This is an updated version of myCandle-Infos

All Details now in the blue Info-Bubble.

I use this indicator as visual information about other indicators for intraday trading.

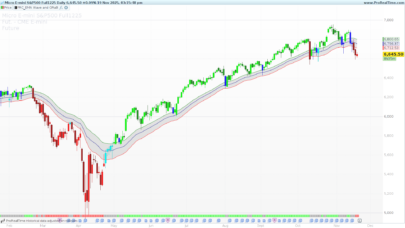

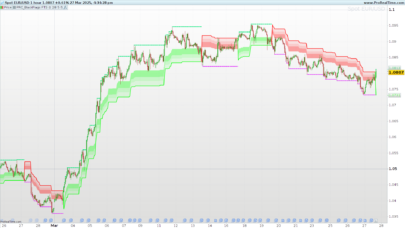

You can see the other indicators in the image “candle_with_indis”.

It gives me mor space for the chart!!!

For me the best configuration is:

I set all checkboxes of “myCandle-Infos-V1.2” on true.

And under the chart i displayed the indicator for 1h, 4h, 1D from Nicolas Heikin Ashi of higher timeframes (hourly TF)

Look on the image “candle_with_HA-highTF”.

And the BB (Bollinger Bands with 20,2 Standard), NOT EMA.

As a supplement I show the VWAP.

Also very good information gives the OBV with BB20[ExponentialAverage] (see “candle_with_indis”), but it is includet in “myCandle-Infos-V1.2“

And last but not Opening Range Good combination for starting in the day oder US start. Displayed also the Close on fixed time. Update comes soon.

This are the Checkboxes and function of “myCandle-Infos-V1.2”:

Info: Shows the range of previous candle, ATR 10 and EMA 20 of ATR10.

If ATR is greater than its average, the text will be displayed in orange =Better moves

Arrows: Shows Arrows in green and red color. When the Price Trend (calculation in code) over EMA20 and OBV (On Balance Volume) over EMA10 and EMA20 displayed green Arrow and revers. Depends on “Trendforce” and / or “OBVforce” activation checkbox.

Daytrend: Close over Centerline Intraday Range displayed green Dot and Text “over” and revers red Dot with Text “under”. The idea is when the price is over the middle intraday range then we have at the moment intraday a Bulltrend and revers.

Centerline: Show the middle of the range between Intraday high and low as a dotted line.

High/LowIntraday: Show the intraday highest high and lowest low as line. High as red dotted line like a resist and low as green dotted line like a support.

HighLow: Show the daily highest high and lowest low beginning on yesterday.

Trendforce: Trend strength is used to calculate the arrows. For this, “Arrows” must be also activated. Or also with “OBVforce”.

OBVforce: Volumen strength, based on OBV, is used to calculate the arrows. For this, “Arrows” must be also activated. Or also with “Trendforce”.

Example. You can deactivate for instrument whitout OBV/Volume Data. Forex, etc.

I hope you enjoy and have good successful trades.

The images “candle-info6-7-8” shows a example of real money trading with this combination.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 |

