayed on the chart using distinct colored dots:

- Pink (RGB: 255,82,189) for bullish trend signals.

- Turquoise blue (RGB: 0,255,229) for bearish trend signals.

This signaling system allows traders to quickly identify entry or exit opportunities, integrating the strength of the movement (measured by RSI) with the directional change dynamics of the Parabolic SAR.

5. Indicator Settings

The Parabolic RSI allows users to adjust several parameters that directly affect the indicator’s sensitivity and precision. These are the default configurable values:

len = 14

This is the number of periods used to calculate the RSI. It is the standard value and typically provides a good balance between sensitivity and stability.upper = 70

Overbought level. If the RSI or SAR exceeds this level, the asset is considered overbought, which may anticipate a correction.lower = 30

Oversold level. If the RSI or SAR falls below this threshold, the asset is considered oversold, which may anticipate a rebound.initial = 0.02

Initial acceleration factor value for the SAR. The lower it is, the further the SAR is from the RSI, making it respond more slowly.increment = 0.02

Amount added to the acceleration factor each time a new extreme (RSI high or low) is reached. The higher the increment, the faster the SAR will adjust.limite = 0.2

Maximum limit for the acceleration factor. It prevents the SAR from getting too close too quickly and generating false signals.

These parameters can be modified according to each user’s trading style. For example, in more volatile markets, the upper and lower levels can be lowered, or initial can be increased for more conservative signals. For aggressive scalping strategies, len and initial could be reduced to improve response speed.

6. Code

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 |

//------------------------------------------// //PRC_Parabolic RSI //version = 0 //14.05.2025 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //------------------------------------------// // Inputs //------------------------------------------// //--- RSI len=14 // RSI Length upper=70 // Overbought level lower=30 // Oversold level //--- PSAR increment = 0.02 initial = 0.02 limite = 0.2 //------------------------------------------// // RSI calculation //------------------------------------------// src=rsi[len](close) //------------------------------------------// // Parabolic SAR (RSI) //------------------------------------------// srchigh=src+1 srclow=src-1 if barindex<=len+2 then Lparabolic=srclow islong=1 af=limite hp=srchigh lp=srclow else if islong then Lparabolic=Lparabolic+af*(hp-Lparabolic) Lparabolic=min(Lparabolic,srclow[1]) Lparabolic=min(Lparabolic,srclow[2]) else Sparabolic=Sparabolic+af*(lp-Sparabolic) Sparabolic=max(Sparabolic,srchigh[1]) Sparabolic=max(Sparabolic,srchigh[2]) endif reverse=0 if islong then if srclow<Lparabolic then isLong=0 reverse=1 Sparabolic=hp lp=srclow af=initial endif else if srchigh>Sparabolic then islong=1 reverse=1 Lparabolic=lp hp=srchigh af=initial endif endif if reverse=0 then if islong then if srchigh>hp then hp=srchigh af=af+increment af=min(af,limite) endif else if srclow<lp then lp=srclow af=af+increment af=min(af,limite) endif endif endif endif if islong then psarRSI=Lparabolic r=255 g=82 b=189 else psarRSI=Sparabolic r=0 g=255 b=229 endif //------------------------------------------// // Signals //------------------------------------------// sigUp=islong<>islong[1] and islong and psarRSI<=lower sigDn=islong<>islong[1] and islong=0 and psarRSI>=upper if sigUP or sigDn then drawpoint(barindex,psarRSI,5)coloured(r,g,b,90) endif //------------------------------------------// return src as "RSI" style(line,2), psarRSI as "Parabolic SAR rsi" style(point,2)coloured(r,g,b), upper as "OB level" style(dottedline),lower as "OS level" style(dottedline) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hola Ivan

Podemos tener el mismo parabolic sar “on chart” ? quiero compararlo con el indicador MA sabre que parece ser muy parecido o complementario.

muchas gracias por tu trabajo. un saludo

Buenas. No sé si te estoy entendiendo. El indicador parabolic SAR en precio ya lo tienes predefinido en Prorealtime. En indicadores predefinidos lo vas a encontrar.

Merci Ivan c’est tres utile. De mon coté je parametre SAR 0.07/0.7 et RSI 10. excellent indicateur .

Génial

hola Ivan

Eso quiere decir que el Parabolic sar RSI est igual al parabolic sar de PRT ? por defecto el SAR esta “on chart”

un saludo

buenas tardes Ivan

me gusteria tener lo mismo on chart con los puntos azules y rosas de cambio de sentido seguido del parabolic SAR “normal” sin los overbuy and oversell

gracias si se puede…

Thanks for the translation. This one can be compared to dynamic zone RSI

Accuracy is on point.

Bonjour à tous,

J’ai importé le fichier mais ça ne marche pas, rien qui s’affiche. Pourriez-vous m’aider svp?

Merci d’avance.

Thank you so much Ivan..Been using this on 30min timeframe with excellent results. Now my main go to indicator. If im trading off the 5 min chart i alwasy keep an eye on the 30 min rsi/par because that determines the trend for the day for me.. If i do trade against the 30 min trend then will be a quick scalp like trade.