// myCandel-Infos-V1.2 // 18.06.2019 (Release 1.2) // Thomas Geisler // Sharing ProRealTime knowledge // https://www.prorealcode.com/library/ defparam drawonlastbaronly=true // Zeichung nur am letzten Bar //--init-- alpha = 255 lookback = 1 //Info = 1 // Arrows = 1 // DayTrend = 1 // Centerline = 1 // HighLowIntraday = 1 // HighLow = 1 //Trendforce = 0 // OBVforce = 0 //-- end-- //--Info-- // previous Candle Range[1] and ATR[10] and EMA-ATR[20]of ATR[1] myRange = round(Range[1]) myATR = round(AverageTrueRange[10](close[0])) myEATR = round(ExponentialAverage[20](AverageTrueRange[10](close[0]))) If Info = 1 then if myATR < ExponentialAverage[20](myATR) then DrawText(" #myRange#/#myATR#/#myEATR#",barindex,open,Serif,Bold,12) coloured(153,153,153,alpha) else DrawText(" #myRange#/#myATR#/#myEATR#",barindex,open,Serif,Bold,12) coloured(255,153,0,alpha) endif endif //--end-- //--Dailys highest high and lowest Low-- if HighLow then if openday <> openday[1] then dayindex = dayindex + 1 dayhigh = 0 daylow = close //dayopen = open //dayclose = close if dayindex > lookback then for j = 1 to barindex if dayindex[j] = dayindex - lookback then mydayhigh = dayhigh[j] mydaylow = daylow[j] break endif next endif endif dayhigh = max(dayhigh,high) daylow = min(daylow,low) endif if dayindex < lookback or not highlow then mydayhigh = undefined mydaylow = undefined endif if dayindex < lookback or not Centerline then mytdaycenter = undefined endif //--end-- //-- proof close over/under high or low of intraday range-- mytdayhigh=DHigh(0) mytdaylow=DLow(0) DM0 = (mytdayhigh-mytdaylow)/2+mytdaylow If DayTrend = 1 then if close > DM0 then DrawText(" • over",barindex,open-10,Serif,Bold,12) coloured(0,255,0,alpha) else DrawText(" • under",barindex,open+10,Serif,Bold,12) coloured(255,0,0,alpha) endif endif //--end-- //--Centerline, center of range between intraday high/low-- If CenterLine = 1 then mytdaycenter = DM0 else mytdaycenter = undefined endif //--end-- //--Show Intraday HighLow as dotted line-- If HighLowIntraday = 1 then mytdayhigh = DHigh(0) mytdaylow = DLow(0) else mytdayhigh = undefined mytdaylow = undefined endif //--end-- //--Arrows-- //Trend bzw Trend force if Arrows = 1 then BullTrend = (Close - LOWEST[20](LOW)) / AVERAGETRUERANGE[10] BearTrend = (HIGHEST[20](HIGH) - Close) / AVERAGETRUERANGE[10] Trend = (BullTrend - BearTrend) TrendEMA = ExponentialAverage[20](Trend) // On Balance Volumen zur Bestimmung der Kaufkraft der Bewegung/Trend myOBV = OBV myOBVA1 = ExponentialAverage[20](myOBV) myOBVA2 = ExponentialAverage[10](myOBV) if Trendforce = 1 and OBVforce = 1 then If Trend > TrendEMA and myOBV > myOBVA1 and myOBV > myOBVA2 then DRAWARROWup(barindex,low-2) coloured(0,255,0,alpha) elsif Trend < TrendEMA and myOBV < myOBVA1 and myOBV < myOBVA2 then DRAWARROWdown(barindex,high+2)coloured(255,0,0,alpha) endif elsIf OBVforce = 1 and not Trendforce then if myOBV > myOBVA1 and myOBV > myOBVA2 then DRAWARROWup(barindex,low-2) coloured(0,255,0,alpha) elsif myOBV < myOBVA1 and myOBV < myOBVA2 then DRAWARROWdown(barindex,high+2)coloured(255,0,0,alpha) endif elsIf Trendforce = 1 and not OBVforce then if Trend > TrendEMA then DRAWARROWup(barindex,low-2) coloured(0,255,0,alpha) elsif Trend < TrendEMA then DRAWARROWdown(barindex,high+2)coloured(255,0,0,alpha) endif endif endif //--end-- Return mydayhigh COLOURED (255, 0, 0)style(line, 2) AS "High", mydaylow COLOURED (0, 255, 0)style(line, 2) AS "Low", mytdayhigh COLOURED (255, 0, 0)style(dottedline, 1) AS "Today High", mytdaylow COLOURED (0, 255, 0)style(dottedline, 1) AS "Today Low", mytdaycenter COLOURED (255,153,0,255)style(dottedline, 1)as "Today Centerline" // End and make money |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hola,

Me parece muy interesante la estrategia que presentas,

Podemos ponernos en contacto ?

Las discusiones en los foros beneficiarían a la comunidad, supongo. Gracias.

Hola juanjo ¿Qué instestidad tienes? ¿Cómo puedo ayudarte? ¿Podemos escribir en inglés?

Hola, ..soy de España tu también no?…Me ha parecido buena la idea de trading del indicador, pero no llego a comprenderla. El sistema parece obeder a un sistema de ruptura de expansion basado en el ATR, muy similar a la idea de trading de Jeff Cooper, pero la parte del OBV y fuerza de la tendencia no llego a entenderla.

Hola, ..soy de España tu también no? Me ha parecido buena idea de trading del indicador, pero no llego a comprenderla. El sistema parece ser un sistema de ruptura de expansión basado en el ATR, muy similar a la idea de comercio de Jeff Cooper, pero la parte de la fuerza de la tendencia no llega a un sentido.

OBV con bandas de Bollinger me muestra el desarrollo del volumen relativo. La tendencia solo es interesante si el volumen también es compatible con la tendencia.

La fuerza de la tendencia es una relación de caída y aumento de los precios. Si hay más precios al alza que precios a la baja, espero un futuro aumento en los precios.

Ambos apoyan mi evaluación de la calificación de la tabla.

Así como las otras opciones. Intento cambiar la tendencia diaria. Pero al final es nuestra experiencia 😉

Puede activar o desactivar ambas opciones (OBVforce y Trendforce). O apagar completamente con “Flechas”.

Soy una alemana que vive en Marbella.

Traduje esta traducción del alemán al español con Google. Un saludo

…soy UN aleman No alemanA 🙂

Muchas gracias por la explicación, muy interesante.

THANKS A A LOT FOR SHARING. I like your trade. I try to remproduce your board but i dont arrive to put ATR10 with EMA20 under my charte on PRT. Can i have some help ?

thanks by advance

Tnx for sharing!! Can someone help me how i can call for the mydayhigh and mydaylow for to use as an indicator in my trading system? Is it the CALL function that i use?

Clean view, thanks for sharing

hi

where i can found the window for candle configuration?

Ciao! . I have seen the pictures that explain this metod but i don’t understand when is moment to buy. and i don’t understand what the three numbers in the graph are (in the pictura for ex 27/13/14. Grazie!!!!!!!